Starting with 3 million USD, within two months, assets surged over eight times. The on-chain trader known as "Calm Order King" showcased the ultimate art of swing trading in the cryptocurrency market with a precise operation that achieved a 20-game winning streak.

From early October to early November, an on-chain trader named "Calm Order King" set a record in the cryptocurrency market with nearly 20 consecutive winning trades. Through precise swing trading and strict risk control, he transformed a 3 million USD principal into a massive asset of 28 million USD.

In the highly volatile cryptocurrency market, this trader executed a strict take-profit and stop-loss strategy by accurately grasping market rhythms. After each profitable exit, he would transfer part of the profits to a spot account for isolation, controlling the risk of drawdown.

1. Precise Ambush: Swing Capture Techniques for Mainstream Coins

"Calm Order King" demonstrated exceptional ability to seize opportunities in a volatile market. The core of his trading lies in accurately grasping market rhythms, particularly excelling in short-term fluctuations of mainstream coins.

● Starting in early October, he began with a principal of 3 million USD and achieved continuous profits through high-frequency rebalancing operations on the two major mainstream coins, BTC and SOL.

● High leverage and flexible switching form the two pillars of his trading style. He prefers to use 20x to 40x high leverage to establish positions, and at critical moments, he can even execute 40x leverage operations with precision.

● Unlike traders who stubbornly stick to a single direction, he can flexibly switch between long and short positions. For example, on November 5, he fully switched to long positions, accurately bottoming out multiple coins.

2. Practical Record: Precise Operations Behind the Winning Streak

The 20 consecutive wins of "Calm Order King" were not achieved overnight. Below is a table presenting key operational nodes from October to early November:

● October 11, 2025: The trader opened short positions in Bitcoin (BTC) and Solana (SOL) and completely closed the SOL short position on the same day, realizing nearly 3 million USD in profits.

● October 18, 2025: The trader closed nearly 40,000 SOL short positions, achieving significant gains; simultaneously, he increased his short positions during the market pullback to maintain a bearish strategy.

● October 23, 2025: The trader closed part of his BTC and SOL short positions, cashing out 3.63 million USD in profits; he then reversed his position, increasing BTC short positions near the Bitcoin price of about 110,000 USD.

● November 3, 2025: The trader took substantial profits, closing part of his BTC and SOL short positions, realizing approximately 1.81 million USD in profits; he also performed a "rollover" operation, meaning he immediately re-established short positions after closing to continue the bearish exposure.

● November 5, 2025: The trader completely switched to a bullish strategy, fully closing all previously held BTC and SOL short positions (total profit of 4.71 million USD); he reversed and established long positions in BTC, Ethereum (ETH), and SOL, while also buying some spot assets to comprehensively layout long positions.

● November 6, 2025: The trader's entire position was converted to long positions, with total floating profits reaching 4 million USD at one point; the main holdings included long positions in BTC, ETH, and SOL, demonstrating strong confidence in the market's upward trend.

Whale address: 0x9263c1bd29aa87a118242f3fbba4517037f8cc7a

From the table, it can be seen that "Calm Order King" has a high trading frequency and can adjust strategies in a timely manner based on market changes, not stubbornly adhering to a single direction.

3. Position Insight: Long Position Layout and Floating Profit Analysis

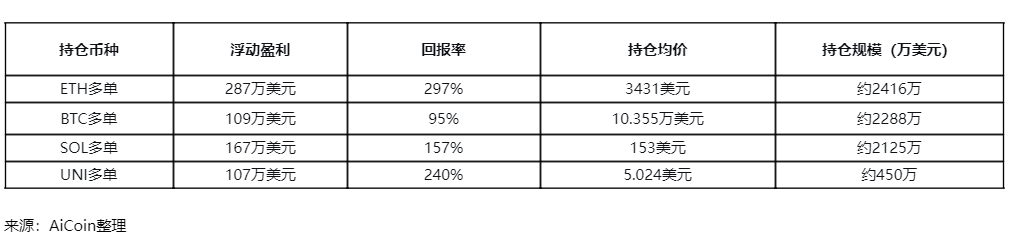

As of the latest data on November 11, "Calm Order King" has achieved considerable floating profits after fully switching to long positions. Here are his specific holdings and profit and loss situation:

● From the holding structure, he adopted a multi-coin diversified layout strategy, mainly focusing on large-cap mainstream coins. Among them, the return rate of ETH long positions is the highest, reaching nearly 300%.

● His total holding scale has exceeded 72 million USD, with total floating profits from long positions exceeding 6.7 million USD, and the total account assets have grown from the initial 3 million USD in early October to about 28 million USD.

4. Risk Control: Profit Preservation and Drawdown Management

While achieving high returns, "Calm Order King" also deserves attention for his risk control. He manages risks through various means to ensure that profits are not swallowed by market fluctuations.

● Profit isolation is the core of his risk management. After each profitable exit, he transfers part of the funds to a spot account for isolation. This method is akin to placing realized profits in a "safe," effectively avoiding the potential liquidation risk of high-leverage positions.

● He also maintains strict control over drawdowns. Reports indicate that in nearly two months of trading, his maximum drawdown has always been kept within 23%. In high-leverage trading, controlling drawdowns is key to survival. He achieves a balance between profit and risk by strictly executing take-profit and stop-loss strategies.

5. Comparative Analysis: Differences in Whale Trading Techniques

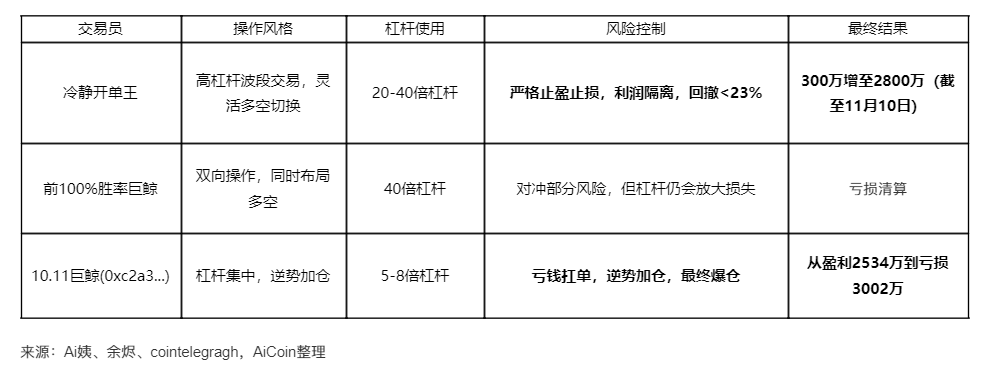

In the cryptocurrency market, the trading techniques of whale traders vary. Below is a table comparing "Calm Order King" with several other well-known whales' trading styles:

Source: Ai Aunt, Yu Jin, Cointelegraph, compiled by AiCoin

● From the comparison, it can be seen that the biggest difference between "Calm Order King" and other whales lies in strict risk control and flexible position adjustments. Those whales who ultimately failed often did so because they stubbornly held onto a single direction and failed to cut losses in losing positions, leading to massive losses.

6. Insights and Risks: The Dual Nature of High-Leverage Trading

While the 20 consecutive wins of "Calm Order King" are indeed impressive, the risks involved cannot be ignored.

● High-leverage trading is a double-edged sword. The 20-40x leverage he uses amplifies profits but also means that if the market moves against him, he may face rapid and substantial losses or even liquidation.

● The lagging nature of on-chain data is also a factor that followers need to be cautious about. The on-chain data we see is public and delayed; by the time you see this information, the trader may have already made new rebalancing operations.

● The prevalent survivorship bias in the market is also worth noting. We only see extremely successful cases, while many failed traders remain unseen. This high-risk trading strategy has a very low success rate and is not suitable for the vast majority of investors.

In the turbulent sea of cryptocurrency, "Calm Order King" continues to write his legend with precise judgment and strict risk control. His story reveals a truth to all market participants: short-term profits rely on strategy, while long-term survival relies on risk control.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。