Original | Odaily Planet Daily (@OdailyChina)

Ethena is experiencing the largest outflow of funds since its inception.

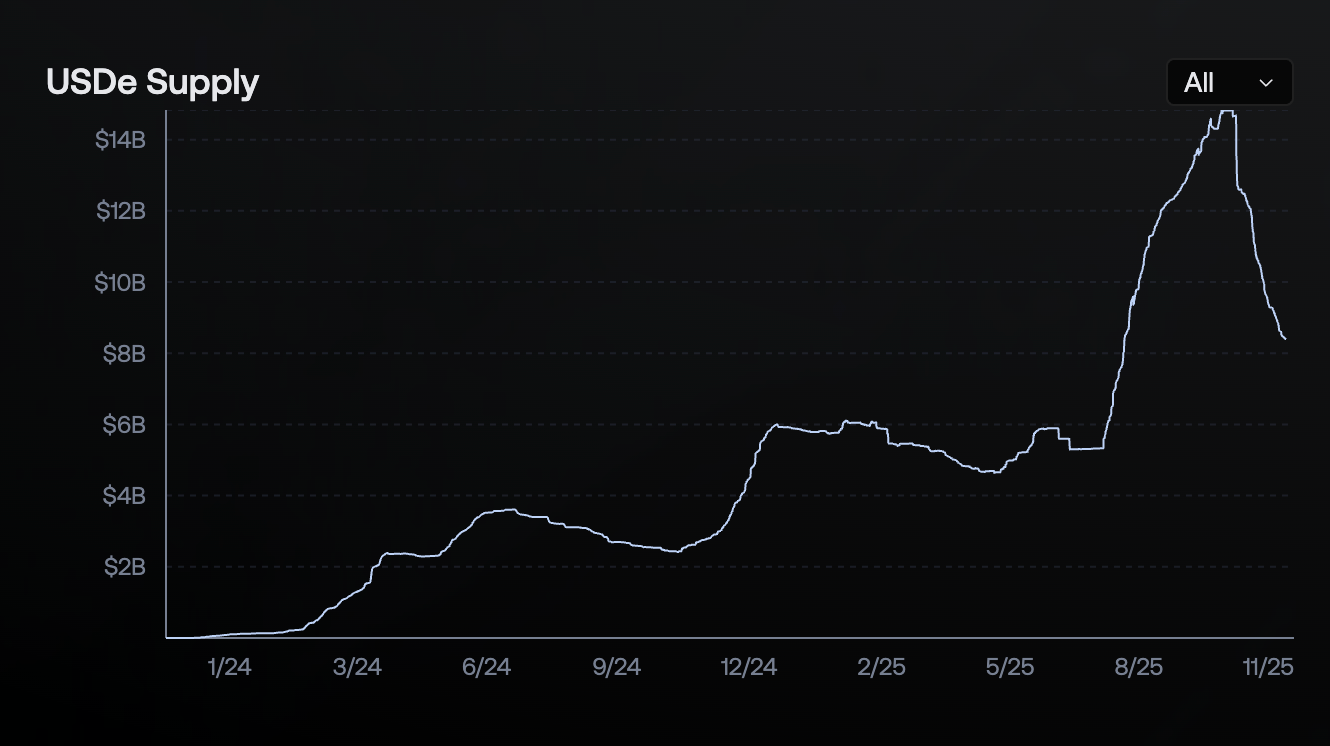

On-chain data shows that the circulating supply of USDe, Ethena's main stablecoin product, has fallen back to 8.395 billion, down about 6.5 billion from its peak of nearly 14.8 billion in early October. While it hasn't been "cut in half," the decline is still quite remarkable.

This comes at a time when DeFi security incidents are frequent, especially with two yield-bearing stablecoins, Stream Finance (xUSD) and Stable Labs (USDX), which claim to use a similar Delta neutral model as Ethena, experiencing consecutive failures. There are rumors that the trigger for these failures may have been the breaking of the neutral balance due to the bloodbath in the market on October 11, which was forcibly disrupted by CEX's ADL. Coupled with the profound memory of USDe briefly deviating from its pegged price on Binance at that time, there has been a large-scale FUD surrounding Ethena.

- Odaily Note: For the story of Stream Finance and Stable Labs and their related impacts, please refer to “On-chain Finance, Danger! Run Away!”

Is USDe still safe?

Considering Ethena's current market scale, if any unexpected events occur, it could potentially brew a black swan event comparable to Terra back in the day… So, has Ethena really encountered problems? Is the outflow of funds really a result of risk aversion? Can we still confidently deploy funds into USDe and its derivative strategies?

To cut to the chase, I personally tend to believe: Ethena's current strategy is still operating normally; while the risk aversion sentiment surrounding DeFi has exacerbated Ethena's outflow to some extent, it is not the main cause; the current safety status of USDe remains relatively stable, but it is advisable to avoid circular loans as much as possible.

The reasons for my acknowledgment of Ethena's current operational status are mainly twofold.

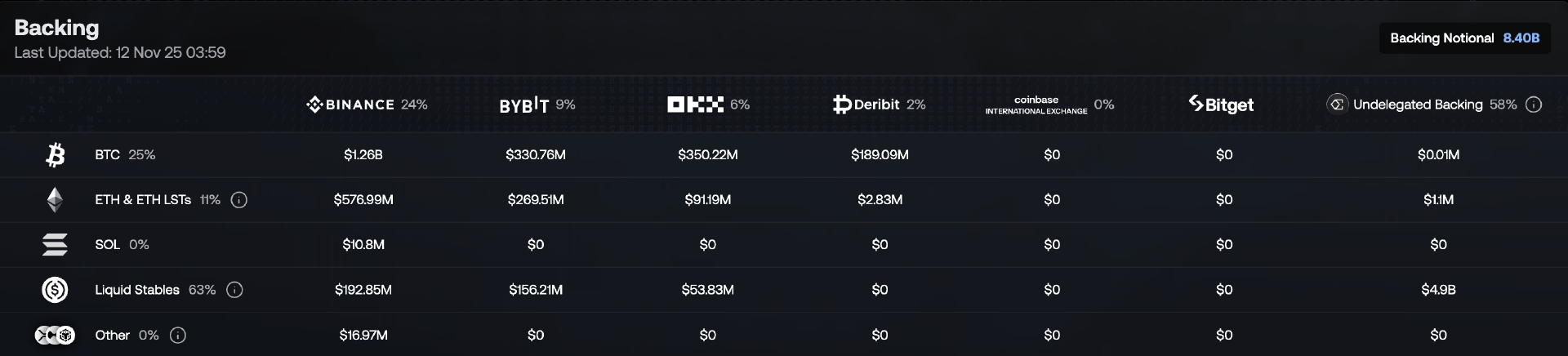

Firstly, unlike most yield-bearing stablecoins that do not clearly disclose their position structures, leverage multiples, hedging exchanges, or even liquidation risk parameters, Ethena can be said to be a benchmark in the industry in terms of transparency. You can clearly see reserve information and proofs, position distribution and proportions, implementation of yield status, and other factors directly on Ethena's official website.

The second point is the issue mentioned earlier regarding ADL causing the neutral strategy to become unbalanced. There are rumors that Ethena has signed ADL exemption agreements with some exchanges, but this has never been confirmed, so we will set it aside for now. Even without exemption clauses, Ethena is fundamentally less likely to be affected by ADL. This is because, from its public strategy, it can be seen that Ethena primarily chooses BTC, ETH, and SOL as hedging assets (with BNB, HYPE, and XRP having very small proportions). These three major assets experienced relatively small fluctuations during the massive crash on October 11, and the counterparty's capacity to bear risk is greater. In contrast, ADL is more likely to occur in the altcoin market, which has larger fluctuations and smaller counterparty capacity. Therefore, the protocols that are currently failing are often those that lack transparency (possibly due to overly aggressive strategies that are not neutral at all).

As for the main reasons for Ethena's outflow of funds, they can also be attributed to two points. First, as market sentiment has cooled (especially after October 11), the arbitrage space between the futures and spot markets has narrowed, leading to a simultaneous decrease in protocol yields and the annualized yield of sUSDe (which has dropped to 4.64% as of the time of writing). Compared to mainstream lending markets like Aave and Spark, which have basic interest rates, it no longer has a significant advantage, causing some funds to shift to other yield paths; second, the price fluctuations of USDe on Binance on October 11 heightened market awareness of the risks of circular loans. Coupled with the decline in yields on both off-chain (CEX reducing subsidy intensity) and on-chain ends, a large amount of funds have exited circular loans and withdrawn their capital.

Based on the above logic, we believe that Ethena and USDe are still maintaining a relatively stable operational state. Although this round of fund outflow has exceeded expectations to some extent due to extreme market conditions and security incidents, the main cause can still be attributed to the decreased attractiveness due to the narrowing arbitrage space in a lukewarm market sentiment, which is precisely determined by Ethena's design logic — the protocol's yield and capital attractiveness will fluctuate in tandem with market environment changes.

A more severe test: scalability

Compared to the periodic outflow of funds, the more severe issue facing Ethena is that its Delta neutral model, which relies on the perpetual contract market for survival, seems to have hit a bottleneck in terms of scalability.

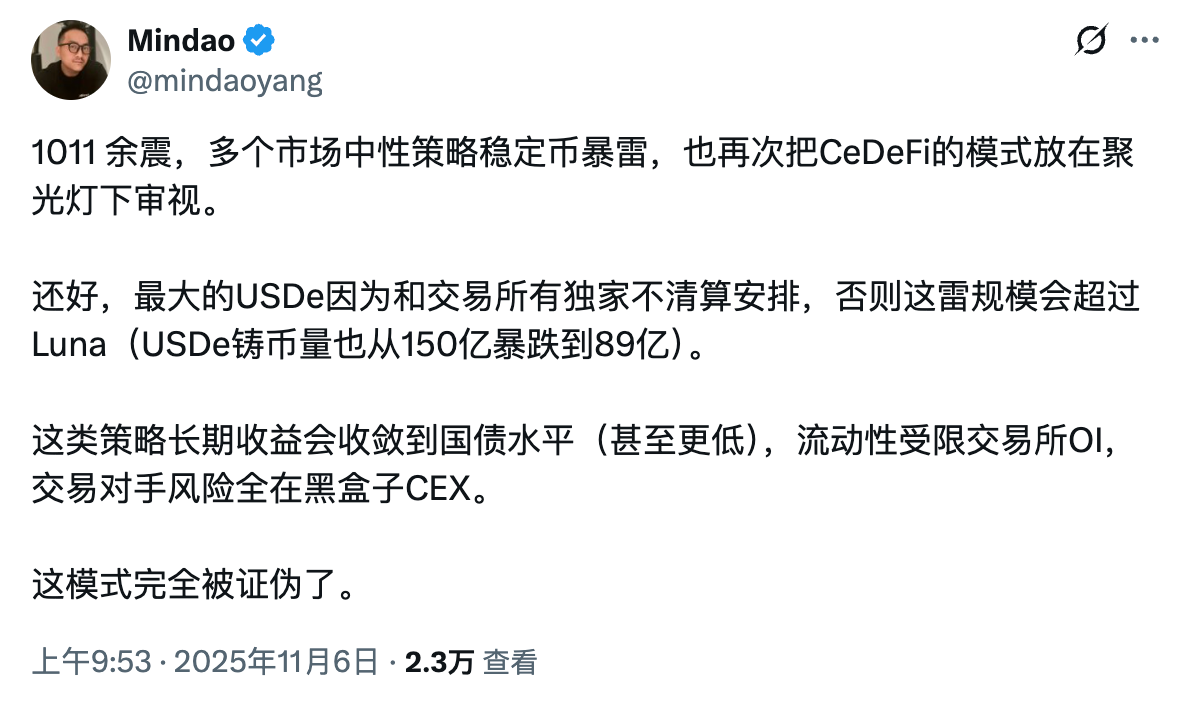

On November 6, DeFi giant Mindao commented on the recent failures of neutral strategy stablecoins, stating: “The long-term returns of such strategies will converge to treasury levels (or even lower), with liquidity constrained by exchange OI, and counterparty risk entirely in the black box of CEX. This model has been completely falsified… They cannot scale, ultimately just niche financial products, and cannot compete with fiat stablecoins.”

This is akin to "The Truman Show," Ethena once thrived in a limited small world, but this small world is constrained by the position size of the perpetual contract market and the liquidity and infrastructure conditions of trading platforms. In contrast, USDT and USDC, which Ethena aspires to challenge, exist in an unrestricted larger world. This inherent difference in growth environments may be the biggest challenge Ethena faces.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。