We have seen many posts explaining what the ZKsync Atlas upgrade brings.

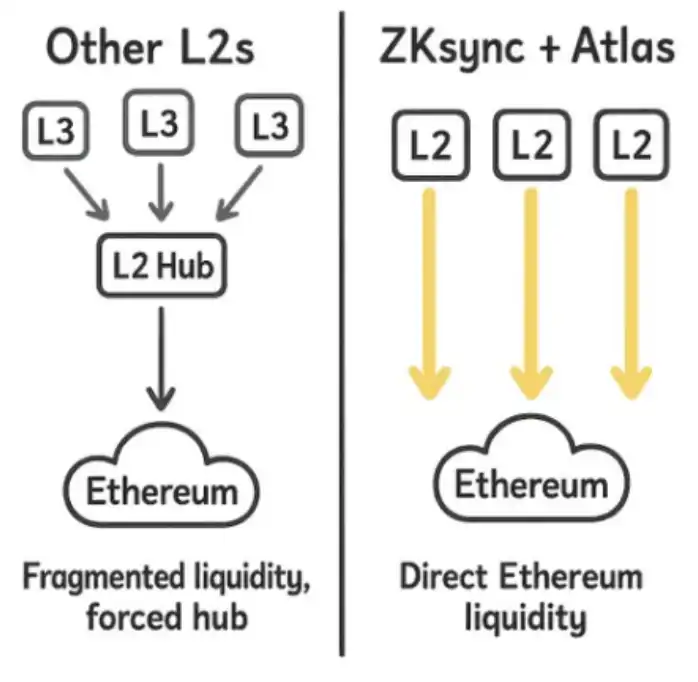

(You can quote a related tweet) As ZKsync founder Alex said, the Atlas upgrade allows L2 to directly rely on Ethereum as a real-time liquidity hub for the first time. This is not only a technical upgrade but also a reshaping of the ecological landscape.

Today, we will focus on the new innovations that Grvt may launch in the future, as well as the new features that users can achieve on Grvt through Atlas, as Grvt becomes the core dApp for immutably expanding Ethereum's liquidity and market layer.

As the largest ZKsync-driven dApp, Grvt achieves composability with the Ethereum mainnet through Atlas. Coupled with its liquidity and immutability, we believe that Grvt and its users will gain maximum benefits in terms of capital efficiency. The ability to interoperate and compose with the most popular DeFi dApps on the Ethereum mainnet will open up many possibilities for Grvt and ETH mainnet users to maximize capital potential. Here are the specific ways:

(1) Lending Protocols: Maximize Your Balance on Grvt through Aave or Euler

With the balance on Grvt, you can directly access Aave or Euler on the Ethereum mainnet (with TVLs of 29.88 billion and 1.6 billion respectively) to borrow from these deep liquidity sources and use the funds for trading and earning yields on Grvt, or invest in Grvt strategies.

(2) Spot DEX: Maximize the Utility of Your LP Positions through Atlas

Users can use LP tokens from spot DEXs like Uniswap on the Ethereum mainnet as collateral for perpetual contract trading, thereby enhancing the returns on LP positions. Grvt strategists can also integrate LP positions from spot DEXs into previously perpetual-only strategies as a means of diversification. The simplest way is for users to access liquidity from any spot DEX on the Ethereum mainnet through Grvt for token swaps.

(3) LRT and LST Protocols: Unlock Greater Value from Your LRT and LST

Through Atlas, traders on Grvt can utilize LRT and LST from protocols like Eigencloud, Lido, and Rocketpool, not only to earn staking rewards but also to use them as collateral for opening perpetual contract positions while enjoying Grvt's native yields (if still provided). This means triple rewards: staking rewards + Grvt native yields + perpetual trading profits.

Additionally, Grvt strategists can incorporate LRT and LST into their portfolios as a source of "risk-free" yield, helping users achieve yield diversification while avoiding impermanent loss and high-risk trades.

(4) Yield Protocols: Make Your Pendle Positions More Flexible

Similar to LRT and LST, Grvt users can use Pendle's PT (zero-coupon bond-like yield tokens) as collateral to open perpetual positions, achieving triple rewards: (i) stable yield from PT, (ii) Grvt's native yield (approximately 10%), (iii) trading profits.

Grvt strategists can also incorporate Pendle's PT and YT into their strategies, exploring more creative yield sources, and even achieving high-risk, high-return through YT without relying on external infrastructure providers like Gauntlet or Morpho.

(5) Stablecoin and RWA Protocols: Maple

Taking the RWA protocol Maple on the Ethereum mainnet as an example, it offers yield-bearing stablecoins based on over-collateralized loans. Users can mint SyrupUSDC using their balance on Grvt to achieve: (i) earning passive income on Grvt, (ii) using SyrupUSDC as collateral for perpetual positions while earning yields, (iii) further enhancing capital efficiency.

Grvt strategists can also utilize stablecoins from diversified yield sources to hedge with stablecoins when "closing positions," while still providing returns to users.

These are just a few examples of how ZKsync-driven Grvt can become an extension of Ethereum's immutability, opening up more products, strategies, and innovations by enhancing capital efficiency and liquidity. I am very much looking forward to the groundbreaking innovations that Grvt will bring, filled with anticipation for the potential brought by Atlas, and hope to explore infinite possibilities after its launch!

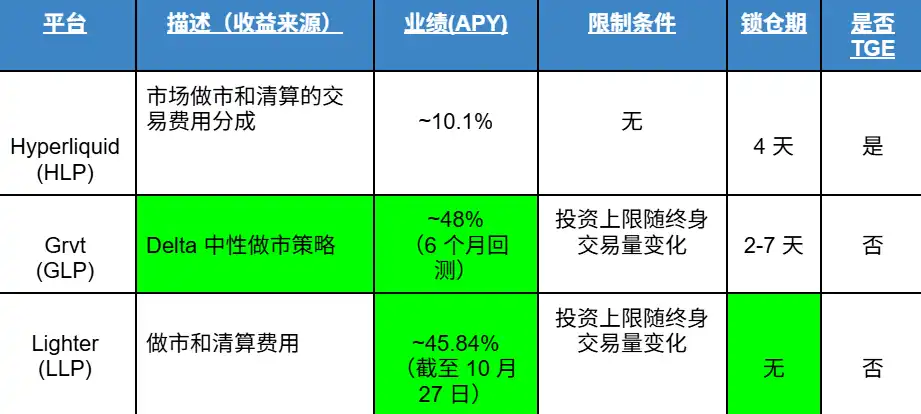

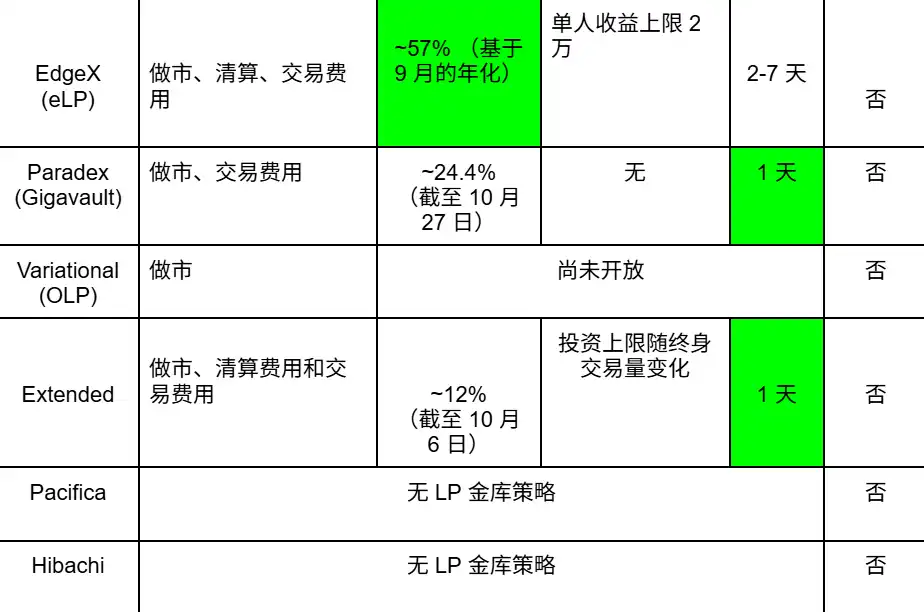

Additionally, Grvt has just launched its native protocol treasury GLP, managing assets exceeding $1.5 million in less than 24 hours. Below is a table summarizing the main perpetual contract DEXs and their "native" LP treasury strategies.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。