Author: Deng Tong, Golden Finance

On October 1, 2025, due to the failure of the U.S. Congress to pass the appropriations bill for the fiscal year 2026, the U.S. federal government began a shutdown at midnight Eastern Time. On November 9, Trump pointed out: $2,000 tariff dividends per American.

Now, the U.S. government shutdown is about to end, and Trump is full of surprises…

1. The Longest Government Shutdown in U.S. History is Coming to an End

A "government shutdown" in the U.S. refers to the situation when Congress fails to pass or the President fails to sign the budget for the next fiscal year (or a temporary appropriations bill), resulting in non-essential federal government operations being halted due to a lack of funding authorization.

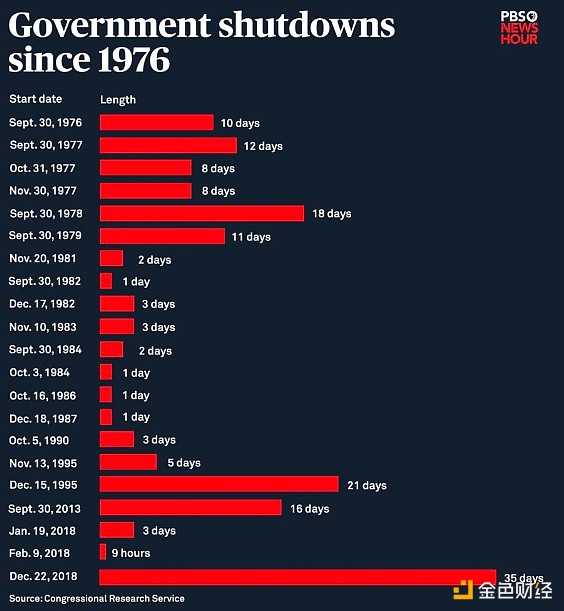

Since the establishment of the modern budget process in 1976, the U.S. government has experienced 22 shutdowns due to funding gaps. However, most shutdowns are short-lived and have limited impact. The true "large-scale shutdowns" began in the 1980s.

After six years, on October 1, the U.S. government shut down again. At that time, Trump stated that the shutdown could bring "many benefits" and threatened to dismiss federal employees and cancel projects favored by Democrats if Congress did not meet his demands before the midnight funding deadline. Trump also told reporters: We can get rid of a lot of things we don't want, and those things are all from the Democrats; they just can't learn. So we have no choice. I have to do this for the country.

Initially, Vance believed that the shutdown would not last long.

A week after the shutdown, Wall Street institutions analyzed the duration of the U.S. government shutdown. Morgan Stanley believed that U.S. Treasury bond options indicated that the shutdown, which began on October 1, would last at least 10 days, potentially extending to 29 days. Goldman Sachs thought it unlikely that the shutdown would continue past the military payday on October 15. If the shutdown were still ongoing at that time, active-duty military personnel would not receive their pay, which has never been allowed to happen. According to the prediction platform Polymarket, the market believed there was an 85% chance that the government shutdown would end after October 15, and a 76% chance that Congress would pass the spending bill by the end of October.

Perhaps no one expected that this government shutdown would last so long.

After more than a month of shutdown, Trump pointed out: We are very close to ending the government shutdown. The U.S. Senate was expected to advance a vote on a bill already passed by the House of Representatives that evening, but the bill would be amended to package short-term funding measures (which could fund the federal government until January 2026) with three full-year appropriations bills. It is reported that this bill has already received enough support from Democratic senators to pass the vote. However, according to Senate Majority Leader and Republican John Thune, the amended appropriations plan still needs to pass the House and be sent to Trump for signing, a process that may take several days.

On November 9, Senate Majority Leader Thune also reported good news: bipartisan negotiations in the Senate to end the federal government shutdown had made positive progress, and lawmakers were working hard to reach an agreement to temporarily reopen the government and propose three longer-term appropriations bills for some agencies. According to Republican senators, lawmakers originally hoped to announce the full text of the three full-year appropriations measures for the fiscal year 2026 on Saturday, including agriculture, food and nutrition programs, military construction projects, veterans' programs, and congressional operation funds. This proposal would fund these actions until September 30, 2026. However, by the end of the workweek, the two parties had not reached an agreement to restart the government, nor had they made the full-year appropriations bill public. The Senate would attempt negotiations again in a rare Sunday session.

As of the time of publication, the U.S. Senate has officially passed a new continuing appropriations bill that will fund the government until January 30 to end the shutdown. All voting results have been tallied, with 60 votes in favor and 40 against.

Impact of the U.S. Government Shutdown

- Q4 GDP May Be Negative

U.S. White House National Economic Council Director Hassett pointed out that if the government shutdown continues, the GDP for the fourth quarter may be negative and could cause long-term damage to an efficient government. The "shutdown" is reducing U.S. economic output at a rate of about $15 billion per week, with the shutdown causing a weekly decline of about 0.1 percentage points in U.S. GDP. If it lasts a month, it could lead to approximately 43,000 additional unemployed and reduce consumer spending by $30 billion. The Congressional Budget Office estimated that the last government shutdown during Trump's first term cost the U.S. economy $11 billion, with about $3 billion permanently lost.

- Digital Asset Market Structure Bill Stalled

The U.S. Senate Banking Committee's review of the digital asset market structure bill (which had been postponed from the end of September to October) has been further delayed.

Wyoming Senator Cynthia Lummis is one of the supporters of the bill. She stated in August that she hoped the Agriculture Committee could review the bill by the end of September and the Banking Committee could review it by the end of October, and she looked forward to President Donald Trump signing the bill into law before 2026. However, with the government shutdown, this vision had to be postponed.

- Cryptocurrency ETF Applications Delayed Again

During the government shutdown, the SEC was unable to review any registration applications, "participate in non-emergency rulemaking," regulate self-regulatory organizations, or provide "non-emergency assistance" to foreign regulators. Therefore, under these regulations, pending cryptocurrency-linked exchange-traded fund (ETF) applications would be paused, but the SEC's electronic filing system could continue to accept applications.

- Air Traffic Control

As the government shutdown entered its second month, the Federal Aviation Administration (FAA) decided to allow commercial space launches and re-entries only from 10 PM to 6 AM local time. The U.S. government must clear large areas of airspace as part of a broader directive to alleviate pressure on the air traffic control system.

2. What Will Happen When the U.S. Government Shutdown Ends?

- Surge in Liquidity

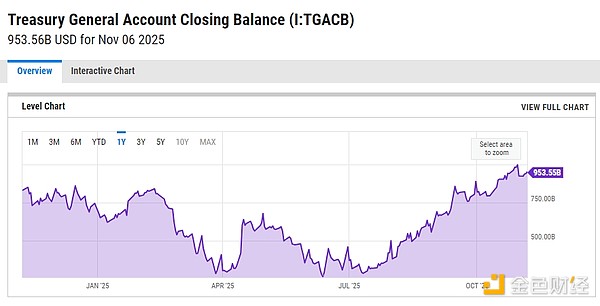

According to the U.S. Treasury's General Account end-of-period balance (I:TGACB), the current balance is $953.55 billion, a stark contrast to the previous long-term balance of below $750 billion. Once the government reopens, there will certainly be a significant amount of spending, potentially injecting $200 billion in liquidity into the financial markets.

- Cryptocurrency Market Will Rebound

The ongoing uncertainty about when the U.S. government will reopen has been a key factor hindering the rise in Bitcoin prices.

Looking back at the relationship between the last U.S. government shutdown and BTC prices, we can see a close connection: the last government shutdown occurred from late December 2018 to late January of the following year, during Trump's first term. After the government shutdown ended on January 25, 2019, BTC rose over 265% in the following five months, from $3,550 to $13,000. Therefore, we might expect a similar trend in the future cryptocurrency market.

Currently, on Polymarket, the probability of the U.S. government ending the shutdown between November 12-15 has reached 85%.

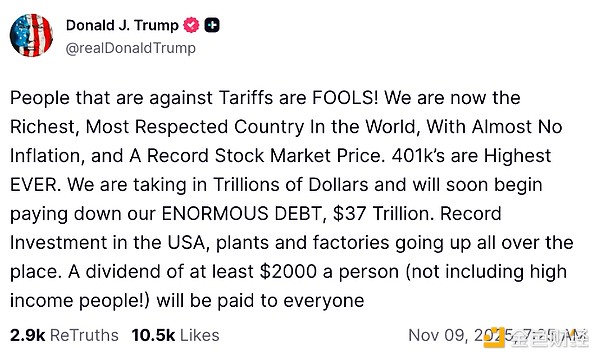

3. Trump’s Generosity: $2,000 Tariff Dividends Per Person

On November 9, Trump stated on the social media platform Truth Social that those opposing tariffs are fools! The U.S. is now the richest and most respected country in the world, with almost no inflation, stock market prices hitting historic highs, and 401k pension accounts reaching record levels. We are absorbing trillions of dollars and are about to start repaying the massive $37 trillion debt. Investments in the U.S. are at an all-time high, and factories are being built across the country. Everyone (except for high-income individuals) will receive at least $2,000 in dividends.

Kalshi traders believe the probability of the Supreme Court approving this policy is only 23%, while Polymarket traders estimate it at 21%.

Trump also stated: "So, let’s get this straight? The President of the United States has the authority (and has received full approval from Congress) to completely prohibit trade with a foreign country (which is much stricter than imposing tariffs!), has the authority to approve a foreign country entering our market, but does not have the authority to simply impose tariffs on a foreign country, even for national security reasons. This is not what our great founding fathers envisioned! The whole thing is utterly ridiculous! Other countries can impose tariffs on us, but we cannot impose tariffs on them??? This is their dream! The reason companies are flooding into the U.S. is because of the existence of tariffs. Has the Supreme Court not been informed of these situations? What is going on???"

Investors and market analysts welcomed the announcement, viewing it as an economic stimulus measure, with some of the stimulus funds expected to flow into the market, thereby boosting cryptocurrency and other asset prices. However, they also warned that the proposed dividends could have long-term negative effects.

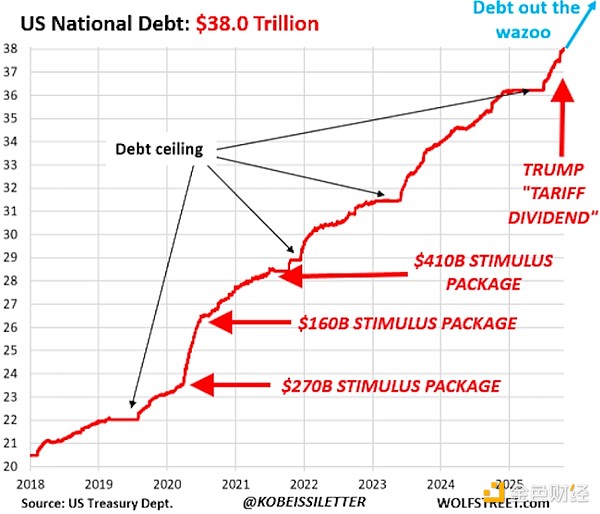

The Kobeissi Letter provided a detailed market analysis on "Trump's $2,000 Tariff Dividends," stating that President Trump has just announced tariff dividends, with each American expected to receive at least $2,000, and it is anticipated that over 85% of American adults will receive this amount, totaling over $400 billion. Meanwhile, U.S. debt is nearing $40 trillion, and the economic impact of such large-scale stimulus payments is significant.

First, who will receive this payment? The last stimulus payment was the $1,400 checks in March 2021. Full payments were only made to: single individuals with an annual income of no more than $75,000, families with an annual income of no more than $112,500, and married individuals with an annual income of no more than $150,000. Applying the same standards to 2025: approximately 220 million American adults currently meet these income standards.

Just as the stimulus checks in 2021 significantly boosted consumption, a one-time stimulus often comes with a prolonged period of high inflation. After the last round of stimulus measures, the U.S. inflation rate approached 10%. Stimulating the economy will only add fuel to the fire; the U.S. has never launched such a large-scale stimulus plan while the stock market is near historical highs. Ultimately, stimulus payments almost always turn into massive involuntary taxes, and the American people will end up paying several times the amount of the stimulus subsidies in the form of inflation.

The proposed economic stimulus checks will increase national debt and lead to higher inflation over time. Source: The Kobeissi Letter

In a commentary by The Pomp Letter, author Pomp (Anthony Pompliano) expressed his views on "Trump's statement that he will pay at least $2,000 in tariff dividends to every American": If Trump really distributes $2,000 to citizens from tariffs, history may regard the panic rhetoric of April 2025 as one of the most foolish mainstream consensus we have seen in our generation. The $2,000 tariff dividend per person will also release strong liquidity into the market.

4. Impact on the Cryptocurrency Market

Yili Hua, founder of Liquid Capital, stated: "As we expected, government reopening + interest rate cut expectations + cryptocurrency policies + universal cash distribution will kick off a new bull market, and it is also the best short squeeze opportunity; do not short + do not short. The repeated low-level bottom-fishing strategy these days should become the best buying point."

Wang Feng, founder of Blue Harbor Interactive, expressed: "In my personal judgment, the moment when the cryptocurrency market, driven by the U.S. government shutdown and the uncertainty of Fed rate hikes, has bottomed out has ended. The Dragon King is more certain to come. Next, this market will be very good."

Investor and market analyst Anthony Pompliano stated: "Stocks and Bitcoin only rise when stimulus measures are introduced."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。