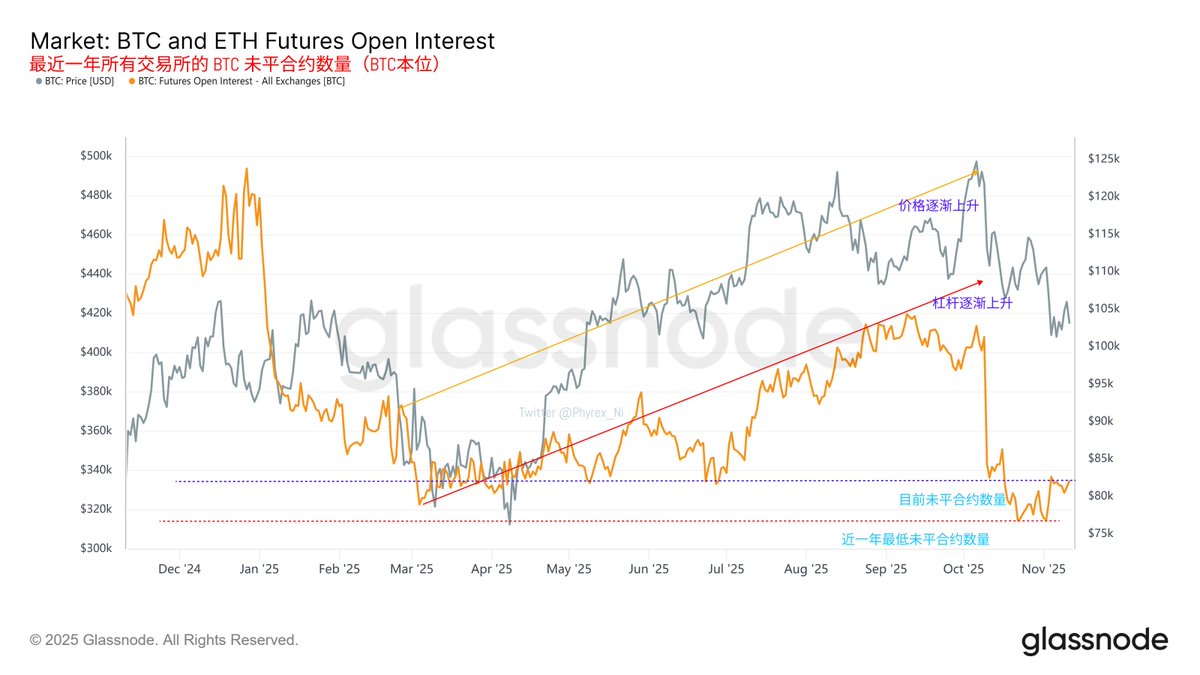

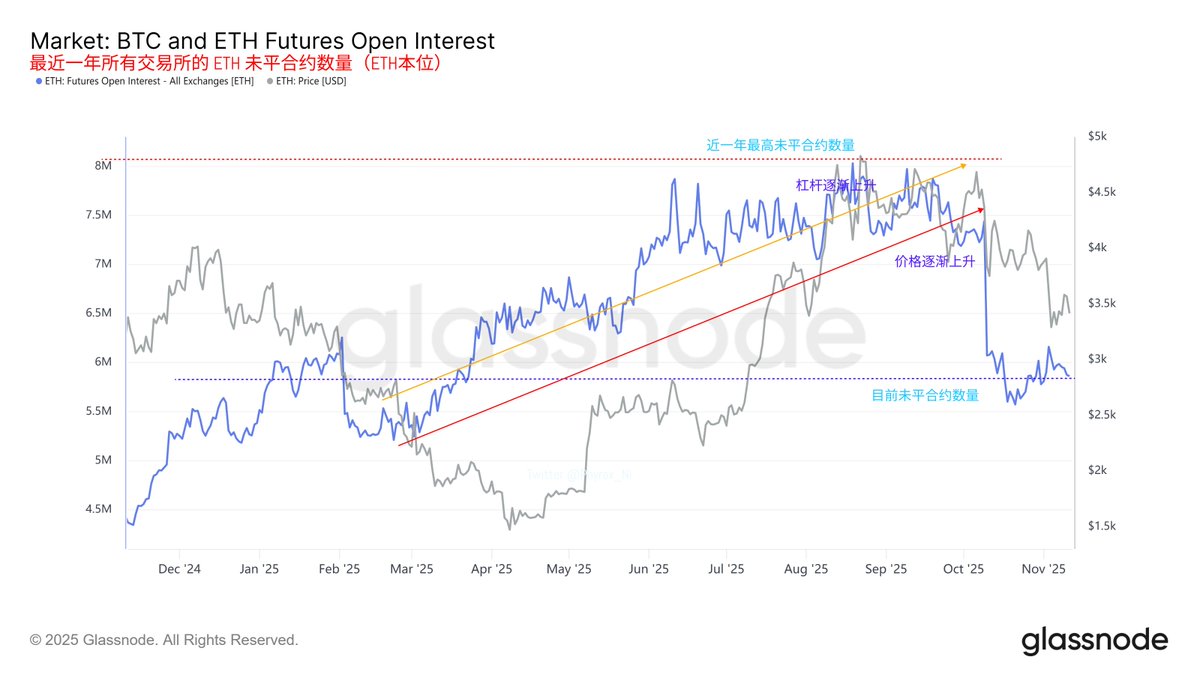

The data on the open contracts for BTC and ETH clearly shows that the leverage for $BTC and $ETH is gradually attempting to increase. Historically, over the past year, price increases have often been accompanied by rising leverage.

Currently, both BTC and ETH have positive funding rates, indicating that bullish sentiment in the market remains dominant, with long positions being more aggressive than short positions. The overall direction of leverage is leaning towards the long side. A positive funding rate means that bulls are willing to pay a premium for holding positions, which typically occurs during phases when the market expects prices to continue rising, reflecting an optimistic sentiment.

However, it is important to note that when rising leverage coincides with positive funding rates, structural risks in the market are also accumulating. Short-term price fluctuations may be amplified because if prices experience a rapid decline, it could trigger a chain reaction of deleveraging.

Currently, the overall leverage level is still far below the mid-year peak, suggesting that this round of leverage expansion resembles a mild test rather than a full-blown overheating. BTC on the spot market continues to flow out of exchanges, and the chips held by long-term holders have not shown significant loosening. The increase in leverage does not appear to stem from panic buying but is likely a market positioning ahead of a recovery in macro liquidity.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。