Author: NDV

The NDV research team recently conducted a systematic analysis of the price relationship between Bitcoin (BTC) and gold (XAU). The focus on this topic arises from the fact that these two asset classes are often viewed by the market as "stores of value" and "hedging tools": gold has been a traditional safe-haven asset and a "safe harbor" for global investors for decades; meanwhile, BTC is increasingly referred to as "digital gold" and has gained a new status amid rising macroeconomic uncertainty.

The starting point of the research is: in an investment portfolio with a high Crypto weight, how to balance volatility and enhance the Sharpe Ratio (a measure of return per unit of risk) through the allocation of gold and BTC.

In other words, are they substitutes or complements?

After analyzing data and market mechanisms over the past four years, the conclusions drawn are:

- In most scenarios, BTC and gold exhibit a "conditional complementary" relationship: their overall direction is aligned, but they differ significantly in risk budgeting and volatility performance, complementing each other;

- In a few extreme narratives, gold has "temporary substitute" properties: during periods of liquidity tightening, geopolitical conflicts, or financial system risk exposure, gold's safe-haven function significantly outperforms BTC and can partially substitute its allocation;

- From an asset allocation perspective, they should be viewed as "cross-mechanism anti-fragile pairs": gold relies on central bank reserves and institutional endorsement, while BTC is driven by its total supply cap and halving mechanism. The two come from completely different systems, but because of this, they often perform complementarily in different market environments. By periodically rebalancing between the two (adjusting during divergent trends), investors can better diversify risk and achieve more stable, risk-adjusted returns over the long term.

The following is a detailed analysis.

I. Long-term Perspective: BTC and Gold Trends Highly Aligned

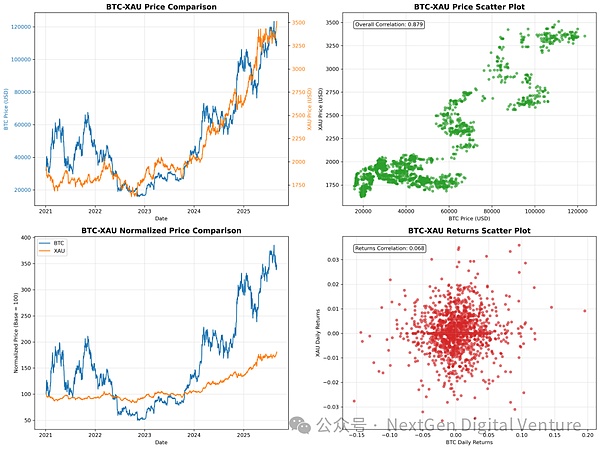

From 2021 to the present, BTC and gold have shown a high degree of alignment in their trends, indicating that macro liquidity and monetary policy are common drivers for both.

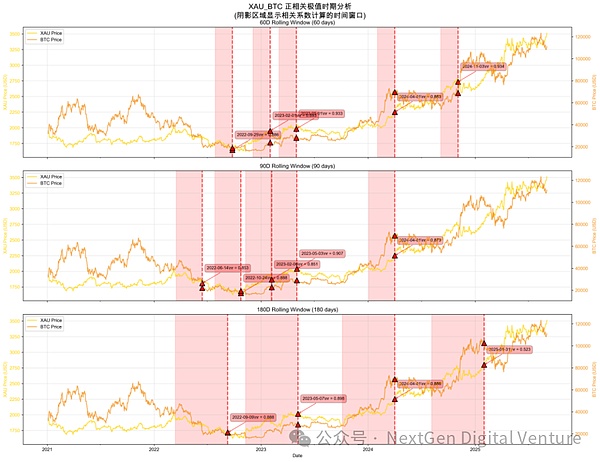

Phases of Concurrent Rise and Fall

Under the dominance of macro policies and market risk sentiment, Bitcoin and gold often exhibit synchronized rises or falls, such as:

Late 2022 to early 2023: Inflation peaks + interest rate hikes slow → BTC and gold both rebound;

March 2023 banking crisis: Increased demand for safe-haven assets → Gold rises, while BTC benefits from the "decentralization" narrative and also rises;

Q1 2024: Fed shifts to interest rate cut expectations + BTC ETF approval → Gold approaches historical highs, BTC breaks historical highs.

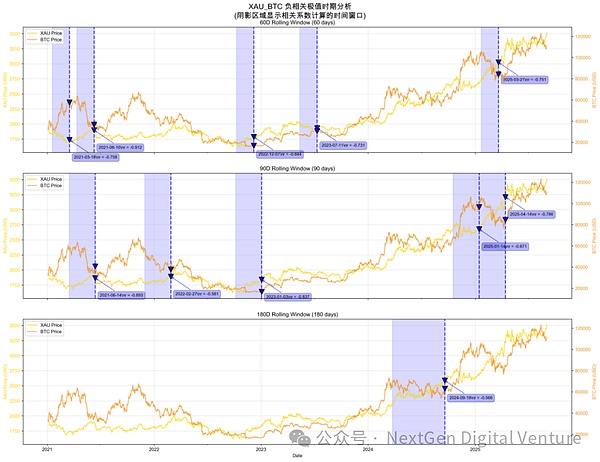

Phases of Divergence

When the market enters a "narrative of their own," the prices of Bitcoin and gold may diverge, such as:

Gold strong, BTC weak: Spring and summer of 2021: Gold strengthens due to inflation concerns, while Bitcoin plummets due to Chinese regulation and Musk's comments; late 2021 to early 2022: Geopolitical conflicts boost gold, but BTC weakens due to Fed tightening and tech stock corrections; Q1 2025, trade frictions and Middle East conflicts → Gold breaks through $3000, while BTC enters a high-level correction after favorable news is priced in.

BTC strong, gold weak: End of 2024, Trump wins + ETF capital inflow → BTC rises independently, while gold remains flat.

Therefore, from a statistical perspective, BTC is highly aligned with gold in the long-term direction, but exhibits independent short-term behavior. This is also the reason it can provide an additional source of returns.

II. Why BTC's Returns Are Higher Than Gold's

Although BTC and gold are highly correlated in long-term price trends, BTC has an advantage in terms of returns. We believe there are several key reasons:

1. Asset Property Comparison: Same Narrative, Different Functions

Commonalities (narrative level):

- Scarcity: Gold is supported by natural scarcity and high mining costs, while BTC is supported by its total supply cap (fixed at 21 million) and halving mechanism (which continuously enhances scarcity);

- Trading and Settlement: Gold has strong physical attributes, a long settlement chain, but a mature institutional fit; BTC offers programmable on-chain settlement, high cross-border efficiency, and decentralization, but there is a disconnect between on-chain and offline liquidity;

- Volatility and Risk Budgeting: Gold's annualized volatility has remained relatively stable in the medium-low range over long periods (historical average around 15%, data source: State Street Global Advisors); during extreme market periods, its pressure is relatively low. In contrast, Bitcoin's volatility is much higher than traditional assets (historically common ranges are 50%–80%, with extreme cases exceeding 100%, data source: WisdomTree, The Block), making it more like a high Beta risk asset;

- Institutional Adoption Path: Gold is a global central bank reserve asset with strong institutional anchoring; BTC is currently in the process of institutionalization (ETF listings, compliant custody, institutional allocation), but will still be periodically affected by regulatory disturbances in the short term.

Summary: In the narratives of "inflation hedging" and "store of value," BTC and gold have some substitutability; however, in terms of risk budgeting, institutional adoption, and settlement functions, the differences between the two are significant, thus reflecting their complementarity.

Differences in Capital Flow: Incremental buying of gold mainly comes from central banks and some hedging positions, which are limited; while the new funds for BTC are more explosive, covering ETF capital inflows, institutional allocations, and retail participation (data source: CME Group, CoinShares flow report).

Historical Performance Validation: Over the past decade, gold's annualized return rate has been about 4%–5% (in USD, not adjusted for inflation, data source: StatMuse); while BTC's long-term annualized return rate is significantly higher.

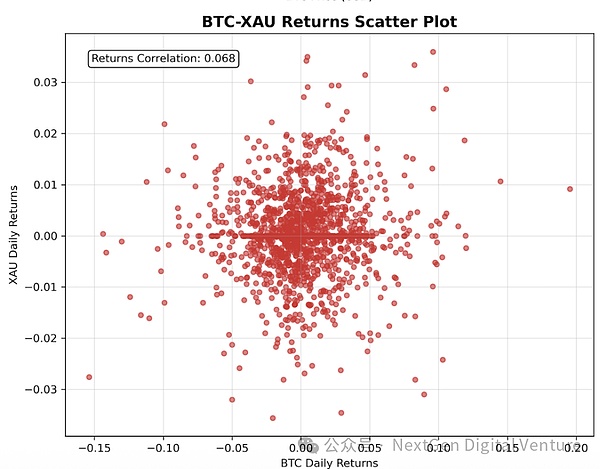

Technical Validation: Statistical tests show that the correlation between BTC and gold's returns and volatility is close to zero (DCC-GARCH, Granger, and other modeling methods have not shown significance, data source: NDV internal model), indicating that BTC's excess returns are independent of gold, and gold cannot provide the same high elasticity.

Therefore, in most cases, when both move in the same direction, directly holding BTC can yield higher risk compensation and excess returns; while gold's value is more reflected in extreme risk environments, serving as a defensive complement to the portfolio.

【Technical Analysis Chart Explanation】

Return Correlation: Statistical tests show that BTC and gold's daily returns have no significant correlation. This indicates that their short-term volatility does not move in tandem, and BTC's fluctuations are more driven by its own market events.

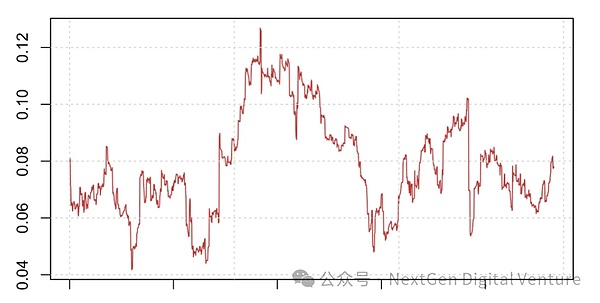

Volatility Correlation: Through DCC-GARCH dynamic correlation modeling, it was found that the conditional correlation coefficient between the two is mostly below 0.1, indicating that their volatilities are almost independent, and the inter-asset linkage effect is low.

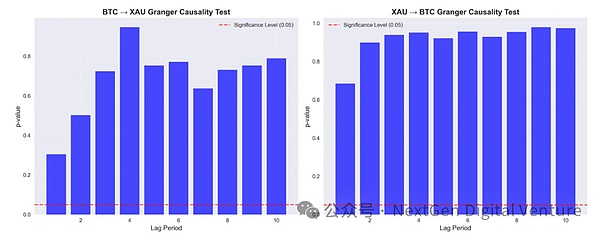

Causality Test: Granger causality test results show that there is no significance in the analysis of BTC and gold over 1–10 day lags, meaning that neither asset's return changes exhibit leading characteristics, and one asset's price movements cannot better predict the future price movements of the other.

III. Mid-term Perspective: Holding Gold is More Effective Than Cash in USD

In the current macro environment, gold's hedging effect is more pronounced compared to cash in USD. The reason is that the U.S. fiscal deficit continues to expand, weakening the safe-haven status of government bonds and the dollar, leading even long-term institutional investors who support dollar assets to begin reassessing their allocations. Meanwhile, inflation remains high, and market expectations for future interest rate cuts persist, which means real interest rates are continuously declining. Holding cash not only lacks interest advantages but also faces the risk of eroded purchasing power. In contrast, gold, as a "no counterparty risk" physical asset, does not rely on any credit endorsement, and its demand as a safe haven has significantly increased amid frequent geopolitical conflicts and trade frictions. Historically, whether during the stagflation of the 1970s or the recent recurring inflation cycles, gold has demonstrated better value preservation capabilities compared to cash.

Therefore, we believe that gold is a more effective defensive asset than cash in USD from a mid-term perspective.

IV. Allocation Insights

Based on our analysis, we can derive three levels of allocation thinking:

First, in a normal environment, BTC remains the core position of the portfolio, as it possesses higher elasticity and growth potential, maintaining synchronization with gold in the overall direction, but typically with more substantial upward movement.

Second, in extreme risk environments, such as sudden tightening of global liquidity, escalation of geopolitical conflicts, or uncertainty in the financial system, gold's defensive properties will significantly outperform BTC. During these phases, moderately increasing gold positions to replace part of BTC can help reduce drawdowns and enhance robustness in the portfolio.

Finally, more broadly, in the current macro context, gold can play a more effective hedging role compared to cash in USD. Rather than passively holding cash and waiting for depreciation, it is better to achieve defense and value preservation through gold allocation. This dynamic allocation thinking reflects our continuous improvement of the investment framework and optimization of the risk-return structure.

V. Conclusion

The relationship between BTC and gold is essentially long-term synchronous, short-term divergent.

We firmly believe that BTC remains the core asset of the portfolio, carrying higher growth and elasticity; while gold demonstrates unique defensive value in extreme risk environments and outperforms cash as a hedging tool. The two are not substitutes but complements. This dynamic allocation thinking allows us to grasp growth while ensuring the portfolio remains robust in an uncertain macro environment.

More importantly, we hold a strong belief in the long-term value of BTC. Historically, BTC has experienced severe cyclical volatility, but its long-term returns have significantly outperformed any traditional asset. If BTC rises tenfold in the next decade, we are confident that through active management strategies, we can capture cycles, seize volatility, and continuously create alpha above beta, significantly enhancing the overall performance of the fund compared to merely holding BTC.

The value of gold lies in its complementarity and defense, while the value of Bitcoin lies in long-term growth. For us, the direction is clear: BTC is superior to gold, while the NDV fund strives to outperform BTC. Through rigorous risk control, flexible allocation, and in-depth research, we not only follow the rising cycle of this generation of digital assets but also aim to continuously deliver long-term returns that exceed the assets themselves for investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。