When Bitcoin briefly fell below $107,000 and the total liquidation across the network exceeded $1.2 billion, altcoins like ZEC surged over 9%, showcasing a brutal capital shift in the crypto market.

Against the backdrop of the Federal Reserve's failure to boost market confidence with interest rate cuts, the crypto market is undergoing a severe liquidity test. In the past 24 hours, Bitcoin dipped below the critical support of $107,000, while Ethereum also fell below the psychological level of $3,600, with mainstream cryptocurrencies generally declining over 4%.

In stark contrast, altcoins like ZEC and DASH rose against the trend, with a daily increase of up to 9%, becoming an oasis in a desert of capital scarcity.

1. Market Overview: Collective Pressure Under Liquidity Exhaustion

The crypto market is facing the most severe liquidity environment of the year, with mainstream cryptocurrencies under collective pressure and market sentiment in an extremely fragile state.

● Mainstream cryptocurrencies are generally experiencing significant declines. Bitcoin hit a low of $105,000, with a maximum drop of over 4% in 24 hours, followed closely by Ethereum, which fell below the psychological barrier of $3,600.

Market volatility has surged sharply, leading to the liquidation of numerous leveraged positions. Data shows that the total liquidation amount across the network reached $1.2 billion in the past 24 hours, involving over 330,000 investors.

● Selini Capital CEO Jordi Alexander described the current market state as a "hangover phase." He pointed out that after the historic liquidation events in October, rebuilding the destroyed capital base will take time, and restoring market confidence will not happen overnight.

● On-chain data also confirms the current state of liquidity tightness. Long-dormant Bitcoin wallets have recently been frequently activated, with tokens entering the market and creating selling pressure. CoinShares analyst Matthew Kimmell stated, "These tokens may be re-entering the market, creating selling pressure, and investors are taking profits." Teucrium ETFs Managing Director Jake Hanley shares a similar view: "In this process, the price itself is telling you that people are cashing in profits."

2. Institutional Trends: Diverging Signals in ETF Fund Flows

In the context of overall liquidity tightness, the flow of institutional funds through ETFs has shown significant divergence, providing important clues for understanding changes in market structure.

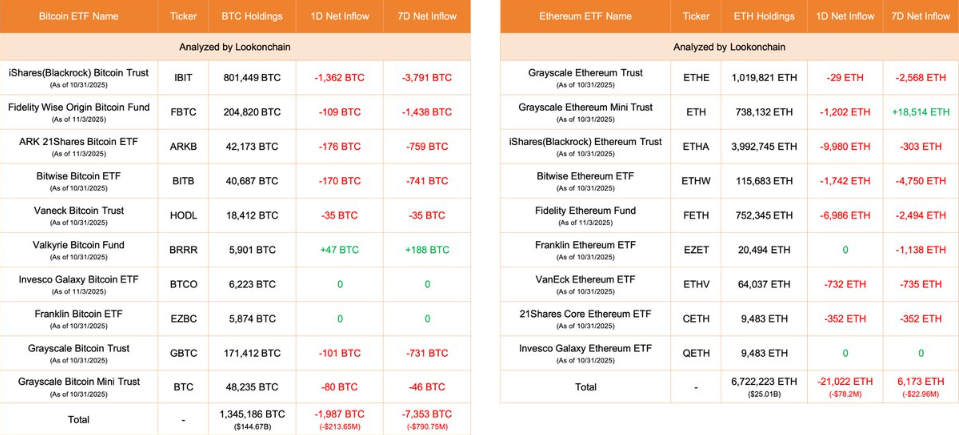

According to the latest statistics from Lookonchain, the fund attraction of Bitcoin ETFs and Ethereum ETFs is widening the gap. Here are the specific fund flow data:

● Capriole Investments founder Charles Edwards pointed out a key change: "The demand for Bitcoin from large institutions has fallen below the rate of new coin production for the first time in seven months." This finding explains why Bitcoin's price continues to be under pressure despite overall net inflows into ETFs. The marginal weakening of institutional demand has caused the market to lose an important price support factor.

3. Whale Strategies: Different Strategies Determine Divergent Fates

In the midst of market volatility, crypto whales exhibit differing operational strategies, and their movements often signal the next evolution of the market.

● Bullish whales boldly bet on a market rebound. A whale known as the "Hyperunit whale," with a successful track record, splurged $55 million to buy Bitcoin and Ethereum, showing optimism for the future market.

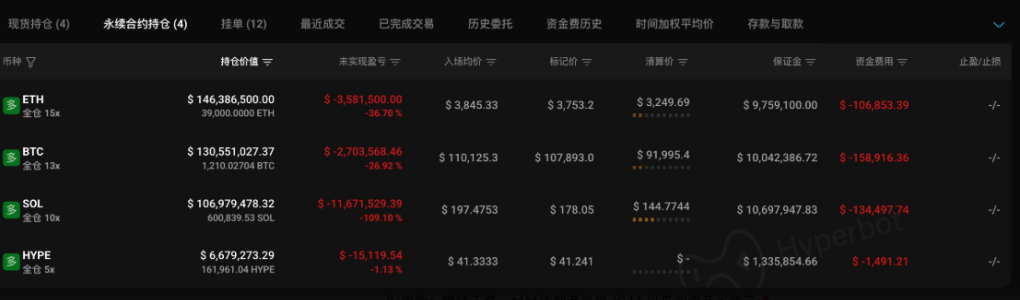

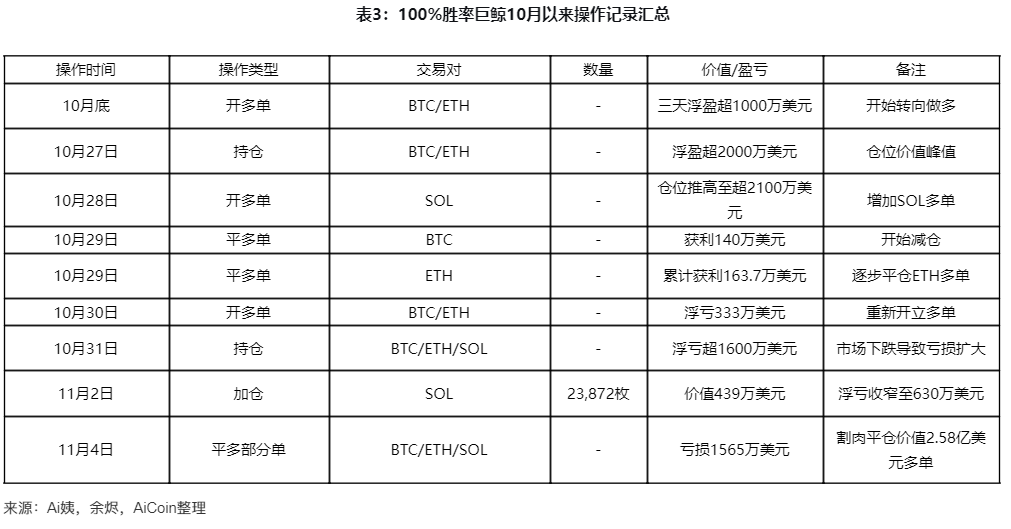

● However, not all whales can confidently navigate such a market. A whale that had a record of 14 consecutive wins has seen all profits evaporate and is now facing a loss of principal during this round of volatility. After closing some long positions, this whale has already lost $15.65 million, and the remaining positions are also at risk of liquidation. This case vividly illustrates the dangers of high-leverage trading in the current high-volatility environment.

● The position adjustments of whales reflect their predictions about market liquidity. Some long-term holders have chosen to take profits, such as a whale selling 5,000 ETH for a profit of $14.43 million. Meanwhile, speculative funds are beginning to shift towards altcoins in search of opportunities, with phenomena of whales concentrating their positions in coins like ZEC, where two whales have already seen unrealized profits exceeding $4 million.

4. Altcoin Opportunities: The Logic and Risks of Grouping Together for Warmth

In the context of liquidity exhaustion in mainstream cryptocurrencies, the flow of funds towards altcoins is not without reason, but rather has clear logical support, albeit accompanied by significant risks.

● ZEC surged 9% within 24 hours, breaking through $450, becoming the focus of market attention. This performance attracted a large influx of funds seeking short-term gains into other altcoins.

● The privacy coin sector is performing strongly overall, with coins like DASH also rising, creating a small-scale sector rotation effect.

● Market analysts generally believe that the counter-trend rise of altcoins stems from the reallocation of funds under liquidity crisis. When mainstream cryptocurrencies lack a profit-making effect, the funds withdrawn from them do not completely leave the market but instead choose more elastic altcoins for short-term speculation, forming a special phenomenon of "grouping together for warmth."

● This grouping behavior has a reasonable economic logic: a low liquidity environment amplifies price volatility, and a small amount of concentrated buying can significantly push up the prices of small-cap coins.

However, the sustainability of this trend is questionable. If overall market sentiment deteriorates further or mainstream coins enter a new round of decline, these rising altcoins may quickly correct, posing high risks.

5. Risks and Outlook: How to Navigate the Current Market Environment

In the face of a complex market environment, investors need to be acutely aware of potential risks while preparing for possible market turning points.

● The risk of whale operations reversing is the most immediate threat. If those profitable altcoin long positions are concentrated and closed, it could trigger a flash crash. ZEC long positions have already shown signs of profit withdrawal, which warrants high vigilance.

● The possibility of further deterioration in liquidity cannot be ignored either. The probability of the Federal Reserve cutting rates in December is only 67.8%. If monetary policy tightens more than expected, the market may face greater selling pressure. In this environment, investors should focus on defensive sectors. Historical data shows that RWA, DeFi, and AI-related projects tend to perform relatively well during major market declines, making them suitable for defensive allocation.

● Strictly controlling leverage is crucial. The case of that 14-win whale illustrates the dangers of high-leverage trading in a high-volatility market environment.

Looking ahead, two dynamics are worth closely tracking:

● The Federal Reserve's December interest rate decision (within the next month) and Powell's statements;

● The progress of altcoin ETF approvals (within the next two weeks), especially whether ETFs for SOL, LTC, and others can be approved.

The market is at a critical stage of "liquidity reconstruction." When traditional mainstream coins lose their appeal, funds will not leave the market but will seek new habitats. The counter-trend rise of altcoins like ZEC is just the tip of the iceberg in this capital shift.

The cold winter has arrived, but it does not mean the disappearance of opportunities. On the contrary, the market's differentiation is brewing new leaders for the next cycle.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。