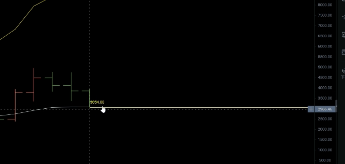

Today is Wednesday, November 5th. Yesterday, Ethereum experienced a significant drop, breaking below the previous weekly support level of 3350, and directly plunged to 3054 before starting to rebound.

How should we position ourselves in today's market?

Let me provide a demonstration analysis for today. First, does the pullback to 3054 indicate that the upcoming trend will shift to a larger bearish trend? Looking at this pullback to 3054, it actually touched the support level of the monthly midline, so it is normal to see a significant rebound after reaching 3054.

In addition to the monthly level pullback and rebound, there was also a spike in the smaller timeframe, leading to a rebound in Ethereum's TD indicator.

We might not see it clearly yet due to the lack of clear indicators, but in Bitcoin, we can see a bottoming signal on the 6-hour chart. The stochastic indicator is also starting to turn up from a low position.

SOL also showed a similar bottoming signal on the 6-hour chart followed by a rally. Therefore, for Ethereum today, considering the correlation between coins, we should also expect a rebound. Today, we mainly focus on the pullback.

So how should we position ourselves in the smaller timeframe? Currently, Ethereum is being pressured by the moving averages on the 30-minute chart, while the bullish wave at the bottom of 3054 is a monthly level pullback, forming a bottom structure on the 30-minute chart.

Thus, the first long position should be considered between 3,200 and 3,210. For aggressive entries, refer to the 3-minute pullback.

The support level from 3 minutes ago is around 3270/3280.

What can we see as the target for this bullish wave?

If the price breaks above 3,330 and stabilizes, the next small resistance level is around 3410/3420, which is the hourly moving average pressure.

Today's main direction is to focus on the rebound and low long positions. When the price touches 3410/3420, we can attempt a short position. Where should we consider placing short positions? It should be around the moving average resistance on the 2-hour or 3-hour chart, near 3540, which is relatively safe.

In other words, today's market should focus on low long positions, with high short positions as a supplement.

The first resistance level to observe is the pullback and breakout situation at 3410/3420. Once it stabilizes above 3420/3430, we consider placing short positions between 3,540 and 3,560.

When Ethereum's current price is around 3320, we have already started focusing on low long positions. The current price has pulled back to the monthly midline at 3055, with the rebound in the smaller timeframe focusing on low long positions, with high short positions as a supplement.

Currently, for the 3-minute long position, we should consider positioning around 3280, which is the support level of the pattern, with a target of 3330.

The 30-minute resistance is the hourly pressure level at 3410. If the price breaks below 3250, it will continue the small bearish trend, testing the support at 3200/3180. We can consider continuing to go long with that target.

If the price breaks below 3250, our target will also be around 3260. If the 30-minute chart can hold and continue to drop below 3160, the next level to consider is the bottom of the 4-hour chart, which is also the place where the monthly level pulled back last night.

3050, right? The 4-hour bottom support is around 2970/2950. Therefore, when we position for long, we should consider placing stop-loss points between 2940-50, with a unified stop-loss at 2900.

In other words, in the 3-minute chart, the last bottom support to consider is around 2930/2950 for positioning. This bullish wave is certainly at 3050.

In the past few days, it has been a bottom position, but we need to be prepared for ambushes because the market is largely probabilistic. There are no absolutes. This is our real-time positioning for Ethereum today.

For more strategies, follow BTC-ETH crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。