Author: 0xcoconutt

Compiler: Block unicorn

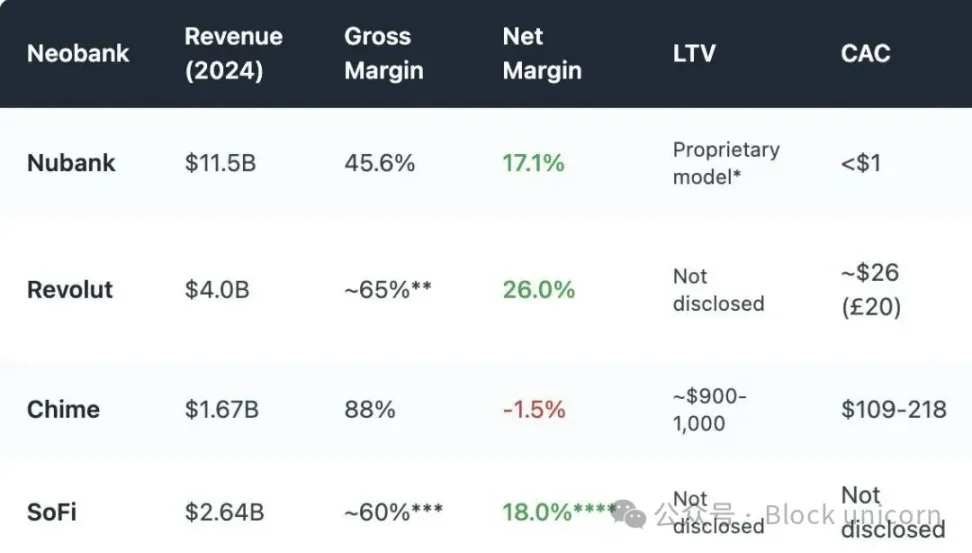

Did you know? Less than 5% of new banks are profitable?

The slogans of new banks are quite appealing: fully digital banking services, lower fees, and better user experiences. However, it turns out that the economic benefits of these digital banks are fundamentally weak.

This article will delve into why many traditional new banks struggle to be profitable, and how cryptocurrency new banks are following a similar path.

Image from ashwathbk

1. Over-reliance on interchange fees

The revenue of new banks primarily depends on transaction fees, which are a small portion of the fees charged by banks each time users swipe their debit cards.

This model only works effectively when scaled, with high margins and high spending. However, in practice, this model often has poor economic benefits and is very fragile.

Chime, a digital bank based in the United States, does not have a banking license and can only rely on partner banks to hold deposits and issue debit cards, which is very similar to the operational model of cryptocurrency digital banks. Its business model is entirely focused on card transactions. It is expected that by 2024, about 80% of its total revenue will come from transaction fees.

However, regulators in many regions have set caps on interchange rates:

- European Union: 0.2% per transaction

- United States (Durbin Amendment): about $0.21 per swipe + 0.05% fee

- Chime partners with small banks, charging a maximum fee of about $0.44 per swipe.

But this legal arbitrage opportunity is under pressure, and for new banks relying on transaction fees as a sustainable business model, the profit margins are already very narrow.

Moreover, transaction fee income is also highly sensitive to consumer spending cycles. During economic downturns, if people reduce card spending, the income of new banks will also decline.

2. Idle capital: No lending, no interest income

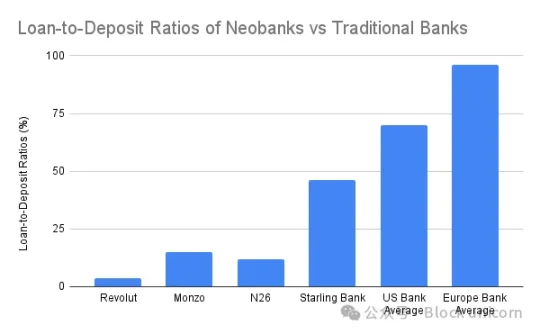

The core income of banking operations comes from interest income from lending, not from paying interest.

Traditional banks convert deposits into loans, earning interest from mortgages, credit lines, and commercial financing.

Even those new banks with banking licenses have mostly failed to establish this core function.

Traditional banks derive 60% to 65% of their income from net interest income, with a loan-to-deposit ratio of 55% to 65%, and the global average is even higher. However, most new banks perform poorly in this primary income source, with only Starling Bank standing out due to its acquired mortgage portfolio.

Cryptocurrency new banks operating on a self-custody model cannot earn interest income from deposits. They cannot use user funds to generate returns. At best, they will pass deposits to DeFi protocols like Aave or Lido and take a small portion of the returns as a commission. However, these integrations lack underwriting mechanisms, have no real control, and carry risks such as protocol hacks and stablecoin de-pegging.

In the fintech and cryptocurrency models, the same paradox keeps recurring: deposits keep accumulating but cannot be monetized.

Essentially, many new banks, including cryptocurrency new banks, are just expensive deposit storage units.

3. High customer acquisition and maintenance costs

Unlike traditional banks that grow naturally through historical accumulation or branch networks, new banks must win every customer through marketing and referrals in a highly competitive digital market. This leads to high customer acquisition costs (CAC), severely squeezing their profit margins.

Due to high registration thresholds and the need for user education, the customer acquisition costs for cryptocurrency new banks are even higher. Not to mention, most cryptocurrency new banks use high annual yield rates and token incentives to attract users to deposit within the app. This is equivalent to deferred debt that the company needs to repay and will significantly increase customer acquisition costs.

The cost-to-income ratio of cryptocurrency new banks is also worse than that of traditional new banks:

- Stablecoin-based payment methods compress foreign exchange and transaction fees, triggering a vicious cycle of price undercutting in increasingly fierce competition.

- Even in self-custody models, regulatory obligations include Know Your Customer (KYC), cash control, and card program compliance. If fraudulent activity is detected in card spending, refunds and penalties will be borne by the cryptocurrency new banks. They may even face the risk of being suspended by centralized issuing institutions.

- Most users are small retail users (with deposits under $1,000), while after-sales, fraud, and infrastructure costs remain constant.

4. Restructuring the model: Winning through embedded DeFi

Cryptocurrency new banks cannot succeed by mimicking Chime or Monzo, as the foundational business model of cryptocurrency new banks is fundamentally different due to their self-custody nature. I do not believe that cryptocurrency new banks have an advantage over traditional new banks, but cryptocurrency can help new banks improve profitability through embedded DeFi.

1. Transaction activity as the main source of income

Transaction income has become an effective way for traditional new banks and crypto wallets to achieve high-profit revenue.

- Revolut's wealth division (including cryptocurrency, 2024): £506 million (16.3% of total revenue), a year-on-year increase of 298%, primarily driven by customer speculation in cryptocurrency rather than traditional banking services.

- Phantom Wallet (2025 forecast): Wallet transactions reach $79 million.

Embedded trading features have been seen as standard industry configurations. Applications need to offer a rich variety of asset types, trading pairs, MEV protection, fast execution, etc., to stand out and ensure users have the best trading experience.

2. Structured income and on-chain wealth products

New banks do not lend directly but package complex DeFi products into wealth products that are easy for retail users to understand and invest in.

- Self-issued stablecoins, earning treasury yields by guiding users to exchange for the new bank's stablecoins.

- Selected yield vaults and retail savings protocols.

- On-chain ETFs/Real World Assets (RWA).

- Insurance.

I have not seen many Western emerging banks successfully replicate the success of Alipay's wealth product portfolio.

Screenshot of Alipay's wealth products

Cryptocurrency new banks have an advantage in providing a wide range of wealth management products that can simplify DeFi and make high-yield financial products more accessible to a broader audience.

Embedded DeFi can help enrich the wealth management product portfolio of new banks.

Conclusion: Don't build banks, build decentralized finance (DeFi) rails

The profit margins of new banks have always been low. Cryptocurrency new banks, even with DeFi-native tools, face even more severe challenges: reduced stablecoin payment fees, higher compliance costs, stricter customer onboarding processes, and intensified competition once traditional new banks shift to the cryptocurrency space.

As Revolut and Nubank begin to offer stablecoins, cryptocurrency trading, and on-chain yields based on existing infrastructure, new banks prioritizing cryptocurrency will find it difficult to capture user mindshare.

The winning opportunity does not lie in building another new bank, but in providing rails: yield routers, stablecoin forex layers, DeFi wrappers, or curators that can connect to existing bank distribution networks. Competing with new banks that have already accumulated a large user base is challenging, but we should strive to use cryptocurrency to supplement and enhance their profitability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。