_This article is from: _Wintermute

Translation|Odaily Planet Daily (@OdailyChina); Translator|Azuma (@azumaeth)_

Key Conclusions

Liquidity dominates the cycles of the crypto market, while the inflow of funds from stablecoins, ETFs, and DATs (Digital Asset Treasuries) is slowing down.

Global liquidity remains abundant, but higher SOFR rates are keeping funds in short-term Treasury bills (T-bills) rather than flowing into the crypto market.

The crypto market is in a "self-sustaining" phase—funds are circulating internally until new external capital re-enters.

The Dominance of Liquidity

Liquidity often dominates each cycle of the cryptocurrency market. In the long term, adoption may determine the narrative of the cryptocurrency industry, but it is the direction of capital flow that truly drives price changes.

In recent months, the momentum of this capital inflow has noticeably slowed. The capital flow into the ecosystem through three main channels—stablecoins, ETFs, and Digital Asset Treasuries (DATs)—has weakened, shifting the crypto market from an expansion phase to a phase supported by existing capital.

While technological adoption is important, liquidity is the key factor driving the cyclical rotation of the market. This is not just a matter of market depth but also of capital availability. When global money supply expands or real interest rates decline, excess liquidity will inevitably seek risk assets, and crypto assets have historically (especially during the 2021 cycle) been among the biggest beneficiaries.

In previous cycles, liquidity primarily entered digital assets through the issuance of stablecoins, which is the core fiat entry point. As the market matures, three major liquidity funnels have gradually formed, determining the paths for new capital to enter the crypto market:

- Digital Asset Treasuries (DATs): Tokenized funds and yield structures that connect traditional assets with on-chain liquidity.

- Stablecoins: The on-chain form of fiat liquidity, serving as collateral for leverage and trading activities.

- ETFs: Channels for traditional financial institutions and passive funds to gain exposure to BTC and ETH.

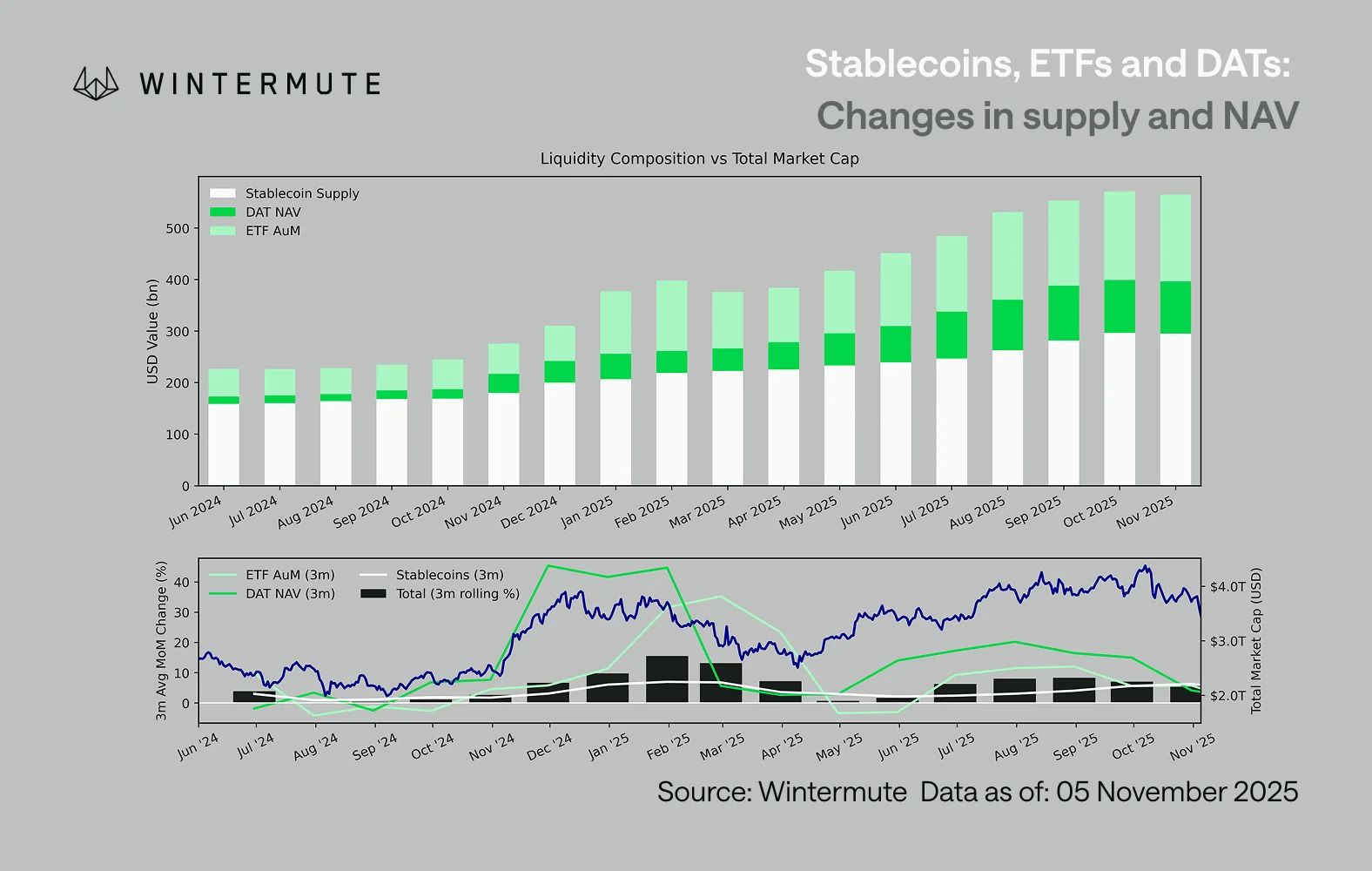

Combining the assets under management (AUM) of ETFs, the net asset value (NAV) of DATs, and the number of issued stablecoins can serve as a reasonable indicator of the total capital inflow into digital assets.

The chart below shows the changes in these components over the past 18 months. The bottom chart indicates that the change in this total is highly correlated with the overall market capitalization of digital assets—when capital inflows accelerate, prices tend to rise accordingly.

Which Pathway Has Slowed Down?

A key piece of information reflected in the chart is that the inflow momentum of DATs and ETFs has significantly weakened. These two pathways had performed strongly in Q4 2024 and Q1 2025, with a brief rebound in early summer, but the momentum has gradually dissipated since then. Liquidity (M2) is no longer flowing into the crypto ecosystem as naturally as it did at the beginning of the year. Since early 2024, the total scale of DATs and ETFs has grown from about $40 billion to $270 billion, while the supply of stablecoins has doubled from about $140 billion to $290 billion. This shows structural growth but also a clear "platform period."

It is important to observe the pace of slowdown across different pathways, as each pathway reflects different sources of liquidity: stablecoins reflect the native risk appetite of the crypto market; DATs embody institutional demand for yield-bearing assets; ETFs map the allocation trends of traditional financial capital; the simultaneous slowdown of all three indicates that new capital deployment is generally decelerating, rather than merely rotating between products.

The Market of Existing Capital Games

Liquidity has not disappeared; it is circulating internally within the system rather than continuously expanding.

From a broader macro perspective, overall economic liquidity (M2) outside the crypto market has also not stagnated. Although higher SOFR rates may constrain liquidity in the short term—making cash returns more attractive and keeping funds in the Treasury market—global conditions remain in a loosening cycle, and the U.S. quantitative tightening (QT) has officially ended. The structural backdrop still provides support, but current liquidity is flowing more towards other forms of risk expression, such as the stock market.

Due to the decrease in external capital inflows, market dynamics have become closed. Funds are more often rotating between large-cap coins and altcoins, creating a situation of internal competition (PVP). This explains why rebound trends are always short-lived and why, even with total assets under management remaining stable, market breadth continues to narrow. Currently, the surge in market volatility primarily stems from a chain reaction of liquidations rather than being driven by sustained trends.

Looking ahead, if any liquidity pathway experiences a substantial recovery—whether through the reissuance of stablecoins, renewed enthusiasm for ETFs, or a rebound in DAT scale—it would indicate that macro liquidity is flowing back into the digital asset space.

Until then, the crypto market will remain in a "self-sustaining" phase, with funds circulating internally rather than compounding growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。