Written by: Seed.eth

In November 2025, RippleLabs announced it had secured $500 million in a new round of strategic financing, with the company's valuation soaring to $40 billion. This marks the first public fundraising for the crypto finance company in six years and the largest capital injection since the Series C funding in 2019.

More importantly, the capital factions behind this round of financing are extraordinary: Wall Street giants Fortress Investment Group and Citadel Securities led the round, joined by well-known institutions such as Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

For those who have heard of Ripple, this can be considered a "comeback"—is this still the same Ripple that was once mired in a lawsuit with the SEC and even regarded as a "zombie company"?

From "Master Storyteller" to "Compliance Disaster Zone"

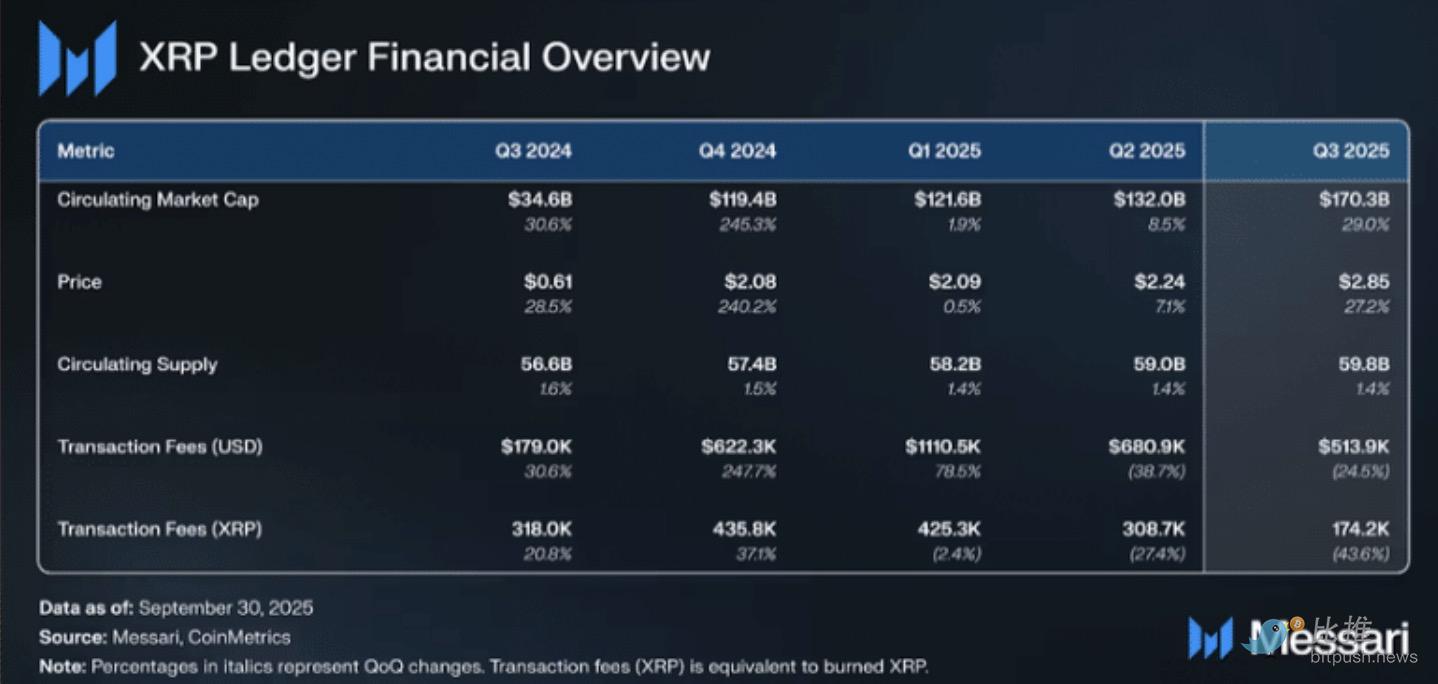

Founded in 2012, Ripple is one of the oldest projects in the crypto space, with its core technology being the XRPLedger, a decentralized ledger designed specifically for cross-border payments. Ripple relies on this to develop payment and settlement systems, and its token XRP was all the rage globally between 2017 and 2018, ranking among the top three in market capitalization, second only to Bitcoin and Ethereum.

However, as the price of cryptocurrencies plummeted and the reality of inflated partnerships came to light, Ripple's narrative of "bank-level cooperation" began to collapse.

During this period, Forbes published an article pointing out that Ripple's core business model might be a "pump and dump" scheme: Ripple used its massive holdings of XRP to buy partnerships, creating a false sense of prosperity, and used vague statements to evade regulation. Its ultimate goal was not to genuinely promote technology but to inflate the value of its freely acquired tokens through marketing and speculation, allowing insiders to cash out for profit.

In December 2020, the regulatory hammer fell.

The U.S. Securities and Exchange Commission (SEC) sued Ripple on the grounds of "unregistered sale of securities," accusing it of illegally raising over $1.3 billion through XRP.

This was the most significant regulatory battle in the crypto industry.

The chain reaction triggered by the lawsuit was devastating: mainstream exchanges like Coinbase and Kraken quickly delisted XRP; long-term partner MoneyGram terminated its collaboration; the price of XRP plummeted over 60% in the following month. Ripple not only suffered business setbacks but was also completely blacklisted in terms of compliance.

Strategic Transformation

This years-long tug-of-war cost Ripple nearly $200 million in legal fees but also earned it crucial breathing space and some favorable court rulings, buying valuable time for strategic transformation.

In 2024, it officially launched the dollar-pegged stablecoin RLUSD, focusing on compliance and targeting payment and settlement for financial institutions. Unlike USDT and USDC, RLUSD is not designed for inter-exchange "stablecoin" transactions but attempts to enter traditional credit card and cross-border settlement systems.

In 2025, Ripple announced partnerships with Mastercard, WebBank, and Gemini to use RLUSD for real-time credit card settlements, becoming the world's first on-chain stablecoin to enter card network systems.

This not only opened B2B channels for stablecoin applications but also cleared the way for Ripple to connect with the real financial world.

To build a complete on-chain financial capability, Ripple undertook a series of precise acquisitions between 2023 and 2025:

- Acquired Metaco: Gained institutional-level digital asset custody technology, laying the foundation for serving large financial institutions.

- Acquired Rail: Obtained a stablecoin issuance and management system, accelerating the launch of RLUSD.

- Acquired Hidden Road: Completed the final piece of the puzzle for institutional credit networks and cross-border settlement capabilities.

Through these acquisitions, Ripple's system capabilities have expanded from a single cross-border payment to a full-stack financial infrastructure of "stablecoin issuance + institutional custody + cross-chain settlement."

The Truth Behind the $40 Billion Valuation

On the surface, Ripple's transformation seems to be gaining momentum.

However, seasoned players in the capital markets see a different picture.

To understand the true logic behind this financing, one must recognize Ripple's essence: a massive "digital asset treasury."

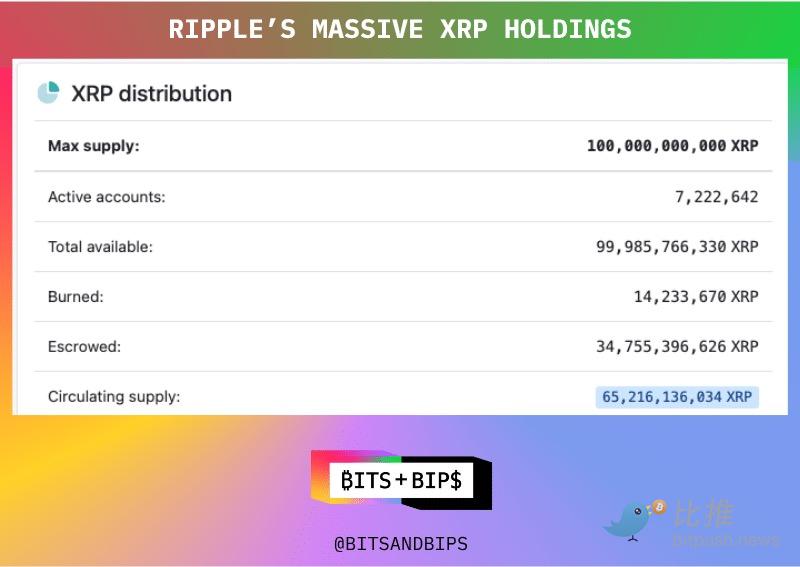

At the inception of XRP, 80 billion of the 100 billion tokens were entrusted to Ripple for custody. As of now, the company still holds 34.76 billion tokens, with a nominal value exceeding $80 billion at market price—twice its financing valuation.

According to several venture capitalists, the $500 million transaction is closely related to the purchase of XRP held by Ripple and is likely to be acquired at a price far below the spot price.

From an investment perspective, investors are essentially buying an asset at 0.5 times the mNAV (market cap to net asset value ratio). Even applying a 50% liquidity discount to the XRP holdings, the value of these assets still aligns with the company's valuation.

A source familiar with the situation told Unchained: "Even if they cannot successfully build a business, they can directly acquire another company."

One venture capitalist stated: "This company has no value beyond holding XRP. No one uses their technology, and no one cares about their network/blockchain."

Some community members expressed: "The equity of Ripple itself may not be worth much, certainly not reaching $40 billion."

One participant revealed the real logic: "The payment sector is too hot right now, and investors need to bet on multiple horses in the race."

Ripple is just one of them—a horse that may have mediocre technology but possesses abundant resources (XRP reserves).

For Ripple, this is a win-win situation:

- Solidifying valuation: Officially establishing the $40 billion valuation in the private equity market, providing a pricing benchmark for early investors to exit.

- Avoiding sell pressure: Using financing cash for acquisitions to prevent selling XRP from impacting the market.

Ripple co-founder Chris Larsen's personal wealth has also surged to about $15 billion.

From this perspective, Ripple's story has transformed into a classic financial narrative: about assets, about valuation, about liquidity management.

From the defendant's seat in the SEC case to the boardroom on Wall Street, Ripple's journey reflects the entire crypto industry's shift from idealism to realism. If the past Ripple represented the pinnacle of "narrative economics," then today it demonstrates how, when the tide goes out, project teams rely on the most fundamental capital strength to achieve a "soft landing."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。