Original Author: Frank, PANews

The activity of NEAR Intents has recently surged, with daily trading volume skyrocketing to over $200 million, resulting in transaction fees exceeding $400,000 at one point. From this data, its trading volume is only lower than that of Ethereum, Solana, and BSC, and its fee levels rank among the top five across all public chains.

This "data" boom not only brings NEAR, which has been quiet for a long time, back to the mainstream narrative table but also raises the question: Will NEAR rise again because of this? However, what exactly are these $400,000 in "transaction fees"? Can they truly support NEAR's "rise"?

The Rise of NEAR Intents: Data Explosion Driven by Privacy Coins

To understand this round of data explosion, we must first clarify what "NEAR Intents" actually is.

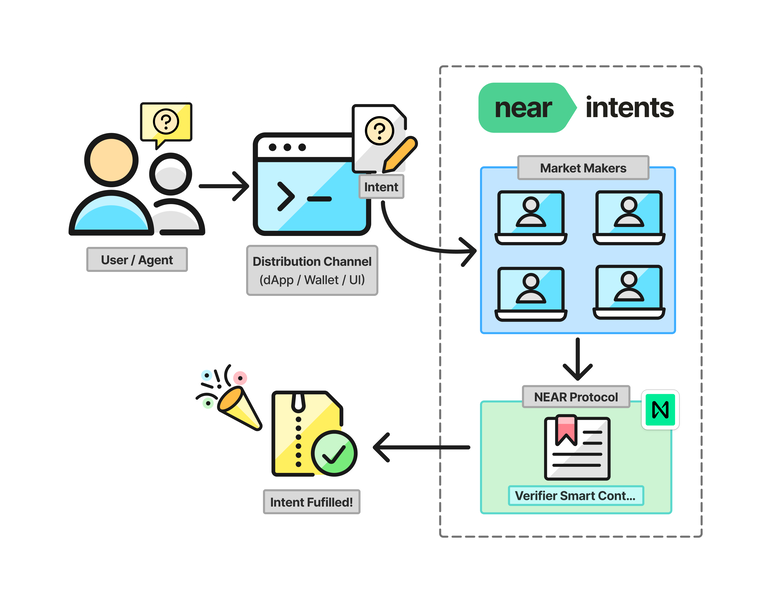

NEAR Intents is a new type of transaction infrastructure launched by the NEAR protocol starting in November 2024. NEAR Intents is one of the three core technical components of the NEAR chain's abstract architecture. As a decentralized cross-chain system, NEAR Intents allows users to simply express their desired outcomes (e.g., "exchange token A for token B at the best price") without specifying technical details. Then, a network of solvers competes to fulfill these intents in the most optimal way, handling complex cross-chain operations in the background.

This product changes the traditional cross-chain process, which requires users to be familiar with multiple on-chain operations, accurately calculate transaction fees, and find the best exchanges. It can also integrate AI agents for transaction optimization, significantly streamlining the cumbersome cross-chain operations and saving on fees.

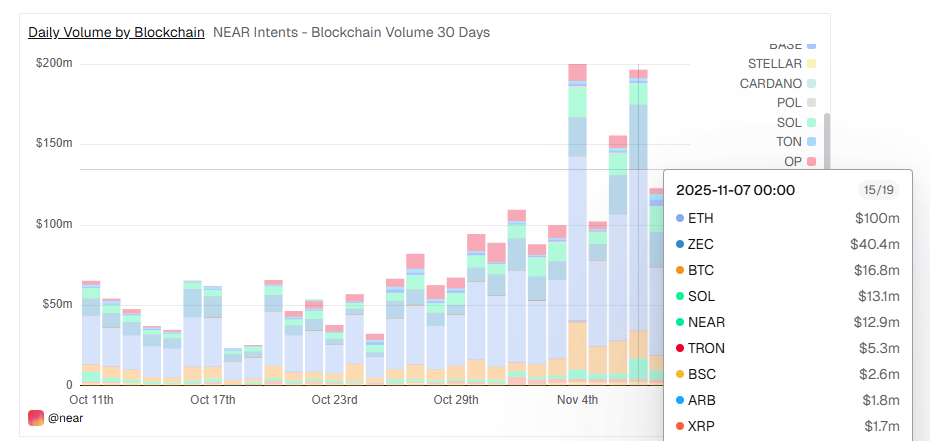

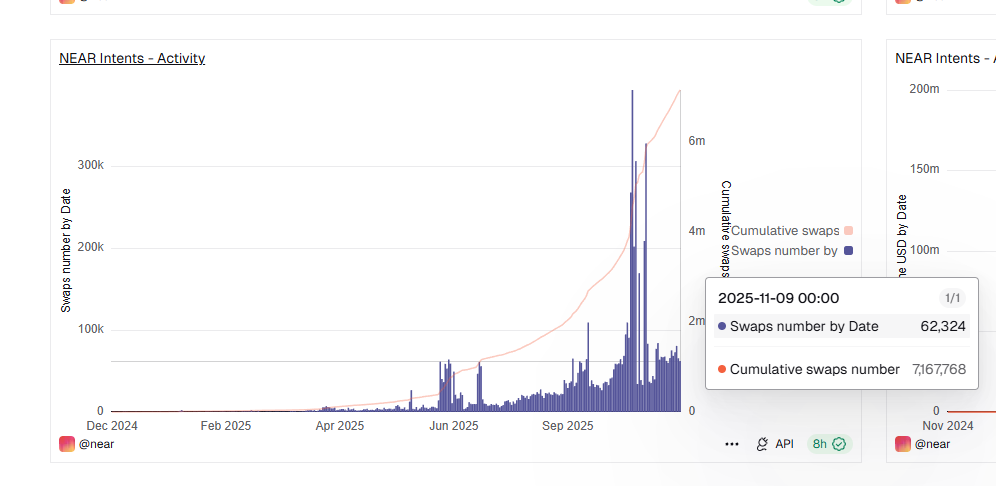

From a practical perspective, since its launch, NEAR Intents has maintained a daily trading volume of several million dollars until September of this year. In October, with the explosion of the privacy coin sector, there was a surge in demand for ZEC. People found that NEAR Intents seemed to become the best channel to ZEC, making trading ZEC the primary use case for NEAR Intents.

On-chain data shows that starting in October, the trading volume of ZEC on NEAR Intents began to surge, reaching $5.9 million on October 1, second only to Ethereum. By November 4, this figure grew to $23.9 million, and on November 7, it reached $40 million, contributing nearly one-third of the trading volume. Meanwhile, cross-chain trading volume on the Ethereum chain also saw significant growth, collectively driving up the trading volume of NEAR Intents.

Among all channels, SwapKit stands out, contributing a total of $4.32 million in fees, accounting for over 70%. SwapKit is a B2B aggregator integrated into major wallets like Trust Wallet. However, this $4 million in revenue is only generated by the solvers behind SwapKit.

"Busy Shops" and "Quiet Malls"

The rise of NEAR Intents seems to bring new hope to NEAR. Many believe that if NEAR Intents can maintain its current revenue levels and return or repurchase tokens in a manner similar to Hyperliquid, it would greatly improve the current economic narrative of NEAR tokens.

However, this seems unrealistic.

First, in terms of relationships, NEAR, as an L1 public chain, serves as the underlying infrastructure, while NEAR Intents is a protocol layer built on top of NEAR L1, providing "chain abstraction" services through NEAR L1's infrastructure. This relationship is akin to a very popular shop opening in a mall, but the revenue from this shop cannot be directly counted as part of the mall's income.

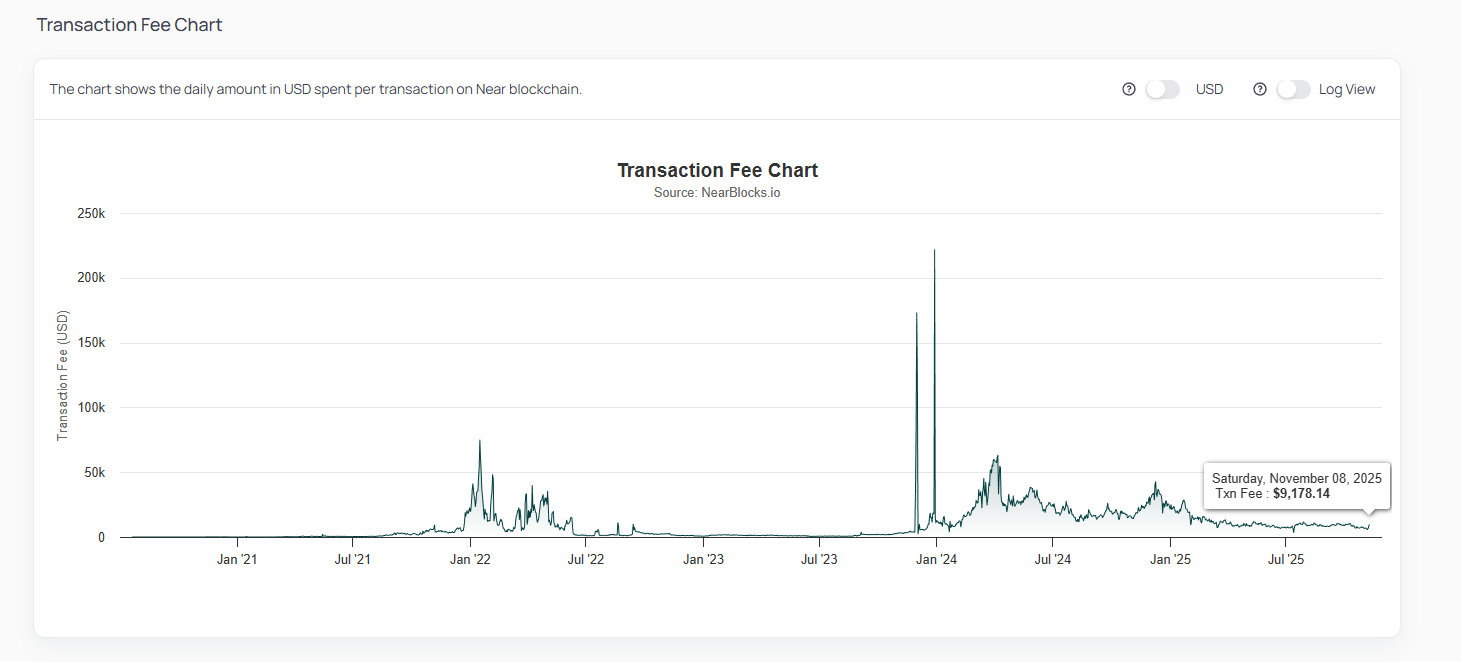

Moreover, the majority of NEAR Intents' revenue is captured by third-party solvers and market makers (MMs). The NEAR mainnet only collects gas fees for on-chain transactions, which are related to the number of transactions but not tied to the transaction amounts.

As of November 9, NEAR Intents has generated a total of 7.16 million transactions. Based on NEAR's current gas prices, the gas fees from these transactions may only amount to a little over $2,000. Additionally, according to NEAR's fee structure, 70% of the fees will be burned.

This explains why, on one hand, NEAR Intents is bustling, while on the other hand, NEAR's on-chain fees remain around a few thousand dollars daily.

"AI Narrative" Begins to Validate, NEAR Still in Decline

If these $400,000 in fees are almost unrelated to NEAR's revenue, does the rise of NEAR Intents hold any "meaning"? Objectively, its significance lies not in current direct revenue but in strategic validation and future potential.

First, at a strategic level, the rise of NEAR Intents is a strong validation of NEAR's "chain abstraction" vision. It proves that the technology is feasible and that there is a significant real demand in the market for a "frictionless" multi-chain experience. Although the current use case for NEAR Intents is still in the crypto DeFi space, its longer-term goal is to expand into Web2 or the real world, such as "help me book a flight" or "buy a pizza" (official examples), with the "solver" network finding the best solution and executing it. This vision is essentially similar to the currently popular X402 protocol narrative. AI, as the main narrative of the NEAR ecosystem in recent years, has finally created a potential blockbuster that could become an industry leader.

Looking at NEAR's other data performance, its current performance seems somewhat lacking. Its mainnet's TVL ranks 42nd, with a TVL of only $133 million, and it has been in a declining state in recent years. Daily active users are currently around 2.9 million, down significantly from 4 million at the beginning of the year. Against the backdrop of low on-chain activity, NEAR's token performance has also remained in a bottom range.

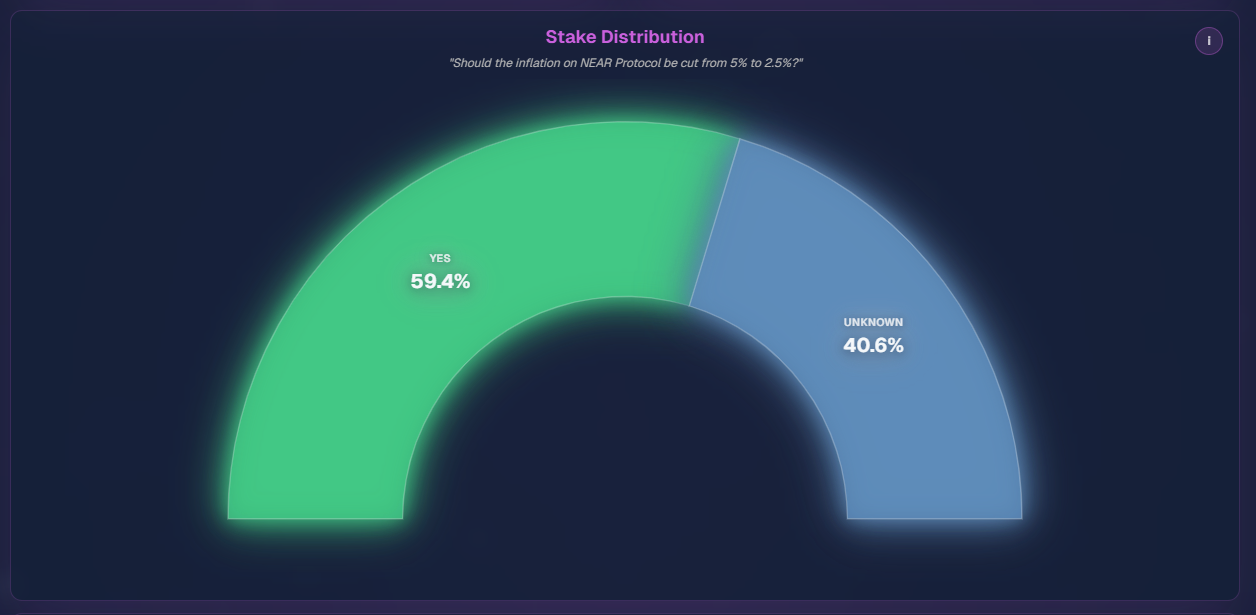

Perhaps to boost market sentiment, in October, the NEAR Foundation and several ecosystem members initiated a new proposal to reduce the maximum inflation rate from 5% to 2.5%. However, as of now, this proposal has only received about 60% support from nodes, and according to NEAR's governance rules, it requires over 80% support to pass.

However, some experts in the industry remain optimistic about NEAR from a technical capability perspective. Andy, the founder of the well-known cryptocurrency-themed podcast The Rollup, tweeted that he is optimistic about the future development of Starknet, NEAR, and ZEC, expressing great confidence in the prospects of zero-knowledge proofs, intent architecture, and privacy technology.

Currently, the popularity of NEAR Intents, even if it may not significantly impact actual revenue, still brings a certain level of discussion to NEAR. For the NEAR ecosystem, traffic and attention may be the most important resources at this time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。