The cyclical downturn of the economy, government shutdowns, and the AI frenzy are pushing the U.S. economy into an unprecedented predicament. The U.S. economy is currently facing an unprecedentedly complex situation.

The U.S. economy is in a unique predicament characterized by the "overlap of three phases": cyclical economic downturn, fiscal contraction due to government shutdowns, and structural crowding out of consumers and non-AI businesses by AI. These three forces intertwine to create a complex stagflation environment.

I. Overlapping Phases: The Complex Interweaving of Three Major Forces

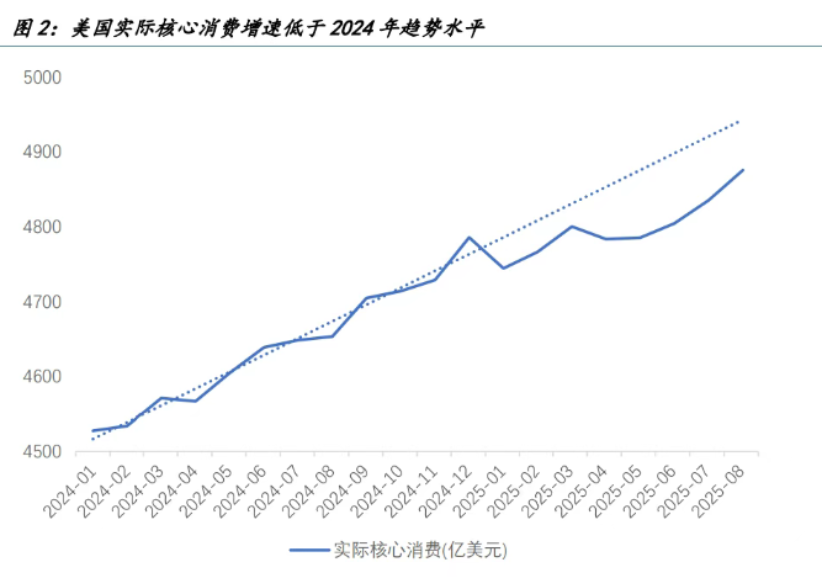

The U.S. economy is currently experiencing a negative chain reaction of declining income, shrinking consumption, and weak employment. These overlapping phases not only operate independently but also reinforce each other, creating a tricky economic dilemma.

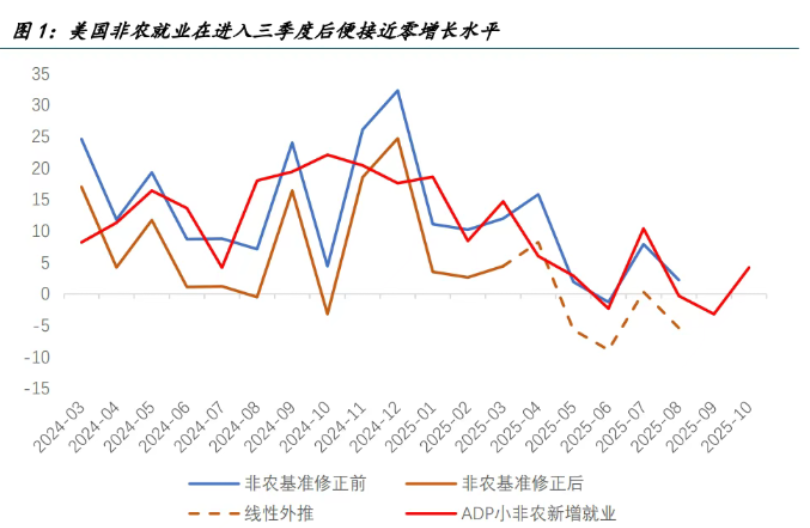

● Cyclical downturn: Since the beginning of the year, the downward trend in the U.S. economy has become increasingly evident. The phenomenon of "soft data being poor while hard data is good" has been broken, and from mid-year onwards, "soft and hard data" have begun to align, with hard data starting to weaken.

● Temporary shocks: The current U.S. government shutdown has become a significant economic and livelihood crisis, lasting 43 days, surpassing the previous record of 35 days set in December 2018.

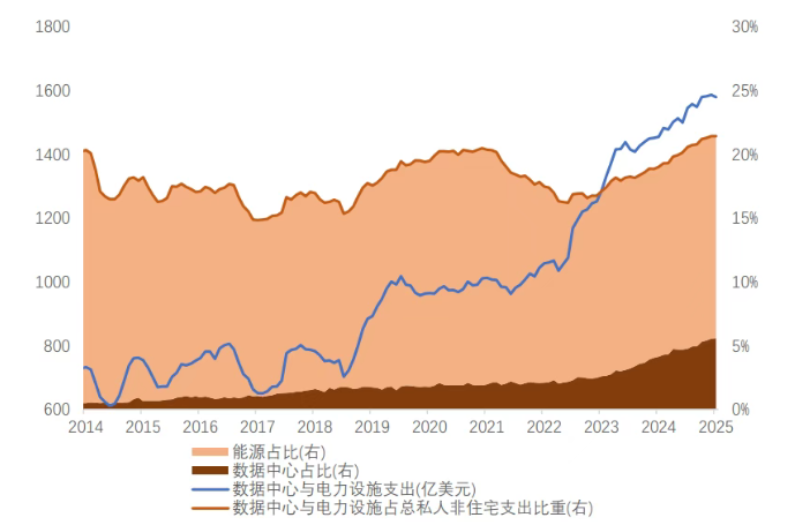

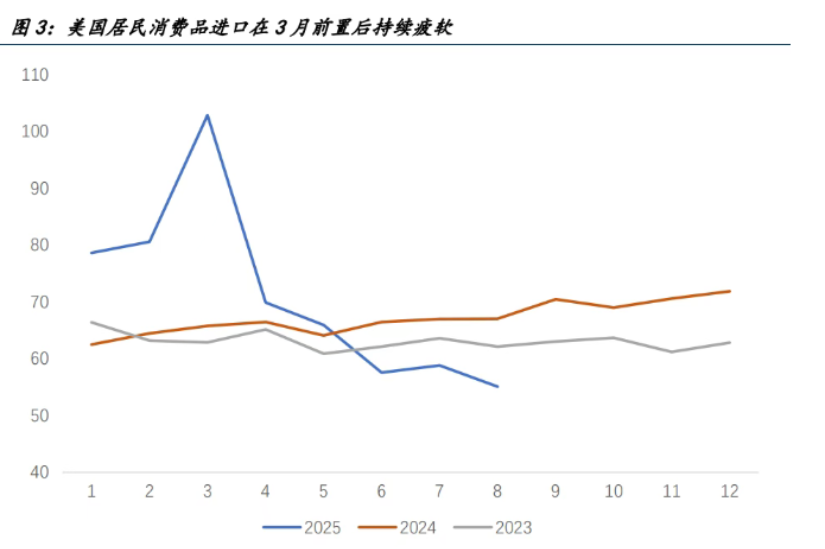

● Structural distortions: The "one-horse show" of AI investment has reinforced structural distortions in the economy. Currently, global exports to the U.S. are showing a clear "K-shaped" divergence, with AI-related sectors performing exceptionally well, while traditional consumer goods exports continue to weaken.

II. Cyclical Downturn: Tariff Disturbances and Economic Preemption

The cyclical downturn of the U.S. economy is not coincidental but is influenced by various factors, among which tariff policy disturbances are particularly significant.

● Concerns over reciprocal tariffs at the beginning of the year disrupted the normal economic rhythm, leading businesses and households to preempt their activities. In March and April, economic activity was unusually vigorous, but by May, both consumer spending, business inventory accumulation, and import demand began to decline consecutively.

● Inventory has entered a prolonged digestion period. The sales of corrugated boxes, a barometer of retail health, hit a 10-year low in the third quarter of this year, reflecting the sluggish state of U.S. consumer goods consumption.

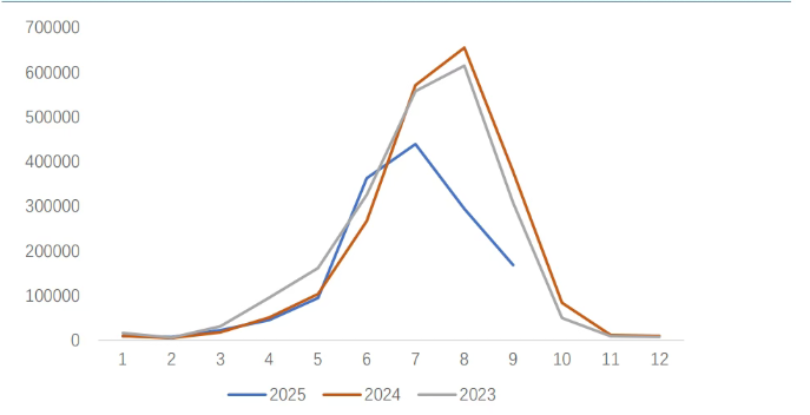

● The most obvious example is the unprecedented advance in the Christmas stocking period. Due to concerns over subsequent tariffs and the end of the 90-day transition period, merchants began stocking up early. Christmas goods, which are usually procured by August-September, peaked in July and then declined.

● This effect of tariff concerns being released early in May and June has led to 1 to 2 quarters of inventory accumulation beyond normal, effectively overdrawing economic activity for the coming months.

● The consumer confidence index has hit its lowest level since June 2022, with the Michigan consumer confidence index in November at only 50.3 (with 100 as the benchmark). These signs indicate that consumption and economic performance in the U.S. are deteriorating.

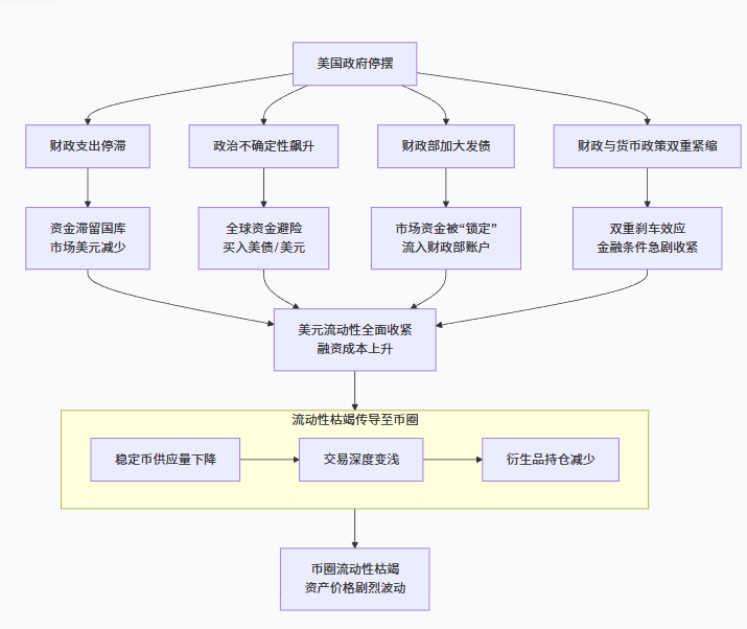

III. Government Shutdown: Liquidity Tightening and Livelihood Crisis

The U.S. government shutdown is not only a political crisis but also an increasingly deepening economic and livelihood crisis.

● The shutdown has put immense pressure on the job market. There are approximately 2.3 million federal employees (excluding postal workers), of which 750,000 are on mandatory unpaid leave. Additionally, up to one to two million government contractors are also without income.

● For critical positions that cannot be closed, such as airport controllers, employees must work without pay, facing a "no work, no pay" dilemma. This not only severely impacts their willingness and ability to consume but also threatens public safety.

● The government shutdown directly led to approximately $24 billion in federal goods and services spending being paused last month. The Congressional Budget Office (CBO) estimates that the shutdown will cause a two percentage point decline in U.S. economic growth in the fourth quarter.

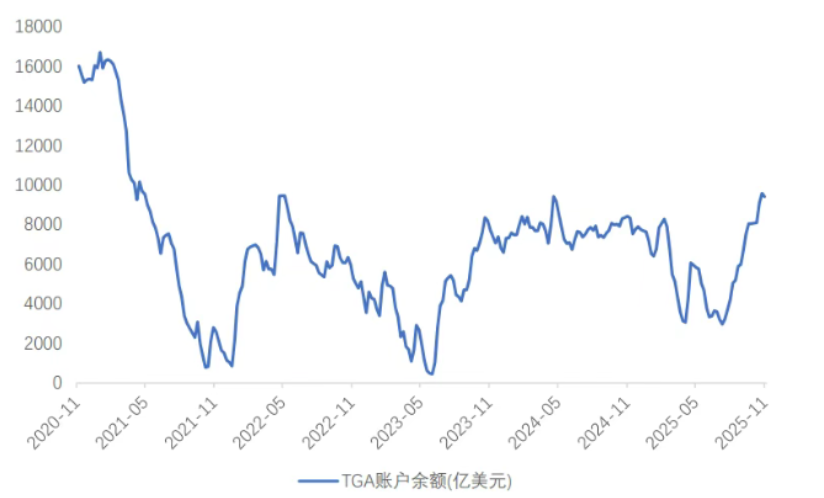

● The government shutdown also indirectly affects the liquidity of financial markets. With the government closed, the Treasury's cash account has no expenditures, and the $24 billion in spending cannot be used, leading to a backlog of government deposits that cannot flow out, thus forcing a tightening effect.

● About one-eighth of the U.S. population relies on food stamps, with an average monthly subsidy of $187. The halving of subsidies, combined with the impact of the government shutdown, has caused even the poor who relied on government relief to begin feeling economic pressure.

IV. Structural Distortion of AI: K-shaped Divergence in the U.S. Economy

Currently, global exports to the U.S. are showing a clear "K-shaped" divergence, with AI-related sectors performing exceptionally well, while traditional consumer goods exports continue to weaken. This divergence reflects the structural cracks within the U.S. economy.

● Beneficiaries of AI are performing prominently: Taiwan's exports to the U.S. surged by 144.3% in October, driving its overall export growth rate to 49.7%; among them, graphics cards propelled the growth rate of information, communication, and audio-video products (ICT) to 142%. South Korea also saw a 25.4% increase in semiconductor exports in October due to demand for high-end storage chips like HBM and DDR5.

● In contrast, Vietnam and other ASEAN countries are bearing the pressure of weakened U.S. non-AI import demand. This reflects the K-shaped structure of the U.S. economy—on one hand, AI investment has driven demand for chips, storage, and supporting power equipment, energy storage, and upstream grid electrical equipment; on the other hand, demand in non-AI sectors continues to be weak.

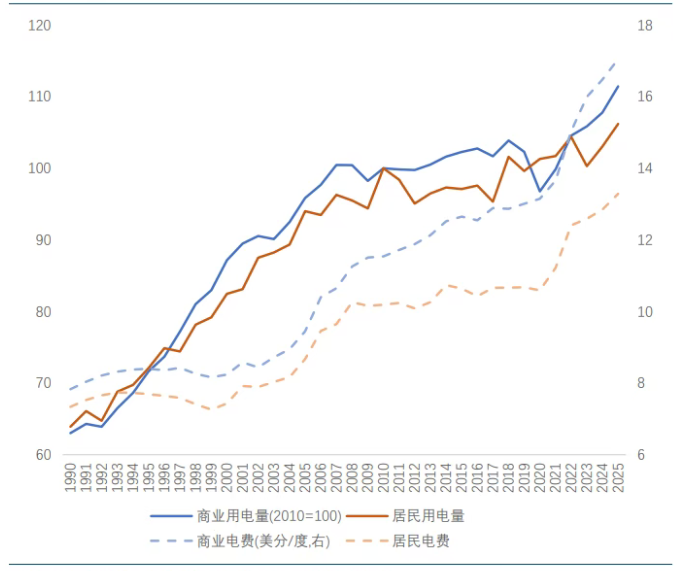

● The enormous power demand of AI computing centers has begun to crowd out other economic sectors. For example, in the past six months, U.S. residential electricity prices have risen due to the surge in electricity consumption by computing centers, with the power consumption of computing centers currently accounting for about 5% of the total U.S. electricity generation, roughly equivalent to the electricity consumption of the entire state of California.

V. The Fed's Dilemma: Data Vacuum and Policy Quandary

In the context of the partial government shutdown leading to interruptions in the release of key economic data, Federal Reserve officials have recently been vocal, engaging in intense debates over whether to continue cutting interest rates in December.

● Several regional Fed presidents and governors, both voting and non-voting, have sent out starkly different policy signals in public speeches, reflecting the difficult balancing act between stubborn inflation and a weakening labor market.

● Fed Governor Stephen Milan continues to call for a faster pace of easing. He reiterated that current monetary policy is "too tight" and should further lower interest rates to mitigate economic downturn risks. Milan advocates for a single rate cut of 50 basis points, at a minimum, 25 basis points, and emphasizes that monetary policy has a lag effect of 12 to 18 months, stating, "If policy is made solely based on current data, it is backward-looking."

● In stark contrast, St. Louis Fed President Alberto Musalem stated that the U.S. economy is expected to rebound significantly in the first quarter of 2026. He pointed out that current monetary policy is nearing a level that no longer suppresses inflation, emphasizing that further rate cut space is limited and caution is needed to prevent overly loose policies.

● Boston Fed President Susan Collins clearly stated that with inflation still above the 2% target and the government shutdown leading to the absence of key data, the threshold for further rate cuts in the short term is "relatively high," and maintaining rates at current levels "may be an appropriate course of action for some time."

VI. The Difficult Balancing Act of the U.S. Economy

Given the depth of economic weakness, the widespread collapse of the consumer base, and the political necessity of maintaining systemic financial stability (the AI pillar), the Fed's monetary policy path has been locked in, leaving no room for tightening.

● In the absence of clear data guidance and mixed economic signals, the likelihood of pausing rate cuts and maintaining rates in December is increasing, which is both a pragmatic response to policy uncertainty and reflects the Fed's heightened vigilance against the risks of "overly loose" policies in the aftermath of high inflation.

This highlights the difficult balancing act and high level of caution the Fed faces in fulfilling its dual mandate.

● The state of "everyone on board" means that any fluctuations in AI will trigger broader economic turmoil through complex chains. This deep entanglement is both a guarantee of short-term stability and an accumulation of long-term risks, as the U.S. economy walks a path filled with uncertainty.

After the data vacuum period ends, the official employment and consumption data released are likely to be more pessimistic than market expectations. Other employment indicators, such as ADP, Challenger surveys, initial jobless claims, and job vacancy numbers have all shown a continuous downward trend, indicating a persistent deterioration in the economic fundamentals.

The economic cycle of "income-consumption-service sector growth" has been severed, leading to more unemployment and reduced income. The Fed and the U.S. economy are deeply tied to the AI ship, and any fluctuations could trigger broader economic turmoil through complex chains.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。