CoinW Research Institute

Recently, the decentralized finance protocol Stream Finance disclosed that its external fund manager (Curator) incurred a loss of approximately $93 million, leading to a suspension of all deposit and withdrawal operations the following day. Following the incident, its synthetic stablecoin xUSD quickly depegged, plummeting from $1 to about $0.1, and the liquidity pool was nearly drained within two days, triggering a series of chain reactions in the market. Multiple lending protocols related to xUSD, xETH, and xBTC were affected, with an estimated outflow of around $1 billion from the market. Meanwhile, the total locked value in DeFi dropped from approximately $150 billion to $130 billion in a short period, and the market capitalization of stablecoins shrank by over $2.5 billion during the same timeframe.

Currently, Stream Finance remains in the withdrawal suspension phase and has not announced a repayment plan. This incident has become the largest systemic crisis in DeFi since the collapse of Terra UST. The crisis has prompted the market to reassess the fragile structure and growth model of DeFi. The previously high-yield cyclical model has been debunked under tightening liquidity, and the current market is shifting its focus towards transparency, robustness, and sustainability. The following CoinW Research Institute will conduct an in-depth analysis of the causes, transmission mechanisms, and impacts of this event on the future structure of DeFi, aiming to provide more references for the industry's development.

1. The Rise and Fall of Stream Finance

1. The Hidden Dangers of Lending Cycles

The core mechanism of Stream Finance is to achieve yield amplification through cyclical lending and synthetic asset structures. Users can deposit mainstream assets such as USDC, ETH, and BTC into the protocol to receive corresponding synthetic assets xUSD, xETH, and xBTC, and then use these assets as collateral to borrow more native assets and repeat the operation, thereby achieving higher yields in a leveraged cycle. On the surface, this mechanism can enhance capital efficiency, but it essentially relies heavily on the external market environment and the stability of collateral assets in a high-leverage model. Once the lending spread narrows, collateral fluctuates, or liquidity dries up, the positive feedback of enhanced yields can quickly turn into negative feedback in a liquidation chain. For example, if a user uses xUSD worth $100,000 as collateral to borrow $50,000 from a lending protocol, and if xUSD drops from $1 to $0.5, the collateral is suddenly worth only $50,000. If it continues to decline, it will directly lead to losses and chain liquidations.

The greater risk lies in the protocol's transparency and risk management mechanisms being extremely weak. Stream Finance has not publicly disclosed complete reserve proofs or leverage limits, and there has long been a discrepancy between protocol assets and on-chain verifiable data. At the same time, the "market-neutral strategy" announced by Stream Finance is not a completely risk-free hedge but rather balances price fluctuations by simultaneously holding long and short positions. Its stability relies on the market price and funding environment remaining stable; once there are severe fluctuations or insufficient liquidity, this "neutral" structure will become unbalanced, and the leverage will amplify losses, potentially triggering chain liquidations. Since its synthetic assets (especially xUSD) are widely used as collateral in other lending protocols, the depegging not only triggered internal runs but also created transmission risks at the ecological level, causing liquidity and trust to evaporate rapidly in a short time.

2. Causes of the Crisis and Latest Developments

The direct trigger for this crisis was a liquidity crisis caused by external asset management errors combined with the protocol's leverage structure. On November 3, Stream Finance disclosed that its outsourced fund manager incurred a loss of approximately $93 million; subsequently, on November 4, it suspended all deposit and withdrawal operations. Due to the high cyclical utilization of protocol assets, this off-chain loss quickly weakened collateral capacity, triggering liquidations and panic withdrawals. Within just 48 hours, xUSD plummeted from $1 to about $0.1, and the liquidity pool was nearly drained, prompting multiple protocols to initiate emergency shutdown and redemption procedures due to the decline in xUSD's value.

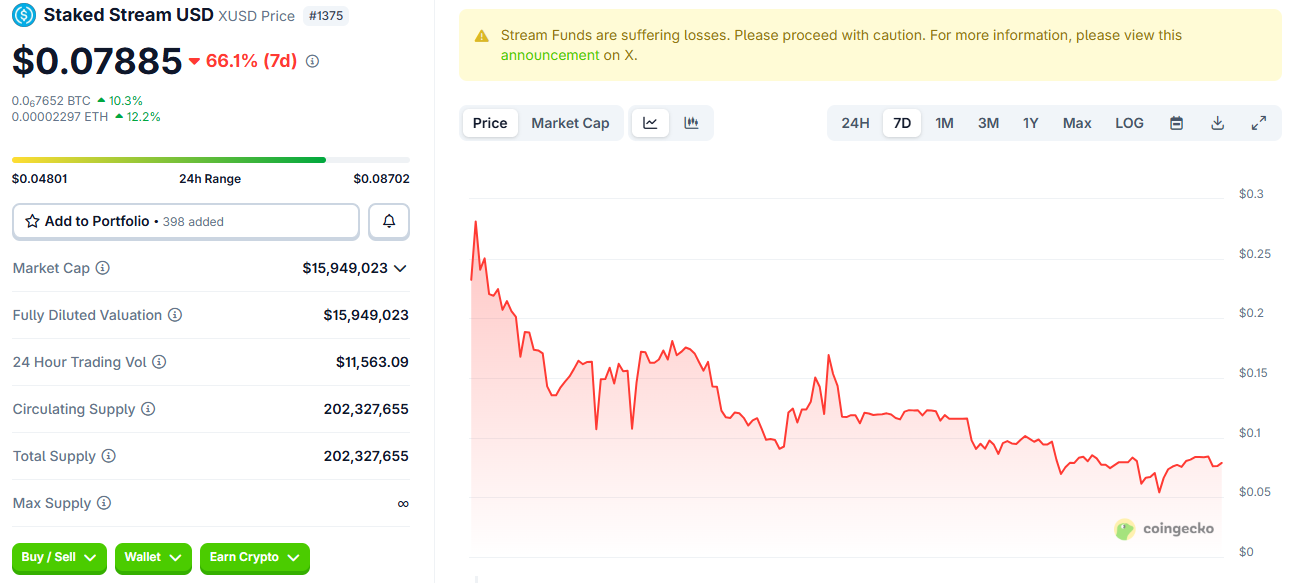

As of now, Stream Finance remains in the withdrawal suspension phase and has not announced a repayment and redemption plan, with the price of xUSD having dropped to about $0.079, and market trust has nearly evaporated. The market outflow caused by this incident is estimated at around $1 billion, making it one of the largest single systemic risk events in the DeFi space in 2025. The collapse of Stream Finance not only exposed structural shortcomings in DeFi regarding leverage management, asset disclosure, and liquidity defenses but also served as a wake-up call for the entire industry.

Source: coingecko

### 3. Market Chain Reactions

1. Trust Crisis in DeFi Protocols

The collapse of Stream Finance has acted like a contagion on the blockchain, quickly affecting multiple DeFi protocols. According to on-chain tracking data from the DeFi research group YAM, the debts among related protocols amount to $284.9 million. Among them, TelosC has the largest risk exposure, approximately $123.6 million, nearly half of Euler's total exposure; MEV Capital has allocated about $34 million across multiple lending markets; and Re7 Labs has a total risk of about $27.4 million. These institutions formed a high-leverage chain due to their excessive reliance on synthetic assets issued by Stream, which quickly backfired after the market depegged.

At the same time, Elixir Finance was significantly affected, as about 65% of the core collateral for its stablecoin deUSD came from Stream Finance, and it provided a loan of $68 million to Stream. After the collapse of Stream, Elixir effectively played a dual role as both creditor and collateral-dependent party, forming a typical circular dependency. When xUSD crashed, the collateral value of deUSD nearly reached zero, and the anchoring mechanism completely failed. On November 6, Elixir announced the permanent cessation of deUSD services and established a 1:1 USDC redemption channel for remaining holders. Subsequently, protocols such as Morpho were also affected.

2. On-Chain Capital Flight

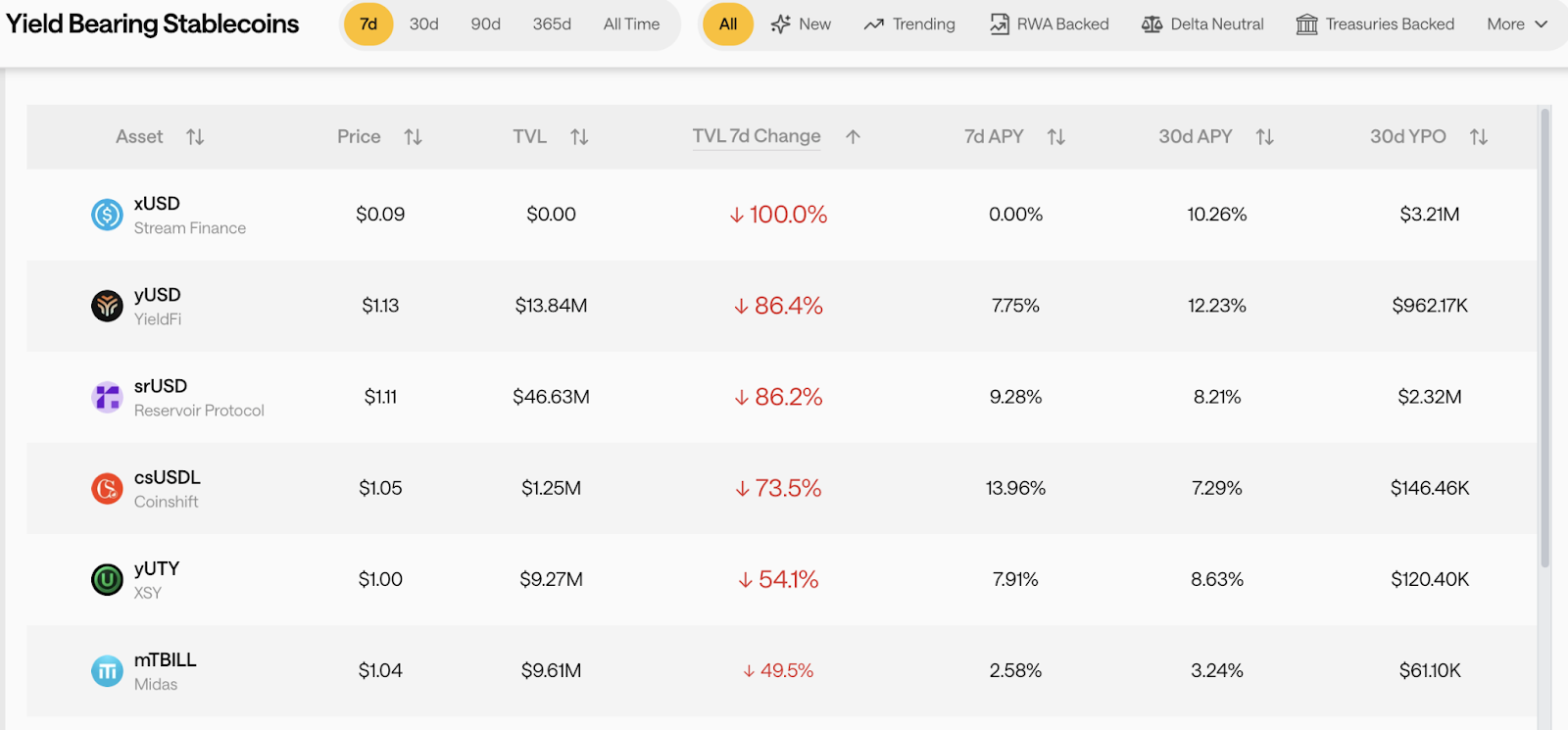

The incident involving Stream Finance triggered a chain liquidation that quickly evolved into a wave of capital withdrawal from the industry. In the first week of November, the total locked value in DeFi dropped from approximately $150 billion to $130 billion in a short period, and the total market capitalization of stablecoins shrank by about $2.5 billion during the same timeframe. Among them, the yield-bearing stablecoin sector was hit hardest, with xUSD's TVL nearly reaching zero, while the locked value of similar assets such as yUSD, srUSD, and csUSDL also fell by about 80% within a week, with some liquidity pools experiencing outflow rates exceeding 60%, and market risk aversion sentiment rapidly intensified.

Source: stablewatch

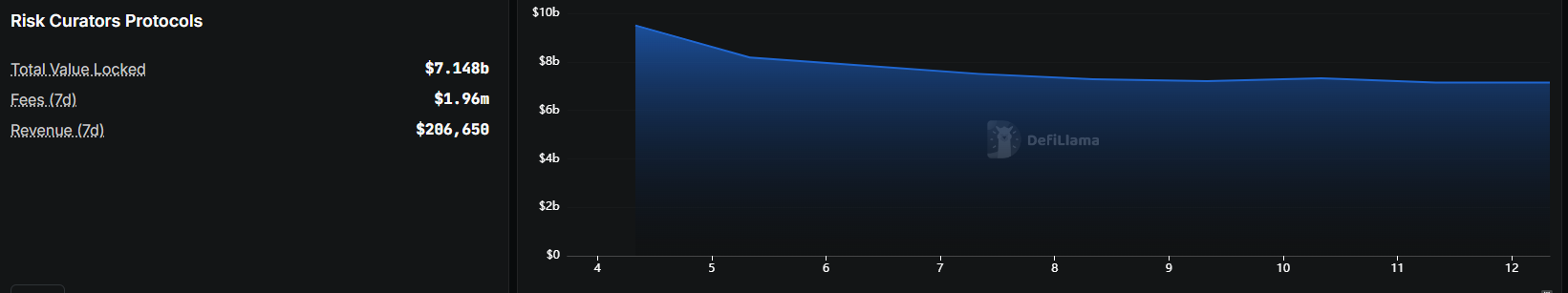

In addition, on-chain wealth management and yield aggregation protocols were also impacted, with the capital structure rapidly shifting from high yields and high leverage to stable yields and low risks, with funds clearly flowing towards larger, more transparent, and more creditworthy protocols. Currently, the scale of related funds managed by major fund managers has shrunk by nearly $2 billion within a week. Overall, this incident not only weakened trust in specific products and protocols but also prompted the entire DeFi ecosystem to undergo a deep reconstruction of risk pricing and capital allocation.

Source: defillama

### 3. Related Reflections

1. The False Stability of Yield-Bearing Stablecoins

The Stream Finance incident reveals the long-standing structural paradox of yield-bearing stablecoins, which claim stability while embedding high-risk yield logic. Products like xUSD and deUSD derive their yields largely from leveraged cycles, outsourced fund management, and market spreads, performing robustly in favorable market conditions, but once collateral assets fluctuate or strategies fail, the anchoring mechanism can collapse rapidly. This incident marks the transformation of the risks associated with such assets from theoretical to real impacts, exposing that their "stability" is more of an illusion. In essence, yield-bearing stablecoins are closer to yield certificates with principal risk. Their prosperity is built on the stacking of leverage expansion and speculative liquidity, and once liquidity contracts, systemic vulnerabilities will be concentrated and exposed.

A deeper issue is that the value system of these stablecoins has long departed from real economic activities. Yields primarily come from on-chain capital cycles and spread operations rather than from fundamental needs such as payments or settlements, so their stability does not stem from real transaction support but relies on continuous capital inflows and market confidence. When yield-driven motives replace functional demands, the anchoring logic loses its foundation. To rebuild trust, these assets should return to real use cases and verifiable reserves, establishing stability based on actual capital and liquidity supply rather than high-yield narratives through transparent collateral structures, on-chain reserve proofs, and strict redemption mechanisms.

2. The Systemic Crisis of DeFi and Reconstruction Pathways

The ongoing fallout from the Stream Finance incident has once again put the DeFi ecosystem to the test of trust and structural integrity. The development of some DeFi protocols in the past relied on high yields, liquidity expansion, and a cycle of re-collateralization, forming typical characteristics of excessive financialization. In this model, collateral assets are repeatedly utilized, yield certificates are continuously derived, and the flow of funds between protocols is nested. This structure was seen as a symbol of efficiency during market uptrends, but when confidence wavers, liquidity contraction can quickly amplify systemic vulnerabilities, intensifying liquidation pressures and triggering chain reactions.

It is noteworthy that the DeFi market's trust system has been severely damaged due to the dual impact of the market turmoil on October 11 and the collapse of Stream Finance. On-chain data indicates that funds continue to flow out of mainstream protocols, and the liquidity of some high-yield funds is accelerating its decline, with liquidation risks potentially not fully released. This crisis not only reflects the risk management deficiencies of individual projects but also exposes deep-seated issues within the entire DeFi system, such as excessive leverage and lack of reserve audits. To emerge from this trust crisis, DeFi must return to the essence of finance, establishing on-chain verifiable reserve proofs, independent risk isolation pools, and automated governance frameworks to rebuild a transparent, robust, and sustainable financial foundation. Only under the premise of visible risks and robust mechanisms can DeFi regain the long-term trust of capital and users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。