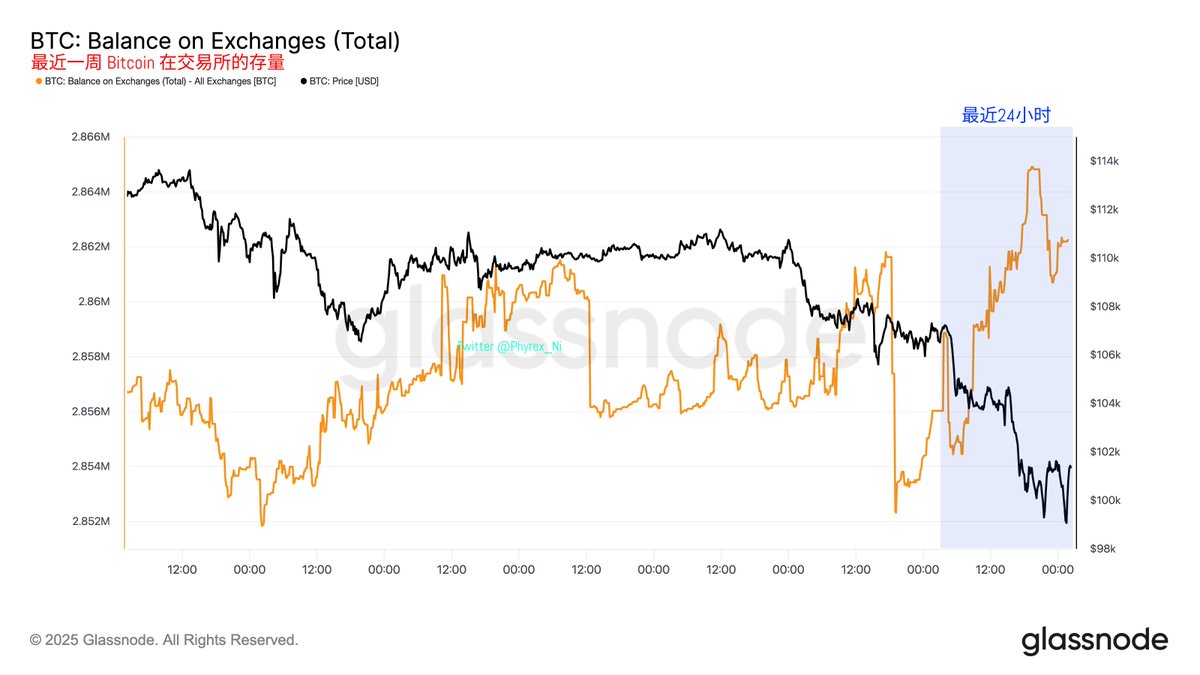

What I am most concerned about is still the stock data of the exchanges. From the detailed data, it can be seen that during the week, as the BTC price fell, the stock showed a gradual upward trend, with all exchanges' Bitcoin stock increasing by 10,000 coins.

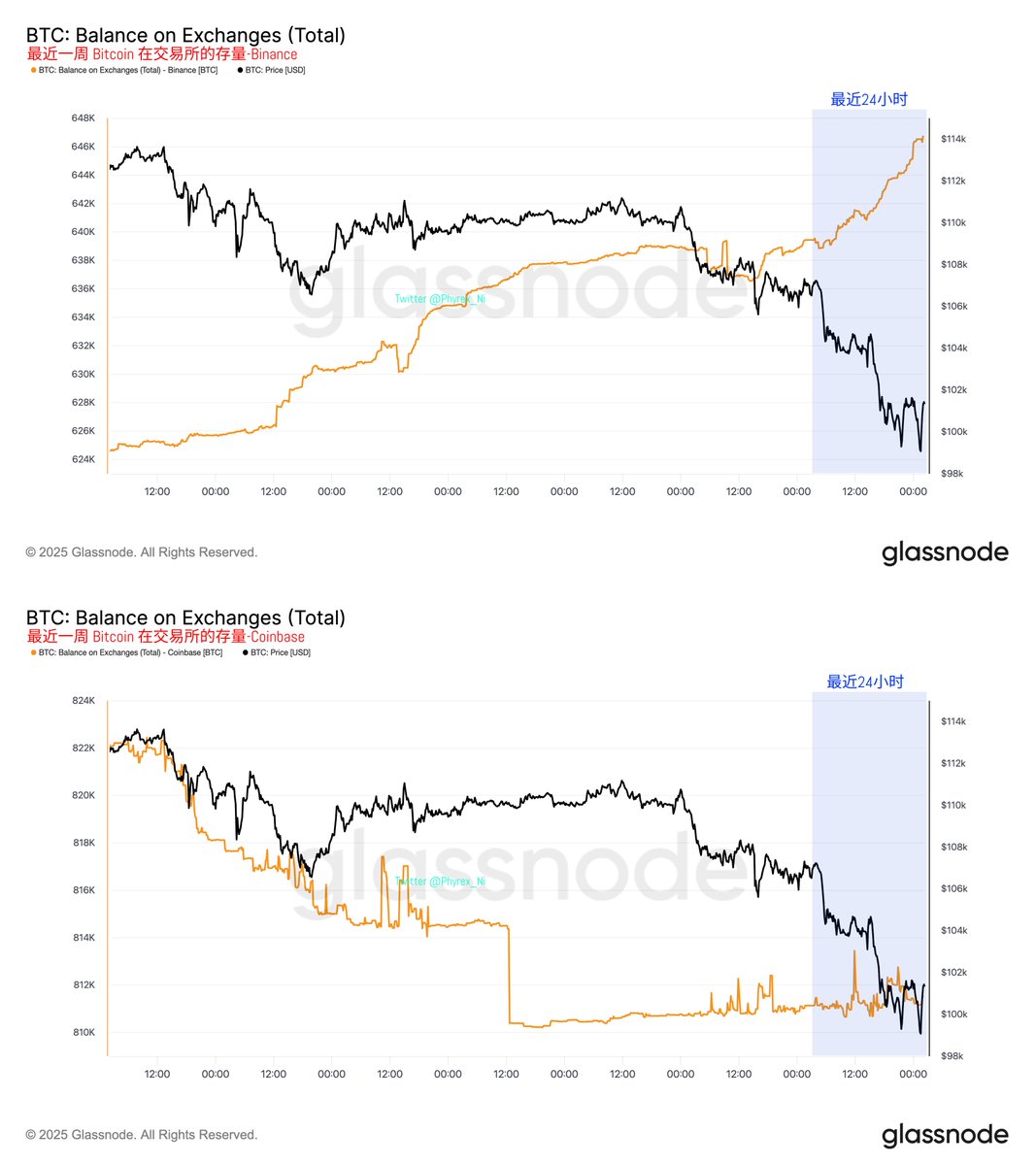

From a more detailed perspective, the two exchanges with the largest positions are Coinbase and Binance, with their BTC stock accounting for about 60% of the total stock across all exchanges.

Among them, the BTC stock on Coinbase has been declining along with the BTC price, indicating that more American investors are gradually buying BTC, especially when BTC experienced its first drop during the week.

On the other hand, Binance's BTC stock has shown an upward trend, increasing by about 20,000 BTC. This also indicates that investors on Binance are showing more obvious signs of panic selling during the decline, with some investors choosing to deposit their BTC into the exchange to seek an exit.

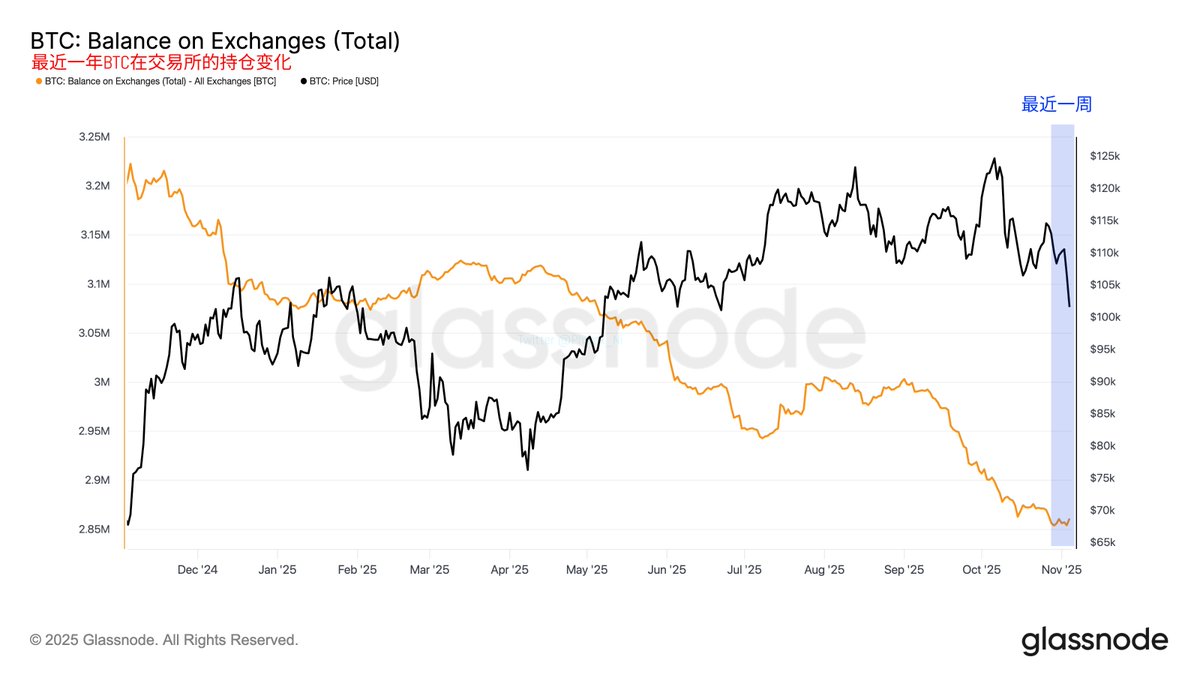

However, looking at the annual data, we are still at the bottom of the overall exchange stock. My personal view on this decline is very clear: it is most likely due to panic caused by the suspension and insufficient liquidity, rather than systemic risk.

When the suspension ends, there is a high possibility that the price will rebound somewhat. Therefore, from the perspective of most investors' positions, only a little over 10,000 BTC experienced panic, while the majority of holders are still treating the situation calmly.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP on Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。