Good evening everyone, I am Jiang Xin. The results from yesterday were quite good. In the morning and evening, a short position was placed, and we saw the results during the night session. Bitcoin and Ethereum reached the targets of 100,000 and 3,250 set for November 5. The rebound after both coins completed their movements was also hindered around the 103,300 and 3,380 levels mentioned during the night session on November 6.

In the morning, I provided a fluctuating trend and outlined the corresponding range. The daytime movement was also hindered around the 102,500 and 3,360 levels given. Everything has a trace to follow. As I always say, sometimes waiting and securing a definite range is a good choice.

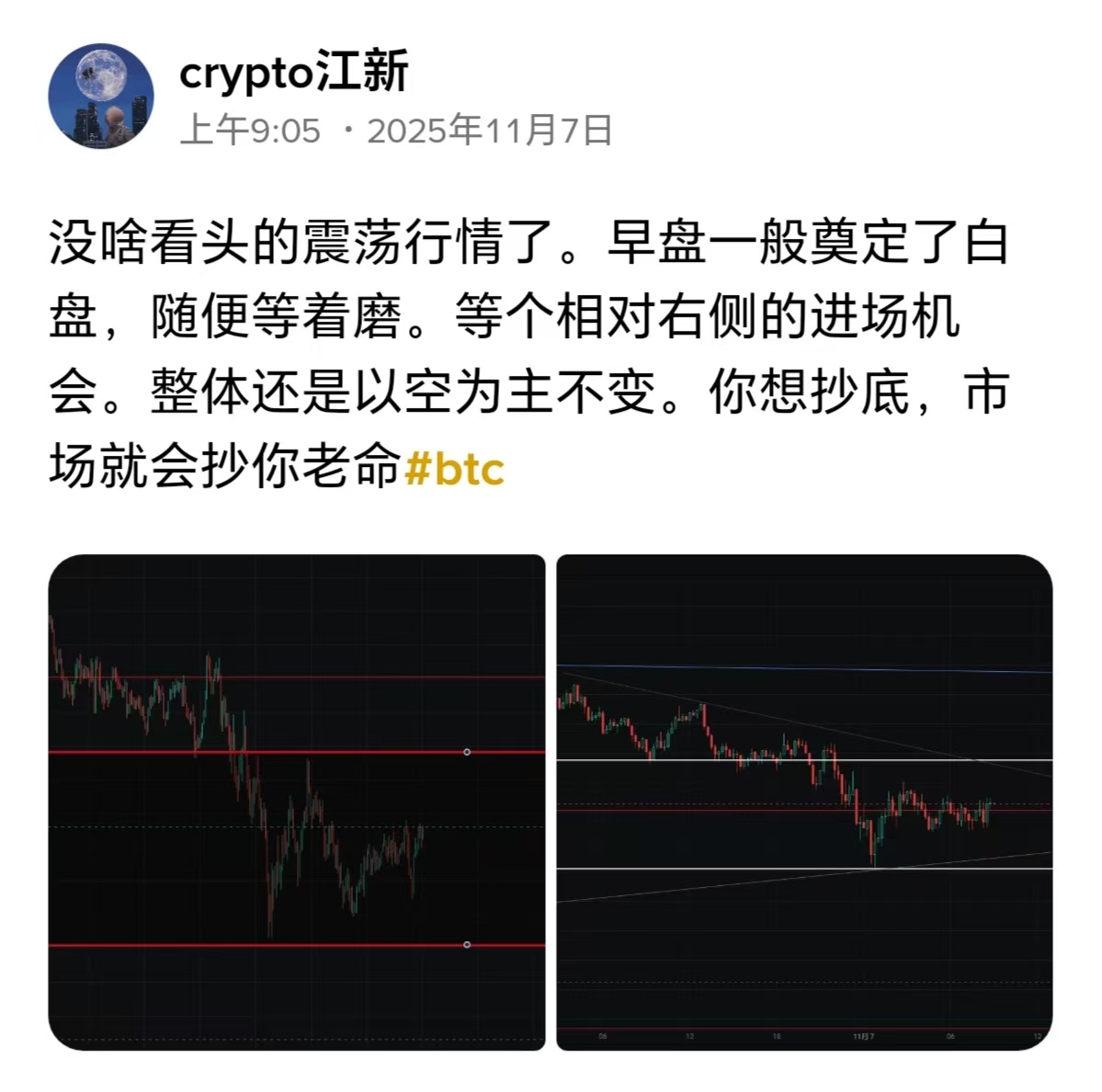

To briefly recap, during the night session yesterday, after Ethereum was hindered at 3,410, it dropped to around 3,250 and rebounded in a dense fluctuation between 3,290 and 3,330. The morning's fluctuations were quite straightforward, bouncing to around 3,360 at 10:30 and then facing pressure. After a pullback to 3,320, it rebounded again but still did not change the downward trend. The one-hour MACD indicator failed to rise above the zero axis. At four in the afternoon, the KDJ formed a dead cross at a high position, and the RSI formed a dead cross at the mid-level, indicating that the divergence has not been fully digested. The market direction remains unchanged, but short-term fluctuations are likely.

Bitcoin is moving more pragmatically. During the night session, it faced pressure around 103,500, testing the 100,000 mark. After fluctuating to around 102,500 in the morning, it faced resistance and fell back, a simple cyclical process. After the drop, Bitcoin showed a decrease in buying interest, with market funds being diverted to various altcoins. In the last cycle, old hot spots saw slight increases, while new hot spots like ZEC and Giggle were aggressively pushed by strong whales. This divergence from the mainstream can easily confuse perceptions. It misleads retail investors into thinking there is a season for altcoins, but that is not the case. If we mention a few similar trading methods from the past, like ORDI and TIA, one would understand that failing to exit in time can lead to being trapped. So it’s better to avoid such trades.

Currently, the key positions to focus on, aside from the positions already established, are still those few old levels. For Bitcoin, pay attention to 101,500, 103,300, and 104,200, while below, watch the lowest levels of 99,800 and 98,500. For Ethereum, above, focus on 3,330, 3,380, and 3,420, while below, watch 3,250, 3,215, and 3,180.

For the weekend, the reference range is 98,800-103,500 for Bitcoin, and 3,150-3,420 for Ethereum, primarily focusing on short positions. Currently, one can move back and forth within the daily fluctuation range.

The conservative suggestion remains the old strategy: short at 103,300 and 3,330, with a replenishment range at 104,500 and 3,380, and stop-loss at 105,450 and 3,445, making rebounds in conjunction with market sentiment.

Based on the given positions, we maintain our view that the market is still in a downward fluctuation. Short-term fluctuations can be captured, but the market needs to digest the divergence. Those who had disagreements with Jiang in the past few days have been passive since yesterday. Before speaking next time, take a look at how things have been given these days, and you will understand the continuity of rhythm.

The market changes rapidly. For real-time adjustments, contact the public account: Jiang Xin on Trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。