After a seven-year hiatus, U.S. retail investors have once again gained the opportunity to participate in compliant token launches, which could be a key step towards the mainstreaming of the crypto market.

On November 10, 2025, Coinbase announced the launch of a brand new token sale platform that allows retail investors to purchase tokens before they officially go live on exchanges. This initiative marks the first time since 2018 that U.S. users can widely participate in such public sales, breaking the long-standing exclusion of American retail investors from token launches.

The platform employs a unique "algorithmic allocation" mechanism that prioritizes small purchase requests, aiming to prevent large buyers from overly concentrating their holdings. This move could reshape the investment landscape of the cryptocurrency primary market, creating a fairer participation environment for ordinary investors.

1. U.S. Retail Investors Return to the Token Sale Market

● After a long winter, the cryptocurrency primary market has finally reached a thawing moment. Coinbase's newly launched token sale platform reopens the door for U.S. retail investors to participate in compliant token launches. This news directly drove Coinbase's stock price up about 4% in early trading.

● This breakthrough ends the regulatory restrictions that have been in place since 2018. At that time, due to concerns from regulators about investor protection and information disclosure, initial token issuance activities gradually decreased, effectively excluding U.S. users from the token launch process.

2. Platform Operation Mechanism: Fairness-First Algorithmic Allocation

The core design philosophy of Coinbase's new platform is fairness and transparency, which sharply contrasts with traditional token sale models.

● In terms of allocation mechanism, the platform uses a unique "bottom-up filling" algorithm. This algorithm prioritizes fully satisfying the smallest purchase requests before gradually filling larger orders until all tokens are allocated. This design lowers the financial threshold and curbs the space for high-frequency arbitrageurs, providing retail investors with a more genuine opportunity to participate.

● In terms of anti-arbitrage mechanism, the platform has also introduced community retention tools. If users sell the tokens they acquired within 30 days of the token listing, they will be automatically downgraded by the system in the future.

● Regarding project constraints, Coinbase has set a mandatory lock-up period for project parties—within six months after issuance, project parties and their affiliated entities are prohibited from conducting over-the-counter transactions or selling tokens.

3. Debut Project: Monad Token Sale Details

Blockchain startup Monad has become the first project to issue tokens through Coinbase's new platform. Its MON token sale is scheduled to take place from November 17 to 22.

● Monad is a developing high-performance public chain that focuses on parallel computing and extremely high transaction throughput, fully compatible with the Ethereum Virtual Machine. The project is backed by several well-known institutional investors, including Jump Trading, Placeholder, Lattice, and Dragonfly.

● The public offering price is set at $0.025, which represents a significant discount compared to the pre-market trading price of about $0.06. The market expects the price to have a 2-3 times short-term upside potential, especially under the halo of Coinbase's launch.

4. Comparison with Traditional Token Sale Models

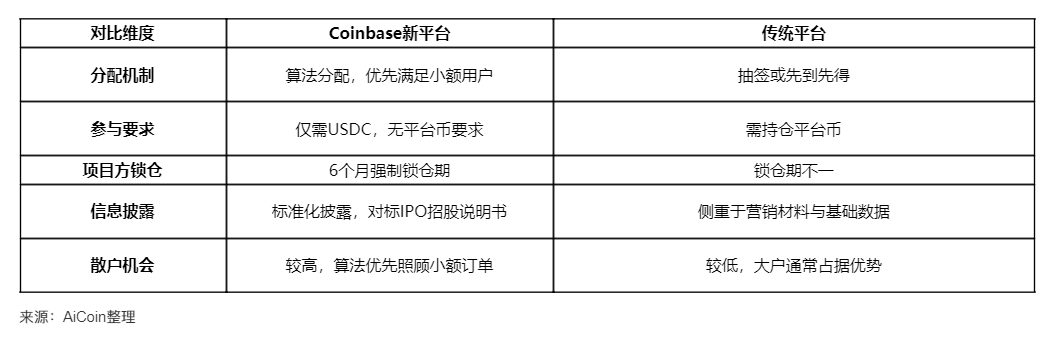

Coinbase's platform has significant differences from the token sale models of existing mainstream exchanges. The table below details the key differences between them:

5. Impact on Liquidity and Security in the Crypto Market

Coinbase's new initiative is expected to have a profound impact on the liquidity and security of the crypto market.

● In terms of liquidity impact, the platform opens the door for U.S. retail investors to participate in early token sales on a large scale for the first time since 2018. This is expected to bring a significant influx of new funds and users into the crypto market, directly increasing the overall liquidity of the market.

By maintaining a sales frequency of about once a month, Coinbase is building a one-stop channel from token issuance and sale to listing and trading. This provides the market with a more predictable path for new asset listings, helping to create a continuous liquidity injection.

● In terms of security impact, the platform's mandatory information disclosure and project party lock-up mechanisms significantly enhance the transparency and accountability of token issuance. This helps filter out low-quality projects and fraudulent activities, protecting investor interests and thereby enhancing the overall security foundation and trust level of the market.

The six-month lock-up for project parties and the 30-day holding incentive for users effectively curb the intense selling pressure in the early stages of token listings. By reducing short-term speculation, these mechanisms provide a more stable launch environment for asset prices, lowering the risks associated with significant market volatility.

6. Structural Transformation of the Crypto Market

Coinbase's move represents a structural transformation in the cryptocurrency market—from chaos and disorder to improved institutional frameworks.

● On one hand, the role of exchanges is changing. Coinbase is not replicating Binance's success but is instead carving out a new path, building a new type of token issuance route that is more suitable for compliant users and aimed at long-term investors.

The essence of this model is: injecting stability and predictability into crypto assets through standardized processes and risk control systems.

● On the other hand, the regulatory environment is also changing. The launch of this platform is widely seen as aligning with the current U.S. government's more favorable policy trend towards cryptocurrencies. With the Trump administration adopting a more open attitude towards cryptocurrencies and financial regulatory agencies taking a more lenient stance, the industry generally expects that such financing methods will not face excessive restrictions in the future.

● The launch of the platform also marks the expansion of Coinbase's business model. Following Coinbase's acquisition of the crypto investment platform Echo for approximately $375 million last month, it shows that Coinbase is evolving from a mere trading venue to a full-chain service provider in the primary market.

7. Challenges and Prospects: The Future of Institutionalized Crypto Primary Markets

Although Coinbase's new platform brings innovation to the crypto market, its future development still faces multiple challenges and opportunities.

● The main challenge lies in market saturation. In a market that is already saturated with new coins, can another launch platform really save it? Coinbase has restructured the rules of issuance, but perhaps its biggest challenge is finding truly valuable new assets for a saturated market.

● In terms of prospects, the industry currently urgently needs blockbuster projects and a system that allows ordinary people to participate fairly and legally in the issuance process. Coinbase may be paving a new path for this.

If successful, the platform could help restore retail investors' confidence and may become the "front door" for quality projects to enter the market in the future, reducing gray paths that bypass regulation and establishing a new trust foundation for the primary market.

Coinbase's token sale platform represents an attempt: Can the early financing mechanism of Web3 offer a more orderly alternative to speculation, a fairer alternative to lotteries, and a more rational alternative to blind investments? It may not succeed immediately, but it indeed opens a new path for the industry.

The market is not lacking in new tokens, but it has long lacked a system that allows ordinary people to participate fairly and legally in the issuance process. Coinbase's attempt may be rebuilding the trust foundation in the crypto world.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。