Written by: Tia, Techub News

Recently, a new proposal from the Hyperliquid community, HIP-5: Assistance Fund 2 (AF-2), has sparked widespread discussion both within and outside the ecosystem. HIP-5 not only reallocates a portion of protocol revenue but also ignites a heated debate about ecological incentives and the purity of tokens.

What is HIP-5: From Single Buyback to Ecological Fund

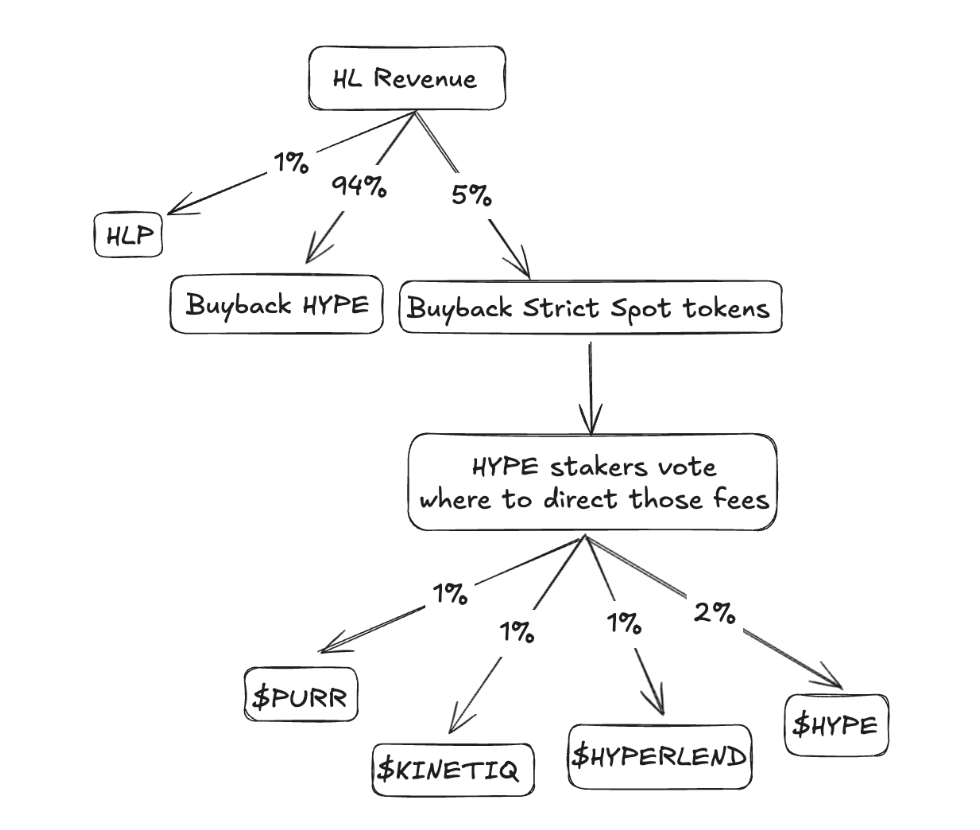

HIP-5 proposes to allocate 1% (gradually increasing to 5%) of the Hyperliquid protocol's transaction fees to a new fund, AF-2 (Assistance Fund 2), which will be used to buy back specific tokens on the "Strict List" within the ecosystem, such as PURR, HFUN, etc.

According to the design, AF-2 will accumulate funds in USDC and the allocation weight of these funds will be determined by HYPE stakers through real-time gauge voting. The execution process will adopt a continuous TWAP (Time Weighted Average Price) buying mechanism, and the voting results will remain effective until modified. Meanwhile, if LSD (Liquid Staking Derivatives) wants to participate in voting, it must implement a verifiable holder-level voting transfer mechanism.

Based on the operational level of approximately $91 million in monthly transaction fees for Hyperliquid in September 2025, even if only 5% is extracted, the annual scale of AF-2 could reach about $55 million—this is a highly influential stimulus plan for current ecosystem projects with a market value of only tens of millions of dollars.

Proposal Motivation: Stimulating Ecological Growth

The starting point of HIP-5 is "fund-driven ecological incentives." The proposal argues that AF-2 will provide continuous buying pressure for existing Hypercore projects, thereby enhancing their market confidence and encouraging more developers to deploy tokens on Hypercore. The Hyperliquid Foundation previously implemented a buyback for PURR through AF-1, and HIP-5 can be seen as a systematic extension of this mechanism.

Supporters believe that the Hyperliquid ecosystem is at a stage that requires a catalyst. Early projects like PURR and HFUN have low market values, while future projects like Kinetiq, which are highly anticipated by the market, may have valuations as high as hundreds of millions of dollars upon launch, yet still require long-term ecological support. An "ecological booster" with an annual buyback scale of $55 million can clearly bring direct capital injection and increased attention to these projects.

Moreover, the current value of HYPE mainly comes from transaction fee revenue. If a Convex-style voting aggregation and "bribery" mechanism can be introduced, future ecological projects could attract buying pressure through incentivized voting, making the value accumulation of HYPE more diverse.

The 5% diversion ratio is relatively controllable—if implemented, it would only reduce the HYPE buyback amount by about $150,000 per day, which has a limited impact compared to the current average daily buying scale of about $3 million. Supporters believe that this slight adjustment is sufficient to exchange for the long-term vitality of the ecosystem.

Opposition: Dilution of Faith, Incentives May Be Abused

However, this "buy pressure support" has raised concerns among some community members. They believe that while this mechanism can boost token prices in the short term, it may deviate from Hyperliquid's core spirit of market efficiency and spontaneous growth.

The unique value of HYPE lies in its simple and transparent economic model: all revenue is used to buy back HYPE. The "pure revenue buyback of HYPE" model has established Hyperliquid's status as a "scarce asset." This clear value path makes HYPE one of the few tokens in the market with solid buying pressure. If some revenue is redirected to other tokens, even if the proportion is not high, it may weaken this trust foundation and blur HYPE's core positioning.

Furthermore, the existence of AF-2 may also induce project parties to be forced to issue tokens early in order to compete for buying pressure. Such "token-for-vote" behavior can lead to short-term price inflation but does not necessarily improve project quality. Currently, in some token holding structures, the ratio of teams to investors is relatively high (e.g., Kinetiq's core team accounts for 23%), meaning that the benefits of buying pressure may mainly flow to internal holders, creating an unfair incentive distribution.

Moreover, the adoption of Convex's governance model in HIP-5 has also raised general concerns within the community. This "bribe" mechanism may lead funds to flow to projects that offer the most incentives rather than the most promising protocols. Once projects start bribing voters, AF-2 may continuously buy tokens that are over-marketed and lack long-term value, thus falling into a negative cycle of "incentives—buying—selling."

At the same time, as voting weights and buyback powers are decentralized, the governance structure will become more complex. Some large stakers may form voting alliances, exerting asymmetric influence on the direction of buybacks, and even triggering risks of front-running or insider trading. This potential concentration of power contradicts the decentralized spirit that Hyperliquid has always advocated.

Conclusion

From a macro perspective, HIP-5 reflects the Hyperliquid community's balance between "self-growth" and "ecological expansion." On one hand, the liquidity and price performance of ecological tokens urgently need external impetus; on the other hand, excessive financial intervention may weaken the system's market self-regulation mechanism. Ultimately, whether HIP-5 can achieve a virtuous cycle of "promoting growth through buying pressure" remains to be seen over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。