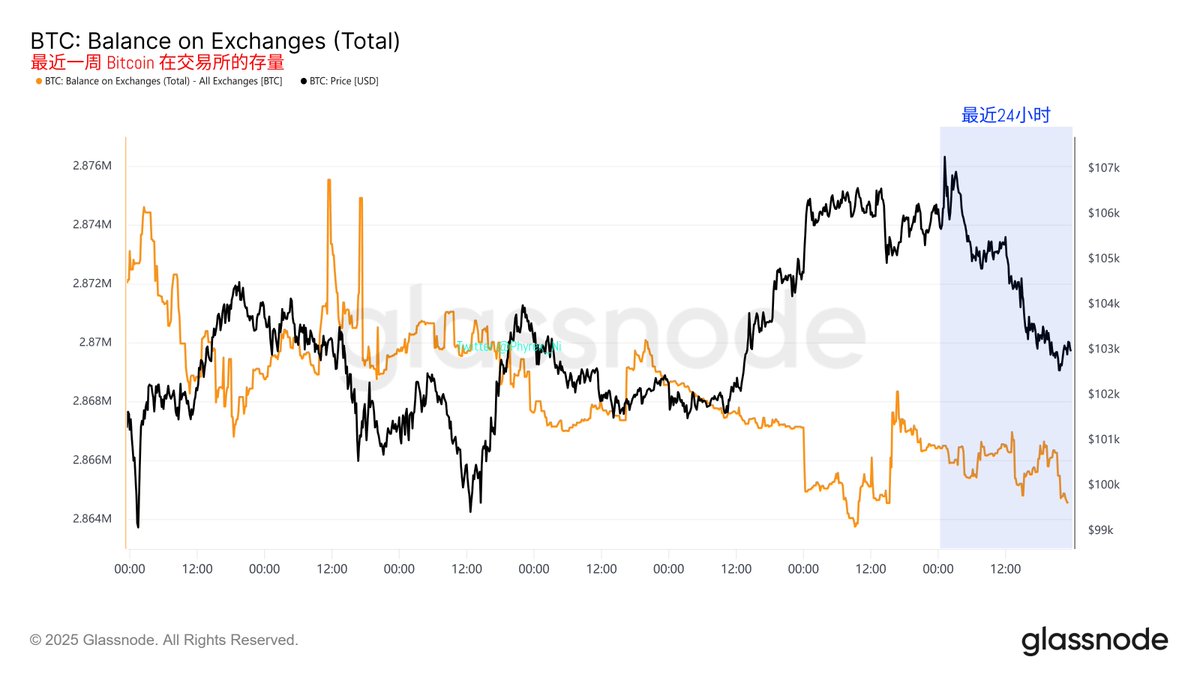

The inventory of exchanges remains a key focus for me personally. Looking at the overall exchange inventory over the past week, the changes have not been significant. However, there is still a trend of more Bitcoin being withdrawn from exchanges, which is due to the market's main contention shifting from concerns about a halt to expectations of the end of the halt.

Investors generally believe that there will be a certain rebound in the market after the halt ends, so after the expectation of the halt ending was announced, panic emotions decreased, naturally leading to a decline in turnover. Investor sentiment for bottom-fishing has appropriately increased. Even though the price of $BTC saw some pullback on Tuesday, the decline in exchange inventory can still be observed.

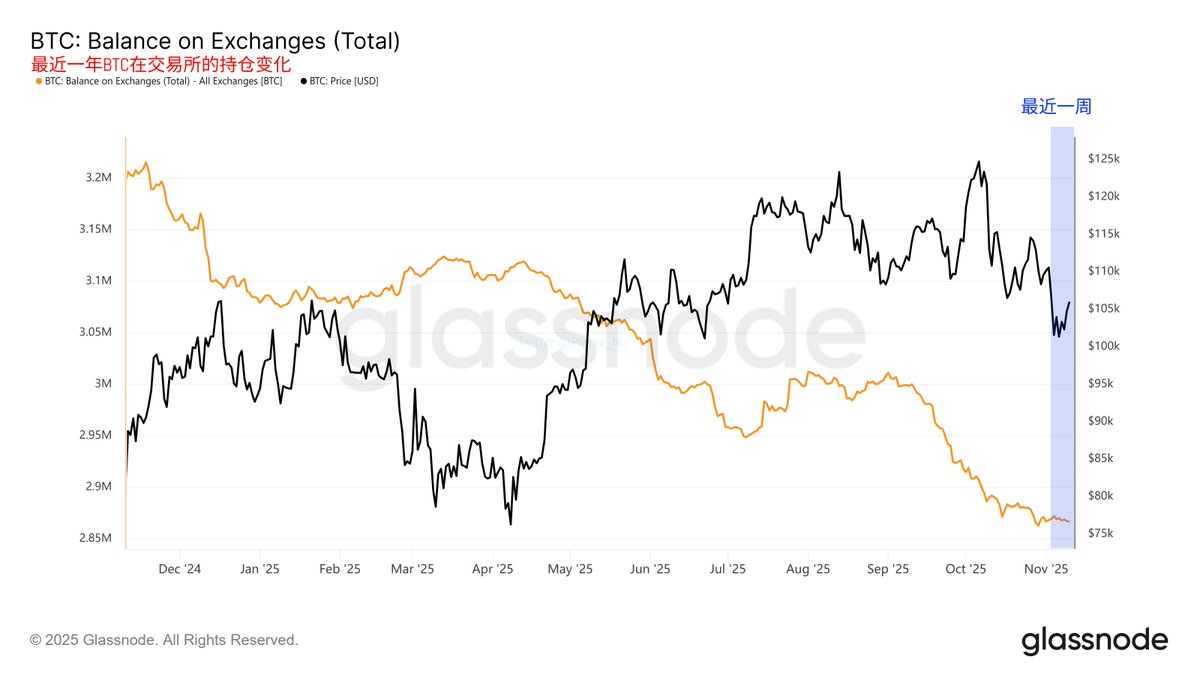

When extending the timeframe to a year, it can also be seen that the overall exchange inventory has been slowly declining over the past two weeks. The inventory and the price of BTC are inversely related, and there has not been a large-scale selling pressure in the market, while chips continue to be withdrawn from exchanges. This means that the recent decline has not triggered panic selling; instead, funds are continuously accumulating during the downturn. This indicates two things:

First, short-term price fluctuations do not reflect the true behavior of large on-chain funds, but are more likely driven by derivative leverage liquidations, emotional fluctuations, or passive position reductions. Most investors have not chosen to transfer BTC to exchanges in preparation for selling; rather, they continue to buy from exchanges and are not sensitive to short-term price fluctuations.

Second, spot demand remains stronger than selling pressure, especially the accumulation trend among institutions and large addresses is more evident. In the past two weeks, BTC has experienced several rapid dips, but the exchange inventory has actually decreased, indicating that with each fluctuation, investors are buying up low-position chips. The weakness in price is more due to weak liquidity rather than an increase in selling.

I feel that the chips are becoming scarcer, the real sellers are decreasing, and the real buyers are becoming more patient.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。