Today's homework is also difficult to write. The market has once again experienced fluctuations, and many entangled factors are making it increasingly complex. The expectation of a standstill has already caused panic among investors. Then there is the latest consumer credit report released by the New York Fed today, which also shows poor data, as high interest rates have led to various types of credit for users reaching historical highs in the third quarter.

This indicates that the lives of the American public are indeed at risk. Whether it is credit card loans, home loans, or student loans, they are all fundamentally adjusted through the federal funds rate. If the Federal Reserve does not enter a phase of significant interest rate cuts, a credit crisis is likely to occur.

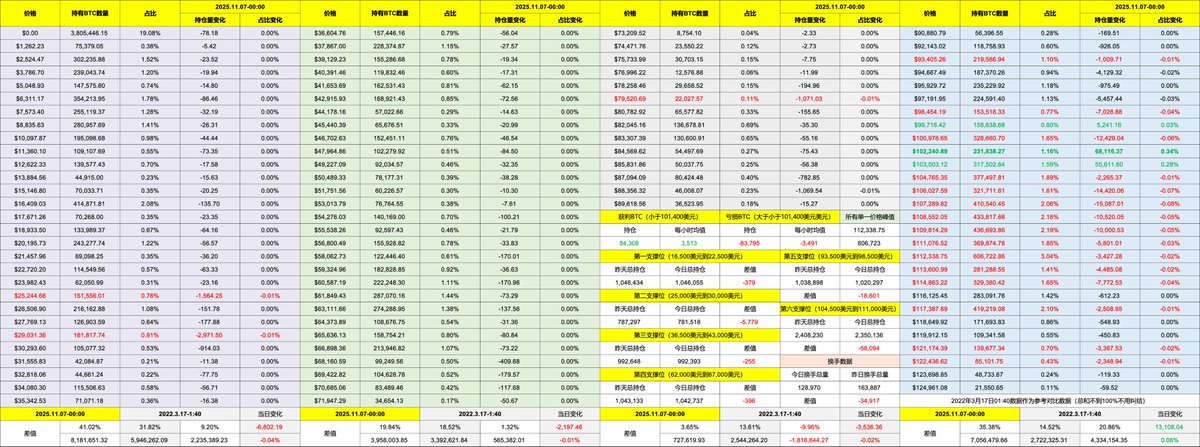

Looking at the data for Bitcoin, although it appears to be quite bullish, the turnover rate has been declining. In the last 24 hours, the turnover rate has normalized significantly, and at least there are no signs of panic among investors. The main sellers are still short-term investors, while earlier investors are still observing.

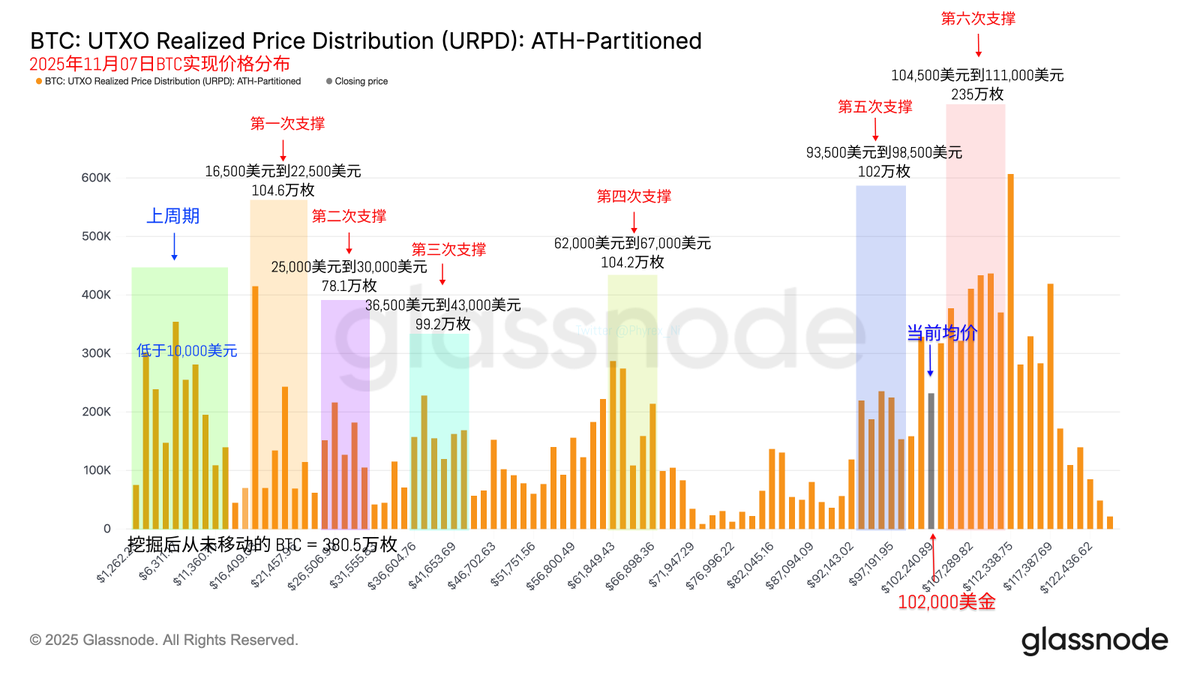

From the URPD data, stability remains quite high, and there are currently no signs of systemic risk. The supporting structure has not collapsed, and although the price of $BTC has fallen below the support level, as long as the support level does not encounter issues, it is unlikely to be a systemic risk.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。