When the NFT bubble bursts, who can still tell a good "IP story"?

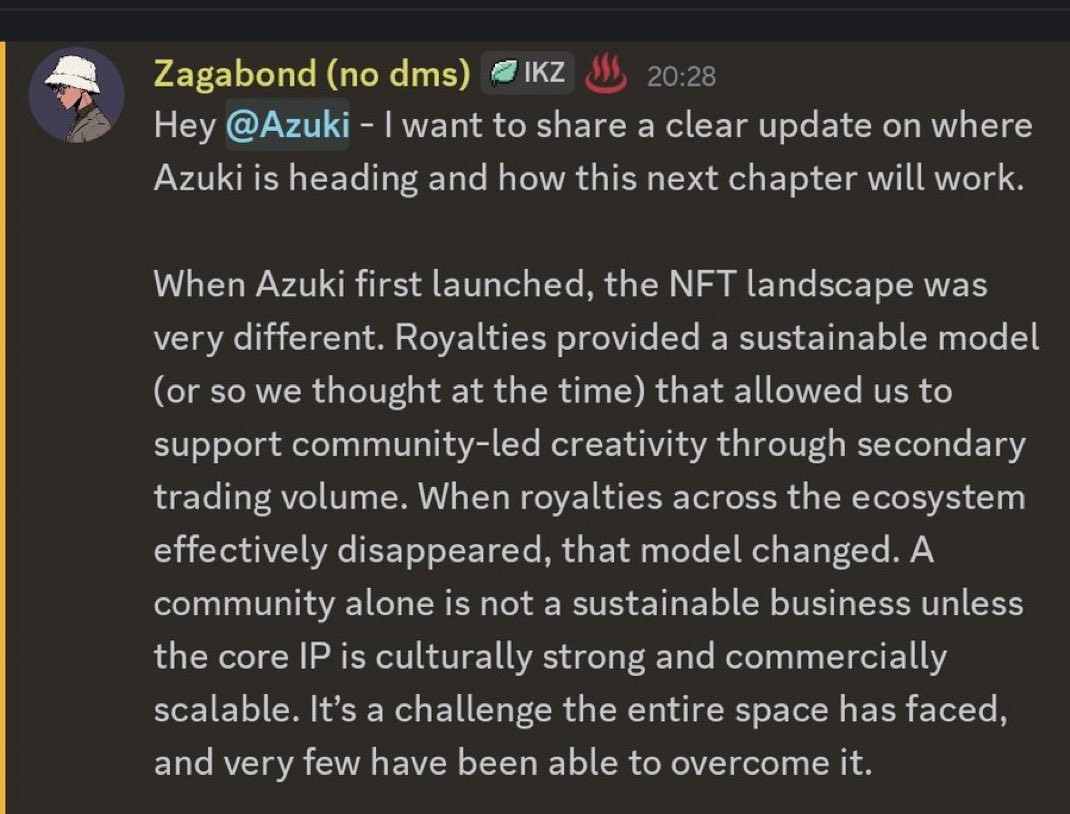

Not long ago, Zagabond, the founder of Azuki, mentioned a statement during a community speech that sparked considerable discussion: "When Azuki was first launched, NFT royalties made us believe this was a sustainable model. But now, the entire industry is losing that support." In the short three-year history of NFTs, such a statement feels almost like a footnote to an era—an era that relied on consensus, sentiment, and hype to maintain its heat has truly come to an end. Azuki's topics always carry a certain symbolic significance; this project once represented the highest standard of "Web3 trendy brands": Eastern aesthetics, youth culture, and extreme visuals, all seemed to paint a future version of Supreme for the crypto world. However, when the secondary market's royalty mechanism was broken, and platforms like OpenSea canceled creator shares, Azuki and countless NFT projects suddenly realized that their "community economic model" actually had no second life. Without a continuous cash flow, there are no manpower or resources to maintain what was once called a "cultural" dream. In Zagabond's words, we hear not only Azuki's helplessness but also the dilemma faced by the entire NFT IP track—the combination formula of "community + story + avatar" seems to have reached its limit.

Source: X

A Delusion About "IP"

Looking back at the prosperous years of NFTs, almost all top projects have been trying to tell an "IP story." From CloneX's virtual fashion to Doodles' cartoon universe, and Moonbirds' creative ecology, everyone is attempting to replicate the "Disney myth" in a decentralized way—only replacing the audience with investors. Unlike other types of Web3 projects, the core of IP-related NFTs lies in "cultural resonance." They attempt to build a unique sense of spiritual belonging through visuals, stories, and community atmosphere. The problem is that the "community" in Web3 is essentially not fans but speculators. They embrace warmly when prices rise and quickly exit when the market cools down. This user structure makes it difficult for IP-related NFTs to be economically self-consistent: they lack the product monetization ability of traditional brands and also lack a stable content production mechanism. Most projects can attract attention in the early stages through artistic style, narrative concepts, or scarcity, but when market enthusiasm wanes and prices decline, community sentiment cools accordingly. For creativity and culture to translate into industrial value, what is needed is the continuous expansion of content ecology and commercial channels, rather than just the rise in the price of a single asset.

After the disappearance of royalties, the revenue models of these projects have almost dropped to zero, and teams can only rely on "faith" to hold on, while faith itself also requires continuous narrative to survive. This reveals a deeper contradiction: the "cultural narrative" of NFTs and their "financial attributes" have long been intertwined, with the former requiring time to accumulate and the latter demanding short-term returns, making it difficult for most projects to find a balance between the two. This is not a mistake of a particular team but a structural dilemma faced by the entire industry. NFTs, as a mechanism of "digital ownership," were supposed to become a new engine for the creative economy, but they have been over-consumed in speculation. We see Azuki, Doodles, and others trying "IP transformation": holding offline exhibitions, launching clothing collaborations, and doing animation partnerships, but these efforts often result in more noise than substance, making it hard to truly drive user growth. For culture to become an industry, it relies on continuous narrative, content, and product implementation, not just temporary resonance and emotion within the community.

The Shift Towards Realization and Commercialization

After the royalty model became ineffective, many projects began exploring new paths—shifting from pure on-chain narratives to real-world applications and brand operations. This trend is not only seen in established projects like Azuki but has also become a consensus among newcomers: if NFTs want to become sustainable cultural symbols, they must possess off-chain vitality.

Specific manifestations include physical productization, bringing NFT IP into real consumption scenarios through toys, clothing, and artistic derivatives; content expansion, strengthening IP storylines through animations, comics, and games, making NFTs part of the narrative; and social dissemination, translating Web3 culture into symbols that the public can understand through short videos and social media content. The essence of these attempts is to detach NFTs from the identity of "speculative assets" and return to the logic of "cultural products."

From On-Chain Consensus to Real-World Business

While many people are pessimistic about NFTs, Pudgy Penguins has made a comeback in a different way. This project, which was mocked in 2021 as the "ugly penguin," has become a "reverse case" in the NFT world after being restructured by a new team. The first thing Luca Netz did after taking over was to bring NFTs into reality—he launched the Pudgy toy series, which went live in over 10,000 retail stores worldwide, including Walmart, Amazon, and Target, becoming one of the first NFT brands to truly enter mainstream retail channels. Each toy comes with a digital identity connected to the blockchain world, but more importantly, it is a product that can be loved by children and family consumers, not just a speculative certificate.

At the same time, Pudgy Penguins achieved cross-circle dissemination on social media, with their Instagram and TikTok accounts going viral with "healing, cute, and warm" content, with individual video views often exceeding tens of millions. Unlike other NFT projects that have "internal consensus" type communities, Pudgy Penguins' audience comes from ordinary people, allowing "Web3 culture" to enter the public world in a light and gentle way—no wallet needed, no understanding of the chain required, just a liking. This is the difference: the former pursues a "decentralized ideal," while the latter engages in "centralized business," which aligns more with the essence of IP—being liked, spread, and purchased. The path of Pudgy Penguins demonstrates a strategy of "multi-interface resonance": toyification opens up real channels, gamification launches the mobile mini-game Pudgy Party, which broke a million downloads in two weeks, and offline presence opens Pudgy Café in Gangnam, Seoul, exploring collaborations with brands like BE@RBRICK and Hyundai.

More symbolically, PENGU is completing the leap from Meme to "cultural symbol." When traditional financial giant VanEck changed its official avatar to a penguin wearing a "vaneck intern" hat, when its CEO Jan van Eck donned a giant penguin costume for a public photo release, and when the adorable PENGU mascot appeared at the Nasdaq closing bell ceremony, the signals conveyed by these images have transcended simple marketing—crypto culture has been actively, publicly, and even enthusiastically adopted by mainstream financial institutions for the first time. The "warmth, humor, and friendliness" conveyed by PENGU sharply contrasts with the rigid image of traditional finance and the "Degen" culture of the crypto world, making it a "translator" connecting the two worlds. Between the cold financial system and the passionate Web3 community, this little penguin uses the most intuitive visual language to make complex financial concepts approachable. As culture, brand, and finance begin to converge, when PENGU frequently appears in ETF advertisements and events of top financial institutions, what it symbolizes is not just the success of a project but a testament to how crypto civilization, with its unique charm and consensus, moves from the margins to the center and ultimately ascends to the mainstream financial hall.

Source: X

Sedimentation and Continuation

When we look back at the evolution of NFTs over the past few years, we find an interesting phenomenon: those projects that have gone further are often not the ones with the most radical technical narratives, but those that understand how to establish emotional connections with users. Pudgy Penguins chose a more traditional path—through products, content, and channels, allowing people to like an image before needing to understand blockchain. This reveals a fundamental rule of IP-related projects: regardless of how innovative the underlying technology is, the establishment of cultural symbols always requires continuous content output and emotional accumulation. Blockchain can confer ownership, but the generation of meaning still relies on stories, experiences, and resonance. Projects that overly rely on technical concepts while neglecting the content itself often struggle to establish long-term user stickiness. The experience of Pudgy Penguins indicates that the growth of IP requires multi-dimensional support—products, stories, channels, and genuine user affection. When projects begin to distinguish between "holders" and "users," and when evaluation criteria shift from "floor price" to "cultural influence," NFTs may truly find their place in the cultural industry. The market's enthusiasm will eventually calm, but the cultural value that sedimented during this process may continue in various forms. The significance of NFTs as a tool will ultimately be defined by these practices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。