The strategic ambition of $AIA is clear - to become the Virtuals of the prediction market.

But wait, what does this mean?

This ambition is based on the judgment that there is a fundamental gap in the current prediction market - there are products, but no tokens.

Specifically:

Kalshi, as a compliant platform, clearly will not issue tokens.

Polymarket, while hinting at a token plan, still has an unclear timeline.

Other prediction market-related tokens are either too small in scale or lack legitimacy.

This situation is highly similar to the 2024 phenomenon of http://Pump.fun, where the platform ignited the Meme track but had no tokens until the Virtuals Protocol emerged, binding the ecological key path to the token, making $VIRTUAL an indexing tool for the growth of the entire AI Agent.

Now, this model is being replayed in the prediction market.

To capture the track value of the prediction market gap, DeAgent AI has made two preparations:

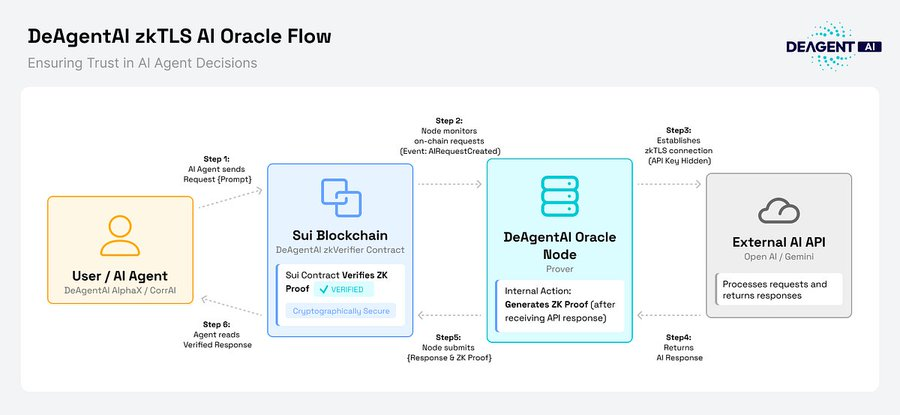

First is the infrastructure layer - AI oracle network.

Traditional oracles (like Chainlink) handle objective data such as BTC/USD, but the prediction market requires subjective judgment capabilities (like election results or event probabilities).

DeAgent AI's AI oracle specifically addresses this type of problem: multiple AI Agents independently judge based on retrieval + reasoning and then vote, with on-chain contracts aggregating results and recording them on-chain.

Compressing the originally divergent AI outputs into a settled deterministic result.

Second is the token economic layer - demand-driven value cycle.

$AIA serves both as a network payment medium and as a staking asset for nodes.

As more prediction applications are integrated, the frequency of calls directly translates into actual demand for $AIA.

This "use equals purchase" model is more sustainable.

The prediction market is moving from niche experiments to mainstream applications.

Kalshi's trading volume exceeded $1 billion in 2025, and Polymarket's valuation jumped from $2 billion to $15 billion, indicating an explosive demand for infrastructure in the entire track.

If $AIA can establish its position as the "standard for prediction market infrastructure" during this window period, its value capture logic will be very clear.

The only suspense lies in the team's product delivery and ecological construction capabilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。