Digital Gold Frenzy: Tether Hoards 1 Ton of Gold Bars Weekly, Retail Investor Expectations Surge by 6%! Wealth Migration Amidst a $38 Trillion Debt Crisis

—— From USDT Vaults to Central Banks Dumping US Treasuries, Understanding the Only Truth in Asset Allocation for the Next Decade

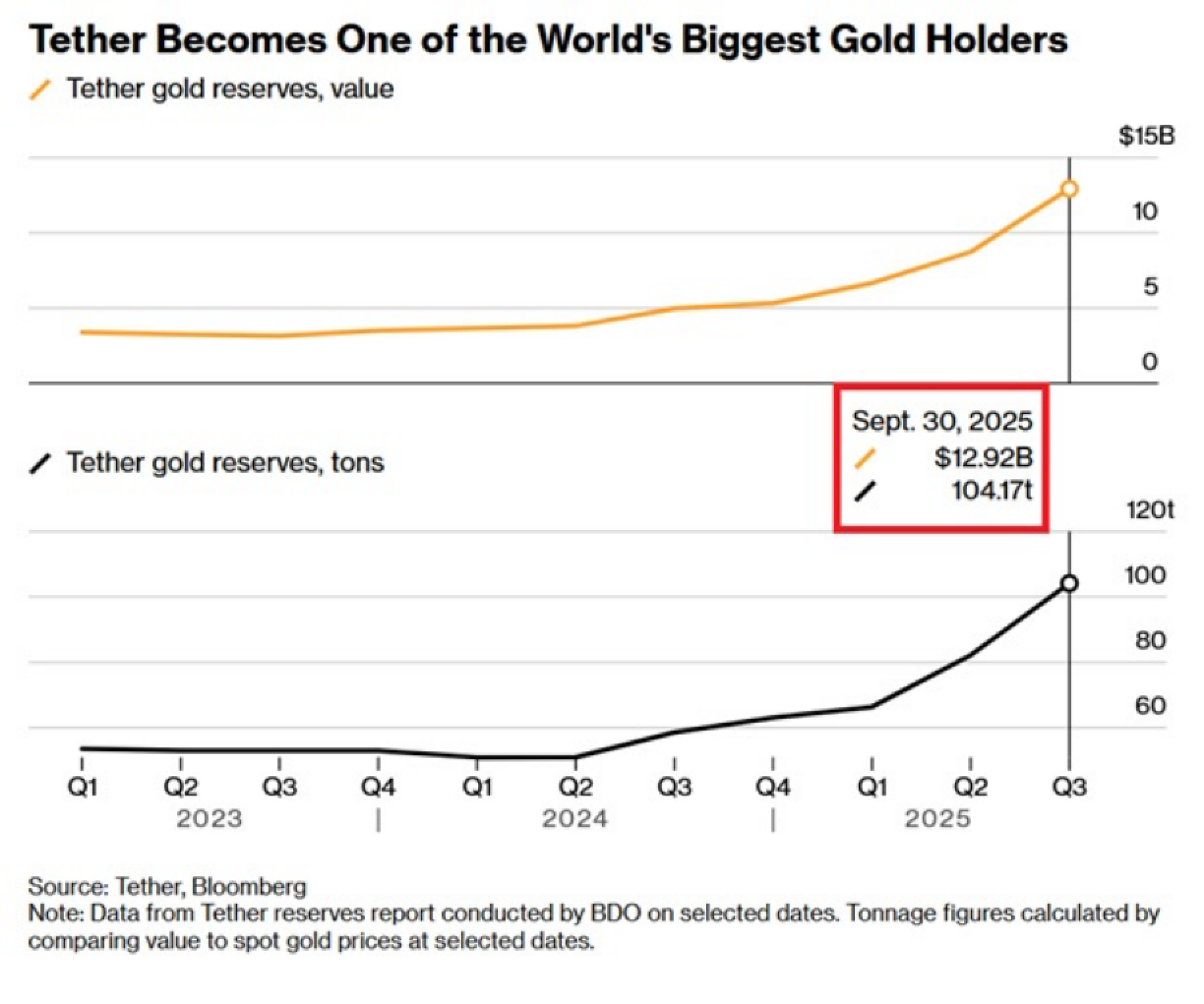

### I. The "Gold Gamble" of Stablecoins: Strategic Breakthrough Behind 104 Tons of Gold Bars

When the world's most aggressive "gold miners" are no longer Middle Eastern tycoons or central banks, but a company issuing digital currency—Tether's gold reserves have soared to $12.9 billion (104 tons), buying gold bars at a staggering rate of "one ton per week." This USDT issuer has converted 7% of its reserve assets into gold, behind which lies a gamble against the credit risk of the US dollar:

· Escaping the US Treasury Trap: The annual interest on America's $38 trillion debt has exceeded $1.2 trillion, with every 1% increase in interest adding $380 billion to the deficit;

· Mimicking Central Bank Strategies: Diversifying against US Treasury interest rate fluctuations and geopolitical sanction risks, injecting physical credit into digital dollars with gold;

· Harvesting Dual-track Dividends: Profiting from the gold bull market (gold prices surpassing $4,000) while attracting users with the "real gold" narrative.

Stablecoins are evolving into "mini central banks," with gold becoming the hardest ballast in the world of code.

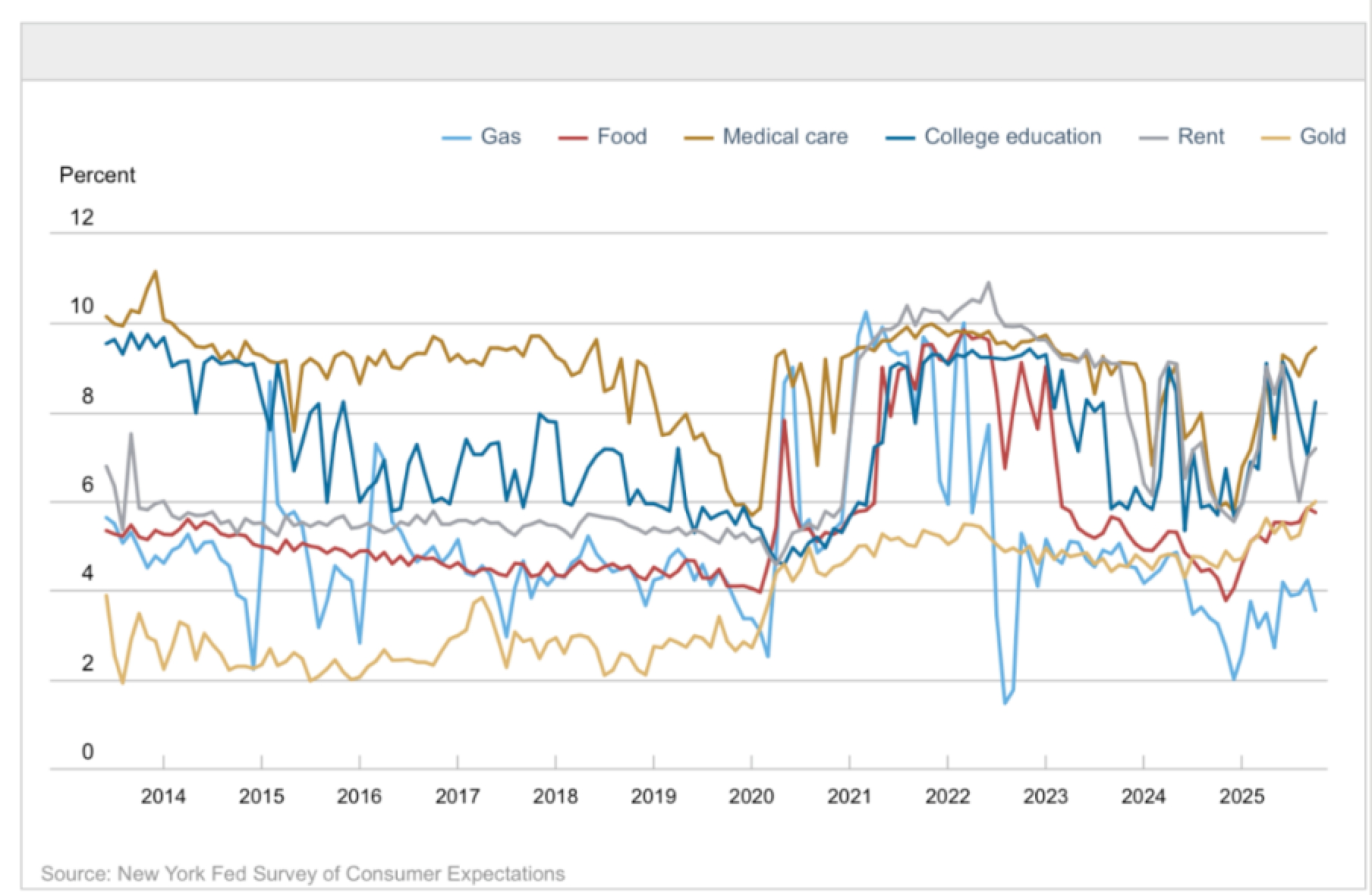

### II. Retail Investors' "Gold Awakening": The Panic-driven Allocation Behind a 6% Expected Increase

American retail investors' intuition about gold is collectively erupting—expectations for gold price increases over the next 12 months have risen to 6%, reaching a ten-year high. This is not blind following but a rational choice under inflation perception and asset vulnerability:

· Inflation Pressure: The public's "perceived inflation" far exceeds official data, making gold the most intuitive tool for defending purchasing power;

· Volatility Advantage: Gold's risk-adjusted returns have matched the S&P 500, but its volatility has remained lower than the stock market over the long term, serving as a "shock absorber" for portfolios;

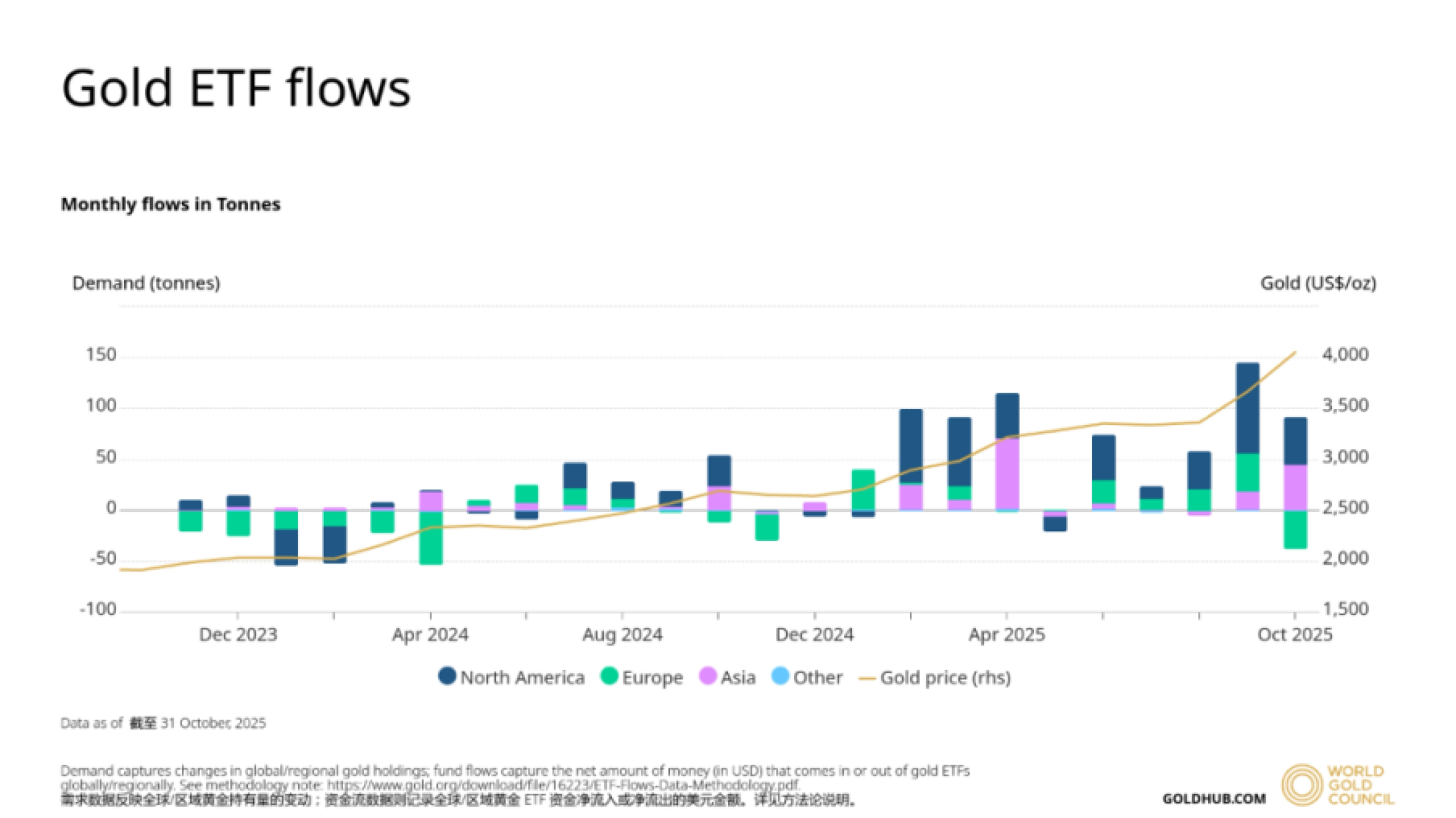

· Solid Funding Evidence: Global gold ETFs have seen net inflows for several months, with an increase of $8.2 billion in October alone, as North American retail investors flock in.

As retail investors and central banks rush to acquire gold simultaneously, the old order of asset allocation is collapsing.

### III. Hegemony Transition: Gold Surpasses US Treasuries for the First Time in 54 Years, the Dollar Empire is Being Undermined by Mathematics

By 2025, gold's share in central bank reserves (23%) will surpass that of US Treasuries (22%), signaling the irreversible decline of dollar hegemony:

· Accelerating De-dollarization: BRICS nations are conducting 20%-25% of trade outside the dollar, with China selling $52 billion in US Treasuries in September;

· Sanctions Backfire: After Russian assets were frozen, 81% of central bank gold purchases came from emerging market hedging demand;

· Debt Mathematics: Annual interest payments in the US have exceeded the defense budget, and by 2030, interest will consume 20% of federal revenue.

This is not hyperinflation, but a massive wealth exchange under a $38 trillion debt.

### IV. Survival Rules for Ordinary People: Gold Tokens, ETFs, or Gold Bars?

In the face of this migration, investors need to be clear-headed:

- Don't Confuse Tools: Buying USDT ≠ buying gold (it only partially reserves gold); only tokens directly pegged to gold (like XAUT) correspond to physical gold bars;

- Beware of Volatility Risks: Gold prices may pull back in the short term, and stablecoins still face regulatory black swan events;

- Core Logic is Diversification: Shift from "betting on the dollar" to a combination of "gold + Treasuries + digital assets" to avoid the collapse of a single asset.

The future is here: as money transitions from paper to code, and Treasuries give way to gold, the only constant is—either own assets or be ravaged by inflation.

Join the community for more insider news

Official Telegram Community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。