Yesterday, when the market was rising, we clearly stated that we would continue to be bearish, and then the market dropped in the evening. Those who shorted according to our thinking made a profit. Currently, the market is still showing a bullish close, but we will continue to maintain a bearish mindset.

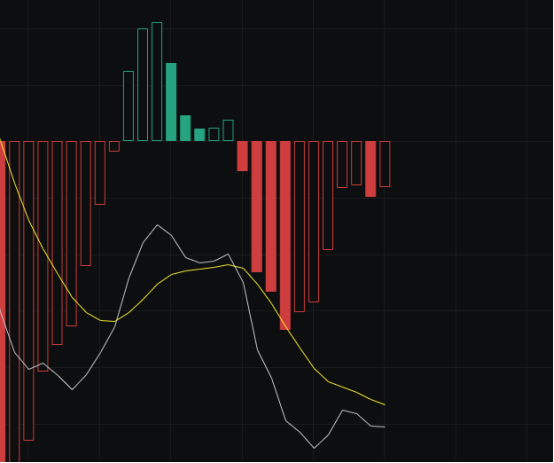

From the MACD perspective, yesterday's pattern showed that the energy bars were close to the zero axis, but with the drop in the evening, the energy bars also fell. The upcoming golden cross between the fast line and the slow line has also failed. As we mentioned earlier, continuous volume is needed to push up; without it, the market will drop.

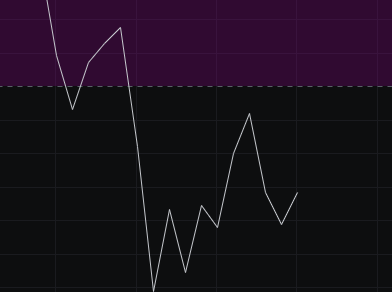

From the CCI perspective, today's market rise has seen a certain increase in CCI, but the increase is not significant, and there is still some distance to -100. We will continue to monitor whether CCI will touch -100 in the next couple of days.

From the OBV perspective, today's market rise has seen a certain increase in OBV, but the volume is still not large. If the market is really going to rise, it needs continuous volume or a large amount to support it, so the current volume has not reached the point of a bullish counterattack.

From the KDJ perspective, the fluctuations in KDJ have not been significant in recent days, indicating that KDJ is also waiting to choose a direction. We will continue to monitor whether KDJ will touch the 50 mark. If it can stay above 50, there is a possibility of further upward movement; if not, it will continue to decline.

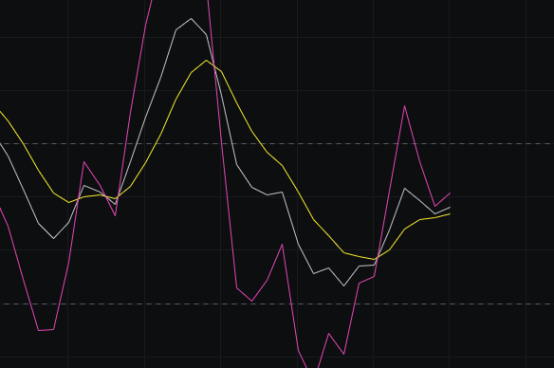

From the MFI and RSI perspectives, both indicators are in a weak zone. Although the pattern appears to be upward, a real upward movement requires several consecutive bullish candles to complete. Therefore, we will see if there will be any bullish candles in the future.

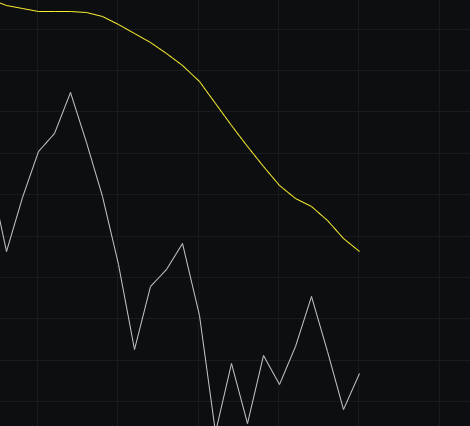

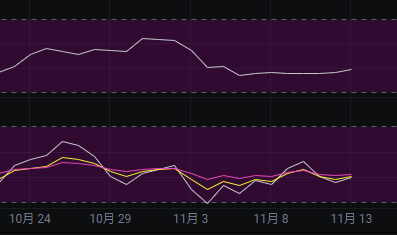

From the moving average perspective, today the price continued to rise to near the BBI, but then it was suppressed and fell back down, similar to yesterday's trend. If the market maker really wants to push upward, and it fails to stand above the BBI on the first and second attempts, a third attempt will be needed. If the next attempt stands above the BBI, we can consider that the market maker is genuinely aiming to push up; otherwise, we will continue to maintain a bearish mindset.

From the Bollinger Bands perspective, following yesterday's bearish close, the Bollinger Bands have entered a downward channel. However, to maintain this downward channel, the market needs to cooperate in the coming days. It would be best to see bearish candles; small bullish candles would also be acceptable. If there are medium or large bullish candles, the downward channel may be broken, so we will observe what kind of candles will form in the next two days.

In summary: The market has reached a critical point, and we need to see if the price can stand above the BBI and the closing situation to judge the market maker's intentions. Therefore, the market movements in the coming days are particularly important. Today's resistance is seen at 103000-104500, and support is at 101500-100000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。