Finally back home, the best news today is that the end of the shutdown is in sight. If all goes well, the shutdown should end this Thursday Beijing time. The market sentiment is gradually recovering, and today the U.S. stock market saw a good increase, which also brought $BTC back to around $106,000. It seems that this bottom-fishing attempt has been successful.

As the shutdown ends, the market's focus will gradually shift back to Trump's tariffs and the Federal Reserve's monetary policy. Due to the shutdown, there may not be much data in the next two weeks, and there is still more than a month until the next interest rate cut, so the emphasis may still be on tariffs.

However, this time the tariffs are not external but rather an internal issue in the U.S. During the oral hearings at the Supreme Court, several justices expressed doubts about Trump's authority on tariffs. If Trump's tariffs are overturned, it could likely trigger a new wave of uncertainty in the market, as Trump will not sit idly by.

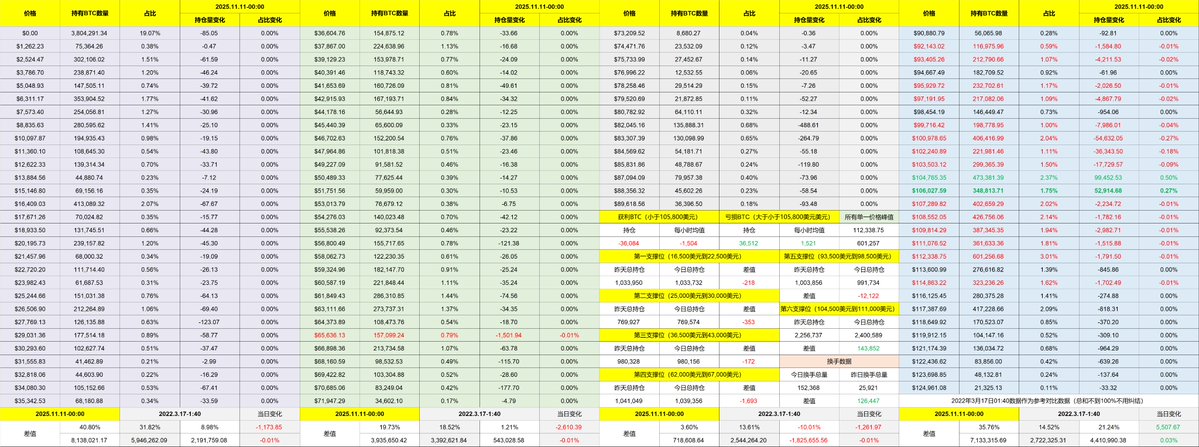

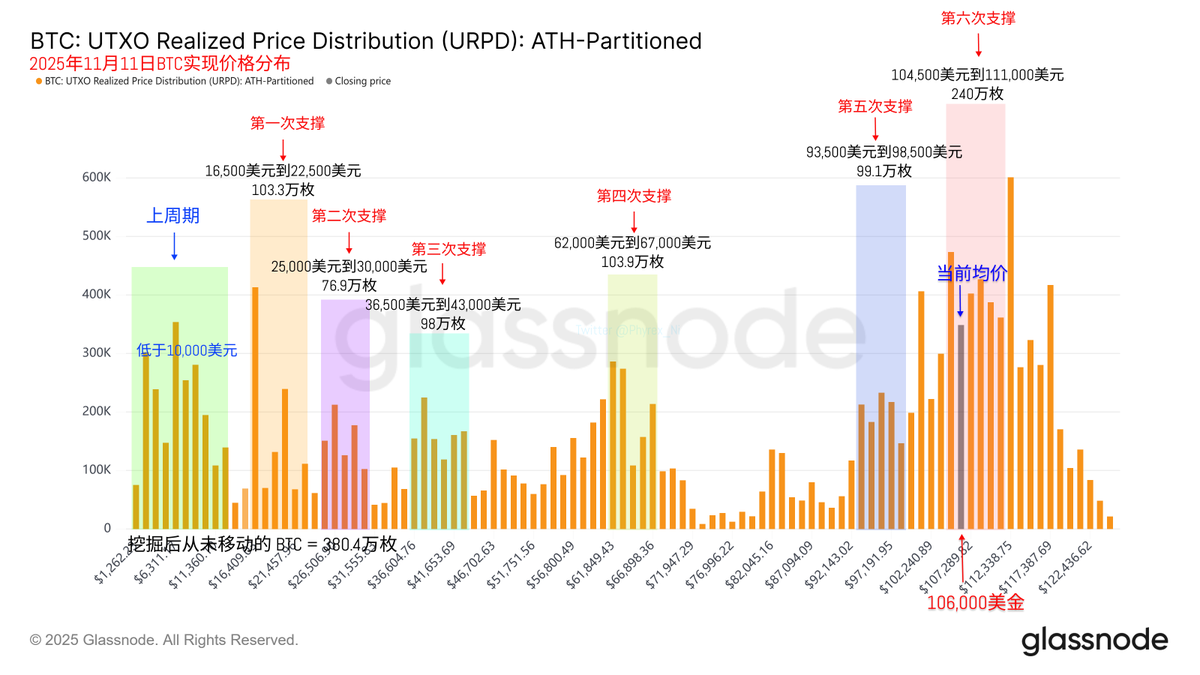

Looking at Bitcoin's data, the trading volume has significantly increased today, mainly due to the news of the shutdown's end. Some investors have started to increase their bottom-fishing efforts, but it is also evident that investors who bought in during the shutdown currently have a strong expectation to exit. It seems we may have to fight a hard battle for a while longer.

Recently, I've been saying that the support level is very stable. Although it briefly fell due to sentiment, as long as the support doesn't collapse, it can easily bounce back. This has indeed been the case; now the price of $BTC has returned to the support range, and the chip structure remains very tight.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。