After experiencing the rapid plunge on "10.11" and facing the continuous blow of the U.S. government shutdown in November, the cryptocurrency market has become somewhat skittish.

What is even more concerning is the serious divergence in opinions among traders and institutions regarding the future market direction. Galaxy Digital has just cut its year-end target price from $185,000 to $120,000, while JPMorgan insists that Bitcoin could reach $170,000 in the next 6-12 months.

Ultimately, the biggest influencing factor on the cryptocurrency market's rise and fall is liquidity. When U.S. dollar liquidity is abundant, funds flow into risk assets, and Bitcoin rises; when liquidity tightens, funds flow back to government bonds and cash, and Bitcoin falls. The recent U.S. government shutdown has set a historical record, leading to the Treasury's total account balance nearing $1 trillion, completely locking up liquidity and affecting almost all global financial markets. Bitcoin is certainly no exception. This also shows that the factors affecting liquidity are largely political.

The Democratic Party's significant victories in the local elections on November 4 raise questions about the direction of the 2026 midterm elections. Will the Federal Reserve cut interest rates in December? Every recent move from the White House deserves careful analysis. Each event is changing liquidity expectations.

So, how will Bitcoin perform as we approach the end of 2025 and the beginning of 2026? Who is right and who is wrong in the bullish and bearish arguments? Rhythm BlockBeats has sorted through the arguments from both sides.

What do the bears say?

Before analyzing the possibility of a rise, let's first hear what the bears have to say.

Democrats Strike Back, Trump is Anxious

"The Democratic Party's victories in several recent state elections are the reason for the cryptocurrency market's decline in the past few weeks; the Democratic Party is very unfavorable towards cryptocurrencies and capitalism," says analyst borovik.eth, and this viewpoint is not unfounded.

After the presidential election and before the midterm elections, there are several important local gubernatorial elections in the U.S. These local elections can be seen as a vote of satisfaction from the American public towards the Republican Party, as well as a precursor to the midterm elections.

Recently, the Republican Party has faced three consecutive defeats in state-level elections, with the Democratic Party achieving a comprehensive victory:

Virginia Gubernatorial Election: Democratic candidate Abigail Spanberger won by a huge margin of 15 percentage points, becoming the first female governor of the state. The Democratic Party not only secured the governorship but also regained the lieutenant governor and attorney general positions, flipping at least 13 seats in the House of Delegates.

New Jersey Gubernatorial Election: Democratic candidate Mikie Sherrill also became the first female governor of the state. New Jersey is a gathering place for moderate voters, but this time the Democratic Party won by 13.8 percentage points, marking the largest victory since 2005.

California's redistricting of election voting: This could add 5 House seats for the Democratic Party and redraw 3 districts. Next, California Governor Gavin Newsom and others will become Trump's and the Republican Party's strongest opponents.

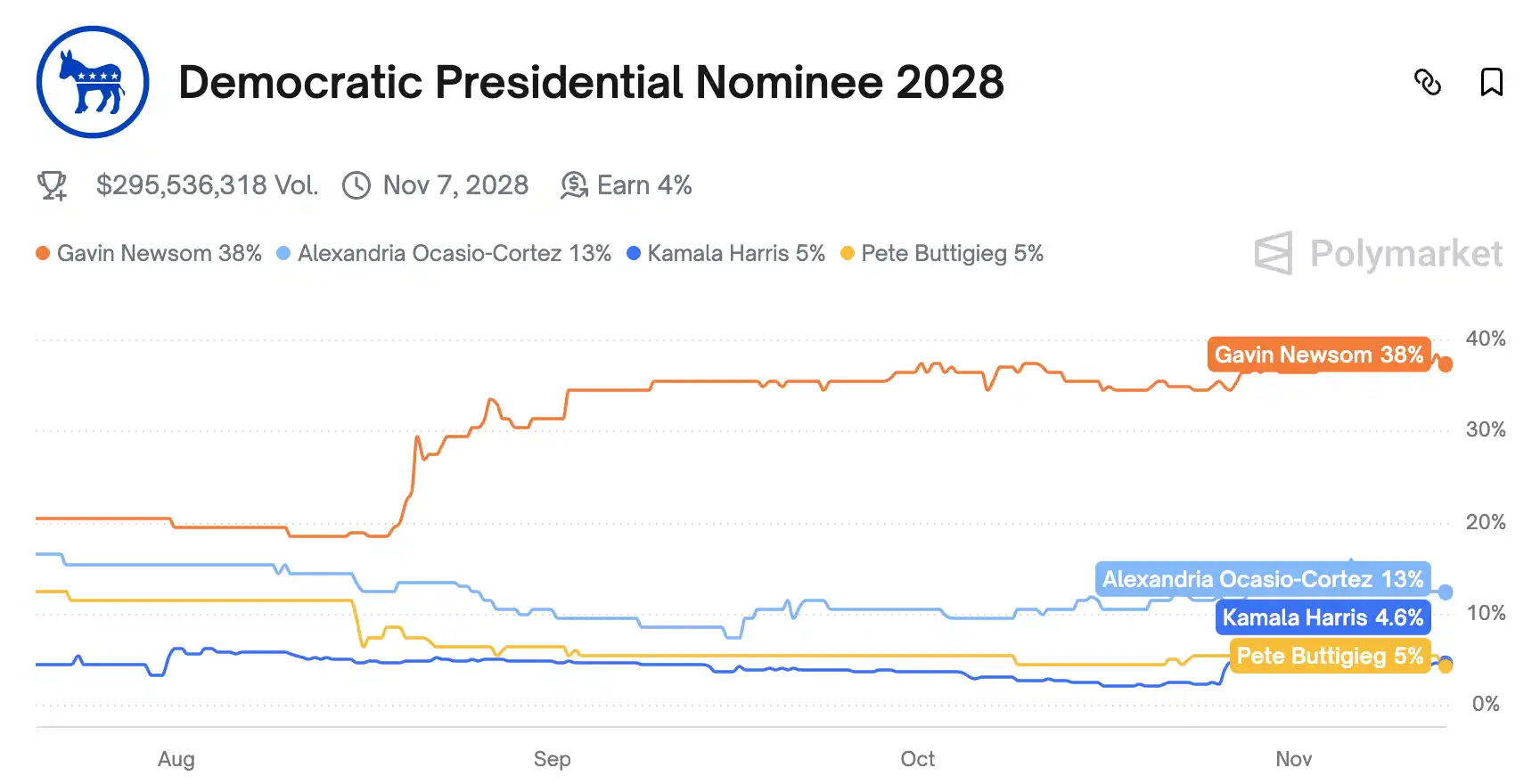

Newsom has consistently maintained the top position for the Democratic presidential nomination in 2028 on Polymarket.

- New York City Mayoral Election: 34-year-old Democratic candidate Zohran Mamdani was easily elected, receiving over 1.03 million votes, with a vote share of 52-55%. He became the first mayor in New York's history born in the 1990s, the first Muslim mayor, and the first Indian-American mayor.

More critically, the symbolic significance of New York is not ordinary; many of the votes supporting Mamdani came from young people who previously supported Trump, earning him the nickname "leftist Trump." This means that in America's largest city, Trump's hometown, nearly 90% of young people have turned to the Democratic Party.

The timing of gubernatorial and mayoral elections in the U.S. is staggered to avoid the "down-ballot effect" of federal elections, allowing local voters to focus more on local issues. Most gubernatorial terms are 4 years, but election years vary by state; mayoral terms range from 2 to 4 years, with more flexible election timing. However, precisely because of this staggered timing, these local elections have become important indicators for federal elections, often predicting national political trends. These governors and mayors are also significant sources for future federal candidates.

For the 2026 midterm elections, the Democratic Party's recent comprehensive victories in state elections provide strong momentum, and many foreign media and analysts believe this is a precursor to a "blue wave" similar to 2017. This poses a political warning for Trump; if he doesn't take action soon, he may repeat the scenario of losing local elections in 2017 and ultimately losing control of the House of Representatives.

In American politics, the first year of governance is often a honeymoon period, the second year is the year of discontent, and the next two years are typically a lame duck period. But Trump probably didn't expect his honeymoon to be so short and his losses to come so quickly.

Even though he still controls both chambers, Trump cannot act freely. The recent U.S. government shutdown is a prime example.

The core contradiction of this government shutdown can be simply stated: the Senate requires 60 votes to advance the government reopening, which is a hard rule. The Republican Party wants the Democratic Party to vote, but the Democrats' condition is to extend an expiring healthcare subsidy, which Trump disagrees with.

Under the leadership of Minority Leader Chuck Schumer, the Democrats have rejected voting 14 times, united like a family.

In contrast, the Republican Party is filled with internal strife and divisions. Trump has repeatedly called for breaking the rules to eliminate the 60-vote threshold, but Senate Republican leaders have rejected this, fearing that abolishing the filibuster would backfire when the Democrats regain power. It is said that Trump was very angry and scolded these Republican leaders.

The final result was that the Republicans compromised, and Trump was forced to accept a package that included Democratic priorities in exchange for reopening the government. This fully demonstrates that the united Democratic Party has the ability to obstruct the Republican agenda, and Trump's control over both chambers is being weakened.

This shutdown has created the longest record in U.S. history, with a large number of civil servants unable to take paid leave and many poor people unable to receive subsidies, leading to significant economic losses that severely weaken the Republican Party's image.

American dissatisfaction has reached a critical point. Livelihood issues are always the biggest political concern.

Dissatisfaction with living standards is indeed on the rise, with frustration over illegal immigration making everyone anxious, and various societal divisions causing further anxiety. Millions of people from the middle class are realizing they are experiencing social class decline, and they feel panic about it.

Millions of people from the middle class are realizing they are experiencing social class decline, and they feel panic about it.

Food inflation is also key; items that used to cost $100 now cost $250, and the quality has worsened. The recent surge in egg prices has just subsided, but Americans' favorite beef is facing new inflation.

The latest Consumer Price Index (CPI) released on October 24 shows that the prices of roasted beef and steak have increased by 18.4% and 16.6% year-on-year, respectively. According to the U.S. Department of Agriculture, the retail price of ground beef has skyrocketed to $6.1 per pound, setting a new historical high. Compared to three years ago, beef prices have cumulatively risen by over 50%.

Additionally, coffee prices have risen by 18.9%, natural gas prices by 11.7%, electricity bills by 5.1%, and car repair costs by 11.5%. Many young Americans burdened with student debt are feeling even more pressure due to the rising cost of living.

The 2026 U.S. midterm elections are scheduled for November 3, and the recent Democratic Party's significant victory in the 2025 gubernatorial elections provides strong momentum for regaining control of the House of Representatives. If next year's midterm elections result in Democratic control of both chambers, Trump will undoubtedly be hampered in the next two years, becoming a complete lame duck.

For the cryptocurrency market, tighter regulations may mean that funds betting on Trump-friendly policies will need to reconsider their direction, and the downward trend may not even wait until the midterm elections.

December Rate Cut is Not a Certainty

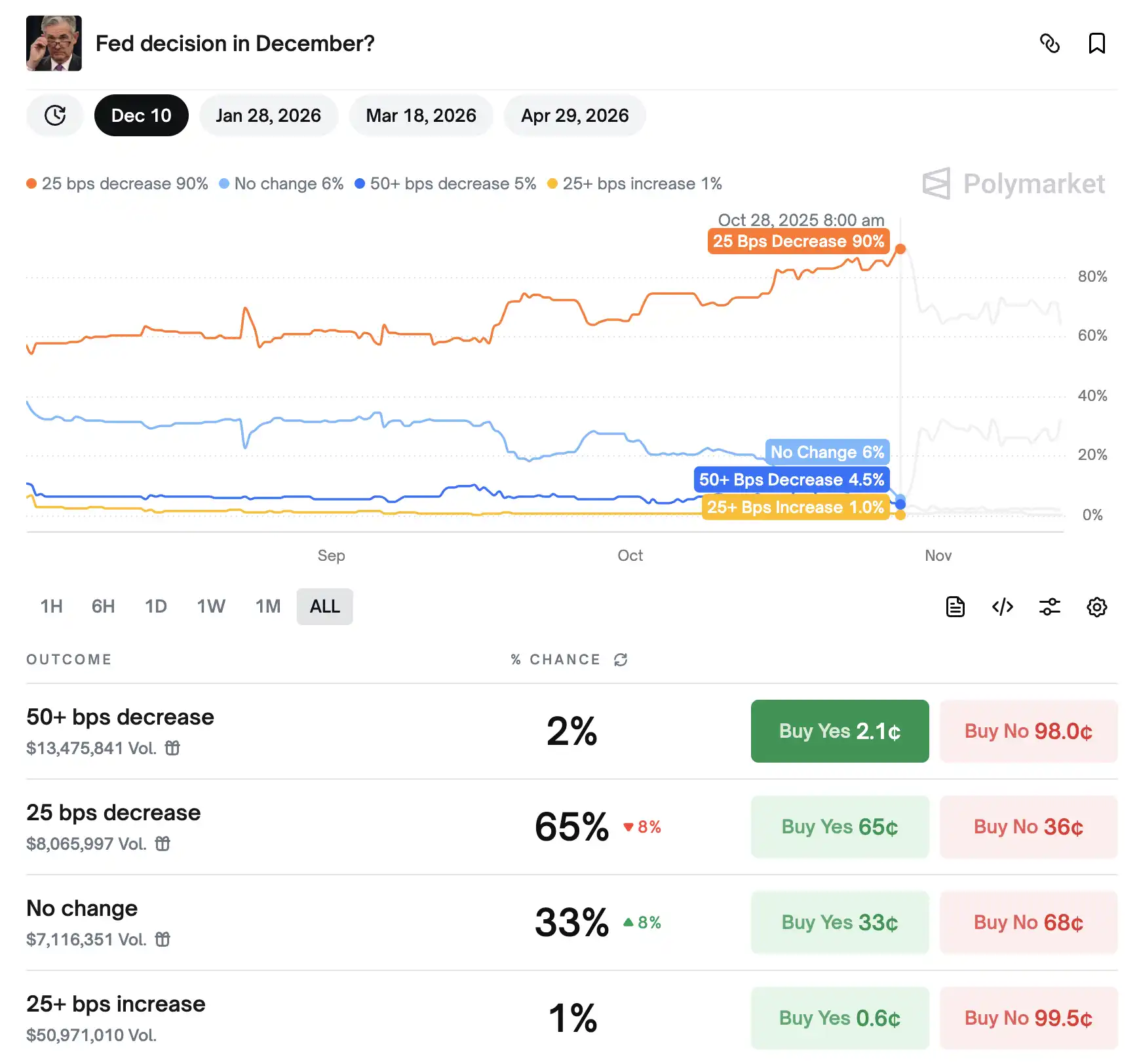

Originally, there was a 90% chance of a rate cut at the Federal Reserve meeting on December 10, but this has now dropped to 65% on Polymarket.

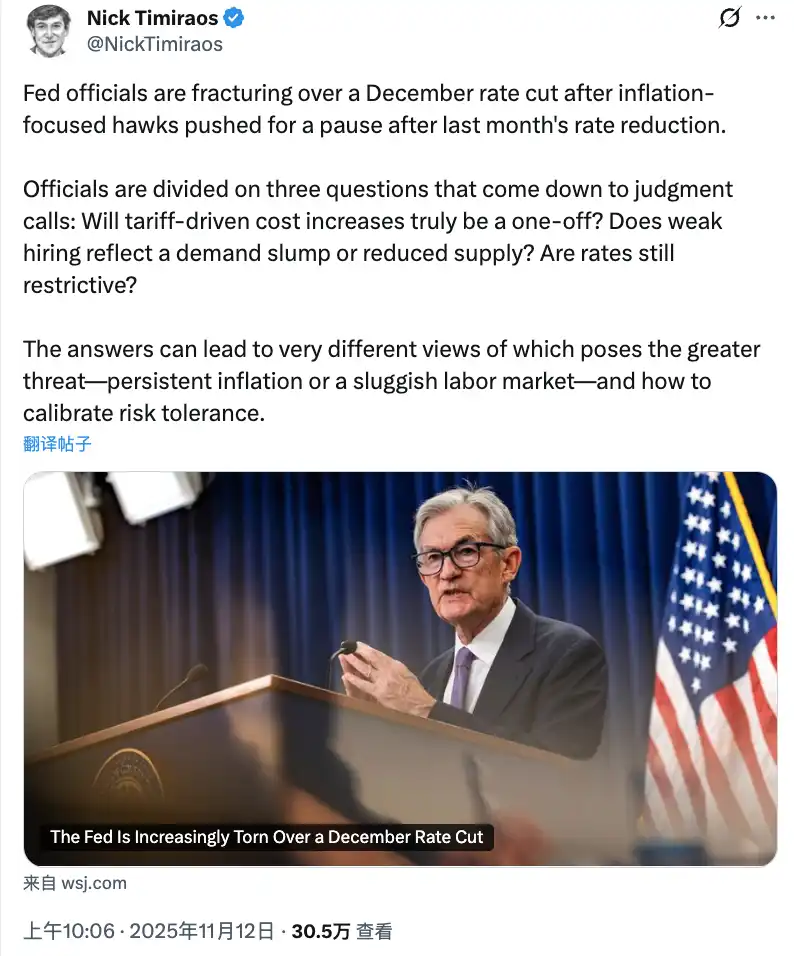

"Fed mouthpiece" Nick Timiraos states that four voting regional Fed presidents (Boston Fed's Collins, St. Louis Fed's Musalem, Chicago Fed's Goolsbee, and Kansas Fed's Schmidt, who voted against the rate cut in October) have not actively pushed for another rate cut in December. Related reading: "Why the Fed's Path to Rate Cuts Suddenly Seems Uncertain"

The divergence among Fed officials regarding a December rate cut is growing. Previously hawkish individuals focused on inflation have begun to advocate for a pause after last month's rate cut, and officials have differing views on three key questions:

First, is the cost increase due to tariffs truly a one-time event? Hawks worry that after absorbing the initial tariff costs, companies will pass on more costs to consumers next year, continuously driving up prices. Doves, on the other hand, believe that companies have so far been unwilling to pass on more tariff costs to consumers, indicating weak demand that is insufficient to support inflation.

Second, is the slowdown in monthly non-farm payroll growth due to weak demand for labor from companies, or is it due to a decrease in immigration leading to insufficient labor supply? If it is the former, maintaining high interest rates will lead to an economic recession; if it is the latter, a rate cut may overly stimulate demand.

Third, do interest rates still have a restrictive effect on the economy? Hawks argue that after a 0.5 percentage point rate cut this year, interest rates are at or near neutral levels, neither stimulating nor suppressing economic growth, thus posing a significant risk for further rate cuts. Doves, however, believe that interest rates still have a restrictive effect, and that a rate cut can support the recovery of the labor market without reigniting inflation.

In August, Powell attempted to quell this debate during a speech in Jackson Hole, Wyoming, arguing that the impact of tariffs is only temporary and that the weakness in the labor market reflects weak demand, thus siding with the doves in support of a rate cut. Data released weeks later confirmed his view: the economic slowdown had indeed halted the creation of new job opportunities.

However, by the meeting on October 29, hawkish voices rose again.

Kansas City Fed President Jeff Schmid opposed the rate cut this month. Several non-voting Fed presidents, including Cleveland Fed President Beth Hammack and Dallas Fed President Lorie Logan, have also publicly expressed their opposition to a rate cut.

At the post-meeting press conference, Powell stated directly that a rate cut in December is not a certainty. Therefore, whether the Fed will cut rates again at the meeting on December 9-10 is currently difficult to predict.

More critically, Fed Chair Powell's term is also nearing its end, with his chairmanship set to conclude on May 15, 2026. Most analysts believe Powell will not risk appearing panicked, and maintaining the status quo is the safest choice.

The dual uncertainty of politics and monetary policy also puts the cryptocurrency market under pressure.

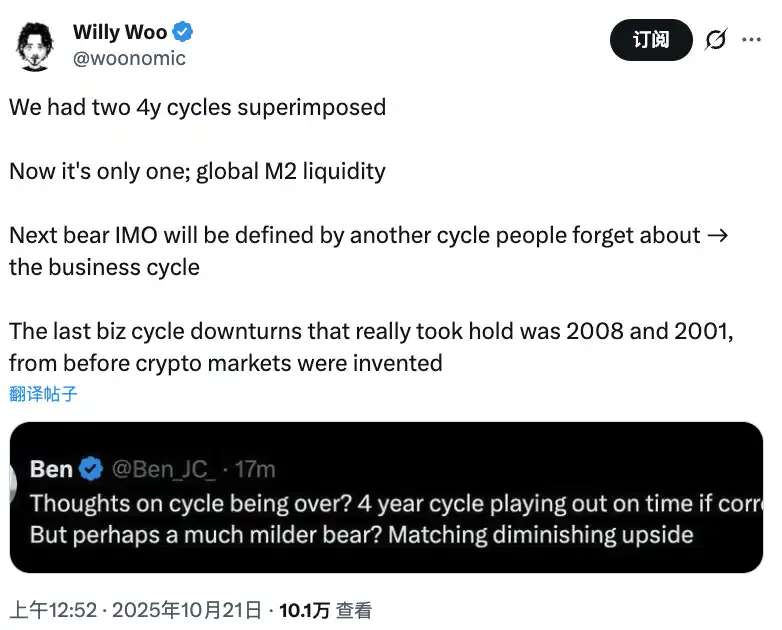

Notable analyst Willy Woo has made a profound observation: the two major cyclical forces that have driven Bitcoin's rise in the past are gradually fading, and what will truly determine the market in the future will not be halving or liquidity, but the macroeconomy itself.

For over a decade, Bitcoin's history has been almost entirely built on the "overlay effect of two four-year cycles": one is Bitcoin's own halving cycle, and the other is the global liquidity (M2) cycle. Whenever the narrative of supply contraction from halving meets the liquidity expansion driven by central bank injections, a strong resonance is formed—this has been the underlying driving force of the past two bull markets. But now, with the misalignment of cycles, this resonance has disappeared, leaving liquidity to act alone.

"The last two real economic recessions, the bursting of the internet bubble in 2001 and the financial crisis in 2008, occurred before Bitcoin was born. In other words, we have never seen how Bitcoin performs during a complete economic recession."

Therefore, Willy Woo suggests: the era of bull markets driven by dual-cycle resonance has ended, and Bitcoin has lost its previous "natural accelerator." The driving force for its rise may be weaker and more dependent on external environments, and Bitcoin's current trend may already be signaling that "the top has been reached."

Galaxy Digital has also recently lowered its Bitcoin price target. They have cut their year-end target from $185,000 to $120,000, citing large-scale sell-offs by major holders, funds rotating into assets like gold and AI, and leveraged liquidations. Galaxy's research director Alex Thorn described this period as a "mature era," characterized by lower volatility and institutional absorption dominating the market.

What do the bulls say?

Of course, not everyone is pessimistic.

U.S. Government Reopens and Injects Liquidity

Real Vision CEO Raoul Pal is optimistic that the cryptocurrency market will soon recover from the ongoing turmoil.

"The road to Valhalla is very close," Pal said. In simple terms, Pal believes that the crypto industry will soon begin an upward trend after experiencing a series of market crashes.

Pal's logic is as follows: the U.S. government shutdown has indeed led to liquidity tightening. Tax revenues are still flowing in, but expenditures are at zero. The Treasury General Account (TGA) balance is approaching $1 trillion, which is the main reason for the liquidity contraction and Bitcoin's underperformance compared to government bonds.

But this is precisely a signal of a turning point. Related reading: "The U.S. Government is About to Reopen, and Bitcoin is Finally Going to Rise."

In response, the Fed has been forced to restart temporary repurchase operations (Overnight Repo), planning to inject nearly $30 billion in liquidity into the market.

More critically, in the next phase: once the government shutdown ends, the Treasury will begin spending $250 billion to $350 billion over the next few months.

When this happens, quantitative tightening will end, and the balance sheet will technically expand. This means that the crypto market will gain free liquidity.

Historical trends also support this judgment. When the Treasury supplements reserves and liquidity becomes extremely tight, it often signals an impending reversal. In other words, the current pain is the darkness before dawn.

Raoul Pal also made an important point: "The four-year cycle is now a five-year cycle… Bitcoin should peak in 2026. Possibly in the second quarter."

This judgment directly addresses the bears' concerns about the "disappearance of cyclical resonance."

Pal's view is that the cycle has not disappeared but has been extended. If the peak is in the second quarter of 2026, then the current position is actually a good time to get on board.

Moreover, even if liquidity acts alone, it is sufficient to drive Bitcoin's rise—provided that liquidity is indeed expanding. The large-scale spending after the government reopens is just the beginning of liquidity expansion.

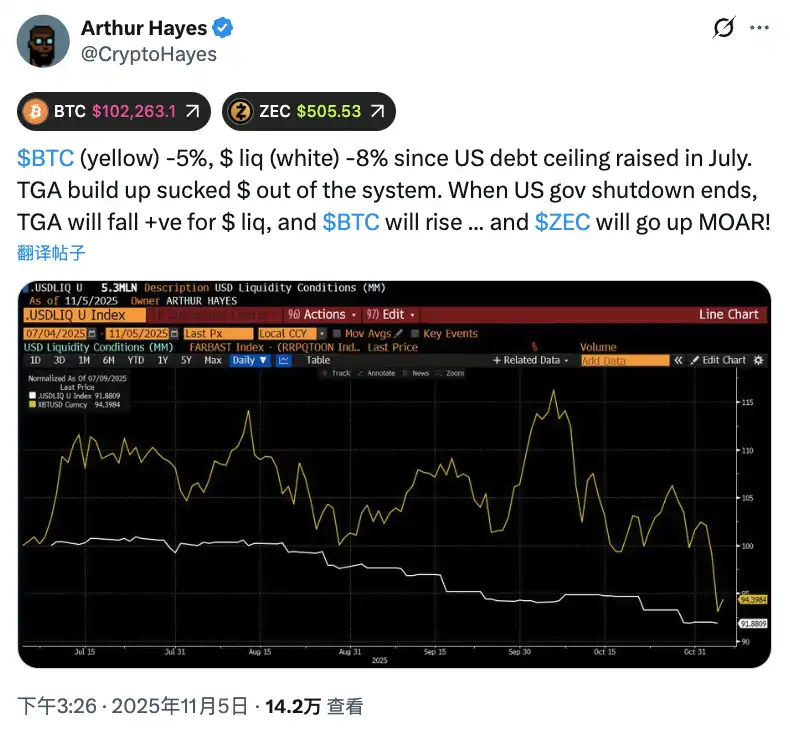

BitMEX co-founder Arthur Hayes echoed similar sentiments. He linked Bitcoin's decline to an 8% drop in U.S. dollar liquidity since July, believing that once the Treasury balance decreases after the shutdown, dollar liquidity will rebound, pushing BTC higher.

In his latest Substack article "Hallelujah," Hayes provided a deeper analysis: the U.S. will issue about $2 trillion in new debt each year for the next few years, while also rolling over old debt. As the purchasing power of the private sector and foreign central banks declines, RV funds will increasingly rely on SRF financing. This will force the Fed to continue expanding its balance sheet, resulting in the effect of "invisible QE." Ultimately, the supply of dollars will continue to expand, which is the fuel for Bitcoin's price increase.

Therefore, Arthur believes that the current weakness in the crypto market is merely liquidity temporarily locked by the Treasury—during the government shutdown, the Treasury absorbed dollar liquidity through bond issuance but has not yet released spending. When the government reopens, this money will flow back into the market, and liquidity will loosen again. Meanwhile, the market may mistakenly perceive this as a peak, leading to Bitcoin sell-offs, but that would be a "major misjudgment." The real bull market will reignite the moment "invisible QE" begins.

JPMorgan analysts also remain optimistic about Bitcoin, predicting that in the next 6 to 12 months, as futures market leverage resets, prices could climb to $170,000. This prediction is based on technical recovery.

The declines over the past few weeks have largely been due to leveraged liquidations. Once the leverage reset is complete, without the burden of excessive leverage, Bitcoin will be more likely to rise.

Accelerating CLARITY Act

The second important reason for the bulls is that the regulatory environment is improving. At the core of this improvement is the CLARITY Act.

Real Vision CEO Raoul Pal repeatedly emphasizes that establishing favorable crypto regulations will provide strong support for the market. His logic is simple: once the CLARITY Act is passed, banks and brokerages will receive regulatory green lights to custody and trade spot crypto ETFs on a large scale.

The CLARITY Act passed the House on July 17, and it has bipartisan support—78 Democratic representatives voted in favor. This number is crucial, indicating that the bill is not just a Republican wish but has a bipartisan foundation.

Just two days ago, on November 10, the Senate Agriculture Committee released a bipartisan discussion draft. The timing is subtle—it's the first significant legislative progress after the government shutdown ends.

The release is from the Senate Committee on Agriculture, Nutrition, and Forestry, led by Chairman John Boozman (Republican from Arkansas) and senior member Cory Booker (Democrat from New Jersey). Note that this is another example of bipartisan cooperation.

Market observers expect the bill to pass by the end of the fourth quarter of 2025. The White House's goal is even clearer: to complete the legislation by the end of 2025.

Currently, on Polymarket, the probability of the CLARITY Act (H.R.3633) passing in 2025 is 41%.

From July to November, it took only four months to move from the House to the Senate discussion stage. This speed is uncommon in U.S. legislative history.

What exactly does this bill change? The most critical point: it transfers the primary regulatory authority over the spot digital commodity market to the CFTC, significantly reducing the SEC's powers.

Specifically, the CFTC will have exclusive jurisdiction over the spot digital commodity market, including mainstream assets like Bitcoin and Ethereum. This means the CFTC can regulate digital commodity exchanges, brokers, dealers, and custodians, establishing anti-manipulation standards, system safeguards, and risk management requirements. Correspondingly, the SEC will lose its authority, retaining only the regulation of securities-type digital assets. The previous uncertain state of "regulating through enforcement" will come to an end.

The bill's treatment of stablecoins is even more clever. It creates a special status for "licensed payment stablecoins": the CFTC's regulatory scope will only apply to trading, solicitation, and acceptance of stablecoins on registered platforms. It will have no regulatory authority over the operations, reserves, or issuance processes of stablecoin issuers. This complements the GENIUS Act (which focuses on issuer licensing and reserves) and avoids regulatory conflicts.

This design is smart. It separates the regulation of stablecoin trading from issuance, avoiding the awkward situation of a single asset being monitored by two agencies simultaneously. The impact on market structure is direct; platforms must register with the CFTC to conduct spot trading of stablecoins, but issuers retain autonomy, avoiding excessive regulation.

This is a significant boon for major stablecoins, such as Ripple's RLUSD stablecoin, Circle's USDC, Tether's USDT, and others.

Countdown for Powell

Powell, who does not heed Trump, is now in a countdown to the end of his term, which will conclude on May 15, 2026, leaving just six months.

In the coming months, the selection of the next Fed chair will become a focal point for the market. The government has narrowed the candidate list but has not yet announced specific individuals.

Currently, the most likely candidate on Polymarket is Kevin Hassett, who is the Director of the White House National Economic Council and has a deep connection with President Trump. Due to his position, he analyzes economic data for Trump almost daily and has even been referred to by Trump as his "economics professor." Their policy ideas align, making him a thoroughgoing dove who has long advocated for rate cuts to stimulate economic growth.

During Trump's first term, Hassett publicly criticized Powell's rate hike policies multiple times, arguing that the Fed's aggressive tightening of monetary policy would harm economic recovery.

This year, the Fed has faced unprecedented political pressure from the Trump administration for not being more aggressive in cutting rates. This political pressure is changing the balance of power within the Fed, and a recent example illustrates this well.

On November 13, according to "Fed Whisperer" Nick Timiraos, Atlanta Fed President Raphael Bostic suddenly announced that he would retire at the end of his current five-year term in February next year. This announcement is somewhat subtle given the potential for a rate cut in December.

After all, Bostic is one of the most hawkish figures within the Fed, and his departure will weaken the hawkish voices within the Fed during this politically sensitive period.

Futures market pricing indicates that by the end of 2026, the Fed will cut rates at least four times, each by 25 basis points. If Hassett indeed becomes the Fed Chair, combined with the diminishing hawkish voices within the Fed, there is no doubt that the pace and magnitude of rate cuts will exceed market expectations. Liquidity will be significantly released, and risk assets will experience a strong rally.

This is very positive news for the crypto market.

Another key political event is that Trump is repairing relationships with former allies. The signal came on November 4, when Trump announced the renomination of Isaacman, a friend of Musk, to head NASA.

After the announcement, Isaacman's friend, SpaceX CEO Elon Musk, quickly retweeted the news.

Trump first nominated Isaacman to head NASA in December last year, but withdrew the nomination in May this year after a heated argument with Musk over the "Beautiful Act," appointing Transportation Secretary Sean Duffy as acting head of NASA, effectively giving Musk a warning. The two then exchanged barbs, leading to a "breakup of the century."

A turning point appeared in August this year. According to the Wall Street Journal, while considering launching the "American Party," Musk's focus included maintaining his relationship with Vice President Vance. Sources say Musk has been in contact with Vance in recent weeks. He admitted to his aides that if he continued to push for forming a political party, it would damage his relationship with Vance. Reports indicate that Musk and his aides have informed close associates that if Vance decides to run for president in 2028, Musk would consider using his substantial financial resources to support him, which indeed seems to be the optimal solution under Musk's return to rational thinking.

In September, media captured Trump and Musk appearing together at a memorial service for Charlie Kirk, shaking hands and conversing, indicating a warming of their relationship. Indeed, multiple U.S. media outlets reported that as Musk's relationship with the Republican Party improved, Isaacman seemed to gradually re-enter discussions about the NASA director nomination.

Trump and Musk engaged in a deep conversation at Kirk's memorial service.

The renomination on November 4 is another signal of reconciliation, and the timing is subtle, occurring right after the Democratic Party's local election victory.

The bears see Trump's declining approval ratings, Republican compromises, and a bleak outlook for 2026. The bulls see the Republican Party consolidating power, repairing ally relationships, preparing to push key legislation before the end of the year, and continuing to impact the 2026 midterm elections.

Uncertainty itself is the greatest certainty

How high will Bitcoin rise? Traders and analysts have given varying answers, ranging from $120,000 to $170,000.

After reviewing all the arguments from both sides, three points can be summarized.

First, look at liquidity in the short term, regulation in the medium term, and cycles in the long term.

If we only consider the next few weeks, the end of the government shutdown + continued liquidity tightness + increased political uncertainty indeed constitutes pressure. Galaxy's $120,000 year-end target may be a relatively conservative but realistic expectation.

However, looking at the next six to twelve months, the combination of large-scale government spending + the implementation of the CLARITY Act + liquidity release could push prices closer to $170,000. JPMorgan's judgment has its rationale.

As for Raoul Pal's prediction of a peak in the second quarter of 2026, that is a longer-term cyclical judgment. The five-year cycle replacing the four-year cycle means that if this assumption holds, now is actually a good time to position oneself.

The key is to clearly understand which time frame you are trading in. Short-term traders should focus on liquidity data and government spending progress, medium-term holders should keep an eye on the CLARITY Act and the Fed's leadership transition, while long-term investors should consider the business cycle and Bitcoin's essential positioning.

Second, political risk is overestimated, but it cannot be completely ignored.

The Democratic Party's victory in local elections does pose a threat to the 2026 midterm elections. However, there is still a full year until the midterm elections.

A lot can happen politically in a year. Trump's reconciliation with Musk may lead the Republican Party to push more favorable legislation before the end of the year, and improving economic data could also shift public opinion.

More critically, even if the Democrats regain Congress in 2026, if the key crypto regulatory framework has already been established in 2025, it is unlikely to be overturned in the short term. The CLARITY Act received support from 78 Democratic representatives in the House, indicating it has a bipartisan foundation.

A characteristic of American politics is that "large ships are hard to turn." Once a regulatory framework is established, even with a change in party control, it is difficult to completely reverse it in the short term.

Therefore, betting on the logic that "Democratic victory leads to crypto doom" is overly simplistic. Political risk exists, but it is not as fatal as the market imagines.

What is truly worth being cautious about is the political uncertainty itself. If the market remains in a state of not knowing who will win for an extended period, funds will choose to wait and see. This wait-and-see sentiment may harm the market more than the victory of either side.

Third, the biggest risk is not political but economic recession.

The bears' concerns about the "business cycle" are, in fact, the most significant risks to pay attention to.

If the U.S. economy does enter a recession, will Bitcoin plummet like tech stocks or become a safe-haven asset like gold?

There is no historical answer to this question, as Bitcoin has never experienced a complete economic recession cycle. The internet bubble in 2001 and the financial crisis in 2008 both occurred before Bitcoin was born.

Current data does show signs of economic slowdown: weak job growth, declining consumer spending, cautious business investment, and food inflation putting pressure on the middle class.

If these trends continue, there may indeed be a risk of recession in 2026. At that time, liquidity release, regulatory friendliness, and Trump's reconciliation with Musk may all become ineffective. Bitcoin will face a real stress test.

This is also why JPMorgan, despite giving a $170,000 target, emphasizes the need for a "leverage reset"; and why Raoul Pal, while optimistic about 2026, also acknowledges that "the market will be volatile until invisible QE begins." They are all waiting for a confirmation signal: whether the economy can achieve a soft landing.

When will the government reopen? When will the CLARITY Act be passed? Will the Fed cut rates in December? What will be the outcome of the 2026 midterm elections? The answers to these questions will determine Bitcoin's short-term direction.

But the longer-term question is: how will Bitcoin perform in the next economic recession? This answer may not be revealed until 2026. Until then, traders will continue to debate, and the market will remain volatile. The only certainty is that uncertainty itself remains the greatest certainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。