The Truth Behind the Market's Widespread Decline: The U.S. Government Shutdown Has Drained Trillions of Dollars in Liquidity!

Dollar liquidity is the lifeblood of the market; when the blood is drained, gold, cryptocurrencies, U.S. stocks, and A-shares cannot escape unscathed.

The global market is experiencing a rare synchronized decline: Bitcoin has fallen below $100,000 for the first time since June, U.S. stocks have recorded their largest single-day drop in nearly a month, and gold has dropped back below $4,000.

The root of all this is a dollar liquidity crisis triggered by the U.S. government shutdown.

As of November 5, the U.S. government has been shut down for 34 days, forcing its Treasury to hoard $1 trillion in cash in the Federal Reserve's accounts while draining nearly $700 billion in liquidity from the market. This massive amount of funds should have been circulating in the market but is now "locked" in government accounts.

01 Three Major Warning Signals of the Liquidity Crisis

The lifeblood of the financial market is running dry, with three key indicators flashing red, indicating that dollar liquidity is in a tight state. The usage of the Federal Reserve's standing repo facility has surged. This tool serves as an "emergency window" for banks to borrow money from the Federal Reserve to cope with cash shortages.

Last Friday, the usage of this tool reached $50.35 billion, setting a new historical high. Banks typically hesitate to publicly borrow from the Federal Reserve, as it is akin to admitting to their peers that they are "out of money." Now, they are borrowing heavily despite their pride, indicating that the financial system is facing a severe cash shortage.

Even more concerning is that the secured overnight financing rate soared by 22 basis points to 4.22% on October 31, far exceeding the Federal Reserve's 3.9% interest rate on excess reserves, widening the spread to 32 basis points, the highest level since March 2020. Meanwhile, the Federal Reserve's bank reserves have dropped to $2.85 trillion, the lowest since early 2021. This means that banks' "safety cushions" are becoming thinner, and their ability to cope with risks is weakening.

02 How the Government Shutdown Triggers "Invisible Rate Hikes"

The U.S. government shutdown is not just a political farce; it is a real liquidity crisis. The core mechanism lies in the "black hole effect" of the Treasury's general account. Under normal circumstances, the U.S. Treasury maintains a rough balance between tax revenue and expenditure, keeping the TGA account balance around $300 billion.

However, during the government shutdown, the situation has dramatically changed. Tax revenues continue to flow in, but government spending is almost frozen. As of last Friday, the balance of the Treasury's general account has surpassed $1 trillion for the first time, reaching a nearly five-year high since April 2021.

This means that over the past three months, the Treasury has drained more than $700 billion in cash from the market. This process is equivalent to the Federal Reserve having conducted multiple rate hikes. Effectively, the government shutdown is akin to implementing several rounds of rate hikes, as the $700 billion in liquidity it has withdrawn from the market has a tightening effect comparable to significant monetary policy tightening.

Mark Cabana, a liquidity expert at Bank of America, points out that the Treasury has become the actual decision-maker of monetary policy, with its fiscal policy determining monetary conditions. It can be said that if the Treasury's cash balance had not surged from $300 billion to $1 trillion within three months, the Federal Reserve might not have announced the end of quantitative tightening.

03 The Logic Behind the Market's Comprehensive Decline

The tightening liquidity has triggered a series of chain reactions, leading to a widespread decline in various assets. Investors are forced to sell assets to maintain liquidity. When interbank market funds are tight, investors need cash to meet margin calls and can only sell their most liquid assets, whether gold, Bitcoin, or stocks.

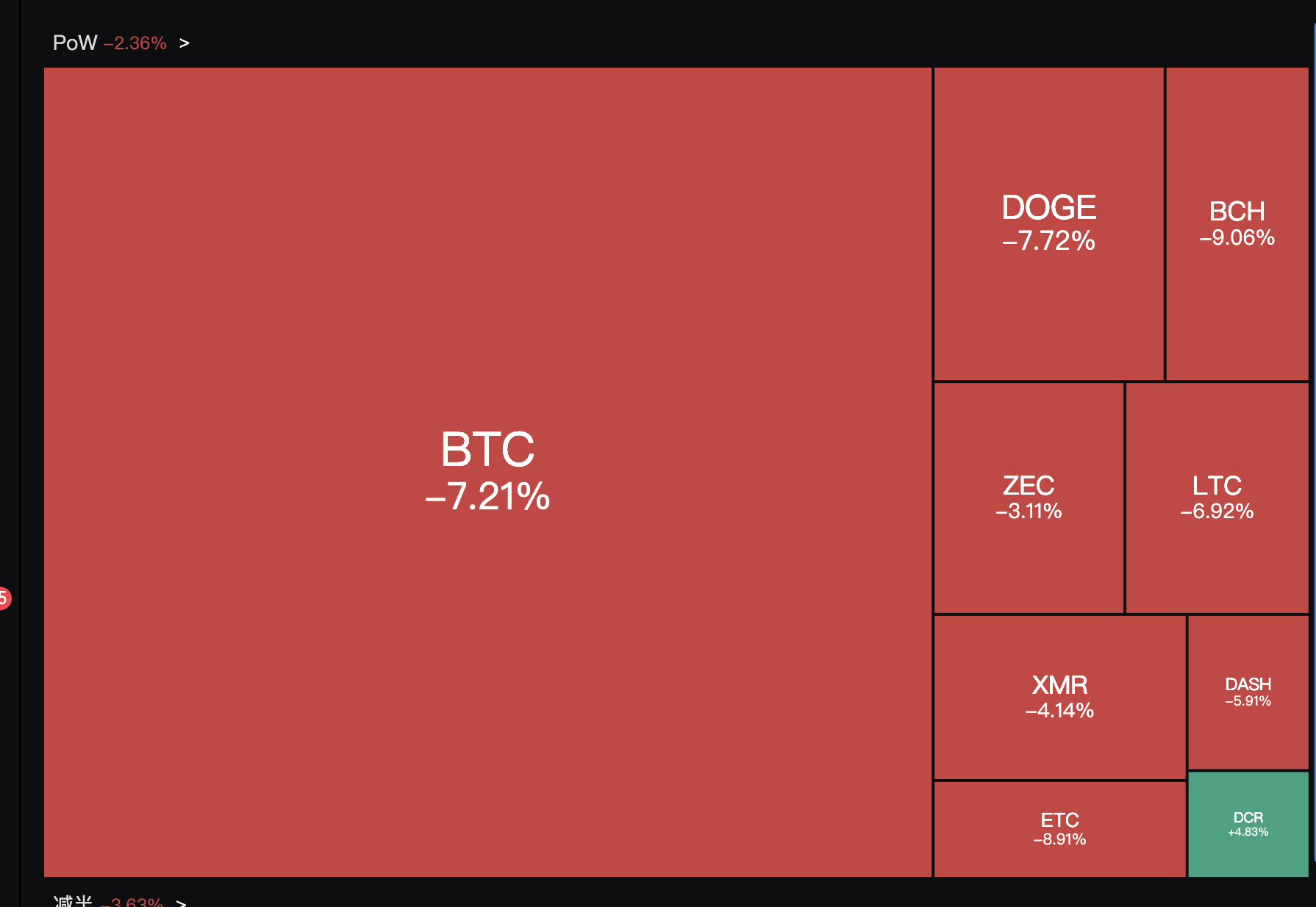

Dollar liquidity is the lifeblood of the market; once drained, gold, cryptocurrencies, stocks, and bonds all suffer from "oxygen deprivation" and decline. Risk aversion drives the dollar to strengthen. The dollar index has risen for the fifth consecutive trading day, surpassing 99.80, reaching a three-month high. A strong dollar further suppresses risk assets priced in dollars. The cryptocurrency market has seen massive liquidations. Bitcoin has fallen below $100,000 for the first time since June, with 342,000 liquidations across the network in the past 24 hours, amounting to over $1.3 billion, of which long positions accounted for 85% of the losses.

Panic sentiment quickly spread to other markets. The Nasdaq and S&P 500 indices recorded their largest single-day declines in nearly a month, with technology and semiconductor sectors being the hardest hit. Panic sentiment rapidly spread to other markets.

04 Historical Lessons: The Lessons of Liquidity Crises

Historical experience shows that liquidity crises often begin with overlooked micro fissures. The September 2019 repo crisis: At that time, the U.S. money market faced a structural shortage of reserves due to balance sheet reduction, with SOFR soaring to 5.25% in a single day, leading to a global asset crash. The Federal Reserve was forced to inject hundreds of billions of dollars in liquidity urgently. The 2020 pandemic shock: Gold and U.S. stocks plummeted simultaneously, with ETF bid-ask spreads widening to 5%, and the market experienced a situation where "only cash is king."

The Federal Reserve's quantitative easing only restored 60% of liquidity. The current situation bears similarities to these historical crises. Bank reserves have dropped to $2.85 trillion, coupled with a sharp decrease in the overnight reverse repo tool balance, thinning the financial system's buffer. Bank of America liquidity experts warn that the deterioration of funding conditions presents a dangerous self-reinforcing characteristic; if key indicators continue to worsen, it could trigger a feedback loop similar to the September 2019 repo crisis or the March 2020 basis trade collapse.

05 Solutions and Market Outlook

The key to resolving the current liquidity crisis is relatively clear: the government needs to reopen. Once the government reopens, the Treasury will begin to utilize its massive TGA cash balance, injecting hundreds of billions of dollars in liquidity into the market. Analysts at Goldman Sachs and Citigroup predict that the government shutdown is most likely to end around the second week of November.

Market predictions show that the probability of the government reopening before mid-November is about 50%. Some Republican senators have expressed "great confidence" in reaching an agreement this week, potentially resolving the deadlock as early as Thursday. The local elections on Tuesday are considered a key factor; after the elections, the Democrats may no longer have a reason to continue obstructing.

Once the government reopens, two things will happen: Liquidity release: The Treasury will quickly deplete the TGA balance, effectively implementing "invisible quantitative easing" in the market. A similar scenario occurred in early 2021 when the accelerated depletion of the Treasury's cash balance drove a significant rise in the stock market. Data release restoration: The Federal Reserve will gain more comprehensive economic data, providing a basis for a possible rate cut in December. This could trigger a massive buying spree in risk assets, driving the stock market to rise significantly by year-end. This liquidity crisis will eventually pass. When the U.S. government reopens, the Treasury will spend the $1 trillion hoarded in the TGA account, injecting massive liquidity into the market. Goldman Sachs expects the government shutdown to likely end around the second week of November. At that time, the return of liquidity could lead to a market rebound. There is no eternal prosperity in the market, only the cycle of recurrence. The current crisis may well be the prelude to the next round of recovery.

Join the Community for More Insider News

Official Telegram Community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group Chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。