This Week's Cryptocurrency Market Dynamics

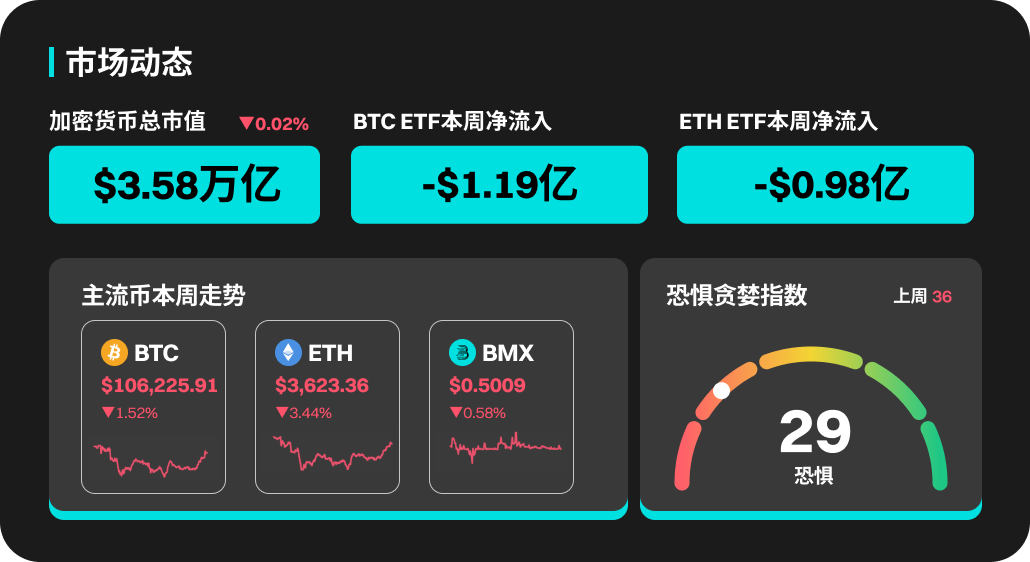

The cryptocurrency market continues to decline, with sentiment further weakening. Following last month's leverage-driven pullback, there has been another large-scale deleveraging this week, with liquidation amounts reaching $1.2 billion and $1.6 billion over two consecutive days. BTC fell by 6.4%, while ETH, SOL, and major altcoins turned negative for the year, with high-beta assets experiencing particularly significant declines as funds continue to flow out of risk assets. The market has evaporated nearly $1 trillion in market value, but the pullback is primarily driven by technical deleveraging rather than a deterioration in fundamentals. The industry's fundamentals remain robust: adoption rates are at an all-time high, regulatory benefits are continuously advancing, and technological innovation is accelerating. However, extremely high leverage has amplified volatility, making the market more sensitive to macroeconomic factors and news. This round of liquidations has pushed BTC down from about $126,000 to around $100,000, triggering a systemic risk reduction in the market. Stablecoin data shows that despite the clearing of leveraged positions, funds remain within the crypto ecosystem and have not flowed out in large amounts, but rather shifted towards stablecoins. The long-term logic remains unchanged, but the short-term market will maintain high volatility in both directions during the leverage reset.

This Week's Popular Coins

In terms of popular coins, QRE, AIA, COTI, ZEC, and STRK have all performed well. QRE's price increased by 334% this week. AIA's price rose by 229.9%. COTI's price went up by 15.3%, with a 24-hour trading volume of 424.33M. TAO and ZEC increased by 12.5% and 8.9% respectively this week.

U.S. Market Overview and Hot News

Last week, risk sentiment in the U.S. stock market weakened again, with a significant pullback in the major indices—the S&P 500 fell by about 2.04%, and the NYFANG+ index dropped by 4.21%, affected by weak tech earnings, concerns over AI valuations, and macroeconomic uncertainties. The U.S. dollar index rose by 0.26%, supported by rising U.S. Treasury yields and safe-haven demand, while USD/JPY fell by 0.72%, with the yen strengthening due to inflows of safe-haven funds and cautious statements from the Bank of Japan. In commodities, gold fell by 0.63%, pressured by a stronger dollar; crude oil dropped by 1.08% due to the largest increase in U.S. crude oil inventories since July and Saudi Arabia lowering prices for Asia. The 10-year U.S. Treasury yield remained volatile, pressured by a large issuance of government bonds and mixed macro data, while market volatility significantly increased—VIX surged by 19.86%, and the MOVE index rose by 10.19%, reflecting heightened hedging demand, increased liquidity concerns, and the impact of a pause in the release of key U.S. economic data. Overall, the market has shifted back to a defensive stance, with weakening tech momentum, unclear macro prospects, and rising volatility collectively suppressing the performance of risk assets.

On November 3 at 22:45, the U.S. will release the final value of the October S&P Global Manufacturing PMI; a potential breakthrough in the U.S. government shutdown may occur this week;

The U.S. SEC will make a decision on Grayscale's DOT spot ETF, with the decision date set for November 8;

The SBF case will begin a week of hearings on November 3;

Popular Sectors and Project Unlocks

Privacy Sector

The privacy sector performed remarkably well over the past week, with ZEC leading the way to set a new all-time high, becoming a core highlight in a weak market environment, followed by a slight pullback with the broader market; driven by this, DASH also saw significant gains, indicating a phase of capital returning to the privacy narrative. Despite the strong performance within the sector, the overall market has not yet detached from the impacts of October 11, with the altcoin season index falling to 25 (BTC dominant), and the fear index reporting 36 (market fear), indicating that the current rise is more reflective of structural capital rotation rather than a comprehensive trend reversal.

Linea (LINEA) will unlock approximately 2.88 billion tokens at 7 PM Beijing time on November 10, representing 16.44% of the current circulating supply, valued at about $34.4 million.

Aptos (APT) will unlock approximately 11.31 million tokens at 2 PM Beijing time on November 11, representing 0.49% of the current circulating supply, valued at about $33.4 million.

Solayer (LAYER) will unlock approximately 27.02 million tokens at 10 PM Beijing time on November 11, representing 9.51% of the current circulating supply, valued at about $6.6 million.

peaq (PEAQ) will unlock approximately 84.84 million tokens at 8 AM Beijing time on November 12, representing 5.57% of the current circulating supply, valued at about $6 million.

Avalanche (AVAX) will unlock approximately 1.67 million tokens at 8 AM Beijing time on November 13, representing 0.33% of the current circulating supply, valued at about $28.2 million.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and there may be significant risks associated with buying, selling, holding, or trading digital currencies. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。