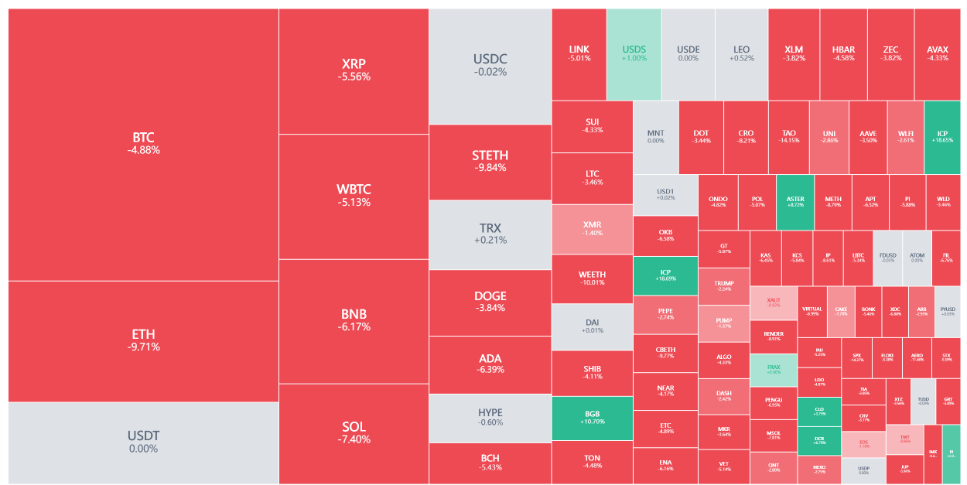

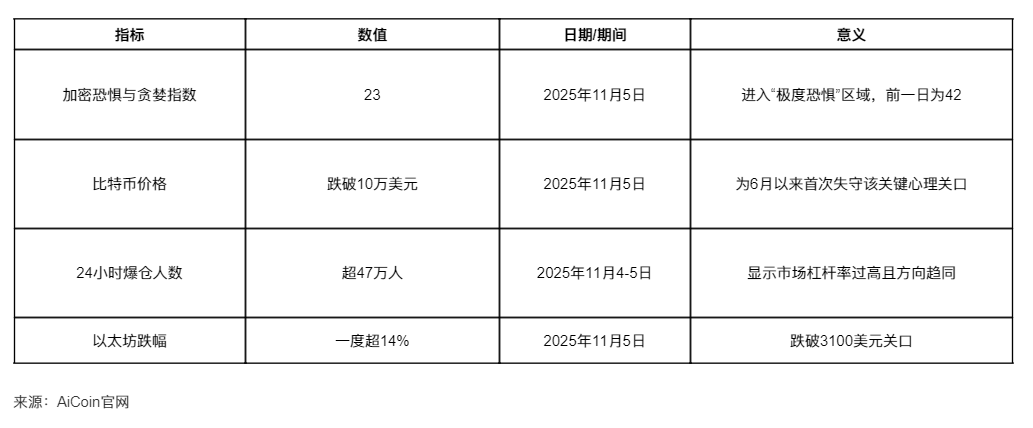

The cryptocurrency fear and greed index has plummeted to 23, entering the "extreme fear" zone, and a market where over 470,000 people have been liquidated is nurturing the seeds of a historic rebound. In the past 24 hours, the cryptocurrency market has experienced a "bloodbath." Bitcoin's price has fallen below the $100,000 mark for the first time since June, while Ethereum has dropped below $3,100, at one point falling over 14%.

According to AiCoin, in the past 24 hours, there have been over 470,000 liquidations in the cryptocurrency market, with a total liquidation amount reaching $2.025 billion. This grim scene inevitably recalls the historic liquidation event on October 11, when major exchanges worldwide liquidated over $19 billion in crypto assets.

1. Market in Extreme Fear: Liquidity Crisis Triggers Widespread Collapse

The cryptocurrency market is undergoing a severe liquidity crisis, with multiple key indicators flashing red.

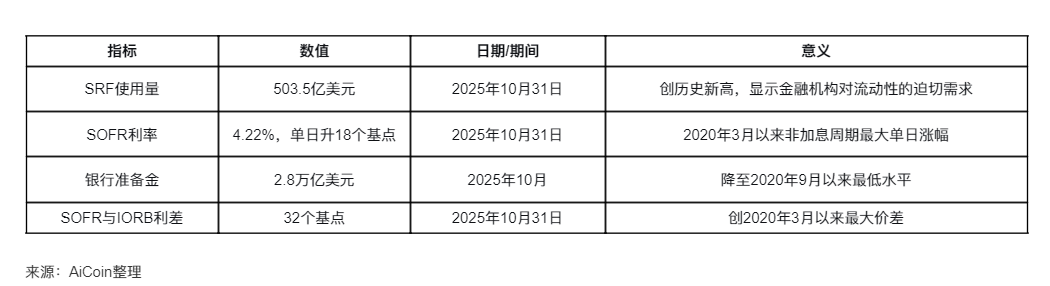

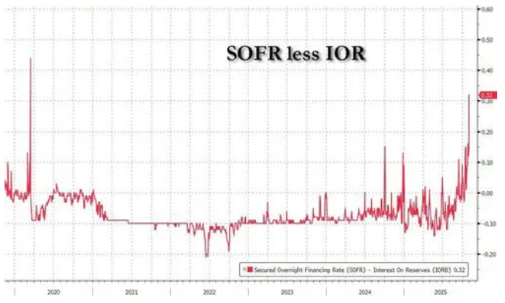

● The financing market is extremely tight, and liquidity is on the verge of exhaustion. Last Friday, the U.S. Secured Overnight Financing Rate (SOFR) surged 18 basis points to 4.22%, marking the largest increase in a year. This increase is the largest single-day fluctuation since March 2020, excluding rate hike cycles. SOFR has remained above the Federal Reserve's key policy rate, indicating that financing market pressures have spilled over into the entire short-term interest rate market.

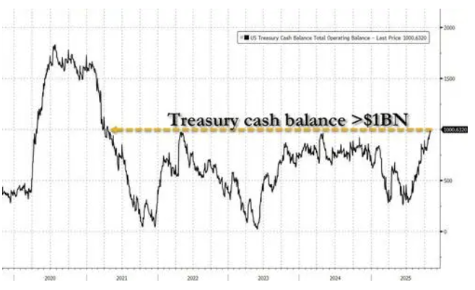

The core reason for the liquidity crunch is the government shutdown, which has forced the Treasury to increase its cash balance from $300 billion to $1 trillion over the past three months, draining market liquidity. The Federal Reserve's reserves have dropped to $2.85 trillion, the lowest since early 2021, while foreign commercial banks' cash assets have plummeted by over $300 billion in four months.

The cryptocurrency market has plummeted across the board. In the early hours of November 5, Bitcoin's price fell below $100,000 for the first time since June. Ethereum dropped below $3,100, at one point falling over 14%. Additionally, BNB, SOL, and others fell over 5%, leaving the entire market in disarray.

● Panic selling intensifies, and the number of liquidations surges. AiCoin data shows that in the past 24 hours, there have been over 470,000 liquidations in the cryptocurrency market, with a total liquidation amount of $2.025 billion, of which long positions accounted for $1.63 billion and short positions for $400 million. The largest single liquidation occurred in HTX-BTC, highlighting the sharp rise in market leverage.

2. Root Causes of the Crisis: Monetary Liquidity Tightening and Structural Issues in the Industry

The core reasons for the current cryptocurrency crisis include both the tightening of the macro monetary environment and structural flaws within the industry.

● Monetary market liquidity continues to dry up. Wall Street analysts point out that the liquidity tightness in the U.S. money market may persist into November. As financing costs remain high, the Federal Reserve may have to increase liquidity injections before officially halting balance sheet reduction next month. Although SOFR decreased on Monday as month-end pressures eased, it remains above the Federal Reserve's key policy rate.

● The Federal Reserve's slow policy shift exacerbates market pressures. Mark Cabana, head of U.S. interest rate strategy at Bank of America, stated: "The Federal Reserve is running out of time to respond; they seem a bit flustered. December 1 is the only compromise they can achieve. I suspect the market will soon force them to react." Dallas Fed President Logan has indicated that if repo rates remain high, the Federal Reserve will need to initiate asset purchases.

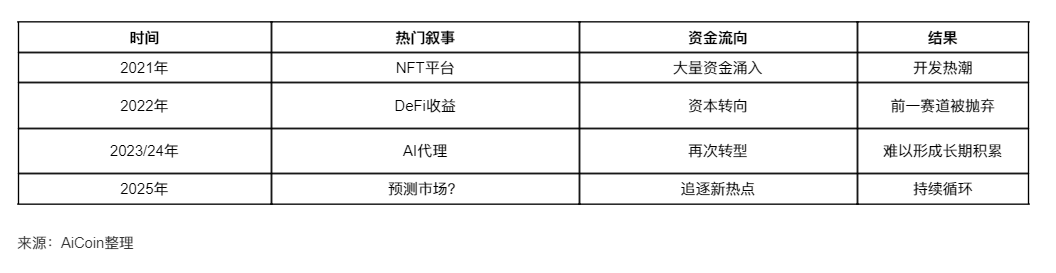

● The cryptocurrency industry's own "narrative maximization" problem. According to Rosie Sargsian, growth director at Ten Protocol, most crypto projects struggle to achieve long-term development because they are forced to constantly chase new narratives to attract investors.

● The crypto industry has an 18-month product cycle: new narratives emerge, funds and capital begin to flow in, everyone shifts focus, this process generally lasts 6 to 9 months, and once the hype fades, founders seek new directions.

● Capital chases attention rather than completion. In the crypto space, if you have a new narrative, you can raise $50 million even without a product; if the narrative is established and a product is available, you might struggle to raise even $5 million; if it's an old narrative with a product and real users, you may not be able to raise any funds at all. VCs do not invest in products; they invest in attention. Attention flows to new narratives rather than completed old ones.

3. The Catalyst for a Historic Surge: Invisible QE and the Return of Liquidity

Paradoxically, the current extreme tightening is nurturing the future extreme easing, and the key to this transition lies in the reopening of the U.S. government and the release of fiscal funds.

● Government reopening will trigger a flood of funds. Once the government shutdown ends, the Treasury will begin large-scale spending, and the over $1 trillion cash accumulated in its TGA account will quickly be released back into the market. BitMEX co-founder Arthur Hayes claims that the "stealth QE" being conducted by the U.S. Treasury and the Federal Reserve could trigger a cryptocurrency bull market.

● Massive liquidity will chase risk assets. Hayes believes that these SRF operations are equivalent to "de facto QE," with funds flowing in through lending, ultimately supporting the treasury market. As SRF usage increases, global dollar liquidity expands, and risk appetite rises. Historically, whenever the Federal Reserve's balance sheet expands, Bitcoin rises. Once stealth QE begins, a strong rebound in the cryptocurrency market will follow.

● The cryptocurrency market will be a major beneficiary of liquidity release. The core logic of Bitcoin has always been: the more 'liquidity' in the system, the more 'Bitcoin market.' When the Federal Reserve prints money and injects liquidity (QE), Bitcoin rises; when the Federal Reserve reduces its balance sheet and withdraws liquidity (QT), Bitcoin falls. The Federal Reserve's announcement to halt balance sheet reduction means liquidity release: dollar liquidity will flow back, and bank reserves will increase.

● Short-term pain and long-term opportunity. Hayes previously predicted a price drop to $100,000 before a rebound, insisting that these are merely temporary corrections. He advises investors to prepare for a "volatile market" before the government shutdown ends and to wait for the best buying opportunity in cryptocurrencies.

4. Industry Paradox: Sunk Cost Maximization and Long-term Development Dilemma

The cryptocurrency industry faces a deep structural paradox: the fundamental contradiction between short-term narrative chasing and long-term development needs.

● The 18-month product cycle constrains long-term development. New concepts emerge → funds flow in → everyone transforms → sustained development for 6-9 months → new concepts fade → transformation again.

A crypto cycle used to last 3-4 years (during the ICO era), then shortened to 2 years, and now, if lucky, a crypto cycle lasts at most 18 months. It is nearly impossible to create anything meaningful within 18 months; true infrastructure requires at least 3-5 years, and achieving product-market fit takes years, not just a few quarters of iteration.

● The sunk cost fallacy as a survival mechanism. Traditional business advice is to avoid falling into the sunk cost fallacy. If a project is not working, pivot immediately.

However, the crypto space is completely trapped in this, using the sunk cost fallacy as a survival mechanism. Now, no one will stick around long enough to verify whether what they are doing is effective; instead, they pivot at the first sign of resistance, pivot when user growth is slow, and pivot when financing is difficult.

● Challenges of team retention and user attention span. If you are a crypto founder, after a new narrative emerges, your best developers may receive double the salary to join a hot new project, and your marketing director may be poached by a company that just raised $100 million.

● The foundational infrastructure paradox. In the crypto space, those things that can exist for a long time were mostly established before cryptocurrencies gained attention. Bitcoin was born when it was ignored, without VCs or ICOs. Ethereum emerged before the ICO boom, before people foresaw the future of smart contracts. Most things born during hype cycles will perish as the cycle ends.

When cash locked in Federal Reserve facilities flows back into the market, the market will witness a surge in asset prices. For seasoned investors familiar with the volatility of crypto assets, the current panic provides a rare buying opportunity. The key to resolving the liquidity crisis is not in the hands of the Federal Reserve, but in the hands of politicians in Washington. Once the government reopens, the Treasury's trillion-dollar cash will flood the market like a burst dam, becoming a form of "stealth QE."

However, the structural contradictions within the cryptocurrency industry—an 18-month product cycle and the inertia of chasing hot money—may make it difficult to fully capitalize on the impending liquidity tsunami.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。