Original Author: Sanqing, Foresight News

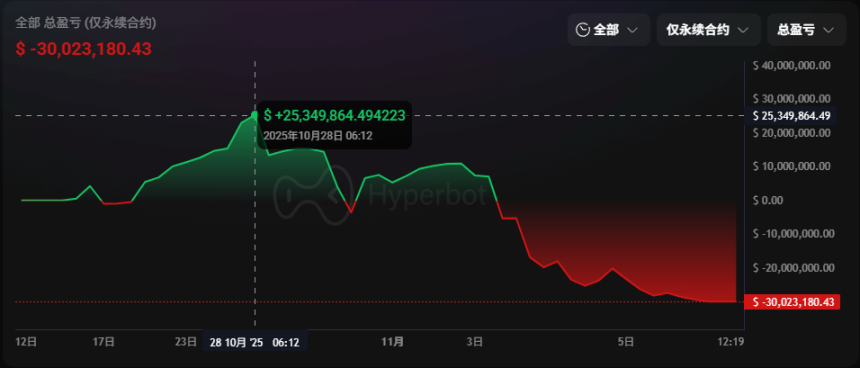

On November 5, an anonymous whale, who had achieved a 100% win rate with fourteen consecutive wins on Hyperliquid, was forced to liquidate. The account, which had peaked with profits exceeding $25.34 million, fell to a net loss of $30.02 million, leaving only about $1.4 million in margin. This trading cycle, lasting 21 days, began with precise shorting and subsequent long positions on October 14 and reached the peak of its profit curve on October 28. In just one week, a chain reaction of concentrated leverage, market correction, and counter-trend position increases led to the evaporation of all profits and principal by this morning.

Source: Hyperbot

From Accumulation to Peak

On October 14, 2025, an anonymous whale with the address 0xc2a30212a8ddac9e123944d6e29faddce994e5f2 began a trading cycle on Hyperliquid, achieving fourteen consecutive profitable trades.

He bought 5,255 ETH and sold all of it the next day for 22 million USDC, shorting BTC with about 5x leverage. Just one night later, on October 16 at 8 AM, he closed the position, earning $2.6 million. This was his first profitable trade in the series and the cleanest of the entire cycle.

In the following week, he precisely switched directions amid volatility. On the morning of October 17, he went long, increasing his position to $222 million with two additional purchases. Before the market dropped in the early hours of October 22, he preemptively closed approximately $300 million in long positions, earning $6.04 million. This trade became a representative action referred to in tweets as "the brother's reaction is quick," solidifying his 100% win rate myth.

From October 24 to 28, he experienced his highlight period. He continuously increased his positions in BTC and ETH, keeping leverage within 8x, expanding his position from $274 million to $447 million. On Hyperbot's profit and loss curve, this was the only complete segment of rising green line—at 6:12 AM on October 28, the account's floating profit reached as high as $25.349 million.

This was the last time his profit and loss curve showed a unilateral rise. In the following week, the rhythm began to show subtle shifts.

From Taking Profits to Obsession

On October 29, the whale chose to close profitable positions first while continuing to hold losing ones. At 4 AM, as the market fell, he closed $268 million in BTC long positions, earning only $1.4 million, and later closed $163 million in ETH long positions, earning $1.63 million, leaving only the trapped SOL.

Two days later, he increased his SOL position to $105 million, with an average cost of $198.3. In the early hours of October 30, a speech by Federal Reserve Chairman Powell triggered a brief market drop, prompting him to buy the dip in BTC and ETH while simultaneously increasing his SOL position. That evening, all three positions were underwater, with a floating loss of $9.73 million.

At 4 AM on October 31, losses peaked at over $18 million. As the market rebounded, the whale attempted to hold on to the positions to break even. By 8 AM on November 3, the floating loss had narrowed to $1.98 million, just one step away from breaking even, yet he did not reduce his positions. Just three hours later, the market turned downward, and the four long positions of this whale with fourteen consecutive wins fell back into floating loss.

He was just one step away from exiting unscathed but handed the initiative back to the market in waiting and hesitation.

From Stop Loss to Self-Destruction

In the early hours of November 4, his undefeated record officially ended. He cut losses by closing long positions in BTC, ETH, and SOL worth $258 million, realizing a loss of $15.65 million. This figure was comparable to the $15.83 million profit he had earned over the previous 20 days and 14 wins. At this point, he still held long positions in ETH, SOL, and HYPE worth $148 million, with a floating loss of $18.86 million, and only 8% left until the liquidation price.

The market continued to decline throughout the day. The whale was just 4% away from the liquidation price. His account balance had dropped by $40.4 million from its peak, returning to pre-liberation levels with both principal and interest. As the liquidation price rapidly approached, any rational trader would have stopped, but he chose to increase his positions in ETH at $3,497 and SOL at $159, buying 2,196 ETH and 78,724 SOL. The liquidation line was pushed higher, with ETH's liquidation price at $3,348 and SOL's at $151.6. ETH was just $130 away from liquidation, and SOL was only $8 away.

On November 5, it all came to an end. At around 5 AM, he was forced to close all positions, leaving only $1.4 million in margin, almost equivalent to a total liquidation. Thus, this 21-day trading cycle ended with a complete return to zero. The $15.83 million profit from fourteen consecutive wins and the $28.76 million principal totaled $44.67 million, all wiped out in a single loss.

Between Leverage and Human Nature

In the trading records of Hyperliquid, almost every legend ends in a similar way: James Wynn once held $1.2 billion in BTC long positions with 20x leverage, peaking at a profit of $87 million, ultimately losing $21.77 million; qwatio rolled over $3 million in principal infinitely, once earning $26 million, but ended up at zero; veteran trader AguilaTrades had a maximum profit of $41.7 million from a $300,000 principal, ultimately losing $37.6 million. And this anonymous whale, known for his "14 consecutive wins," also turned $44.67 million into nothing in just one night.

Winning streaks can rely on skill and luck, but survival always depends on restraint. When everyone is immersed in the upward curve, the ending is often already written beneath the leverage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。