On Sunday, U.S. President Donald Trump posted on the social platform Truth Social, announcing plans to distribute "at least $2,000" in Tariff Dividend to most Americans. This funding will come from the revenue generated by U.S. import tariffs, with high-income individuals excluded.

This proposal quickly drew strong attention from Wall Street and Washington—it could not only become a new tool for Trump to reshape "economic populism," but also sparked discussions in financial markets about the "stimulus check effect."

“America is now the richest and most respected country in the world. There is almost no inflation. We will give back to the American people through fair tariffs.” — Trump stated in a post on Truth Social.

1. Proposal Details: Not Yet Legislation, But Treasury Confirms Evaluation

According to ABC News and The Wall Street Journal (WSJ), Treasury Secretary Scott Bessent stated in an interview that the government is assessing the feasibility of the proposal.

He hinted that the dividends may not be distributed directly in the form of checks, but rather through tax reductions, social security relief, or specific rebate mechanisms. For example:

● Tip tax exemption

● Overtime pay tax exemption

● Temporary reduction of social security taxes

These methods aim to "indirectly return tariff revenues," reducing procedural resistance in Congress.

2. Limited Tariff Revenue, Fiscal Space Questioned

According to the latest data from the U.S. Treasury, as of the end of October 2025, the annual tariff revenue for the U.S. is approximately $97 billion. Even assuming all of it is used for "dividends," it would be difficult to reach $2,000 per person. If distributed to about 130 million low- and middle-income individuals as Trump described, the total would exceed $260 billion.

Several economists pointed out that this "dividend" is more politically symbolic. Oxford Economics commented that the proposal "logically resembles a voter appeasement strategy rather than a sustainable fiscal policy."

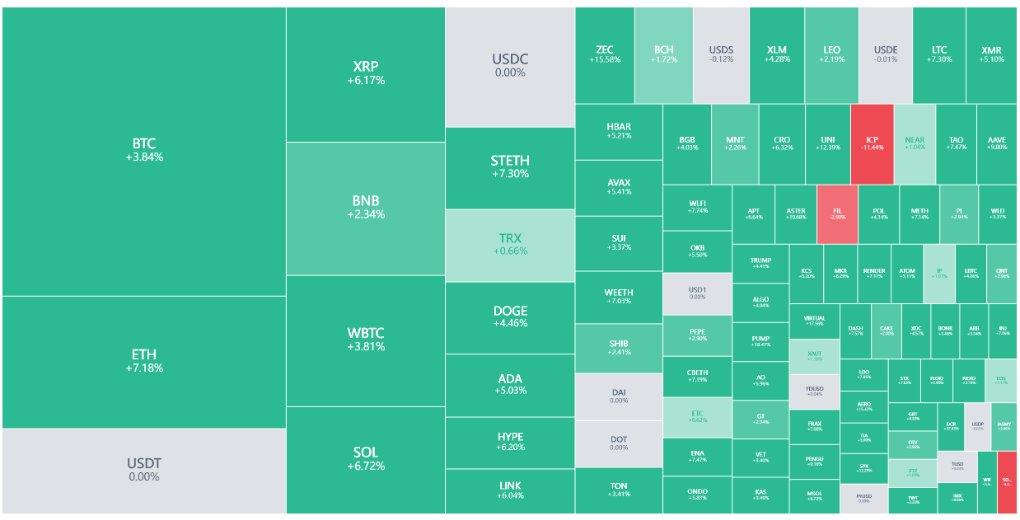

3. Dollar Fluctuates, Gold Rises, Bitcoin Surges Temporarily

After the announcement, global markets experienced short-term volatility.

● The dollar index (DXY) fell to 96.63;

● Gold prices rose by 0.8% to $4,040 per ounce;

● Bitcoin surged about 3.2% within two hours of the announcement, breaking through $106,000;

The market generally interprets this as:

● If the policy is realized, consumption and liquidity may rebound; if the fiscal burden expands, long-term inflation and debt concerns will rise.

In the cryptocurrency market, investors are more inclined to view this news as a short-term positive. Some analysts pointed out that this "government cash distribution" signal reinforces market expectations for a resumption of monetary easing cycles.

4. Expert Analysis: Economic Stimulus or Fiscal Illusion?

● Capital Economics Analyst

“Trump's proposal is politically very attractive, but fiscally unsustainable. If the funding gap is filled by borrowing, it will offset the claimed 'tax reduction effect.'”

● Morgan Stanley Report

“The market will view it as a form of implicit stimulus policy. If implemented, even if limited in scale, it could drive retail consumption and risk asset prices up in the short term, but long-term interest rate pressures will rise.”

● CryptoQuant Researcher Assessment

“Whenever the U.S. government signals cash release or tax cuts, Bitcoin's social media popularity significantly increases within 48 hours. This time may be no different, but the real deciding factor remains the Federal Reserve's policy path.”

5. Political Considerations: "Dividend Narrative" in the Context of Election Campaigns

Observers generally believe that this "dividend of $2,000" is more like a "political signal" from Trump in his re-election campaign.

Currently, U.S. inflation has fallen to 2.4%, and economic growth is slowing, but voters remain sensitive to "rising prices" and "middle-class stagnation." Cash dividends packaged as "tariff revenue returns" help reinforce Trump's "America First" narrative:

● Tariffs → Let foreigners pay for Americans

● Dividends → Let ordinary people directly benefit

This logic is highly communicative in political marketing, especially in the Midwest and manufacturing districts.

6. Potential Impact: From Wall Street to the Crypto Sphere

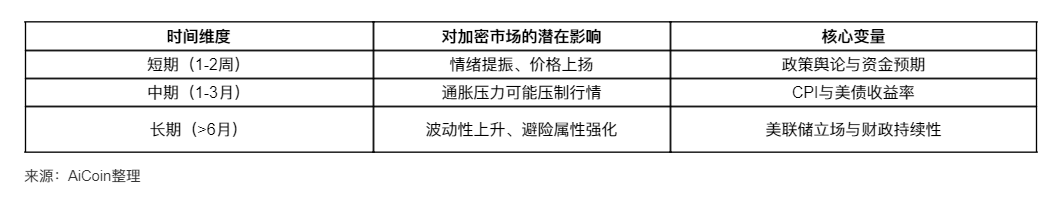

● Short-term: Risk Appetite Rebounds

Increased funding expectations, a temporary weakening of the dollar, and a synchronized rebound of Bitcoin and U.S. stocks. If the policy becomes clearer, crypto assets are expected to gain emotional upward space.

● Medium-term: Inflation and Deficit Risks

If increased tariffs lead to higher prices for imported goods, it may offset the dividend effect. Rising inflation will force the Federal Reserve to maintain higher interest rates, which will suppress both the stock market and the crypto market.

● Long-term: Increased Policy Uncertainty

If Trump bundles trade, fiscal, and monetary policies together, market volatility will significantly increase. The crypto market, as a high-risk asset, may become one of the liquidity "safe havens" during such cyclical fluctuations.

Conclusion: Financial Echoes of Political Language

From the "stimulus checks" of 2020 to the "tariff dividends" of 2025, Trump has always been adept at transforming complex economic policies into simple narratives for the public. This time, he once again wrapped trade protectionism as "universal dividends," responding to voters' expectations for tangible benefits while challenging the bottom line of fiscal sustainability. The market's brief excitement may not mask the underlying logical contradictions—when a country's "dividends" rely on taxation, and when tax cuts become another side of the deficit, the stability of the monetary system itself becomes a suspense.

For the crypto market, every such fiscal experiment signifies a new narrative window: “If the government's currency becomes increasingly politicized, decentralized assets will be re-evaluated.”

Perhaps this is another group truly listening to Trump's words beyond Wall Street.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。