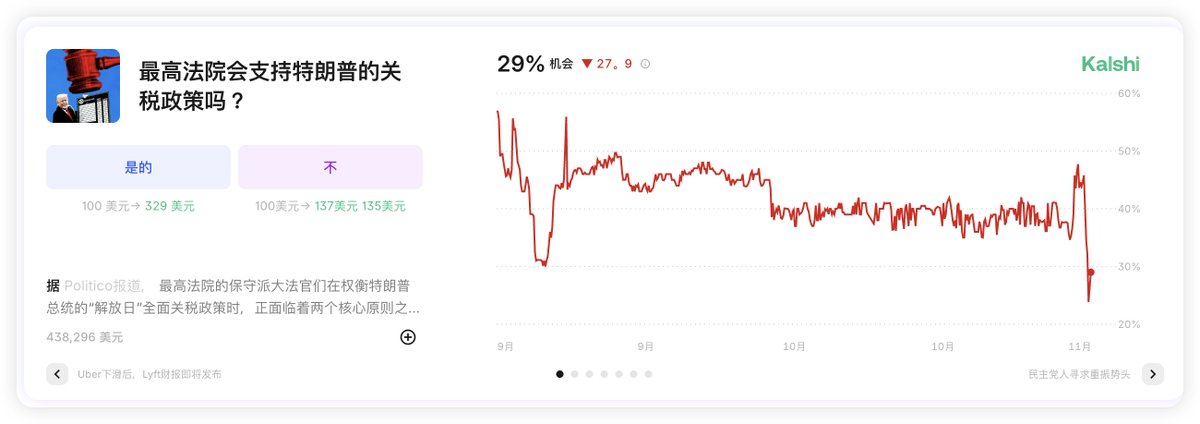

Today, many friends attribute the rise in the risk market to the impending end of the U.S. government shutdown (which, in reality, does not have any information indicating it is about to end). This may not be entirely correct; a more important reason is likely that Kalshi has reduced the probability of the Supreme Court upholding President Trump's global tariffs to 29%. The positive aspect is that if tariffs are ruled illegal, it will lower corporate supply chain costs, increase profits, and reduce inflation.

In simpler terms, if Trump's tariffs are deemed illegal and he cannot maintain his new tariff measures, it means lower taxes, less chokehold on U.S. companies, and cheaper goods, especially for tech companies, manufacturing firms, and consumer goods industries that rely on overseas supply chains. This directly enhances profit margins, essentially making the market wealthier and reducing inflationary pressures.

Of course, this has not been fully confirmed yet, but from the market trends, funds have already begun to trade on this expectation in advance. A typical characteristic is that sectors most sensitive to the global supply chain, such as the tech chain, semiconductors, and cross-border manufacturing, are leading the gains, while defensive assets and high-cost benefiting industries are performing generally, indicating that the market welcomes the reduction of tariffs.

It is not that the end of the shutdown has no impact on the market; rather, the greater reaction should be to tariffs. The market expects that the two parties will reach a consensus this week to end the government shutdown next week, but so far, there has been no clear information indicating that a consensus has been reached. The shutdown is a short-term event, while tariffs affect profit and inflation curves, making the market more sensitive to the latter.

Looking back at Bitcoin data, there has been a noticeable decrease in turnover today. Although investor sentiment was not good during the day, with the information about tariffs being illegal and the general market belief that the shutdown should only end next week, the risk market began to rise. The rise in U.S. stocks also boosted the price of $BTC.

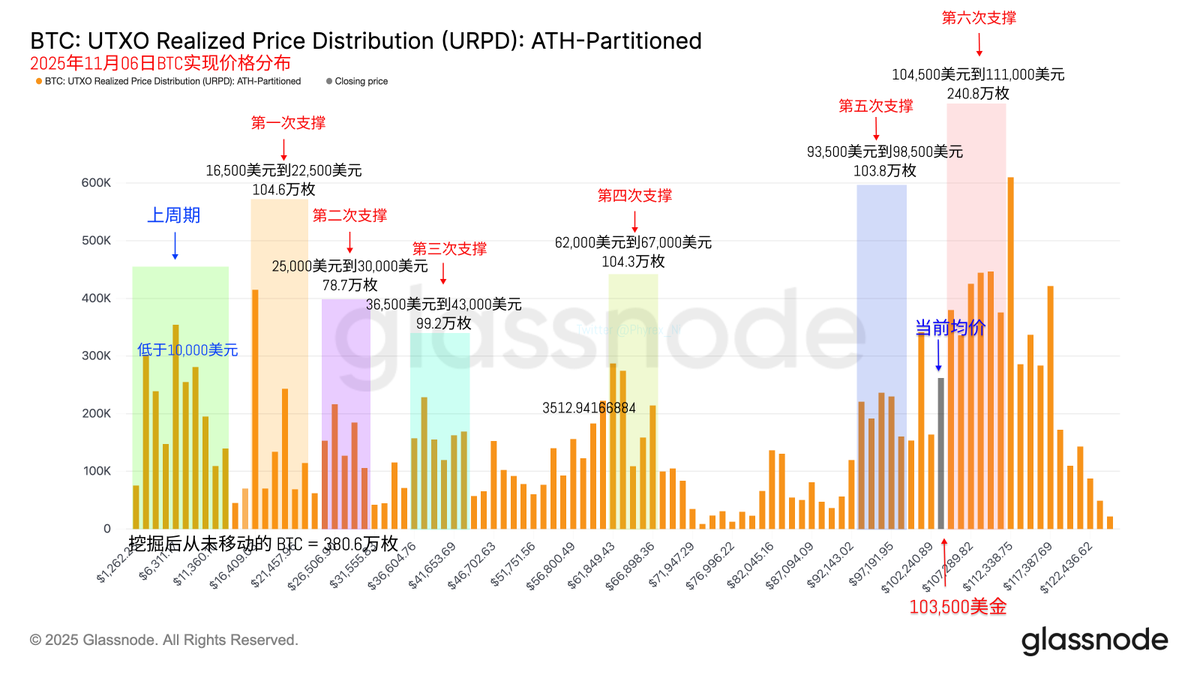

From the URPD data, the support structure has not changed during the downturn, let alone during the upturn. Moreover, as I mentioned yesterday, as long as the support structure is not broken, it will be easy for the price to return to the support point, and today it has already returned to around $104,000.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。