In the past few weeks, the privacy coin sector, represented by Zcash (ZEC), has experienced a thrilling market performance. This veteran privacy cryptocurrency surged over 10 times from September to November 2025, briefly surpassing Monero in market capitalization, but then faced severe volatility, dropping from a high of $744 to $488 within three days, before quickly rebounding above $600.

Such a rollercoaster trend has led investors to question: Can the excitement around privacy narratives continue?

Institutional Entry and Technological Breakthroughs Ignite ZEC Market

The current market performance of Zcash is not coincidental. Grayscale's announcement to launch a Zcash trust was the first shot fired, followed by BitMEX co-founder Arthur Hayes' statement that "ZEC will soar to $10,000," which further fueled the fire. However, the deeper reason lies in the qualitative change in technological maturity.

As the first project to implement ZK technology, Zcash has entered a practical phase after three major upgrades. Particularly, the launch of the official wallet Zashi has completely transformed the user experience of privacy coins. Data shows that after Zashi's launch, the number of ZEC in shielded addresses has grown exponentially, with over 4.5 million ZEC currently in privacy protection, accounting for 28% of the total supply, setting a historical high.

More critically, the integration of Zashi with NEAR Intents has enabled cross-chain privacy transactions. Users can now exchange ZEC directly from other chains without exposing their addresses, addressing the biggest liquidity bottleneck for privacy coins. Data indicates that the number of NEAR intents related to ZEC accounts for over 30% of the total on the platform, becoming an important traffic entry point.

Bull-Bear Tug of War Amidst Severe Volatility

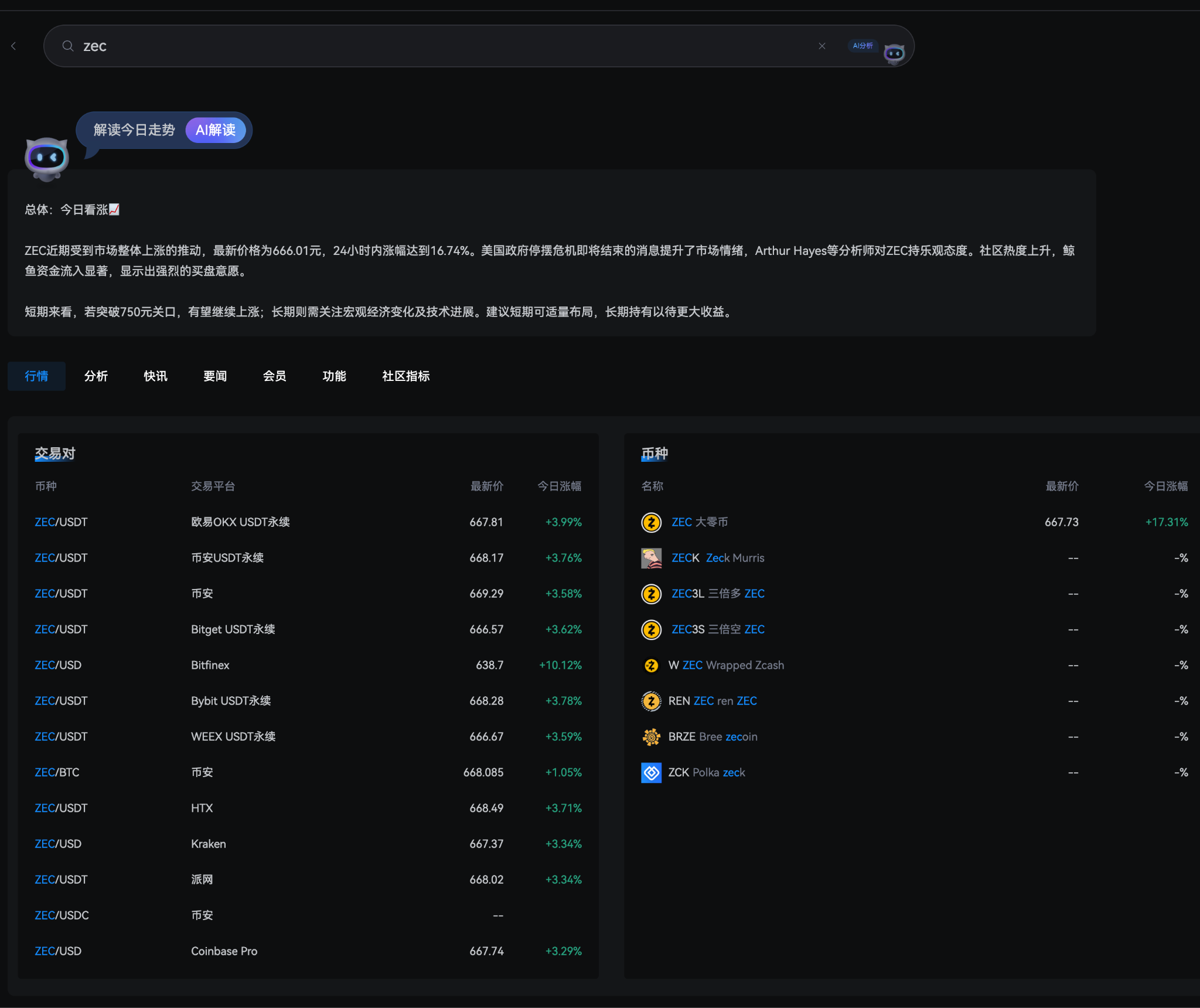

Market enthusiasm is vividly reflected in the derivatives market. ZEC's open interest surged by 9.77% to $939.31 million, with the cumulative trading volume in the futures market continuously showing buyer dominance.

On-chain data reveals that a whale decisively entered the market when the price dropped to $509, opening a long position worth $12.12 million. However, technical indicators are sending warning signals.

The daily chart shows that after consecutive highs, ZEC has formed candlesticks with long upper shadows, with increased trading volume but stagnant prices, presenting a typical "volume without price increase" scenario. Additionally, the steep slope of this round of increase indicates significant short-term correction pressure.

Revaluation of Privacy Value Has Just Begun

From a fundamental perspective, Zcash's narrative has long-term logic. As global regulations tighten and CBDC tracking capabilities increase, the demand for financial privacy continues to rise. Naval's view that "Zcash is the insurance for Bitcoin" accurately captures this trend: as the mainstream financial system's monitoring capabilities grow stronger, true privacy protection tools will become scarce and valuable. Compared to Monero, Zcash's advantages lie in optional privacy and compliance compatibility. Its ZK technology provides cryptographic-level privacy protection while meeting audit requirements through viewing keys, making this balance more practical in the current regulatory environment.

Is Now the Time to Get In? Opportunities and Risks Coexist

For investors, Zcash is currently in a typical high-risk, high-reward phase. In the short term, technical overbought conditions and macro liquidity pressures may trigger a correction. The U.S. federal government has been in a shutdown for 39 days, with the Treasury withdrawing about $700 billion in liquidity from the market, which offsets the benefits of the Federal Reserve's interest rate cuts, putting the entire cryptocurrency market to the liquidity test. However, in the long term, the revaluation of privacy coins may just be beginning. The upcoming Crosslink upgrade for Zcash will introduce a mixed proof-of-stake mechanism, while the Tachyon project aims to achieve "planetary-level" private payments.

If these technological routes are successfully implemented, Zcash is expected to become a core infrastructure in the privacy sector. For ordinary investors, the current strategy should be cautiously optimistic. Investors already holding ZEC may consider taking profits in batches to reduce position risk; those who have not yet entered should avoid chasing highs and wait for better entry opportunities. While the privacy narrative is enticing, the cryptocurrency market has never only gone up without downswings; maintaining patience is key to ultimately succeeding. The volatility of Zcash once again proves that the cryptocurrency market is always full of surprises.

But one thing is certain: in an era of increasingly strict digital surveillance, the value of privacy protection will only become more pronounced. Whether Zcash can become a bastion of privacy in the digital age remains to be seen.

Join the community for more insider news

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group: https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。