Are Trump's tariffs approved by the Supreme Court beneficial to the risk market, or are they not beneficial?

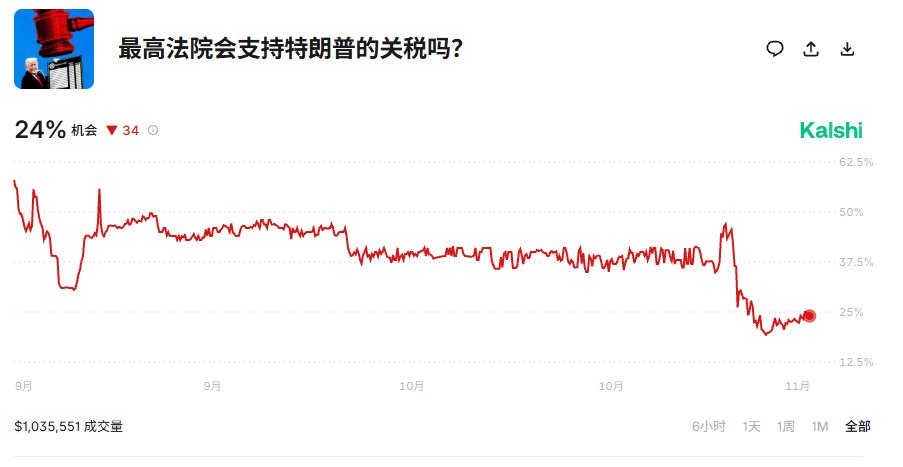

Trump's tariff policy is currently awaiting a final ruling from the Supreme Court. According to Kalshi's prediction data, the probability of the Supreme Court supporting Trump's tariffs is only 24%, which indicates that unless the Trump administration finds another excuse to impose taxes, this tax drama that has lasted nearly a year is likely to be invalid.

So if it is indeed ruled invalid, and Trump does not have better tools for taxation, will this be beneficial or detrimental to the market?

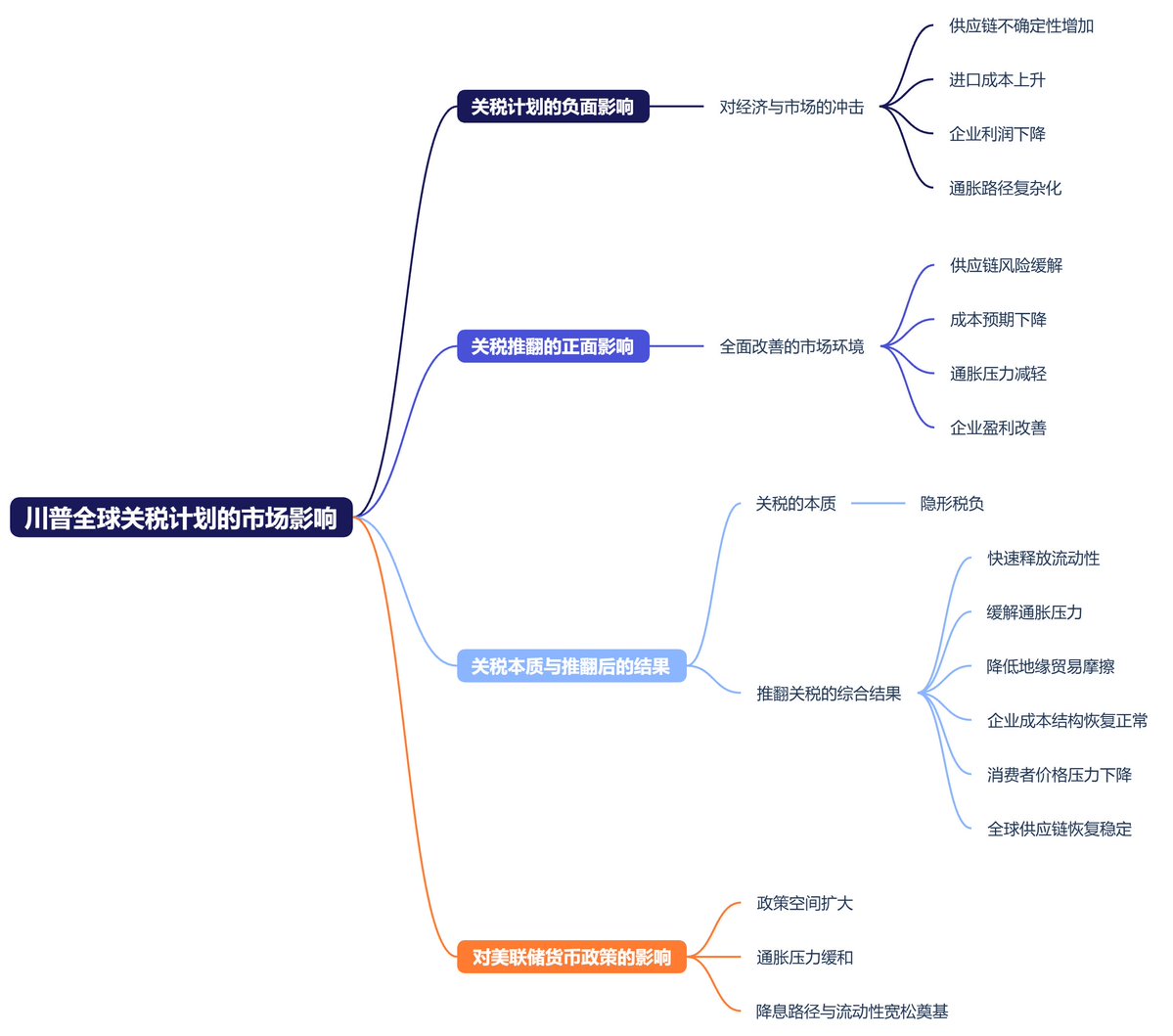

In fact, Trump's global tariff plan creates significant uncertainty for supply chains, import costs, corporate profits, and inflation paths. The market has treated this issue as a risk for a long time; companies need to adjust their cost expectations, investors must reassess profitability, risk aversion increases, and liquidity becomes tightly locked again.

Conversely, if the Supreme Court rules the tariffs illegal or significantly limits their scope, the market's sentiment would react completely oppositely: supply chain risks would ease, cost expectations would decline, inflation pressure would lessen, and corporate profits would improve. This would effectively open a window for the economy from both the fiscal and supply sides, significantly boosting the risk market.

Therefore, tariffs are essentially an invisible tax burden. Overturning tariffs can quickly release liquidity, alleviate inflation pressure, and reduce geopolitical trade frictions. The ultimate result is that companies can restore their normal cost structures more quickly, consumers face less price pressure, global supply chain expectations stabilize, and the overall market's risk premium is significantly lowered. When costs are no longer pushed up by tariffs and inflation pressure begins to ease, the Federal Reserve's monetary policy space will expand, eliminating the need to maintain tightness due to structural inflation caused by tariffs. This lays the groundwork for future interest rate cuts and even liquidity easing.

In other words, if tariffs are overturned, the market will experience a long-term positive resonance from three main lines: improved corporate profits, reduced production costs, and the disappearance of uncertainty. Inflation pressure will ease, no longer driven up by tariffs. Policy space will expand, allowing the Federal Reserve to avoid struggling between forced anti-inflation measures and recession concerns. This effectively removes risk factors from the source for the risk market, not only boosting sentiment but also releasing real funds, potentially allowing risk-averse capital to flow back into sectors like technology stocks and crypto assets.

If the end of the shutdown resolves "fiscal liquidity," then resolving the tariff issue addresses "structural risk premiums." The combination of both is undoubtedly a strong positive for risk assets.

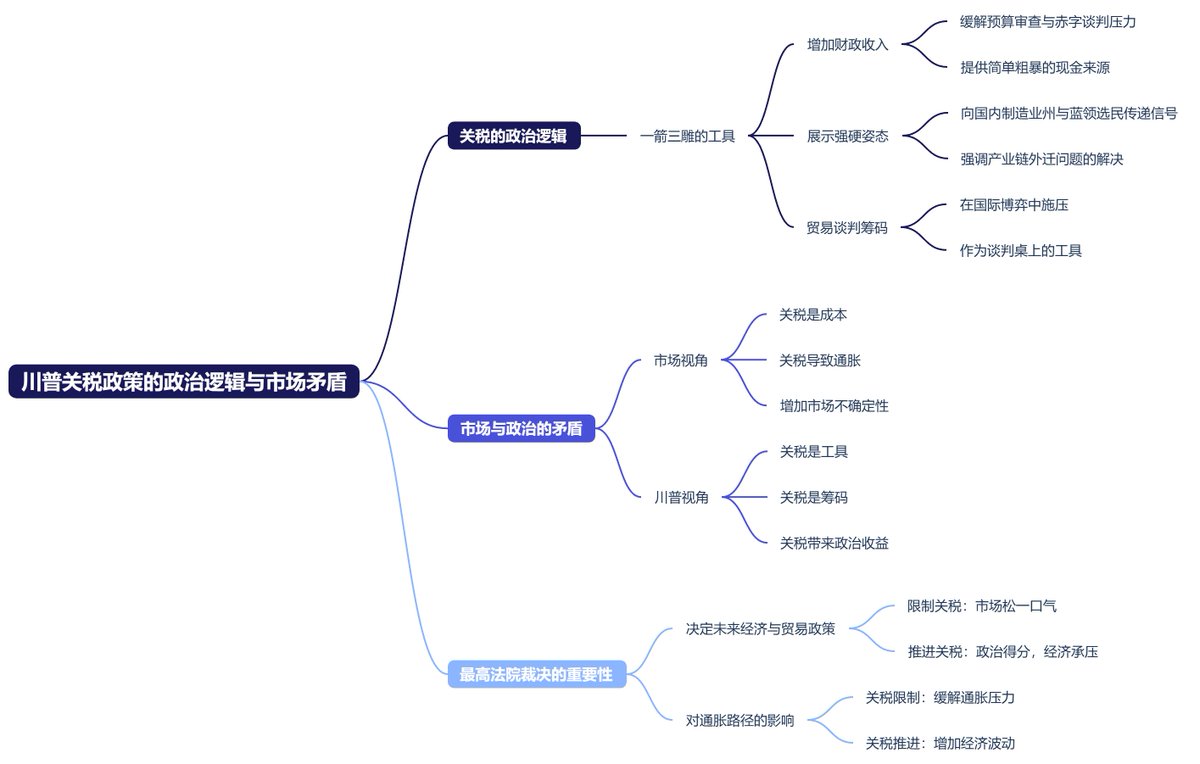

Of course, this is how we view it rationally. From Trump's perspective, the implementation of tariffs not only alleviates fiscal pressure but also serves as a politically advantageous tool that can achieve multiple objectives.

First, tariffs can directly increase fiscal revenue on paper. Even if the scale is not large, they can provide a straightforward cash source amid budget reviews, deficit negotiations, and significant pressure on the Treasury.

Second, the existence of tariffs can demonstrate a "tough stance" domestically, especially when facing manufacturing states, blue-collar voters, and issues of industry chain relocation. Tariffs are the easiest policy to understand, the most intuitive, and the most promotable.

Third, tariffs can become leverage at the trade negotiation table, maintaining pressure in international games, serving as both a pressure tool and a bargaining chip.

From Trump's political logic, tariffs are essentially the lowest-cost, fastest, and most powerful narrative policy weapon. They do not require Congressional authorization, do not need to wait for systemic reforms, and do not require complex designs, allowing for almost immediate visible political effects. Because of this, even if the Supreme Court overturns the current global tariff scheme, Trump may continue to seek other forms of "alternative tariffs" or "administrative fees," as tariffs represent a stance, a form of control, and a symbol of reshaping supply chain discourse.

However, this is precisely the greatest contradiction between market and political logic. For the market, tariffs represent costs, inflation, and uncertainty; for Trump, tariffs are tools, bargaining chips, and political gains. This is why the Supreme Court's ruling is particularly critical. It does not just determine a tax but the future trajectory of the U.S. economy, trade policy, and even inflation.

If tariffs are restricted, the market is likely to breathe a sigh of relief. But if tariffs continue to be pushed forward, although politically advantageous, the economic side will have to bear higher costs and volatility.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。