Another consequence of 10/10 crash:

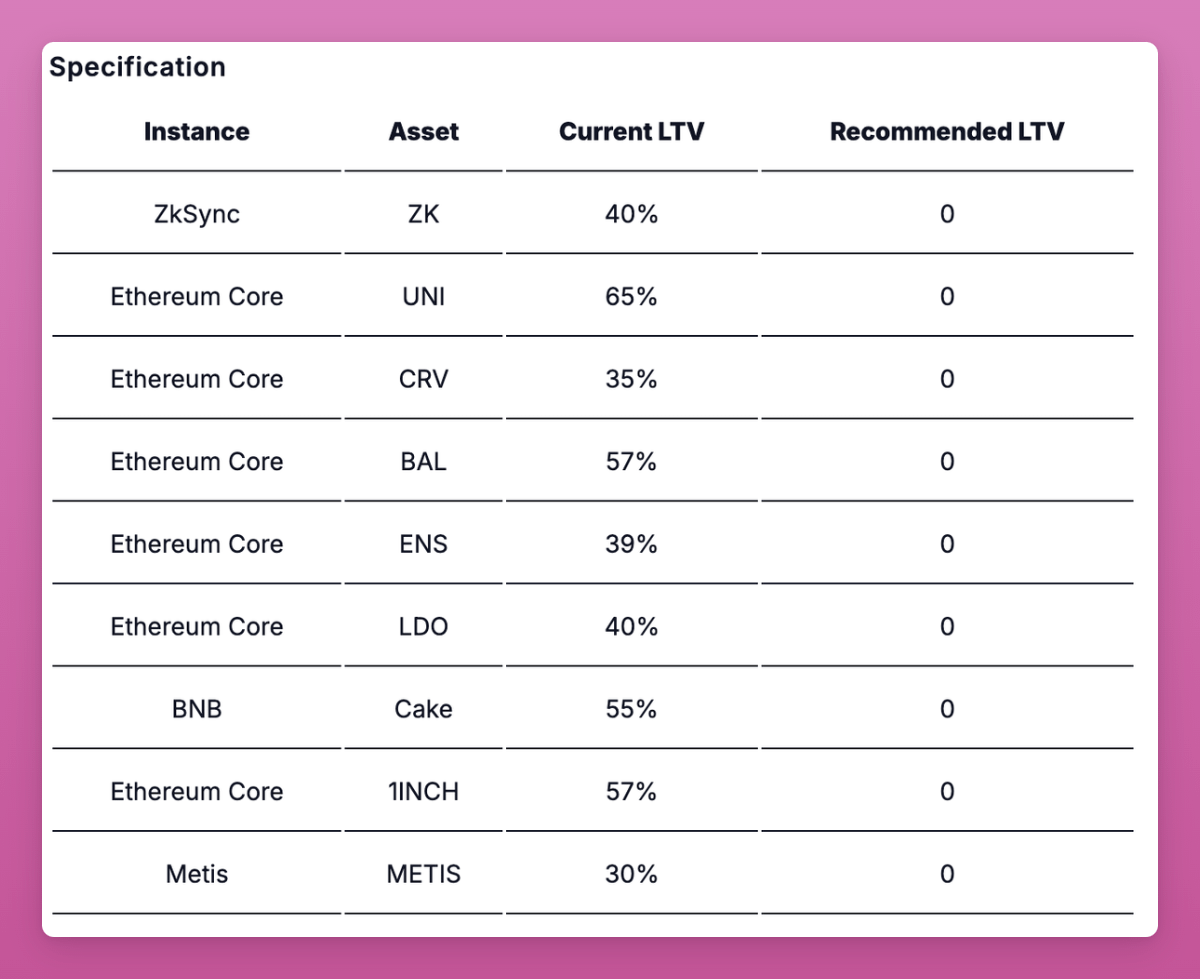

Aave is removing volatile alts as collateral: $CRV, $UNI, $ZK, $BAL, $LDO, 1INCH, $METIS, $CAKE

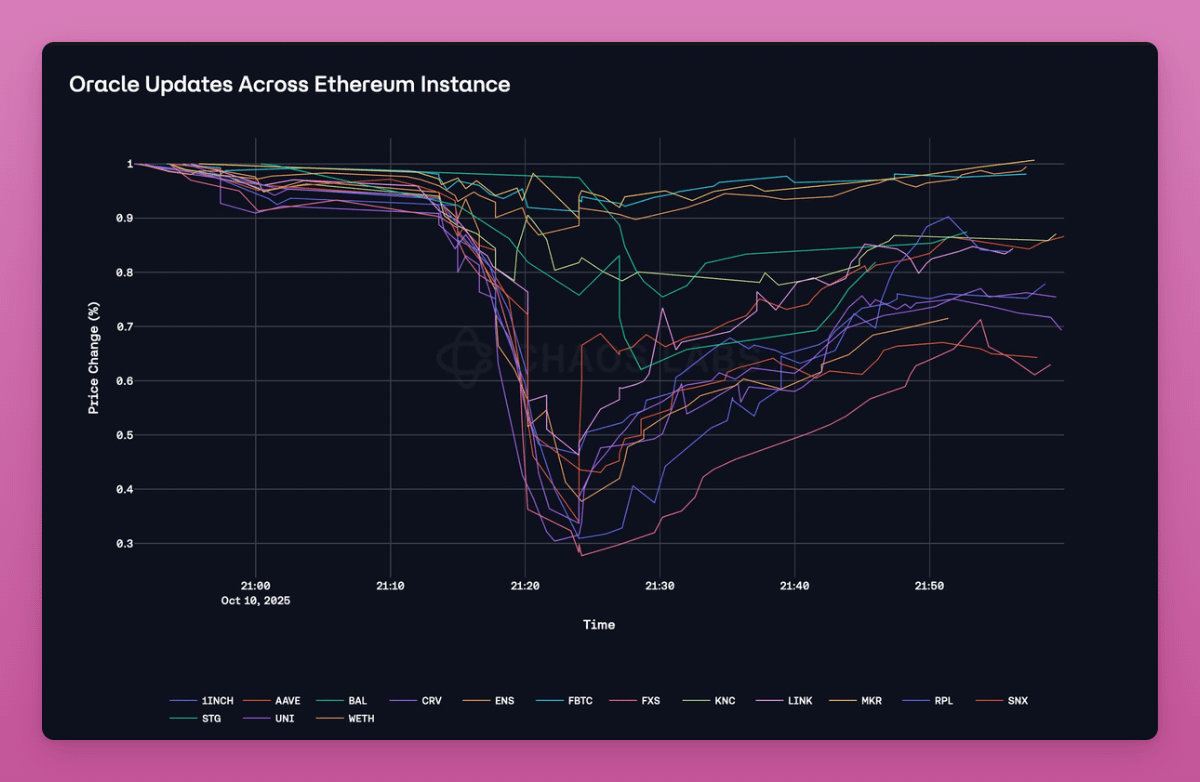

During the crash, oracle prices jumped 15% to 50% in single updates.

Some feeds lagged by minutes posing risk of bad debt:

If the oracle shows a lower price while price on DEXes haven’t moved yet, attackers deposit another asset, borrow the underpriced one, dump it onchain, and repeat until liquidity is gone.

------

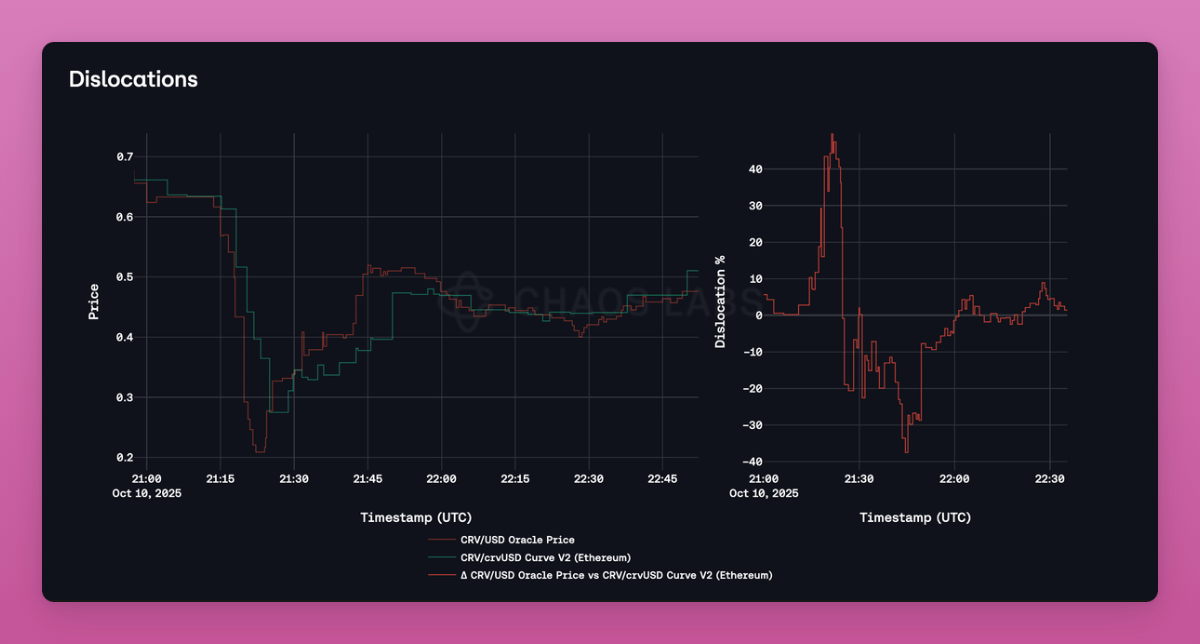

This happened with $CRV.

The Chainlink feed showed ~0.21 while on Curve it was still trading at ~0.36.

A 58% gap that lasted long enough for attackers to drain ~$200K

-------

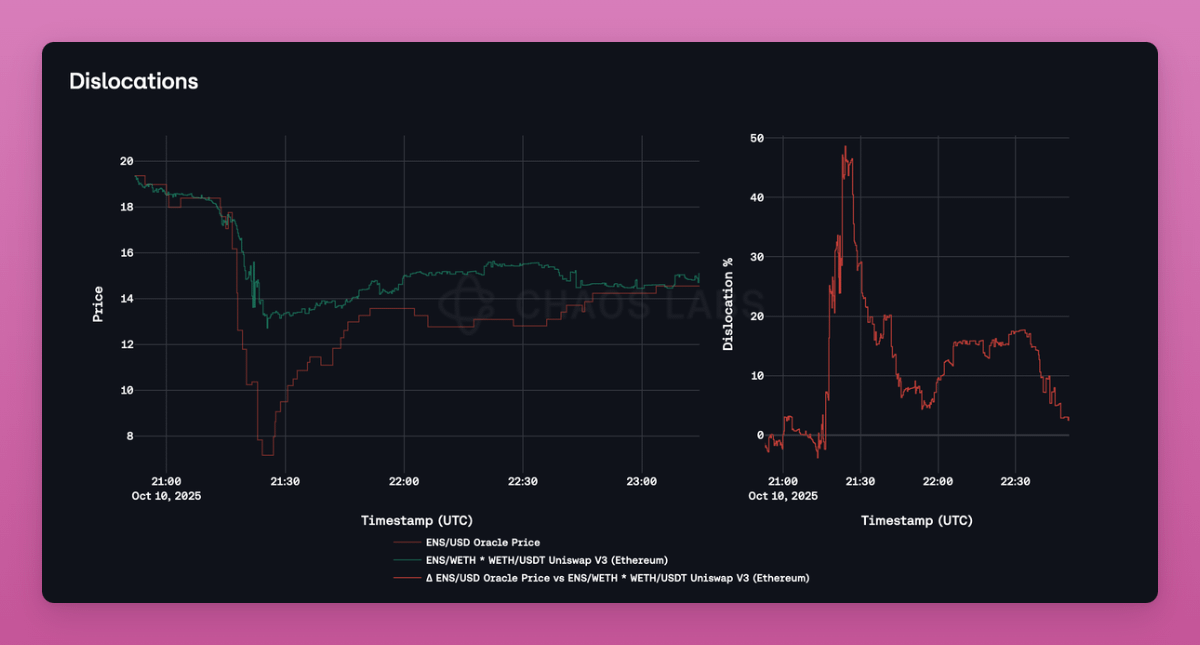

Same thing with $ENS.

One user made over 17 WETH because the oracle lagged while price on Uni LP pools stayed higher.

------

These assets also earn very little for Aave:

- Borrows: $CRV (highest) $80K per year while others $37

- Collateral: $14K over the last 3 months for 7 alts!

High risk, no revenue.

So Aave voting to set LTV to zero and removing them from borrowing. Another reason not to hold alts this cycle.

As a delegate, I also voted 'For' the proposal.

(P.s. Massive shoutout to @chaoslabs for proposal research and execution)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。