Author: Arthur Hayes

Original Title: Hallelujah

Translation and Compilation: BitpushNews

Introduction: The Inevitability of Political Incentives and Debt

Praise be to Satoshi Nakamoto, for the existence of time and the rule of compound interest, independent of individual identity.

Even for governments, there are only two ways to pay for expenditures: using savings (tax revenue) or issuing debt. For governments, savings equate to tax revenue. It is well known that taxes are unpopular among the public, but spending is quite appealing. Therefore, when distributing benefits to the common people and the aristocracy, politicians tend to prefer issuing debt. Politicians always lean towards borrowing from the future to ensure their current re-election, as by the time the bills come due, they are likely no longer in office.

If all governments are "hard-coded" by the incentive mechanisms of officials to prefer issuing debt rather than raising taxes to distribute benefits, then the next critical question is: how do the buyers of U.S. Treasury bonds finance these purchases? Do they use their own savings/equity, or do they finance through borrowing?

Answering these questions, especially in the context of "Pax Americana," is crucial for our predictions regarding future U.S. dollar currency creation. If the marginal buyers of U.S. Treasury bonds finance their purchases through borrowing, then we can observe who is providing them with loans. Once we know the identity of these debt financiers, we can determine whether they are creating money ex nihilo to lend or using their own equity to make loans. If, after answering all the questions, we find that the financiers of Treasury bonds are creating money in the lending process, then we can conclude:

Government-issued debt will increase the money supply.

If this conclusion holds, then we can estimate the upper limit of credit that the financiers can issue (assuming there is an upper limit).

These questions are important because my argument is: if government borrowing continues to grow as predicted by large banks (TBTF Banks), the U.S. Treasury, and the Congressional Budget Office, then the Federal Reserve's balance sheet will also grow. If the Federal Reserve's balance sheet grows, it will be favorable for U.S. dollar liquidity, ultimately pushing up the prices of Bitcoin and other cryptocurrencies.

Next, we will answer the questions one by one and evaluate this logical puzzle.

Question Session

Will U.S. President Trump finance the deficit through tax cuts?

No. He, along with the "red camp" Republicans, has recently extended the tax cuts from 2017.

Is the U.S. Treasury borrowing money to cover the federal deficit, and will it continue to do so in the future?

Yes.

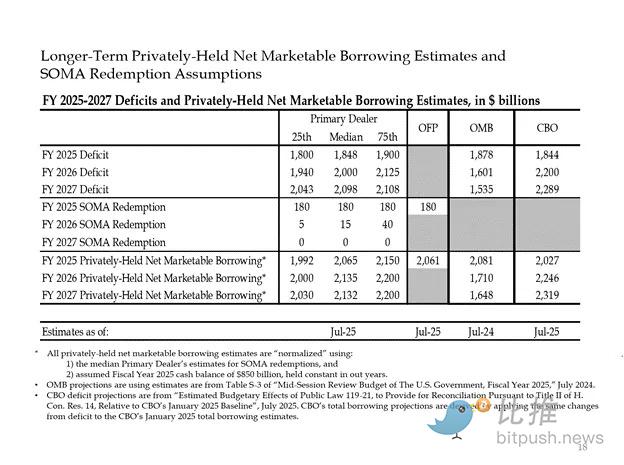

Here are the estimates from large bankers and U.S. government agencies. As seen, they predict a deficit of about $2 trillion, financed through $2 trillion in borrowing.

Given that the answers to the first two questions are both "yes," then:

Annual federal deficit = Annual Treasury bond issuance

Next, we will analyze the main buyers of Treasury bonds and how they finance their purchases.

The "Waste" that Devours Debt

- #### Foreign Central Banks

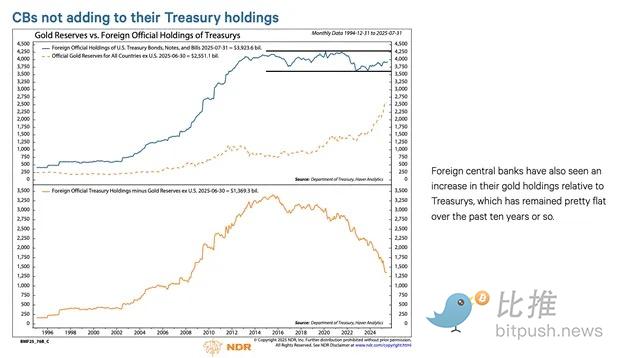

If "Pax Americana" is willing to seize the funds of Russia (a nuclear power and the world's largest commodity exporter), then any foreign holder of U.S. Treasuries cannot ensure safety. Foreign central bank reserve managers are aware of the risk of expropriation and prefer to buy gold rather than U.S. Treasuries. Therefore, since Russia invaded Ukraine in February 2022, gold prices have begun to soar.

2. U.S. Private Sector

According to the U.S. Bureau of Labor Statistics, the personal savings rate for 2024 is 4.6%. In the same year, the U.S. federal deficit is 6% of GDP. Given that the deficit is larger than the savings rate, the private sector cannot be the marginal buyer of Treasury bonds.

3. Commercial Banks

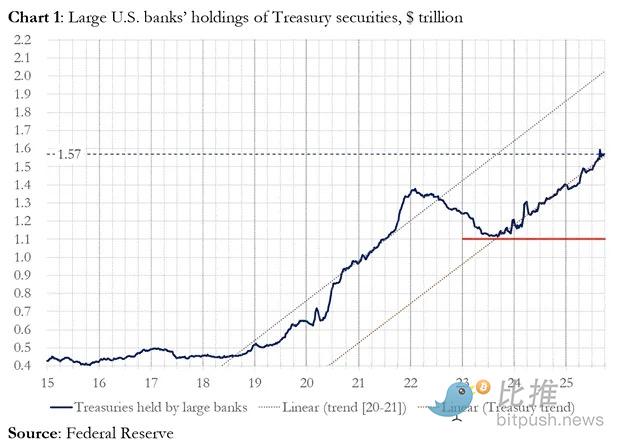

Are the four major commercial banks in the currency centers buying U.S. Treasuries in large amounts? The answer is no.

In fiscal year 2025, these four major currency center banks purchased approximately $300 billion in U.S. Treasuries. In the same fiscal year, the Treasury issued $1.992 trillion in U.S. Treasuries. While this group of buyers is undoubtedly an important buyer of U.S. Treasuries, they are not the final marginal buyers.

4. Relative Value (RV) Hedge Funds

RV funds are the marginal buyers of Treasury bonds, as acknowledged in a recent Federal Reserve document.

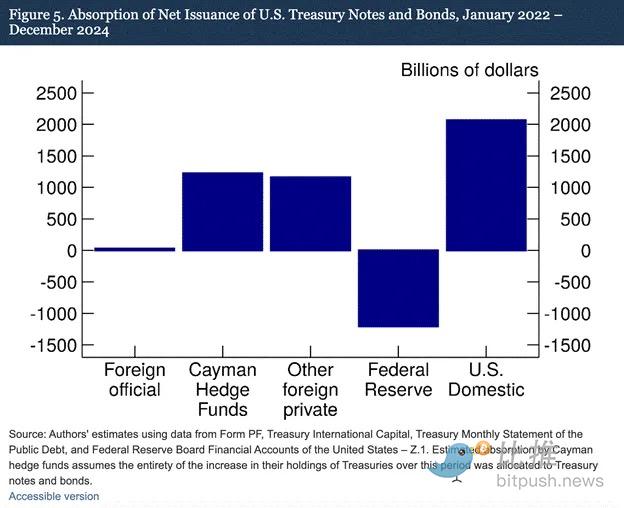

Our findings indicate that Cayman Islands hedge funds are increasingly becoming the marginal foreign buyers of U.S. Treasuries and bonds. As shown in Figure 5, from January 2022 to December 2024—during which the Federal Reserve reduced its balance sheet by allowing maturing Treasuries to exit its portfolio—Cayman Islands hedge funds net purchased $1.2 trillion in Treasury bonds. Assuming these purchases consist entirely of Treasuries and bonds, they absorbed 37% of the net issuance of Treasuries and bonds, nearly equivalent to the total purchases by all other foreign investors combined.

The trading pattern of RV funds:

Buy spot Treasury bonds

Sell corresponding Treasury futures contracts

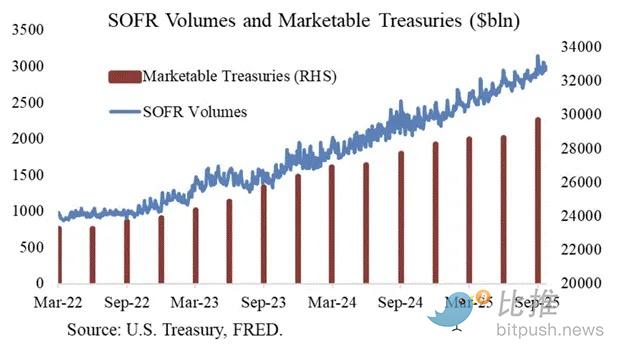

Thanks to Joseph Wang for the chart. SOFR trading volume is a proxy indicator of RV fund participation in the Treasury bond market. As you can see, the growth of debt burden corresponds to the growth of SOFR trading volume. This indicates that RV funds are the marginal buyers of Treasury bonds.

RV funds engage in this trading to earn the small price difference between the two instruments. Since this price difference is very small (measured in basis points; 1 basis point = 0.01%), the only way to make a profit is to finance the purchase of Treasury bonds.

This leads us to the most important part of this article: understanding the next steps of the Federal Reserve: how do RV funds finance their purchases of Treasury bonds?

Part Four: The Repo Market, Implicit Quantitative Easing, and Dollar Creation

RV funds finance their Treasury bond purchases through repurchase agreements (repos). In a seamless transaction, RV funds use the Treasury securities they purchase as collateral, borrow overnight cash, and then use this borrowed cash to settle the Treasury bond purchase. If cash is abundant, the repo rate will trade at a level below or just equal to the upper limit of the Federal Reserve's federal funds rate. Why?

How the Federal Reserve Manipulates Short-Term Rates

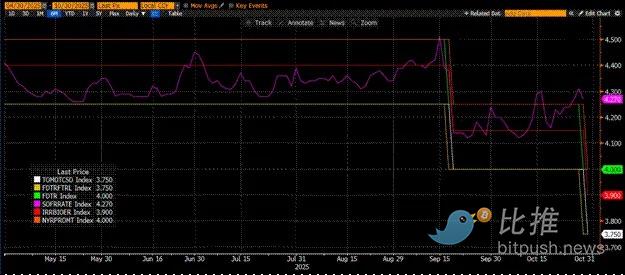

The Federal Reserve has two policy interest rates: the upper limit (Upper Fed Funds) and the lower limit (Lower Fed Funds) of the federal funds rate; currently, they are 4.00% and 3.75%, respectively. To force the actual short-term rate (SOFR, the secured overnight financing rate) to remain within this range, the Federal Reserve uses the following tools (sorted by interest rate from low to high):

Overnight Reverse Repo Tool (RRP): Money market funds (MMFs) and commercial banks deposit cash here overnight to earn interest paid by the Federal Reserve. Reward rate: lower limit of the federal funds rate.

Interest on Reserve Balances (IORB): Commercial banks earn interest on excess reserves held at the Federal Reserve. Reward rate: between the upper and lower limits.

Standing Repo Facility (SRF): When cash is tight, commercial banks and other financial institutions can pledge eligible securities (mainly U.S. Treasuries) to obtain cash from the Federal Reserve. Essentially, the Federal Reserve prints money in exchange for pledged securities. Reward rate: upper limit of the federal funds rate.

The relationship among the three:

Lower limit of the federal funds rate = RRP IORB SRF = Upper limit of the federal funds rate

SOFR (Secured Overnight Financing Rate) is the Federal Reserve's target rate, representing the composite rate of various repo transactions. If the SOFR trading rate exceeds the upper limit of the federal funds rate, it indicates a cash crunch in the system, which could lead to significant problems. Once cash becomes tight, SOFR will spike, and the highly leveraged fiat financial system will come to a halt. This is because if the marginal liquidity buyers and sellers cannot roll over their liabilities at a predictable federal funds rate, they will incur massive losses and stop providing liquidity to the system. No one will buy U.S. Treasuries because they cannot obtain cheap leverage, resulting in the U.S. government being unable to finance itself at an affordable cost.

The Exit of Marginal Cash Providers

What causes the SOFR trading rate to exceed the upper limit? We need to examine the marginal cash providers in the repo market: money market funds (MMFs) and commercial banks.

Exit of Money Market Funds (MMFs): MMFs aim to earn short-term interest with minimal credit risk. Previously, MMFs would withdraw funds from the RRP and invest in the repo market because RRP offered SOFR. However, now, due to the attractive yields of short-term Treasury bills (T-bills), MMFs are pulling funds from the RRP to lend to the U.S. government. The RRP balance has dropped to zero, and MMFs have essentially exited the cash supply in the repo market.

Constraints on Commercial Banks: Banks are willing to provide reserves to the repo market because of IORB SOFR. However, the ability of banks to provide cash depends on whether their reserves are sufficient. Since the Federal Reserve began quantitative tightening (QT) in early 2022, bank reserves have decreased by trillions of dollars. Once the balance sheet capacity shrinks, banks are forced to charge higher rates to provide cash.

Since 2022, both MMFs and banks, the two marginal cash providers, have had less cash to supply to the repo market. At some point, both are unwilling or unable to provide cash at rates below or equal to the upper limit of the federal funds rate.

Meanwhile, the demand for cash is rising. This is because former President Biden and now Trump continue to spend lavishly, calling for the issuance of more Treasury bonds. The marginal buyers of Treasury bonds, RV funds, must finance these purchases in the repo market. If they cannot obtain daily funding at rates below or slightly below the upper limit of the federal funds rate, they will stop buying U.S. Treasuries, and the U.S. government will be unable to finance itself at affordable rates.

Activation of the SRF and Stealth Quantitative Easing (Stealth QE)

Due to a similar situation in 2019, the Federal Reserve established the SRF (Standing Repo Facility). As long as acceptable collateral is provided, the Federal Reserve can offer unlimited cash at the SRF rate (i.e., the upper limit of the federal funds rate). Therefore, RV funds can be assured that no matter how tight cash becomes, they can always obtain funds at the worst-case scenario—the upper limit of the federal funds rate.

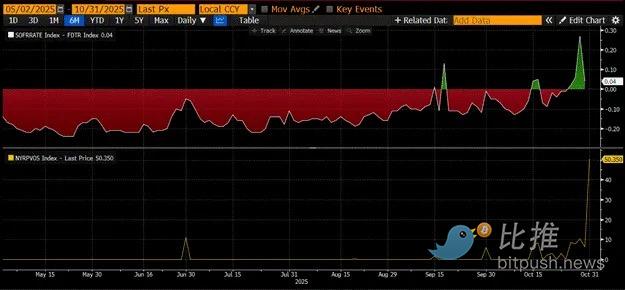

If the SRF balance is above zero, we know that the Federal Reserve is cashing the checks written by politicians with printed money.

Treasury bond issuance = Increase in dollar supply

The above chart (top panel) shows the difference between (SOFR – upper limit of the federal funds rate). When this difference approaches zero or is positive, cash is tight. During these periods, the SRF (bottom panel, measured in billions) is used non-trivially. Using the SRF allows borrowers to avoid paying higher, less manipulated SOFR rates.

Stealth Quantitative Easing (Stealth QE): The Federal Reserve has two methods to ensure there is ample cash in the system: the first is to create bank reserves by purchasing bank securities, known as quantitative easing (QE). The second is to freely lend to the repo market through the SRF.

QE has now become a "dirty word," with the public generally associating it with money printing and inflation. To avoid being blamed for causing inflation, the Federal Reserve will strive to claim that its policies are not QE. This means that the SRF will become the primary channel for printed money to flow into the global financial system, rather than creating more bank reserves through QE.

This can only buy some time. But ultimately, the exponential expansion of Treasury bond issuance will force the SRF to be used repeatedly. Remember, Treasury Secretary Buffalo Bill Bessent not only needs to issue $2 trillion annually to fund the government but also needs to issue trillions more to roll over maturing debt.

Stealth quantitative easing is about to begin. While I do not know the exact timing, if the current conditions in the money market persist, the pile-up of Treasury bonds will necessitate an increase in the SRF balance as the lender of last resort. As the SRF balance grows, the amount of fiat dollars in the global system will also expand. This phenomenon will reignite the bull market for Bitcoin.

Part Five: Current Market Stagnation and Opportunities

Before stealth QE begins, we must control capital. The market is expected to remain volatile, especially before the U.S. government shutdown ends.

Currently, the Treasury is borrowing money through debt auctions (negative dollar liquidity), but it has not yet spent this money (positive dollar liquidity). The balance of the Treasury General Account (TGA) is about $150 billion above the target of $850 billion, and this extra liquidity will only be released into the market once the government reopens. This liquidity siphoning effect is one of the reasons for the current weakness in the crypto market.

With the four-year anniversary of Bitcoin's historical peak in 2021 approaching, many will mistakenly interpret this period of market weakness and fatigue as a top and sell their holdings. Of course, this assumes they have not been "wiped out" in the altcoin crash a few weeks ago.

But this is a mistake. The operational logic of the dollar money market does not lie. This market corner is shrouded in obscure terminology, but once you translate these terms into "money printing" or "currency destruction," it becomes easy to grasp the trend.

(Any opinions expressed in this article are solely those of the author and should not be taken as investment advice or recommendations for trading.)

To facilitate reading, the translation has been slightly edited from the original content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。