Written by: Glendon, Techub News

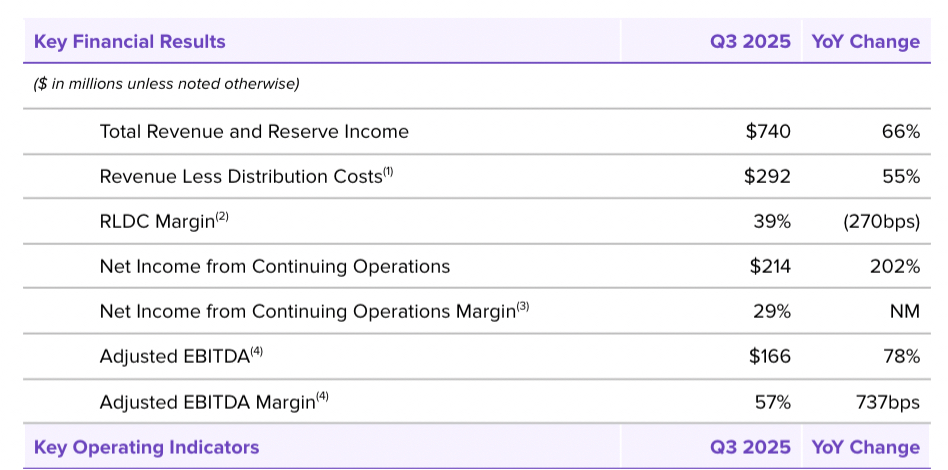

On April 12, Circle announced its financial report for the third quarter of this year, showcasing impressive performance, including key data such as total revenue and reserve income, USDC circulation at the end of the quarter, net profit, and total assets. Circle's total revenue and reserve income reached $740 million, a significant increase of 66% compared to the same period last year. Additionally, in terms of ecosystem development and strategic growth, Circle revealed that it is considering launching a native token for the Arc Network.

Notably, Ark Invest, led by Cathie Wood, significantly increased its holdings in Circle stock yesterday, purchasing 353,328 shares valued at approximately $30.49 million. Circle's outstanding performance, combined with the enthusiasm from the capital markets, paints a bright development picture for the company. So, what highlights does this financial report reveal about Circle? And what potential challenges does it face in the current complex and changing market environment?

Financial Report Highlights: Net Profit Increased by 202% Year-on-Year, USDC Ecosystem is Rising

The financial report shows that Circle's total revenue and reserve income climbed to $740 million, a year-on-year increase of 66%. Among this, reserve income grew by 60% to $711 million, accounting for a remarkable 96% of total revenue. This significant growth is primarily attributed to the substantial increase in the circulation of the stablecoin USDC, which has become the key engine driving revenue growth. Meanwhile, subscription and service income, as well as trading income, also exhibited strong growth, leading to "other income" reaching $29 million, an increase of nearly 21% compared to $24 million in the second quarter of this year.

However, Circle faced certain challenges in cost control this quarter. Its total distribution, trading, and other costs amounted to $448 million, a year-on-year increase of 74%, with the cost growth slightly outpacing revenue growth. This situation is mainly due to two factors: first, as USDC circulation increased, distribution payments correspondingly rose; second, the growth in average USDC holdings on the Coinbase platform also brought some cost pressure. Additionally, in terms of operating expenses, due to rising compensation costs and $59 million in equity incentive expenses provided in the third quarter, Circle's operating expenses reached $211 million, a year-on-year increase of 70%. Adjusted operating expenses were $131 million, a year-on-year increase of 35%.

In terms of profit performance, Circle achieved an astonishing turnaround this quarter. In stark contrast to the net loss of $482 million in the previous quarter, the company turned a profit this quarter, with a net profit of $214 million, a year-on-year increase of 202%. This significant improvement is partly due to the increase in USDC income and the operational leverage of its business model; on the other hand, equity incentive expenses, research and development tax credits, and a $61 million income tax benefit resulting from recent U.S. tax legislation also contributed to the net profit growth. Additionally, the net profit includes a $48 million gain due to the decline in the fair value of convertible debt caused by the drop in stock prices in the third quarter.

Adjusted EBITDA increased by 78% year-on-year, reaching $166 million. These figures indicate that the growth in USDC circulation has driven the optimization of the revenue structure, while the adjusted expense growth rate being lower than the revenue growth rate reflects Circle's improved operational efficiency. Overall, Circle demonstrated a favorable trend of "high revenue growth, controllable costs, and improved profits" this quarter, with the continued expansion of the USDC ecosystem undoubtedly being the core driving force.

Undoubtedly, Circle's performance in the third quarter is largely attributed to the formal signing and implementation of the U.S. "GENIUS Act." This milestone event has brought a historic and significant change to the regulatory environment for the stablecoin industry. The act establishes a clear regulatory framework for payment stablecoins at the federal level for the first time, marking the end of the era of unregulated growth in the stablecoin industry. In this new regulatory landscape, Circle, which has long adhered to high compliance standards, has demonstrated a significant competitive advantage.

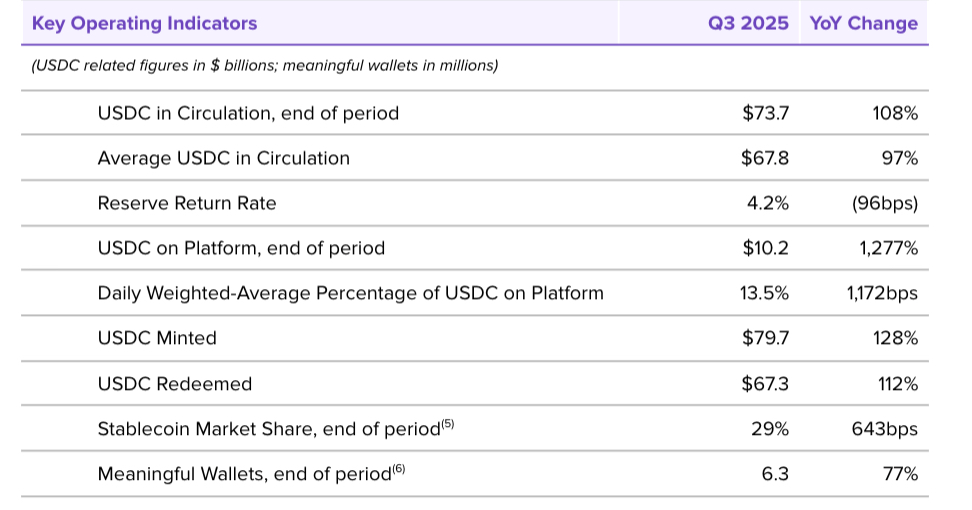

This advantage is vividly reflected in the rapid expansion of USDC. By the end of the third quarter, USDC circulation had reached $73.7 billion, a year-on-year increase of 108%, with an increase of over 20% compared to $61.3 billion at the end of the second quarter. Furthermore, USDC's market share has further increased to 29%, up 643 basis points year-on-year, further solidifying its position as the second-largest stablecoin in the market, only behind USDT.

From the perspective of ecosystem development, Circle has also made breakthrough progress in multiple areas. On October 28, Circle announced the launch of the public testnet for the L1 blockchain Arc, with over 100 companies participating, including leading institutions from capital markets, banking, asset management, insurance, payments, fintech, and technology sectors, as well as various segments of the digital asset ecosystem.

On this basis, it is noteworthy that Circle further disclosed that it is exploring the possibility of launching a native token on the Arc network. This idea aims to promote network participation to drive adoption, further align the interests of Arc stakeholders, and support the long-term growth and success of the Arc network.

Moreover, the development of Circle's previously launched payment network, Circle Payments Network (CPN), is also gradually on track. Currently, this payment network supports fund flows in 8 countries, with 29 financial institutions joining, and is reviewing the qualifications of 55 institutions, with 500 more in the preparatory stage for joining. Since its launch at the end of May this year, network activity has surged, with strong demand from institutional clients. As of November 7, 2025, the annualized transaction volume based on the past 30 days' activity reached $3.4 billion.

Since the second quarter, Circle has also achieved remarkable results in expanding partnerships and innovating financial products. On one hand, it has established key partnerships with numerous well-known companies such as Brex, Deutsche Börse Group, Finastra, Fireblocks, Hyperliquid, Kraken, Unibanco Itaú, and Visa; on the other hand, the scale of Circle's tokenized money market fund USYC has seen significant growth, increasing by over 200% from June 30, 2025, to November 8, reaching approximately $1 billion. These positive developments in ecosystem construction further enhance the adoption rate of USDC and Circle's position in the global financial infrastructure.

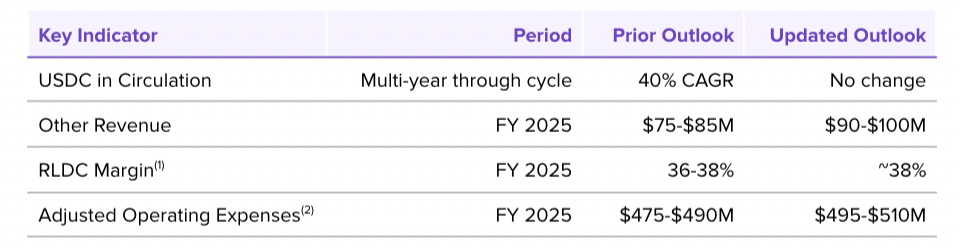

Based on the aforementioned achievements and the strong performance of USDC, Circle has demonstrated firm confidence and proactive planning for future development in its financial report's forward-looking outlook. In addition to maintaining a compound annual growth rate of 40% for USDC circulation, Circle has also made significant adjustments to its revenue expectations, RLDC profit margin expectations, and operating expense expectations.

Specifically, Circle has raised its "other income" expectation from the previous $7.5 million - $8.5 million to $9 million - $10 million. This upward adjustment is mainly due to the growth in subscription and service income in the third quarter, as well as the fundamental growth momentum of trading income. Meanwhile, the RLDC profit margin expectation has been raised from the previously projected 36% - 38% to a maximum of 38% (Note: the calculation method for RLDC profit margin is: "total revenue and reserve income minus total distribution, trading, and other costs" divided by total revenue and reserve income). Additionally, the adjusted operating expense expectation has been raised from $475 million - $490 million to $495 million - $510 million. This series of adjustments indicates that Circle will further expand its investment to better meet the growing market demand.

Opportunities and Challenges: Potential Exploration of Arc Network Native Token

Circle's operational performance in the third quarter is closely linked to the profound changes in the industry regulatory environment. The introduction of the U.S. "GENIUS Act" has brought Circle a more significant compliance advantage compared to other stablecoin issuers. At the same time, the arrival of the institutional era has injected tremendous momentum into the growth of USDC circulation. Driven by these dual favorable factors, Circle's ecosystem is exhibiting a comprehensive prosperity, with key indicators such as USDC supply, total revenue, net profit, and payment network CPN transaction volume all achieving simultaneous increases.

Circle co-founder Jeremy Allaire stated, "In the third quarter, as we build a new economic operating system for the internet, Circle continues to see accelerated adoption of USDC and our platform. The launch of the Arc public testnet has also received enthusiastic responses from traditional finance and digital finance partners."

From the perspective of the important financial indicator of the debt-to-asset ratio, Circle's disclosed balance sheet also reveals some details. As of September 30, Circle's unaudited total assets were approximately $76.781 billion, with total current assets of about $75.903 billion, accounting for 98.86%, mainly including cash and cash equivalents (approximately $73.373 billion) that are segregated for the benefit of stablecoin holders, cash and cash equivalents (approximately $833 million) segregated for the company's holdings of stablecoins, cash and cash equivalents (approximately $1.35 billion), and prepaid expenses and other current assets (approximately $321 million). Total non-current assets were approximately $988 million, including restricted cash, investments, net fixed assets, digital assets, and net intangible assets.

Circle's unaudited total liabilities amounted to $73.821 billion, with a debt-to-asset ratio of approximately 96.14%. In comparison to Circle's situation in the second quarter, when total assets were approximately $64.153 billion and total liabilities were approximately $61.783 billion, with a debt-to-asset ratio of approximately 96.31%, it can be observed that the debt-to-asset ratio slightly decreased in the third quarter.

Due to the unique business model of the stablecoin industry, the "high debt - high liquid asset" ratio ensures the 1:1 dollar peg and instant redemption capability of USDC. Therefore, the asset-liability ratio of over 96% still aligns with the industry characteristics of stablecoin issuers. However, the slight decrease in the third quarter indicates that Circle has maintained a moderate optimization of its financial structure during its business expansion, suggesting a slight enhancement in the company's debt repayment ability. Furthermore, through further analysis of the data, it is evident that Circle's asset expansion rate is slightly faster than the growth of liabilities, with total assets increasing by approximately 20% quarter-on-quarter and total liabilities growing by about 19%. This indicates that the company is accumulating assets more rapidly while expanding USDC circulation.

In terms of revenue structure, Circle's business model has long faced a prominent issue: excessive reliance on interest income from interest-sensitive reserves.

Currently, "other income" accounts for less than 4% of total revenue, which directly reflects the singularity of its revenue structure. However, Circle's determination to increase investment and the rapid growth of subscription services and trading income convey a positive signal: Circle is attempting to change its over-reliance on single reserve interest income. This is precisely one of the biggest challenges Circle faces. The current market is turbulent and appears to be heading towards a bear market. Once market interest rates enter a downward cycle, reserve interest income will face severe tests and will be difficult to maintain at current levels.

Against this backdrop, Circle's active ecosystem construction and strong promotion of the Arc test network and payment network CPN development intentions become increasingly evident. On one hand, this is to achieve a transformation into a global payment and financial infrastructure platform, enhancing its competitiveness in the global financial sector; on the other hand, it is also to expand more profit channels and inject new momentum into its sustainable development.

Therefore, Circle's emphasis in the financial report on "exploring the launch of a native token on the Arc network" is clearly not a casual remark, but perhaps indicates that it has begun to accelerate its strategic layout in this direction.

So, what potential benefits would Circle bring if it launches a native token for the Arc network?

First, it would enhance network governance and ecological control. The launch of a native token could build a more complete governance mechanism for the Arc network, allowing Circle to manage key decisions such as network upgrades and fee adjustments more flexibly. At the same time, through the design of the token economic model, Circle could incentivize developers, validating nodes, and users to participate in ecosystem construction, strengthening control over the stablecoin ecosystem.

Second, it would diversify revenue sources. Currently, Circle's revenue is highly dependent on USDC reserve income, which accounts for about 96%. The issuance of a native token would open new revenue channels for Circle, such as through token sales, transaction fee sharing, or staking yield sharing, effectively reducing reliance on single interest income.

Furthermore, it would enhance the network's value capture ability. The native token could serve as a value carrier for the Arc network, helping Circle capture the dividends brought by ecological growth more effectively. Additionally, this move could promote ecological synergy and user stickiness. Tokens can serve as an effective incentive to encourage users and developers to utilize the services of the Arc network, thereby promoting the prosperous development of the ecosystem.

Finally, it could address the risk of declining market interest rates. In the context of potential downward cycles in interest rates, the launch of a native token would help Circle lay out its strategy in advance, using the token economic model to hedge against the risk of reduced reserve interest income and enhance financial resilience.

The above description sounds entirely beneficial for Circle, but we must recognize that the Arc network is just getting started and is still in the testnet phase. Moreover, the native token is not a "panacea" that solves all problems. The success of the Arc network still depends on Circle's long-term strategic execution capabilities and its ability to attract enough developers and users to form an active ecosystem. From the current situation, Circle's ecosystem still has a long way to go to achieve a diversified revenue structure.

It is important to clarify that while Circle may be one of the biggest beneficiaries of the U.S. "GENIUS Act," it is certainly not the only winner. Under the impetus and transformation of policies, the stablecoin market has already entered a fiercely competitive battlefield. An increasing number of trading platforms, public chains, and other crypto ecosystem participants, as well as traditional financial institutions, are beginning to launch native stablecoins, attempting to carve out a share of this market. For example, Sui announced yesterday that it will launch a native stablecoin USDsui issued by Bridge, a company under Stripe, specifically designed for the Sui ecosystem; today, Telcoin announced that it has received final charter approval from the Nebraska Department of Banking and Finance to issue the first bank-issued on-chain dollar stablecoin, eUSD; earlier, Hyperliquid, MetaMask, and others also launched their own native stablecoins, intensifying market competition.

Circle's biggest competitor, Tether, is not only actively developing blockchain ecosystems through Plasma and Stable networks but is also planning to launch a U.S. compliant stablecoin, USAT, aiming to secure a place in the compliant stablecoin market and even targeting the dominant position in the U.S. stablecoin market.

As of the time of writing, Coingecko data shows that USDC has a market capitalization of approximately $76.09 billion, with the total market capitalization of stablecoins around $312.586 billion, and USDC's market share at about 24.34%. This means that in less than two months, USDC's market share has dropped by over 4% (as mentioned earlier, the financial report recorded USDC's market share at 29% as of September 30). This illustrates the fierce competition in the stablecoin market, which has reached a rapidly changing level.

Looking back, Circle's exploration of launching a native token on the Arc network may not just be an idea. Circle may also hope to further expand its business landscape through this strategic decision, enhancing the overall competitiveness of USDC and the Circle ecosystem.

In summary, the potential challenges Circle faces today are indeed increasing. However, it is undeniable that its third-quarter financial report has delivered an impressive performance, showcasing Circle's rapid development and significant achievements following changes in U.S. policy. But in the long run, the challenges Circle will face will become increasingly severe. Whether it can maintain the "duopoly" with Tether or successfully defend its position in the U.S. market against Tether remains uncertain. In this context, launching a native token for the Arc network may be a viable option for Circle to break through.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。