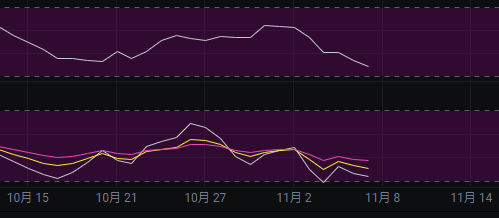

Earlier, we mentioned that after a rebound, we should continue to short. Since the market has experienced a one-day rebound, it has been continuously declining, which perfectly aligns with our judgment of continuing to short after the rebound. Today, we see a new trend forming, and our short positions are also in profit.

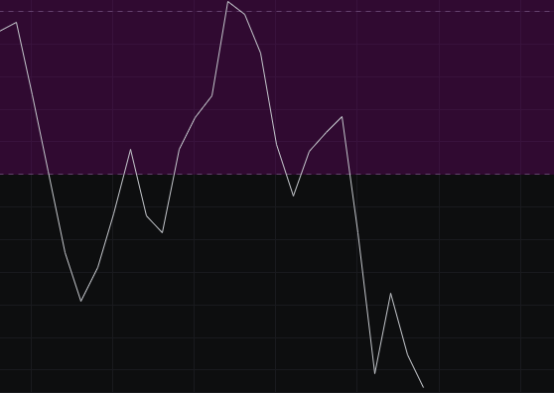

From the MACD perspective, the energy bars are continuously declining, and both the fast and slow lines are moving downward, indicating a bearish trend with no signs of a stop in the decline for now.

Looking at the CCI, it continues to decline, which means there is no possibility of a market reversal. We will wait to see if the CCI stops declining later.

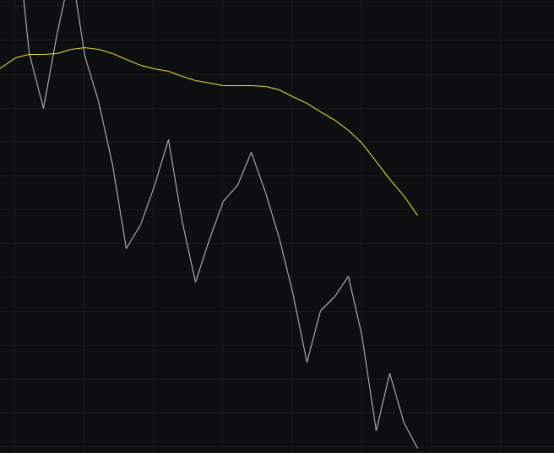

From the OBV perspective, the volume is continuously flowing out, indicating a bearish trend, and the slow line is also pressing down, so we will maintain a bearish mindset.

In terms of KDJ, it has currently dropped below 20. As we mentioned in the past few days, we have seen the KDJ approach 20, and the next step is to see whether the KDJ continues to operate below 20 or turns upward.

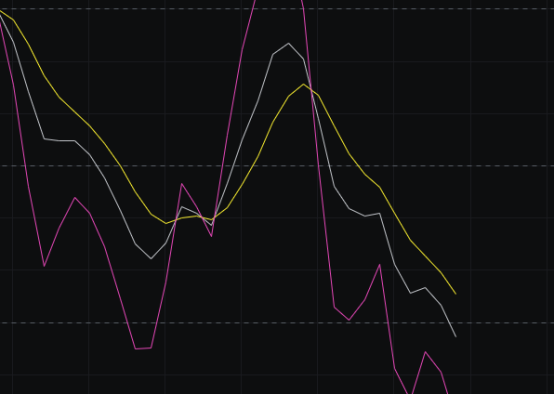

Looking at the MFI and RSI, both indicators are moving downward, indicating a bearish trend, so we will continue to be bearish here as well.

From the moving averages perspective, the moving averages are continuing to press down, and the pressure from the 120 moving average is becoming increasingly evident, so the moving averages also indicate a bearish trend.

From the Bollinger Bands perspective, we mentioned that on the day of the rebound, there was a negative divergence, so the market's adjustment is logical. Currently, it appears that after the adjustment, the market will continue to decline, indicating that the decline is not over yet. Additionally, the Bollinger Bands are still in an opening state, suggesting that the market will continue.

In summary: After the market rebound, it continues to decline, and various indicators are primarily bearish. We believe that the decline will continue, indicating that a new trend is forming. Today's resistance is seen at 101500-103000, and support is at 99000-97000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。