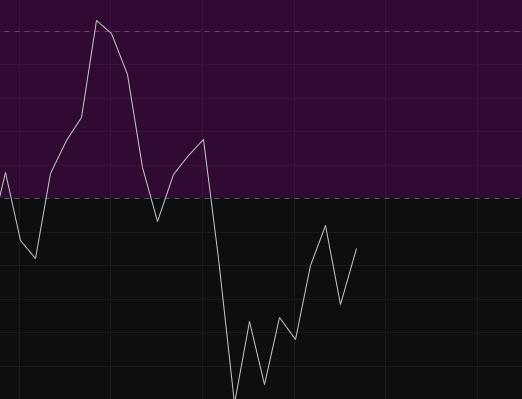

Yesterday, the overall market dropped by more than 3 points. Our strategy is primarily to short, and those who followed our approach made a profit. Today, although the market shows some upward movement, we still maintain a bearish outlook in the long term.

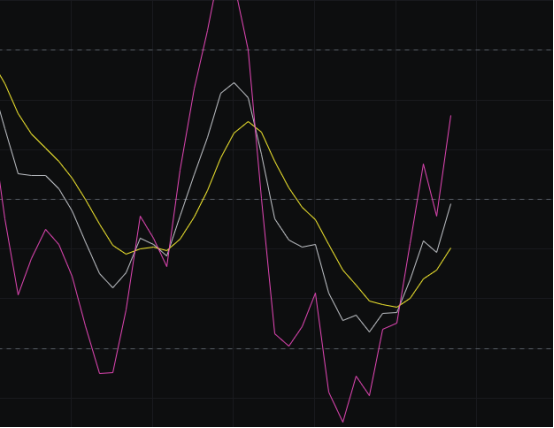

From the MACD perspective, the energy bars are quickly approaching the zero axis, and the fast and slow lines are about to form a golden cross. This indicates that a market movement is likely to occur. If there is follow-up volume, the price will continue to rise; if not, a decline will happen. Therefore, we need to closely monitor the MACD trend over the next couple of days.

Looking at the CCI, it has shown a rebound, but it is still a bit away from -100, which is the first support level. We will watch to see if the CCI can rise above -100.

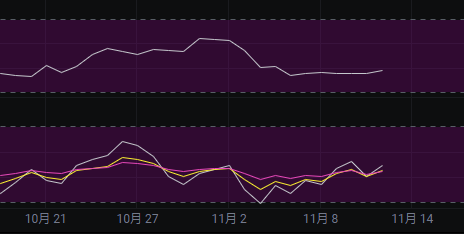

From the OBV perspective, today's price increase did not see a significant rise in volume, so the price increase is unlikely to be sustained, and it is expected to drop again.

In terms of KDJ, it is about to reach 50. If there is still an increase tomorrow, it may cross above 50. We will continue to observe this tomorrow.

Looking at the MFI and RSI, the MFI is in a neutral to slightly lower area, showing a potential upward movement, but to maintain this, continuous increases are needed. The RSI is in a neutral range, continuing to show an upward trend, which overall favors the bulls.

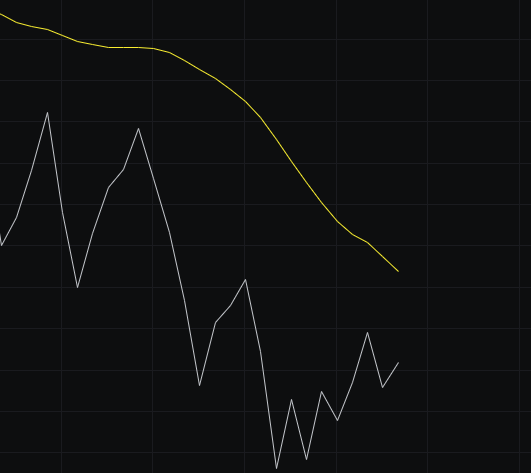

From the moving averages perspective, several moving averages are pressing down. Today, the price rose to the BBI level but was pushed down by it. Whether this pressure can fully suppress the price will depend on tomorrow's closing, but at least for now, it is under pressure.

Looking at the Bollinger Bands, both the upper and lower bands are trending downwards, indicating a downward channel. However, whether this downward channel can be maintained will require the next two days to close with bearish candles. If we see bearish candles in the next two days, we can conclude that the market makers intend to push the price down.

In summary: Although there was an increase today, the indicators still suggest a downward trend, so we will continue to maintain a bearish mindset. Today's resistance is seen at 106000-107500, and support is at 103500-102500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。