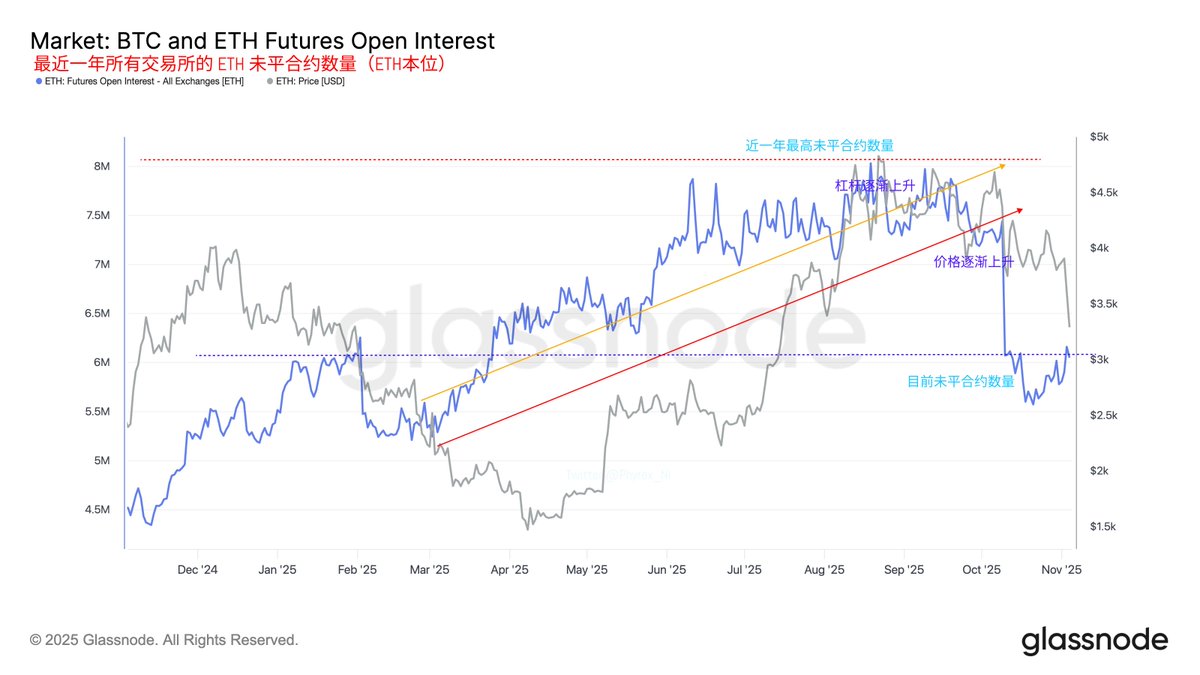

From the perspective of open interest data, both $BTC and $ETH are seeing an increase in open contracts, indicating that leveraged funds are starting to flow back in, and market sentiment is gradually shifting from deleveraging to leveraging.

At the same time, from the funding rate perspective, the long side in the perpetual market is currently more crowded and has stronger demand, which means that sentiment is indeed starting to lean towards betting on a price rebound, with a willingness to pay to hold long positions.

A positive funding rate does not mean that everyone is going long; rather, it indicates that the demand for leverage from longs is greater than that from shorts, reflecting a generally optimistic sentiment. Relatively speaking, ETH has a larger leverage increase, resulting in more open contracts, so when facing volatility, ETH's fluctuations will be greater than those of BTC.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。