Blockchain is changing people's perceptions of money, ownership, and transparency. It redefines how we trade, store value, and interact with financial systems. However, until recently, the applications of blockchain were almost entirely centered around pure digital assets, such as cryptocurrencies and NFTs. Now, the next frontier of blockchain is to truly connect the "real world" to this digital network.

This is precisely the significance of RWA (Real World Assets).

RWA refers to the process of bringing financial or physical assets from the real world onto the blockchain through "tokenization," representing them in the form of digital tokens. In simple terms, it allows traditional assets, such as bonds, real estate, or commodities, to be digitized, divided, circulated, and settled on the blockchain.

This innovation combines the strengths of two worlds: the robustness and familiarity of traditional finance (TradFi) and the efficiency and transparency of decentralized finance (DeFi). For investors and institutions, RWA is opening a new door, making the financial world more connected and inclusive.

As the first article in the RWA education series launched by XT.com, this guide will help you understand: what RWA is, how it works, the main types of assets, and how to safely and confidently explore this emerging field through XT's RWA Zone.

Key Points Overview

- RWA transforms financial or physical assets from the real world into on-chain tokens, making ownership, transfer, and settlement more convenient.

- The five common types include: bonds, real estate, commodities, credit assets, and equity or fund shares.

- The tokenization process is clear: asset confirmation, compliant custody, token issuance, information disclosure, and settlement through smart contracts.

- Before investing, please carefully review custody proof, fee structures, redemption rules, and regional participation qualifications.

- XT.com's RWA Zone provides a complete path from project overview to trading pairs, helping you easily and sequentially understand and participate.

Understanding the Five Types of RWA

Real World Assets (RWA) come in various forms; it is not a specific product but a general term encompassing multiple asset types. These assets map real economic activities onto the blockchain through tokenization. Here are five common types and what they mean for investors.

Bonds

Tokenized bonds refer to traditional debt instruments, such as government bonds, corporate bonds, or money market instruments, issued in the form of digital tokens. Each token corresponds to a portion of the underlying bond, allowing investors to earn returns on fixed-income assets without intermediaries. This type of RWA is favored by investors seeking stable returns, predictable performance, and compliance transparency.

Real Estate

Real estate tokenization converts ownership or rental income of properties into digital tokens, including residential, apartments, office buildings, or commercial complexes. Through tokenized real estate shares, investors can enter the real estate market with a lower threshold, achieving asset fractionalization and on-chain liquidity without directly managing physical properties.

Commodities

Commodity RWA typically represents physical assets such as gold, silver, or crude oil. Each token generally corresponds to a certain quantity of the physical commodity and is reserved or held by a custodian. These tokens serve as digital "proof of ownership," facilitating transfers, fractional trading, and verification of reserve transparency through public audits. For investors looking to achieve inflation resistance and asset diversification, commodity RWA is particularly attractive.

Credit and Notes

This category mainly involves the tokenization of financial instruments such as accounts receivable, loans, or trade financing. Companies can release liquidity by converting outstanding receivables into on-chain assets, while investors can earn returns from a verified pool of credit assets. It establishes a bridge between corporate financing and blockchain innovation, opening new pathways for short-term returns and alternative investments.

Equity and Fund Shares

Some RWA projects will tokenize equity or fund shares within a compliant framework. Investors can participate in the performance of companies or the distribution of returns from fund portfolios through these tokenized assets. This form makes previously high-threshold investment opportunities divisible and participatory, helping both institutional and individual investors access a broader range of investment fields.

Regardless of the asset type, the core idea remains consistent: RWA is transforming traditional, static real value into flexible, programmable digital assets, bringing the world economy into the on-chain era.

How RWA Works: A Complete Analysis of the Tokenization Process

Tokenization is the core aspect of RWA; it is an orderly and verifiable process that ensures each token genuinely represents a verified real-world asset. Its operation typically consists of the following four steps:

Step 1: Confirmation and Registration

First, the legitimacy of the asset needs to be identified and verified. This includes confirming the legal ownership of the asset, value assessment, and supporting documentation. Whether it is a property deed, corporate bond, or commercial invoice, the purpose of confirmation is to ensure that the asset genuinely exists, is legally valid, and is enforceable.

Step 2: Custody and Compliance

After confirmation, the asset will be held in custody by a licensed institution, such as a bank, trust company, or regulated broker. The custodian is responsible for securely holding the underlying asset and ensuring that the entire tokenization process complies with local laws and regulatory requirements, thereby ensuring safety and legality.

Step 3: Issuance and Circulation

Once the asset is confirmed and securely held, the project party will issue tokens on the blockchain to represent partial ownership or income participation rights of the asset. Investors can freely trade these tokens or apply them in decentralized finance scenarios such as lending and staking, achieving flexible asset utilization.

Step 4: Settlement and Disclosure

Smart contracts automatically execute operations such as income distribution, redemption settlement, and information updates. The project party regularly publishes transparent reports, allowing investors to stay informed about the operational status of the underlying assets.

In summary, tokenization perfectly integrates the trust system of traditional finance with the transparency and automation of blockchain, creating a seamless new financial bridge connecting the real world and the digital world.

RWA Investment Considerations: Compliance Requirements and Target Audience

Compliance is a crucial aspect of the RWA ecosystem. Since these assets connect on-chain finance with regulated markets, they must adhere to specific legal and operational standards to ensure safety and transparency.

Regional Restrictions

Some RWA products are restricted in certain regions. For example, some projects may not be open to U.S. residents or users in jurisdictions with strict securities regulations. Before investing, please confirm your eligibility based on your location.

Qualification Requirements

To participate in RWA investments, users may need to complete KYC (Know Your Customer) or KYB (Know Your Business) processes. Some products may also require investors to have "qualified investor" or "professional investor" status, with specific conditions depending on the project's compliance framework.

Information Disclosure

Transparency is the foundation of trust. Each RWA project should publicly disclose key information about its underlying assets, custodians, and risk management. On XT.com, this disclosure information is clearly presented in each project card, helping users make informed investment decisions.

XT's goal is very clear: to combine the robustness of regulatory compliance with the openness of blockchain, creating a safe, transparent, and trustworthy investment environment for global users.

Understanding Custody and Proof Mechanisms Before Investing

Before participating in any RWA project, it is crucial to understand the asset custody methods and verification mechanisms. These two aspects are the core foundation of trust.

Custodian Institutions

RWA assets are typically held by regulated banks, trust companies, or professional custodians. These institutions are responsible for protecting the underlying physical or financial assets and ensuring that investors' rights are legally protected.

Verification and Proof Materials

Reliable RWA projects will provide audit reports, verification documents, or Proof of Reserves (PoR) to verify that the issuance of tokens corresponds to the actual custodial assets.

Frequency of Information Disclosure

Quality projects will regularly disclose information updates, usually on a monthly, quarterly, or as-needed basis. They will also establish contingency plans to address unexpected situations such as market disruptions or redemption delays.

By checking these details, investors can effectively reduce potential risks and ensure that their investments are based on open, transparent, and trustworthy foundations.

Subscription, Redemption, and Arrival: Understanding the Investment Rhythm

The process of participating in RWA investments differs slightly from ordinary cryptocurrency trading, and understanding these details can help investors better plan their liquidity and fund arrangements.

Minimum Subscription and Redemption Amounts

Each RWA product will set its own subscription and redemption thresholds. Some may target institutional investors with higher minimum investment amounts, while others may cater to ordinary users with smaller, flexible configurations.

Settlement Cycle

Most RWA products adopt a T+N settlement mechanism, meaning that transactions are completed within several working days after submission. External factors such as holidays or market pauses may affect the arrival time.

On-chain and Off-chain Redemption

Depending on the project structure, redemption methods can be divided into two categories:

- On-chain Redemption: Tokens are burned, and funds are directly issued in the form of digital assets.

- Off-chain Redemption: Funds are settled through traditional financial channels (such as bank transfers).

Efficiency and Costs

On-chain redemption is usually faster and cheaper, but not all products support this method. Before investing, carefully read the project details to clarify the redemption path, arrival time, and related fees.

Understanding these rules in advance can help investors arrange their funds reasonably and avoid unnecessary delays or misunderstandings during the redemption process.

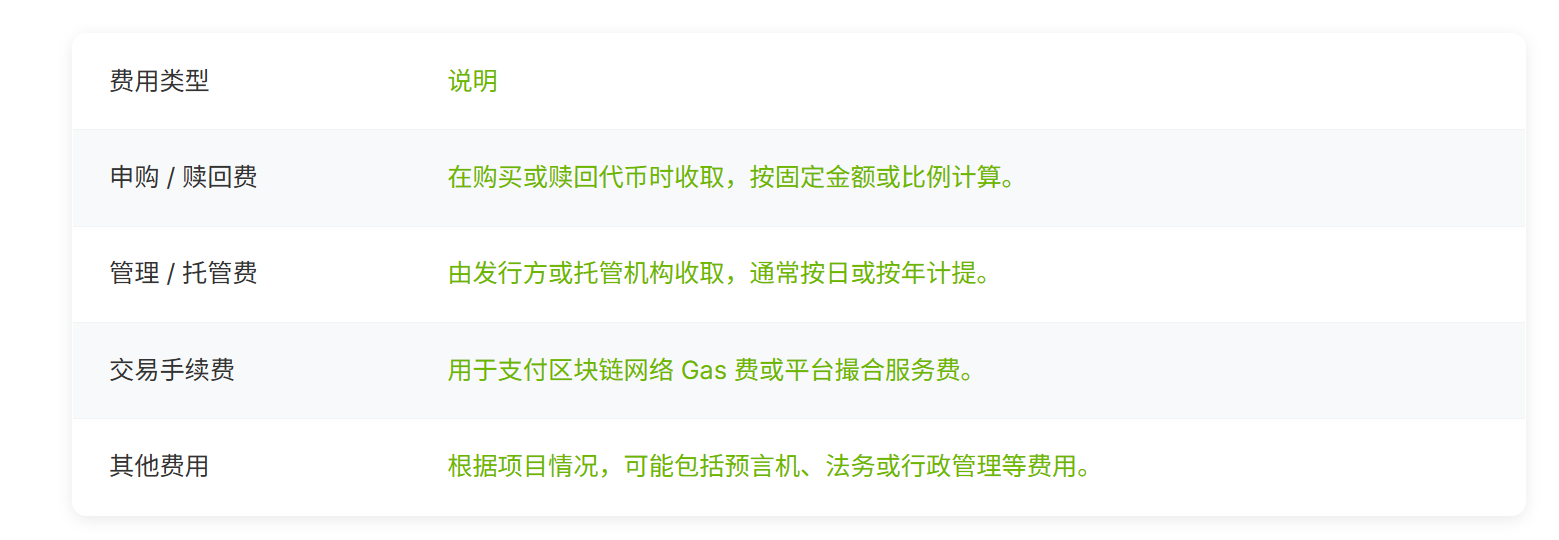

Understanding the Cost Structure of RWA: How to Interpret Cost

Any investment product involves costs, and RWA is no exception. A clear and transparent fee structure helps you accurately assess real returns.

Before investing, be sure to carefully read the project disclosure documents and compare historical settlement records to ensure the information is accurate. Understanding the transparency of the cost structure can help you clearly calculate actual returns and make more informed investment decisions.

Easily Explore RWA Investment Opportunities on XT.com

To make it easier for more users to participate in RWA investments, XT.com has launched a dedicated RWA Zone, simplifying the asset discovery and operation process.

How to Access

- Log in to the XT platform and enter the RWA Zone.

- Select the asset category card you are interested in, such as "Bonds," "Real Estate," "Commodities," "Credit," or "Equity."

- Click on any project card to view detailed information.

- Browse the corresponding trading pairs to start understanding and exploring.

Recommended Reading Order

Before making investment decisions, XT suggests that users gradually understand the following learning path:

- Asset Overview: Understand the specific assets represented by the tokenized product.

- Custody and Compliance: Confirm the custody methods and legal compliance protections for the assets.

- Returns and Fees: Understand the sources of returns and the related fee structure.

- Subscription and Redemption Rules: Master liquidity, arrival times, and redemption methods.

- Risk Disclosure: Read about potential risks and official disclosure documents.

XT's RWA Zone consolidates all key information on one page, allowing you to learn, compare, and invest efficiently, transparently, and easily on a single platform.

The Long-Term Value of RWA: Opening a New Era of Finance

RWA is not just a trend; it is the core foundation of the next round of financial innovation. By connecting tangible assets from the real world with blockchain technology, it injects genuine stability and verifiable value into the digital economy.

For traditional investors, RWA provides a new channel to access global markets, allowing them to enjoy higher liquidity and diversified investment opportunities that were often reserved for large institutions.

For crypto investors, RWA introduces robust yield products backed by real assets, complementing the high volatility of digital assets to achieve a more balanced asset portfolio.

The long-term potential of RWA goes far beyond individual returns. Imagine a world where governments issue tokenized national bonds, property ownership can be transferred instantly across borders, and the entire economic system operates transparently on-chain. This future is gradually becoming a reality through each on-chain asset.

XT.com's RWA strategy is leading this transformation, making tokenized finance easier to understand and participate in. Through continuous innovation, education, and compliance building, XT is committed to helping every user confidently step into a new stage of blockchain development. Explore the new world of integration between reality and blockchain by visiting the XT RWA Zone and start your on-chain investment journey.

RWA Frequently Asked Questions (FAQs)

Q1: In one sentence, what is RWA?

RWA refers to the tokenization of real-world assets, allowing them to be held, traded, and settled on the blockchain.

Q2: Who can participate in RWA investments?

Investment eligibility depends on the region and product type. Some projects require KYC certification or qualified investor status; please check the specific instructions in the project card.

Q3: How are assets secured?

The underlying RWA assets are held by regulated custodial institutions. Investors can view audit reports, verification documents, and Proof of Reserves (PoR) in the project information.

Q4: What is T+N settlement? Why might the arrival time vary?

T+N means that settlement is completed within several working days after the transaction is submitted. Holidays or market fluctuations may cause delays.

Q5: Why might the token price be higher or lower than the Net Asset Value (NAV)?

Token prices may experience premiums or discounts due to liquidity, market supply and demand, and the frequency of valuation updates.

Q6: What should I pay attention to before investing?

Please check key information such as custody information, disclosure frequency, fee structure, subscription and redemption rules, and regional restrictions.

Quick Links

- November 2025 Market Outlook: Comprehensive Analysis of Global Hotspots from FOMC to x402 Protocol

- XT.com and Dash Discuss: Instant Settlement, Chain Lock Mechanisms, and Privacy Innovations

- How to Invest 100,000 USDT? XT's Simple Earn Coin Helps You Achieve Stable 10%+ Passive Income

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform, now boasting over 12 million registered users, with operations in more than 200 countries and regions, and an ecosystem traffic exceeding 40 million. XT.COM cryptocurrency trading platform supports over 1,300 quality coins and 1,300 trading pairs, offering diverse trading services such as spot trading, margin trading, and futures trading, along with a secure and reliable RWA (Real World Assets) trading market. We adhere to the philosophy of "Exploring Crypto, Trusting Trading," dedicated to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。