Written by: Eric, Foresight News

On the evening of November 13, Beijing time, Grayscale submitted an IPO application to the New York Stock Exchange, planning to enter the U.S. stock market through Grayscale Investment, Inc. This IPO is underwritten by Morgan Stanley, Bank of America Securities, Jefferies, and Cantor.

It is noteworthy that Grayscale's listing adopts an Up-C structure, meaning that Grayscale Operating, LLC, which operates and controls Grayscale, is not the listing entity. Instead, the IPO is conducted through the newly established listing entity Grayscale Investment, Inc., allowing public trading through the acquisition of partial interests in the LLC. The company's founders and early investors can convert their LLC interests into shares of the listing entity, enjoying capital gains tax benefits during the conversion process, only needing to pay personal income tax. IPO investors, on the other hand, will need to pay taxes on corporate profits and personal income tax on stock dividends.

This listing structure not only benefits the company's "veterans" in terms of taxation but also allows for absolute control over the company post-listing through AB shares. The S-1 filing shows that Grayscale is wholly owned by its parent company DCG, and Grayscale has clearly stated that after the listing, its parent company DCG will still have decision-making power over significant matters of Grayscale through its 100% ownership of the B-class shares, which have greater voting rights. All funds raised from the IPO will be used to acquire interests from the LLC.

People are naturally familiar with Grayscale, which was the first to launch Bitcoin and Ethereum investment products. Through a hard-fought battle with the SEC, it achieved the conversion of Bitcoin and Ethereum trusts into spot ETFs. Its launched digital large-cap fund has considerable power, akin to a "cryptocurrency version of the S&P 500." During the last bull market cycle, every adjustment of the large-cap fund caused significant short-term price fluctuations for the tokens that were removed and newly added.

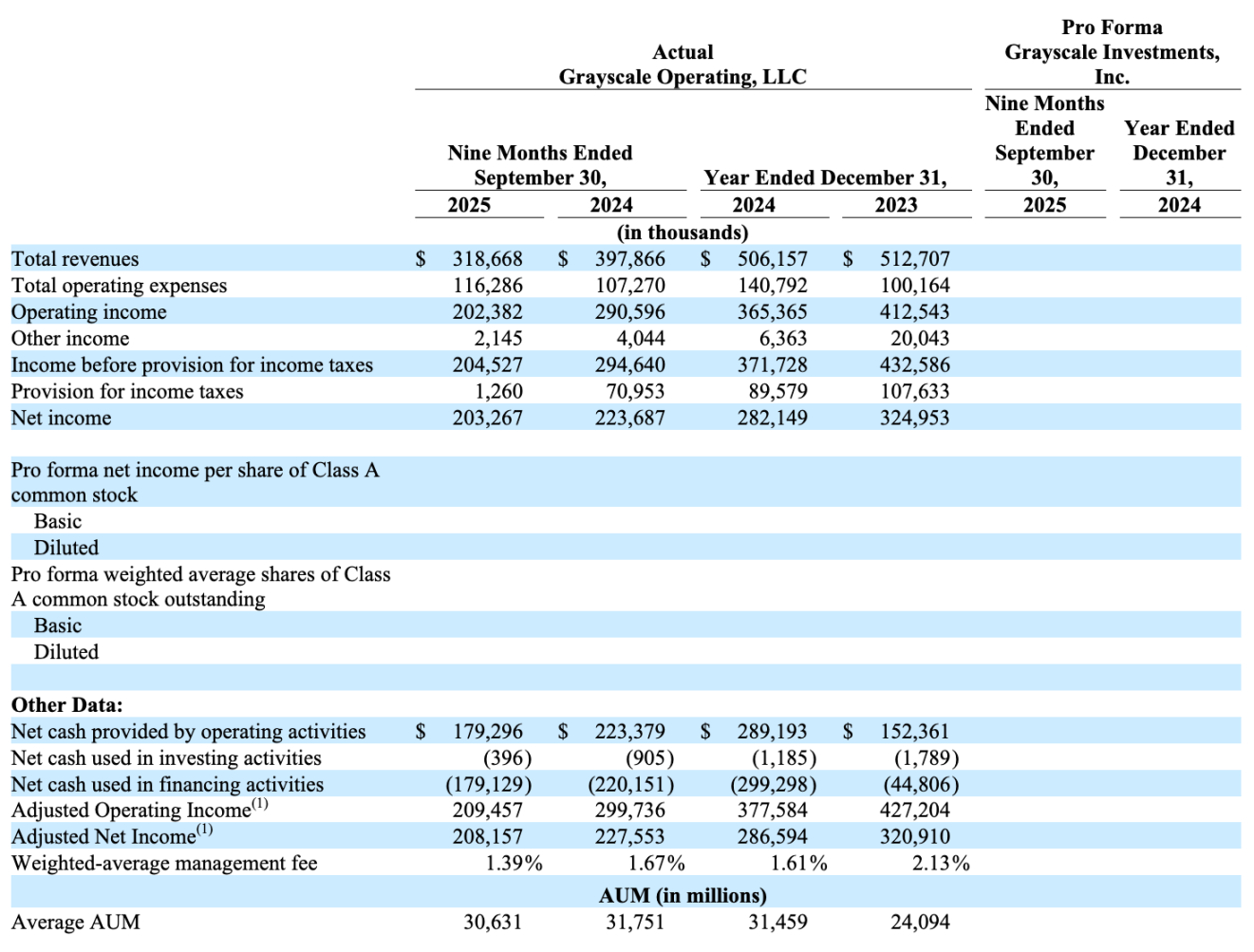

The S-1 filing shows that as of September 30 this year, Grayscale's total assets under management reached $35 billion, achieving the global number one position in cryptocurrency asset management. It has over 40 digital asset investment products covering more than 45 cryptocurrencies. The $35 billion includes $33.9 billion in ETPs and ETFs (mainly Bitcoin, Ethereum, and SOL-related products) and $1.1 billion in private equity funds (mainly altcoin investment products).

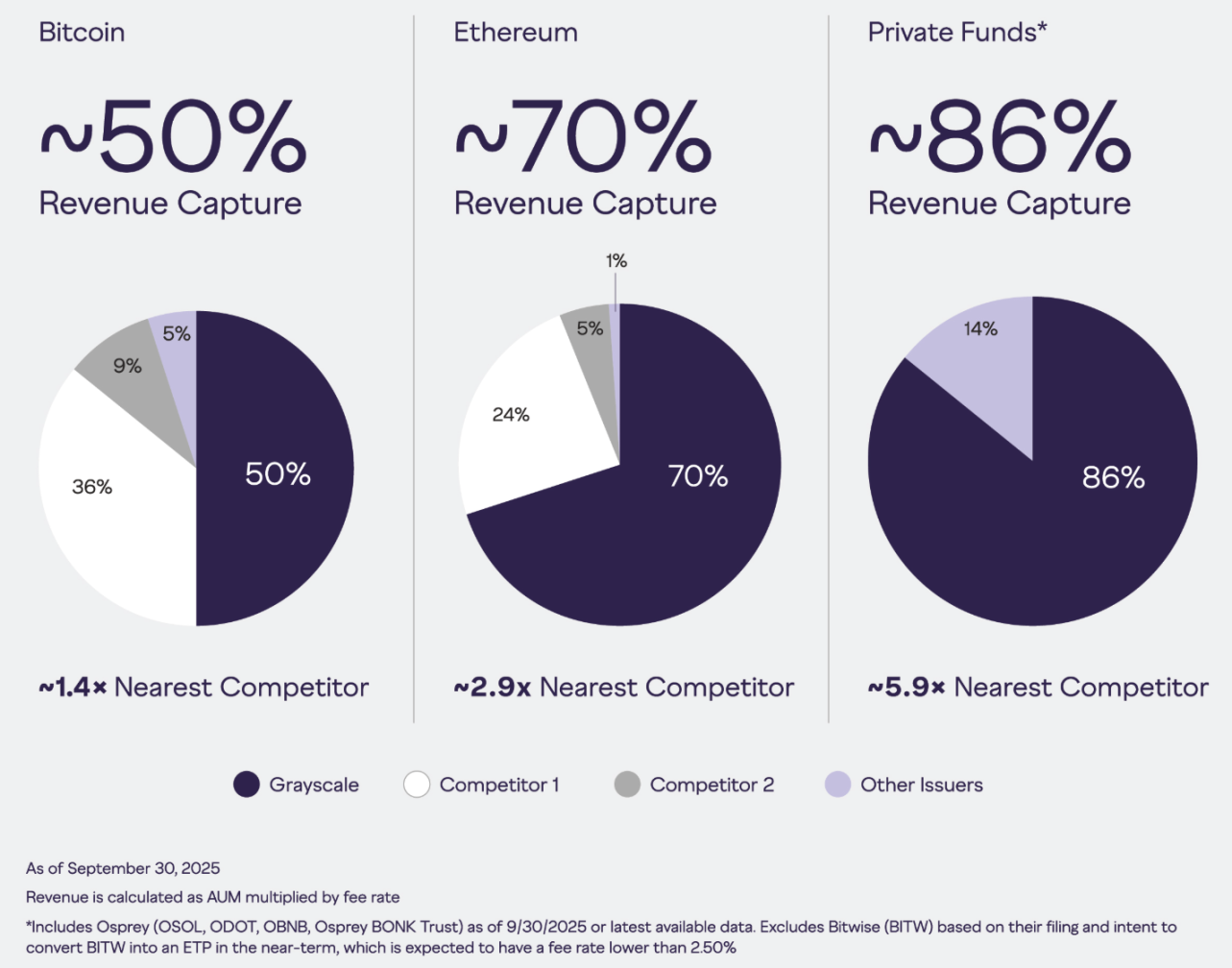

In terms of revenue, Grayscale's main investment products have stronger revenue-generating capabilities than major competitors, primarily due to the AUM accumulated from previously non-redeemable trusts and management fee rates above the industry average.

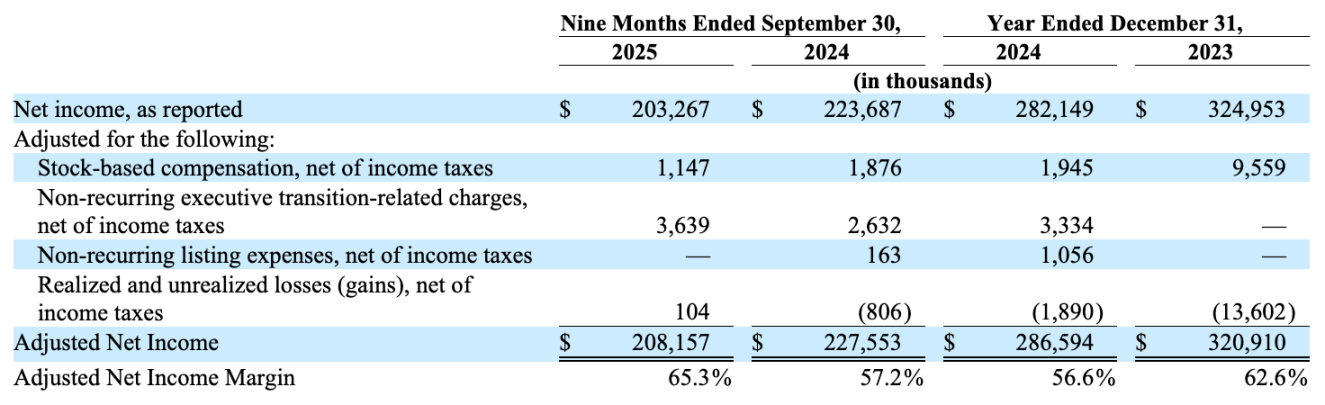

In terms of financial performance, for the nine months ending September 30, 2025, Grayscale's operating revenue was approximately $319 million, a year-on-year decrease of 20%. Operating expenses were about $116 million, a year-on-year increase of 8.4%, and operating profit recorded approximately $202 million, a year-on-year decrease of 30.4%. After adding other income and deducting income tax provisions, the net profit was approximately $203 million, a year-on-year decrease of 9.1%. Additionally, average asset management scale data indicates that this year's AUM may have decreased compared to last year.

Excluding non-recurring items, the adjusted net profit during the reporting period was approximately $208 million, with a net profit margin of 65.3%. Although the former decreased by 8.5% year-on-year, the net profit margin increased from 57.2% in the same period last year.

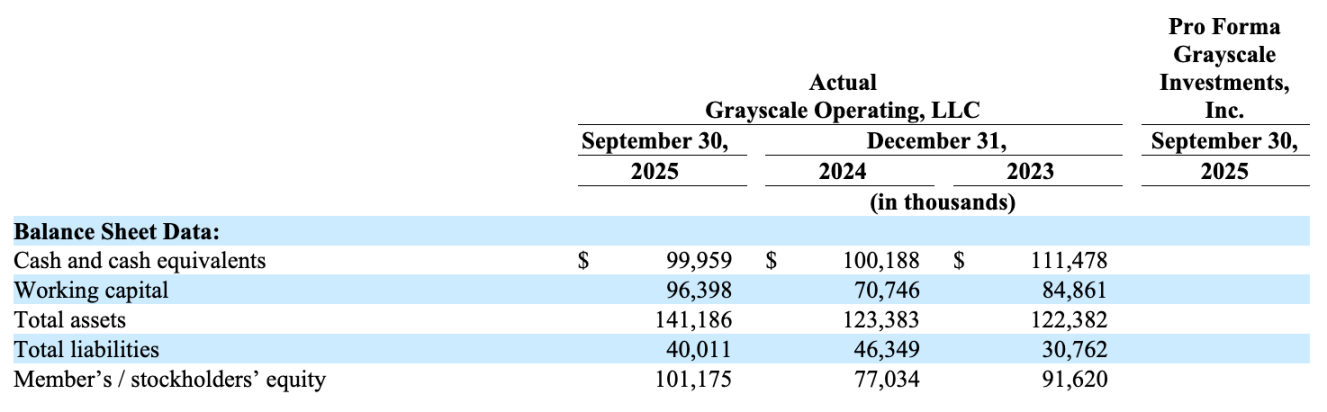

Currently, Grayscale's debt ratio is quite healthy. Although both revenue and profit have decreased, the company's operational status is continuously improving, as evidenced by the increase in asset value, decrease in liabilities, and improvement in profit margins.

The S-1 filing also disclosed Grayscale's future development plans, including expanding the types of private equity funds (launching more altcoin private investment products); launching actively managed products to complement passive investment products (ETFs, ETPs); and engaging in active investments, targeting its own investment products, cryptocurrencies, or other assets.

In terms of expanding distribution channels, Grayscale disclosed that it has completed due diligence with three brokerages with a total AUM of $14.2 trillion and has launched Bitcoin and Ethereum mini ETFs on the platform of a large independent brokerage firm with over 17,500 financial advisors and consulting and brokerage assets exceeding $1 trillion this month. In August of this year, Grayscale partnered with iCapital Network, which consists of a network of 6,700 consulting firms. According to the agreement, Grayscale will provide digital asset investment channels for companies within the network through its actively managed strategies in the future.

Overall, the information disclosed by Grayscale indicates that the company is a relatively stable asset management firm, with the main source of income being management fees from investment products, leaving little room for imagination. However, given the precedents of traditional asset management companies going public, there are predictable estimates for Grayscale's market value and price-to-earnings ratio, making it a relatively predictable investment target.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。