Original|Odaily Planet Daily (@OdailyChina)

It has been over 41 days since the U.S. government shutdown.

For the U.S. stock market, the cryptocurrency market, and even the global economic market, this period has undoubtedly been extremely difficult. The direct economic losses caused by the government shutdown, as well as the blow to confidence in various markets and the compression of liquidity, can be described as devastating.

However, yesterday, the U.S. Senate passed a procedural vote on the "end of the government shutdown plan" with a vote of 60:40, finally bringing hope for a resolution to this matter. Odaily Planet Daily will share some speculation about the channels for announcing the U.S. government shutdown vote and the estimated time for the shutdown to end for readers' reference.

The Most Intuitive Indicator of the U.S. Government Shutdown: White House Government Shutdown Timer

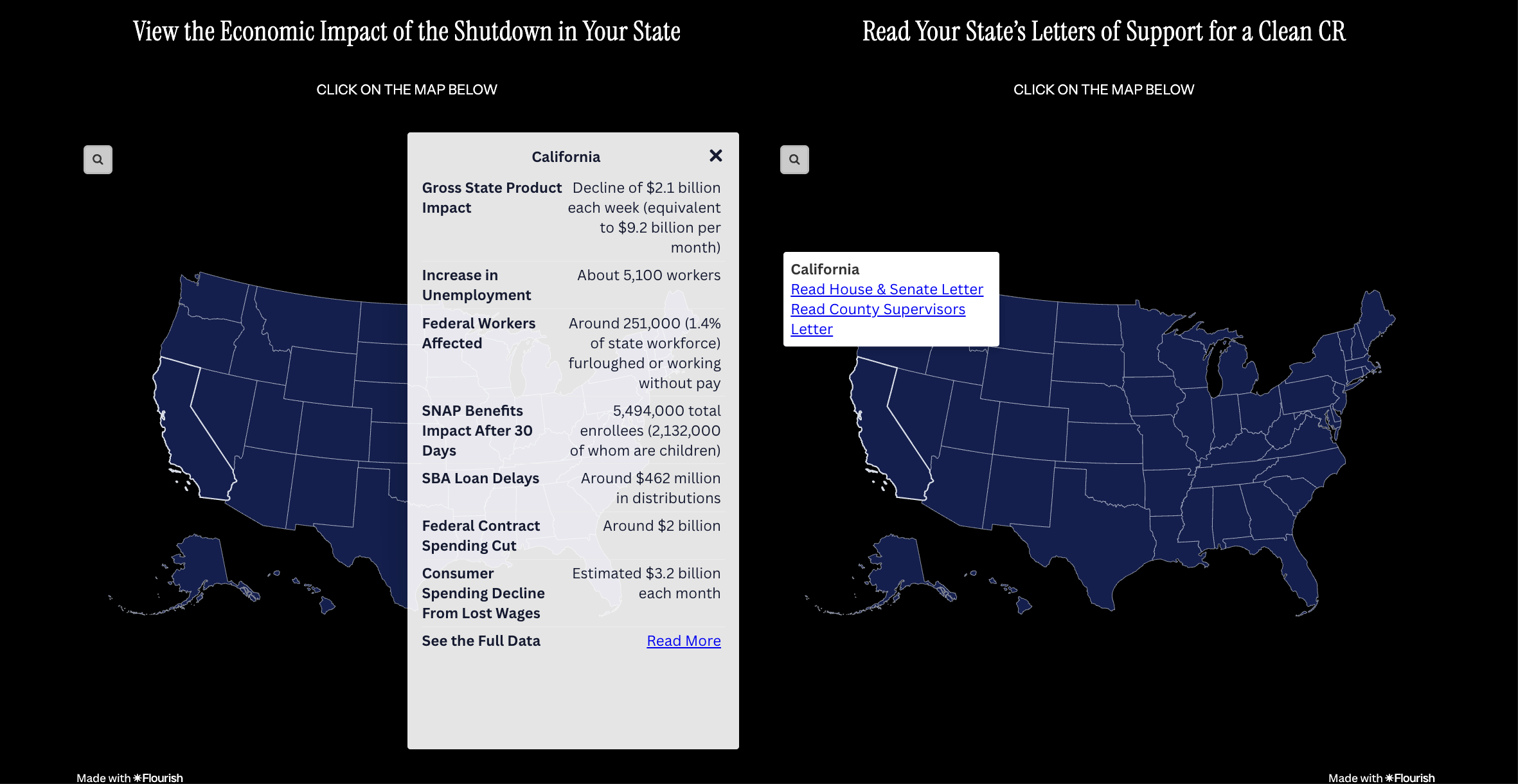

As the center of the longest government shutdown in U.S. history, the White House is undoubtedly one of the focal points of the event.

Therefore, the most intuitive way to check the duration of the U.S. government shutdown is through the "government shutdown timer" set up on the White House's official website — https://www.whitehouse.gov/government-shutdown-clock/

According to the information on that page, as of the time of writing, the duration of the "government shutdown caused by Democrats" has extended to approximately 41 days, 5 hours, and 35 minutes.

In addition, the website also "thoughtfully" marks data indicators such as economic losses, unemployment situations, and declines in consumer spending in various states affected by the government shutdown; furthermore, it displays information about the calls from state senators and representatives to their constituents.

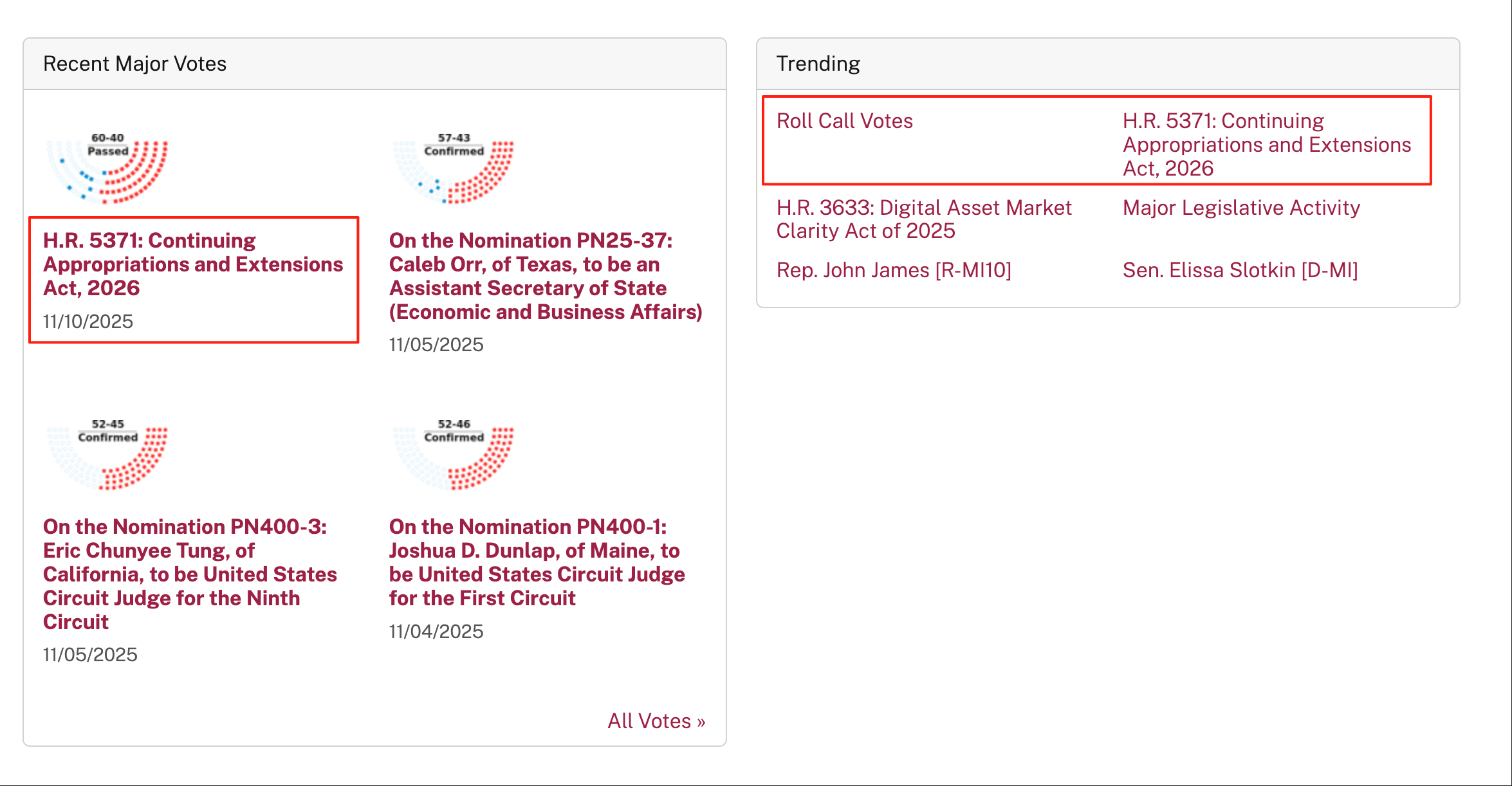

Third-Party Tracking Website for the "U.S. Government Shutdown": Govtrack.us

Aside from the official timer page, a more comprehensive and centralized source of information is the independent event tracking website Govtrack.us, which has been tracking U.S. government dynamics — https://www.govtrack.us/

According to the information on its website, the latest development of the event is the voting result of H.R. 5371, the "2026 Continuing Appropriations, Agriculture, Legislative Branch, Military Construction, and Veterans Affairs and Extension Act."

Media Tracking Websites: CNN, NBC, Reuters, etc.

In addition to official and third-party channels, media channels are also an important source for confirming the official end of the U.S. government shutdown. In this regard, CNN, NBC, and Reuters' related topic pages can serve as references.

NBC "Shutdown End" Search Page

Reuters "U.S. Dynamics" Related Page

Finally, the webpage displaying the Senate voting results can be found at https://www.senate.gov/legislative/votes_new.htm; the House of Representatives voting and bill-related progress can be found at https://www.congress.gov/.

The U.S. Government Shutdown May End This Week, and the Market is Expected to Rebound

The U.S. government shutdown is expected to bring some liquidity to the financial and cryptocurrency markets, but the boost to market confidence is undoubtedly more direct and powerful. However, analysts' views are relatively conservative, believing that this news is more of a short-term positive.

TD Securities: U.S. House Expected to Vote on Wednesday, Government Likely to End Shutdown on Friday

Prashant Newnaha, a senior strategist for Asia-Pacific rates at TD Securities, stated, "The next step is expected to be a vote in the U.S. House of Representatives on Wednesday (regarding the temporary funding bill), and the U.S. government is likely to reopen on Friday."

Additionally, he mentioned that the shutdown has undoubtedly had a negative impact on the economy, but the market is likely to expect a rapid rebound in the economy after the shutdown ends. Aside from the short-term positive sentiment, the direct market impact of the end of the U.S. shutdown should become limited after early next week.

Economists' Views: A Bunch of Poor Data May Affect the Market After the U.S. Government Shutdown Ends

As the direction of the U.S. government shutdown becomes clearer, it means that Wall Street may soon face a slew of key economic reports that have been delayed for more than a month. The first to arrive will be the employment data for September. Morgan Stanley economists estimate that the September employment report may be released as early as this Friday, but more likely early next week.

Moreover, in the worst-case scenario, the Consumer Price Index (CPI), Producer Price Index (PPI), and Personal Consumption Expenditures (PCE) price index for October may not be released at all. The PCE index is the Federal Reserve's preferred measure of inflation. Another possibility is that the U.S. Bureau of Labor Statistics will attempt to piece together the inflation trends for the month. However, economists have stated that the quality of the reports will be significantly compromised, and the release time may be delayed to the point of being almost meaningless.

The delay in the release of the September employment report and the absence of the October inflation report will leave the Federal Reserve lacking sufficient decision-making basis when discussing whether to cut interest rates for the third consecutive meeting.

Historical Patterns Suggest a Sharp Market Rise After the Shutdown Ends

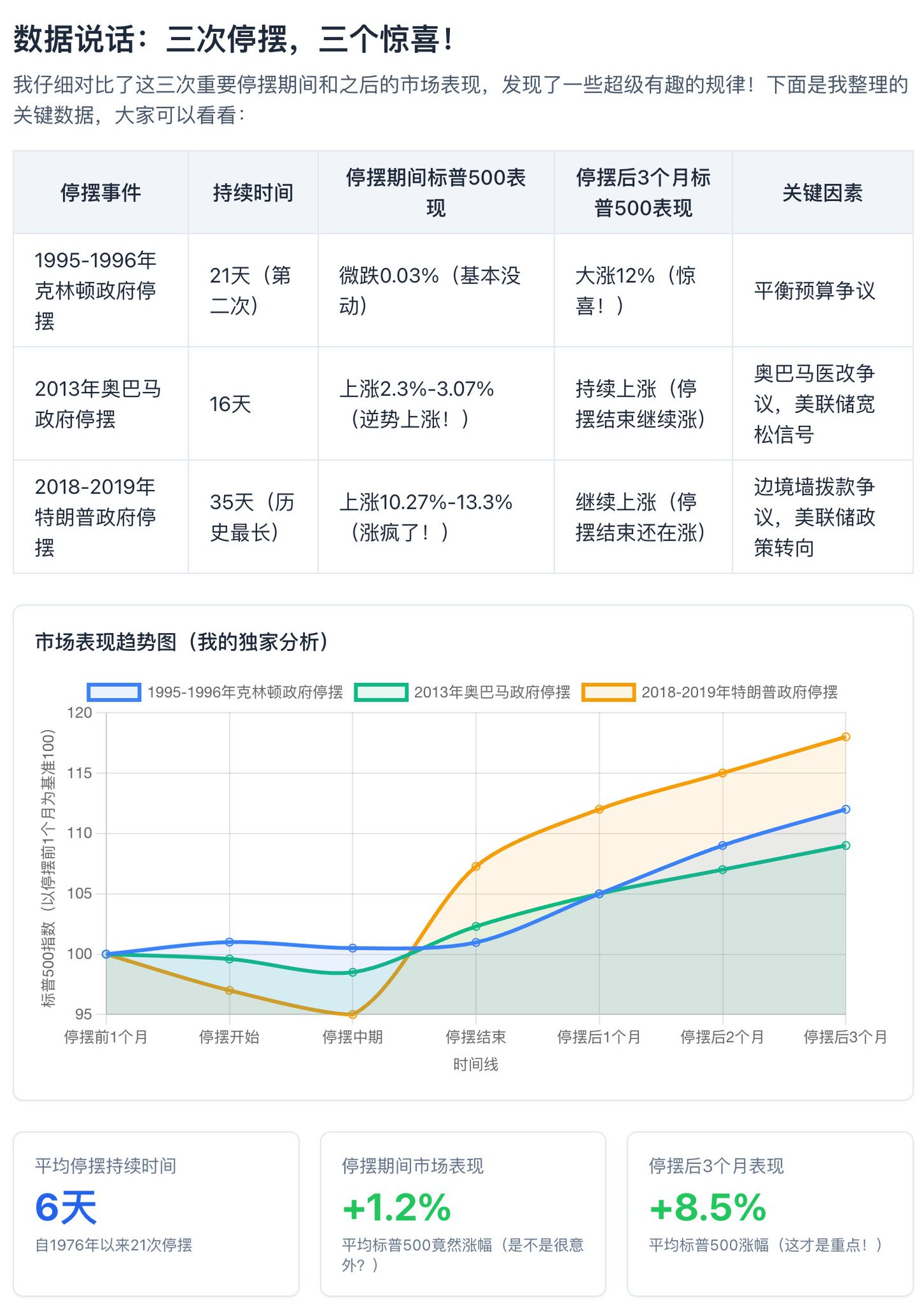

According to blogger @BunnyTalks_, since 1976, the U.S. government has shut down 21 times, averaging 6 days each time. Additionally, he observed, "Based on past performance, the market often remains lukewarm or even declines during the government shutdown, but once the shutdown ends, the market surges as if it has been injected with adrenaline. This pattern has been validated during the three major shutdowns in 1995-1996, 2013, and 2018-2019."

As for whether the traditional financial market and the cryptocurrency market can rebound as expected, it still depends on the results of the House vote (≥218 votes) and the subsequent signing of the bill by Trump and other events being settled.

It is worth noting that based on past transmission paths and existing information, after the end of the U.S. government shutdown, the U.S. stock market is likely to react ahead of the cryptocurrency market, and the leading stock market may experience a more direct rebound, while the rebound of mainstream cryptocurrencies may be slightly delayed, which should be approached with caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。