Onchain options didn't gain traction in the past because they couldn't match the performance of centralized exchanges.

@DeriveXYZ is building the infrastructure to compete.

Derive is a complete derivatives platform offering options, perpetuals, structured products, and lending all under one roof. They operate on their own OP stack L2 with a CLOB that delivers CEX level performance with onchain settlement.

Derive uses portfolio margin to evaluate risk across all your positions. This is useful for institutional traders as hedged positions require far less capital and unlocks more capital efficiency.

Your collateral is also more productive. Derive has integrated Ethena's yield bearing stables so you can earn yield while posting collateral. Multi asset collateral and cross margin lets one single pool back all your positions.

Liquidations also work differently. Derive uses a reverse Dutch auction to partially liquidate positions to restore margin health, preventing a full account wipeout at once.

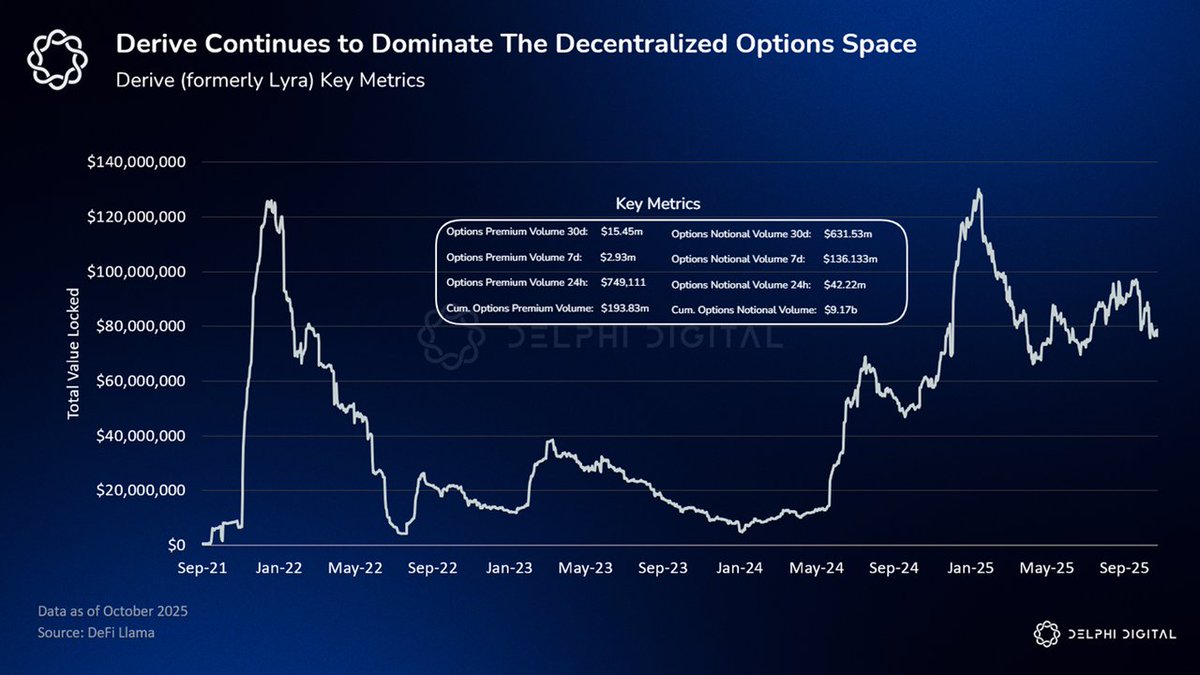

Derive continues to lead in the decentralized options space with $630M+ monthly notional options volume and $75M+ TVL.

Crypto options may have been too early before, but now they could be right on time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。