Author: Trading Strategy

Translated by: Wu Says Blockchain

Stream xUSD is a "tokenized hedge fund" disguised as a DeFi stablecoin, claiming to adopt a delta-neutral strategy. Now, Stream is in trouble under suspicious circumstances. Over the past five years, several projects have followed this strategy, attempting to launch their tokens through income generated from delta-neutral investments. Some successful examples include: MakerDAO, Frax, Ohm, Aave, Ethena.

Unlike many more legitimate DeFi competitors, Stream lacks transparency regarding its strategies and positions. On portfolio trackers like DeBank, only $150 million of the claimed $500 million TVL is visible on-chain. It turns out that Stream invested in off-chain trading strategies run by proprietary traders, some of whom faced liquidation, leading to a claimed loss of $100 million.

As reported by CCN, the $120 million Balancer DEX hack on Monday is unrelated to this matter.

Rumors (which we cannot confirm as Stream has not disclosed) suggest that the off-chain trading strategy involving "selling volatility" may be related. In quantitative finance, "selling volatility" (also known as "short volatility" or "short vol") refers to a trading strategy that profits when market volatility decreases, remains stable, or when the actual volatility is lower than the implied volatility priced into financial instruments. If the price of the underlying asset does not fluctuate significantly (i.e., low volatility), options may expire worthless, allowing the seller to keep the premium as profit. However, this approach is highly risky, as a sudden spike in volatility can lead to massive losses—often described as "picking up pennies in front of a steamroller."

During the 1011 event, we also experienced such a "volatility spike." The fervor surrounding Donald Trump in 2025 fueled systemic leverage risk that had long accumulated in the cryptocurrency market. When Trump announced new tariffs, all markets fell into panic, which spilled over into the cryptocurrency market. In the panic, preemptive selling was key, leading to a chain of liquidations.

Due to the long-accumulated leverage risk, systemic leverage reached high levels, and the perpetual futures market lacked sufficient depth to smoothly unwind and liquidate all leveraged positions. In this situation, the automatic deleveraging (ADL) system was triggered, beginning to socialize losses among profitable market participants. This further distorted a market already deep in madness.

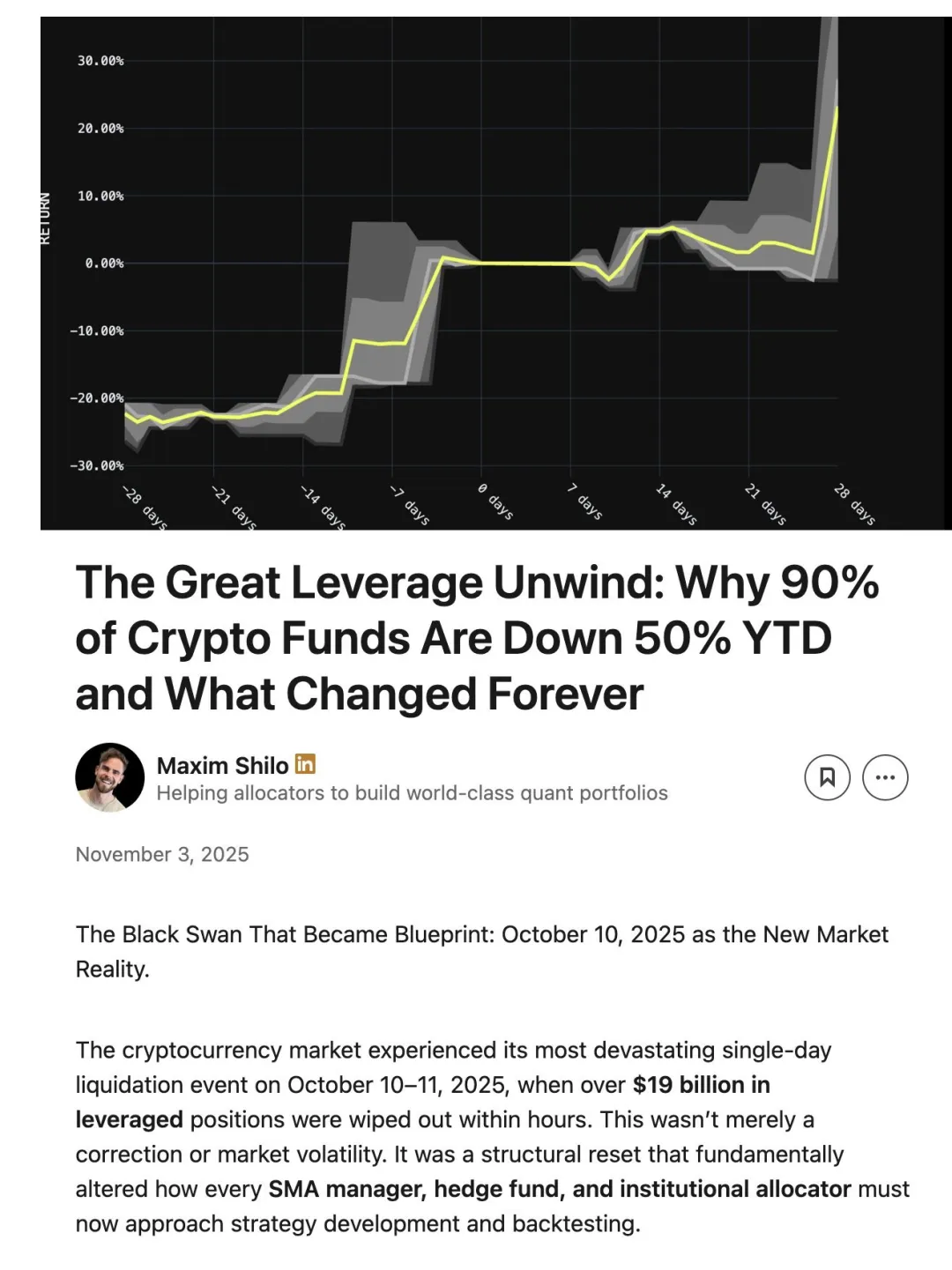

The volatility resulting from this event is a once-in-a-decade occurrence in the cryptocurrency market. While similar declines occurred in the early cryptocurrency market in 2016, we lack good data from that period, so most algorithmic traders based their strategies on recent "smoothed volatility" data. With no such spikes seen recently, even positions with leverage of only ~2x were liquidated.

Maxim Shilo, founding partner of a crypto quantitative trading firm, analyzes the impact of this event on algorithmic traders and how cryptocurrency trading may be permanently altered post-1011: strategies relying on stable, trending market conditions have proven extremely vulnerable to catastrophic blows. Managers without circuit breaker logic, tail risk hedging, or rapid deleveraging protocols face capital destruction that traditional risk models failed to predict. Each strategy must be rebuilt with 1011 as the new baseline, rather than viewing it as a historical anomaly. Asset allocators and managers who recognize this shift and quickly adjust their frameworks will be the winners in capturing institutional capital flows in the next phase of cryptocurrency evolution. [Note: The full text by Maxim Shilo can be found in the reference article "Deleveraging: Why 90% of Crypto Funds Are Down 50% Year-to-Date, and What Changed Forever."]

Now, the first "corpses" from the 1011 event are surfacing, and Stream has been hit hard.

The definition of a delta-neutral fund is that it cannot lose money. If it loses money, it is not delta-neutral by definition. Stream claims to be delta-neutral but privately invested in proprietary, non-transparent off-chain strategies. Delta-neutral is not always black and white, and hindsight is easy to judge. Many experts might consider these strategies too risky and not to be regarded as truly delta-neutral. Because these strategies can backfire, and they indeed did. When Stream lost principal in these bad trades, it became insolvent.

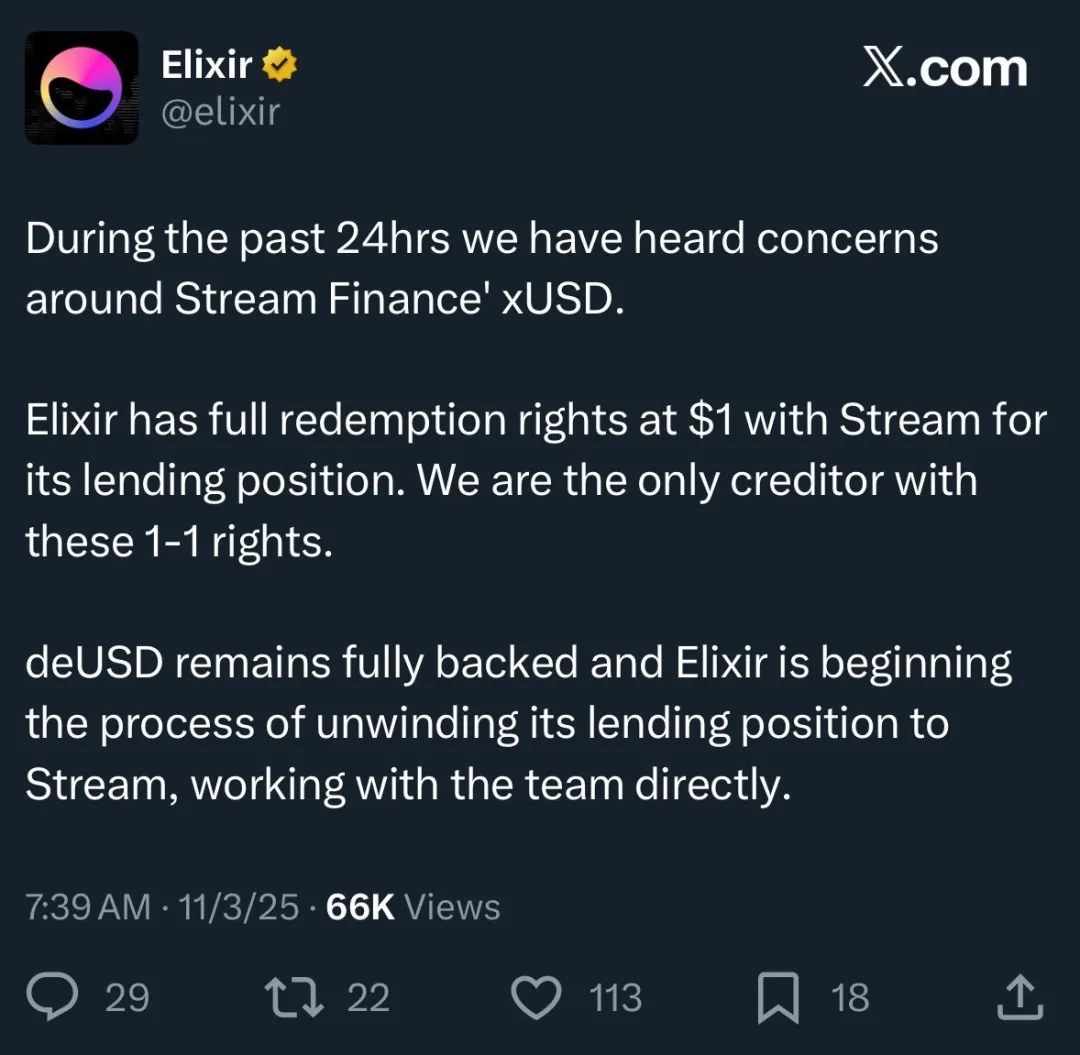

DeFi is highly risky, and the possibility of losing part of the funds always exists. If you can still recover 100% of your dollars, a 10% drop at an annualized return of 15% is not catastrophic, but in this case, Stream also leveraged itself to the extreme through a "recursive loop" lending strategy with another stablecoin, Elixir.

Worse still, Elixir claims to have "priority" over its principal based on off-chain agreements in the event of Stream's bankruptcy, meaning Elixir may recover more funds while other DeFi investors receive less (or nothing).

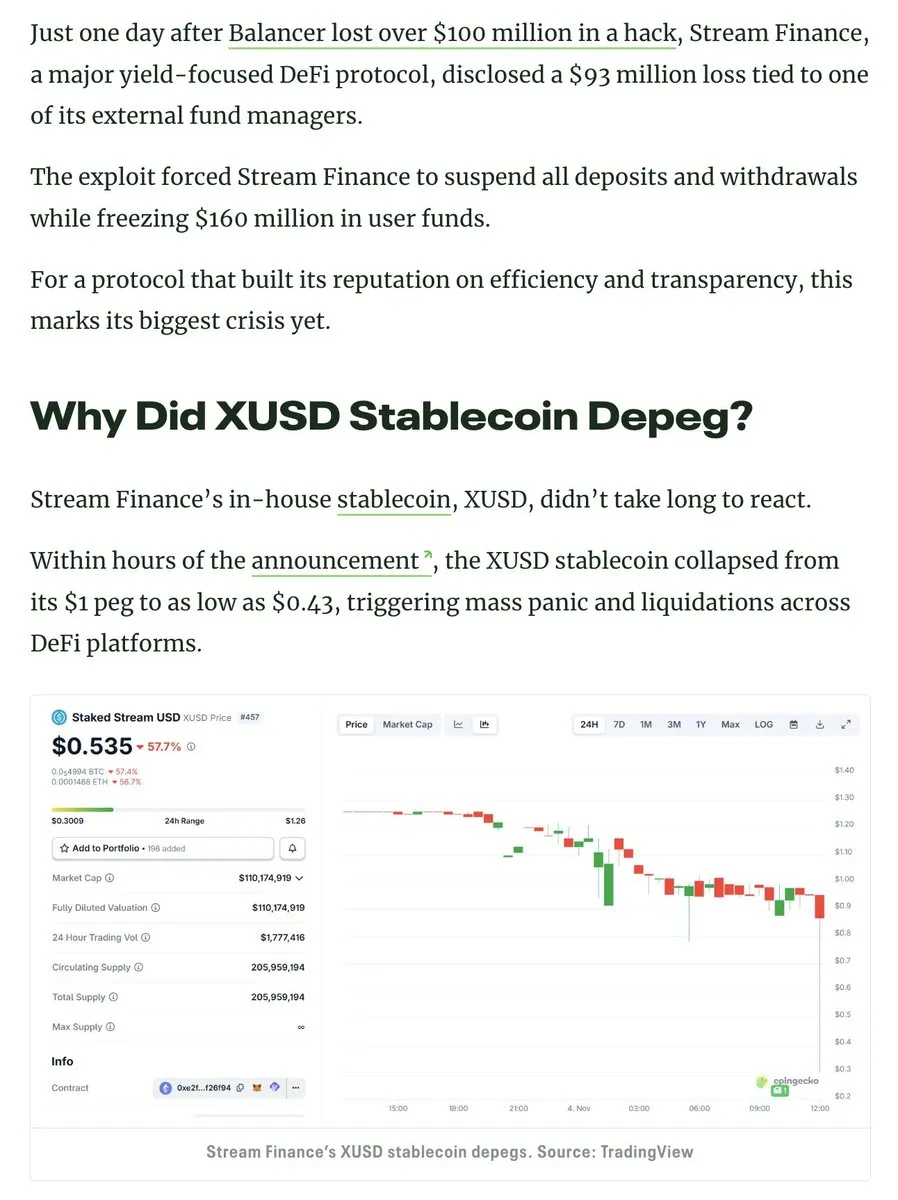

Due to the lack of transparency, recursive loops, and proprietary strategies, we do not actually know the scale of losses for Stream users. Currently, the price of the Stream xUSD stablecoin is $0.15.

Many users are now extremely angry with both Stream and Elixir due to the lack of disclosure to these DeFi users: not only have they lost money, but the losses have been socialized to ensure that wealthy Americans from Wall Street backgrounds maintain profits.

This event has also impacted lending protocols and their curators:

"Everyone who thought they were lending against collateral positions on Euler was actually doing so through an uncollateralized loan via an agent" — Rob from infiniFi.

Furthermore, due to Stream's lack of transparency regarding its positions and profits and losses, users began to suspect that Stream may have fraudulently diverted user profits for the management team. Stream xUSD stakers rely on Stream's self-reported "oracle" for profits, and third parties cannot verify whether the calculations are correct or fair.

How to Respond?

Events like Stream's are avoidable in the young DeFi industry. The "high risk, high reward" rule always applies. But to apply this rule, one must first understand the risks: not all risks are equal, and some risks are unnecessary. There are several reputable yield farming, lending, and stablecoin protocols as tokenized hedge funds whose risks, strategies, and positions are transparent.

Aave founder Stani discussed the potential consequences of DeFi curators and excessive risk-taking:

The survival of DeFi lending depends on trust. One of the biggest mistakes is trying to compare DeFi lending with AMM pools, as they operate entirely differently.

Lending can only function when people believe the market is robust, collateral is reliable, risk parameters are reasonable, and the entire system is stable. Once that trust is broken, on-chain bank runs can occur.

Therefore, the model that allows anyone to create lending pools without permission and promote them on the same platform has inherent weaknesses. As most strategies have been commoditized, curators do not have much to distinguish their methods. They either minimize fees or take on increasing risks to attract funds from other pools.

At some point, a significant failure could destroy confidence in the entire industry and set it back. The next Terra Luna moment will come from a reckless curator on an open platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。