The significant internal divergence regarding interest rate cuts within the Federal Reserve has led to a severe market upheaval. On November 7, in the eighth time zone, U.S. stocks experienced a "Black Thursday," with all three major indices plummeting.

The Dow Jones fell by 0.84%, the S&P 500 dropped by 1.12%, and the Nasdaq saw a sharp decline of 1.9%. Meanwhile, gold prices briefly surged due to safe-haven demand before retreating, showcasing a thrilling "roller coaster" market.

The root cause of this market turmoil directly points to the rare disagreement within the Federal Reserve regarding the path of interest rate cuts. Among the 12 FOMC voting members, two cast dissenting votes, marking the first significant policy divergence in six years.

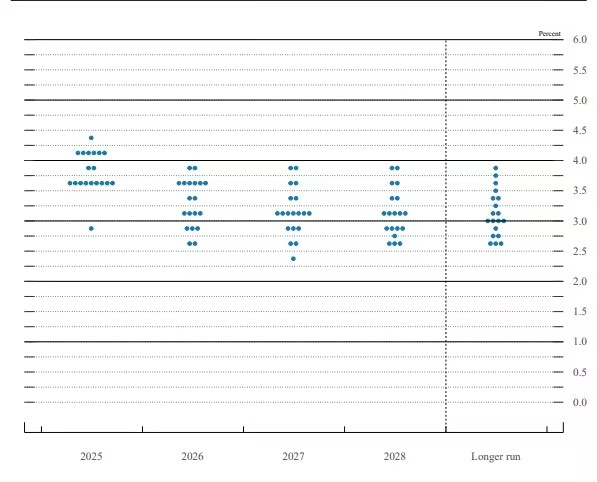

1. Dot Plot Signals

In the latest FOMC decision statement, a clear policy divergence emerged within the Federal Reserve for the first time in six years. Among the 12 voting members, two officials stood on completely opposite sides: Governor Milan advocated for a 50 basis point cut, while Kansas City Fed President Schmidt argued for keeping rates unchanged.

This divergence not only exposes the significant differences in economic outlook within the Federal Reserve but also brings unprecedented uncertainty to the market. The crucial dot plot visually presents this internal disagreement and its implications for future policy paths.

Deep Analysis of the Dot Plot:

● 2025 Forecast: Most officials' predictions cluster within the 3.5% to 4.5% range. The distribution of points is relatively concentrated, indicating a basic consensus on the general direction of future rate cuts from current levels.

● 2026 and Beyond: The distribution of points begins to show significant divergence, with a wider range of predictions. This indicates that as the forecast horizon extends, members have notable disagreements regarding the ultimate direction of the economy, particularly concerning the level of the "neutral rate."

● Long-Term Rate Expectations: In the "Longer run" section, the distribution of points is also quite dispersed, with the median remaining around 2.5%. This strongly suggests that there is intense debate within the Federal Reserve on a core issue: Has the "neutral rate" structurally increased post-pandemic? Some members believe that a high-rate environment will be the norm, while others insist that inflation will eventually return to the 2% target, allowing rates to revert to lower historical levels.

Although there is little disagreement within the Federal Reserve about initiating rate cuts, there are deep-rooted differences regarding the pace, magnitude, and ultimate endpoint of these cuts. This chart perfectly corroborates that the voting divergence observed in the FOMC meeting is not coincidental but rather an inevitable result of profound ideological conflicts.

2. Divergent Views

Recent statements from Federal Reserve officials further reveal their profound disagreements on economic assessments and policy paths.

● Cleveland Fed President Harmack candidly expressed her concerns: "Given the inflation situation, it is not clear whether the Federal Reserve should cut rates again." She even suggested that rates should not have been cut last week, emphasizing that "persistently high inflation levels are detrimental to the Federal Reserve's ability to cut rates again."

● In contrast, St. Louis Fed President Musalem held a more neutral view. He stated that "monetary policy is in a moderately tight to neutral range" and indicated that "if rates were to decline further, the real estate market might perform better."

● Chicago Fed President Goolsby exhibited a more cautious attitude, expressing unease about rate cuts in the absence of inflation data.

● Fed Governor Milan expects the FOMC to continue cutting rates in December, aiming for a neutral rate with each cut being 50 basis points.

3. Market Reaction

U.S. Stocks Plummet

The U.S. stock market reacted strongly to the internal divergence within the Federal Reserve. On November 6, all three major U.S. indices plunged. Among the eleven sectors in the S&P 500, nine sectors declined, with the consumer discretionary and technology sectors leading the drop at 2.50% and 2.00%, respectively.

● Technology stocks were hit hard, with Nvidia down over 3%, Tesla falling more than 3%, Amazon dropping nearly 3%, Facebook down over 2%, and Microsoft declining nearly 2%.

● Chinese concept stocks performed relatively strongly, with the Nasdaq Golden Dragon China Index slightly down 0.03%, while the Wind Chinese Technology Leaders Index rose by 0.93%.

● Xpeng Motors surged nearly 10%, Canadian Solar rose nearly 7%, and Baidu Group increased by over 3%.

Gold Prices Surge and Retreat

Gold prices staged a dramatic "surge and retreat" on Thursday. In the morning, gold briefly soared nearly 1%, reaching a high of $4019.44 per ounce, close to the $4020 mark. However, this upward momentum halted during the New York session, with gold prices giving back all gains and ultimately closing at $3976.85 per ounce, nearly unchanged from the previous trading day.

● The tug-of-war between safe-haven demand and risk aversion was vividly reflected in the gold price movements.

● The U.S. government shutdown has entered its 37th day, coupled with the U.S. Supreme Court's skepticism regarding the legality of Trump's tariffs, which together have driven a resurgence in safe-haven buying.

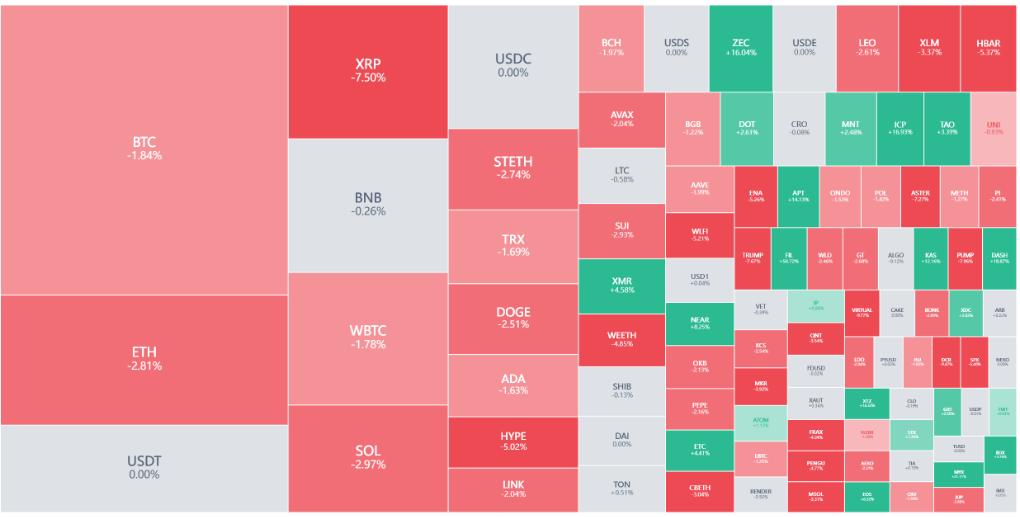

Cryptocurrency and Bond Market Performance

● The cryptocurrency market was also not spared. Bitcoin fell by 2.5%, and Ethereum dropped over 5.6%.

Meanwhile, the bond market reacted to the deteriorating labor outlook.

● The yield on the 10-year U.S. Treasury bond fell by over 6 basis points to 4.089%, the 2-year Treasury yield dropped to 3.566%, and the 30-year Treasury yield fell to 4.686%. The dovish repricing in the bond market raised the implied probability of a rate cut in December, as shown by the Chicago Mercantile Exchange's FedWatch tool, from 62% the previous day to 69%.

4. Economic Data Shadows

A series of unsettling employment data has raised market concerns.

● A report from employment information company Challenger, Gray & Christmas revealed that the number of layoffs in U.S. companies in October was 153,074, an increase of 183% from September, marking the highest figure for October since 2003. This data represents a year-on-year surge of 175.3%, setting a record for the highest number in twenty years for the same period.

● Data from U.S. private data provider Revelio Labs further indicated that non-farm payrolls in the U.S. decreased by 9,100 in October, compared to an increase of 33,000 the previous month.

These weak employment figures resonate with other recent signals suggesting a potential economic slowdown, reinforcing investors' expectations for the Federal Reserve to maintain a loose policy path.

5. Future Path

In the face of a complex economic situation, market predictions regarding the Federal Reserve's future policy path have shown clear divergence.

● According to CME's "FedWatch," the probability of the Federal Reserve cutting rates by 25 basis points in December is 70.6%, while the probability of keeping rates unchanged is 29.4%.

● The probability of the Federal Reserve cumulatively cutting rates by 25 basis points by January next year is 54.2%, with a 17.7% chance of keeping rates unchanged and a 28.2% chance of a cumulative cut of 50 basis points.

● These expectations contrast with recent "hawkish" remarks from Fed Chair Powell. Powell described rate cuts as "driving in the fog, needing to slow down" and emphasized that "a December rate cut is not a foregone conclusion."

Whether the Federal Reserve will cut rates in December may depend on when the U.S. government ends its "shutdown" and whether subsequent employment data deteriorates.

6. Investment Outlook

In the current market environment, how should investors position themselves?

● Gold has medium to long-term support. With frequent risk events such as geopolitical tensions and financial institution "blowups," and more central banks increasing their gold holdings, there is potential for precious metals to experience a bull market similar to the 1970s in the medium to long term.

However, they also caution that, based on historical experience, prices may face a 2-3 month consolidation after reaching new highs, with short-term international gold prices likely to oscillate within a range of $3900 to $4030. Peter Grant, Vice President and Senior Metal Strategist at Zaner Metals, has proposed a more optimistic outlook—gold's year-end target is between $4300 and $4400 per ounce.

● For the U.S. stock market, Paul Nolte, a senior wealth advisor at Murphy & Sylvest, pointed out: "From a long-term perspective, valuation remains a concerning issue, but the market still leans bullish. That 'buying the dip' mentality still exists."

This mentality is currently facing severe tests amid the ongoing government shutdown and the vacuum of economic data.

The likelihood of a Federal Reserve rate cut in December currently stands at 70.6%, but the future path remains shrouded in uncertainty. The dot plot expectations indicate that the median estimate of the number of rate cuts by Federal Reserve officials for 2025 may be revised down from two cuts last December to one.

As the U.S. government shutdown enters its 37th day, the "black hole" of economic data is growing larger, and every decision made by the Federal Reserve feels like navigating through fog. Investors in gold, U.S. stocks, and the cryptocurrency market are anxiously watching, waiting for clearer signals from the Federal Reserve in December.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。