Written by: will 阿望

In the global personal consumer credit chain, borrowers often resemble a gently herded flock of sheep—accustomed to convenience but lacking a keen sense of interest rates and terms. Undoubtedly, this is a lucrative market. As unsecured consumer credit gradually shifts to stablecoin tracks, its operational mechanisms will undergo fundamental changes, and new "shepherds" will have the opportunity to share in the rich rewards during this transition.

The uniqueness of stablecoins lies in their position at the intersection of three massive markets: payments, lending, and capital markets. While we are entangled in the "red sea" of stablecoin payments, waiting for the continuous popularization of stablecoin market education, can we shift our focus to the financial lending sector? Because whether it is about capturing the value of market interest spreads or reconstructing the entire value chain, this may be the simplest and most straightforward market.

1. The Market is Large Enough

According to data from the New York Fed in 2023, the outstanding balance of unsecured personal loans has reached $232 billion, an increase of $40 billion from 2022 and a surge of $86 billion from 2021, indicating strong market demand for this type of credit. Between 2021 and 2023, the issuance of loans to subprime and below borrowers has continued to grow, with fintech platforms becoming the core driving force behind this expansion.

The increasing awareness of unsecured personal loans among the younger generation is significantly driving global market expansion. Many young people find themselves in financial instability due to factors such as student loans and rising living costs, leading them to high-interest personal loans and short-term cash advances as a "shortcut" to quickly relieve financial pressure. The ease of application, minimal requirements, quick disbursement, and unrestricted use make payday loans an attractive convenience tool. Meanwhile, the rising penetration rate among young consumers and the influx of new lending institutions further accelerate market expansion.

Despite the challenging macroeconomic environment, the unsecured personal loan market continues to set historical highs, showing no signs of slowing down. According to an industry report released by TransUnion in May 2025, as of the first quarter of 2025, the unsecured personal loan market size has reached $253 billion, with a total of 29.8 million loans issued. Currently, 24.6 million people in the U.S. hold unsecured personal loans, with an average debt of $11,600 per borrower.

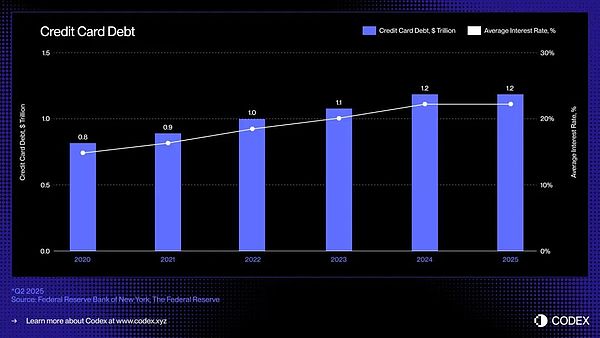

In the U.S., the mainstream form of unsecured lending is credit cards: a ubiquitous, highly liquid, and instantly accessible credit tool that allows consumers to borrow without providing collateral at the time of purchase. The outstanding credit card debt continues to grow, currently amounting to approximately $1.21 trillion.

2. The Essence of Finance Remains Unchanged, but Technology is Upgrading

What is the essence of finance? It is the mismatch of value across time and space. This essence has remained unchanged for millennia. However, the service methods are changing: the "origin" of personal consumer credit is ancient credit, but what truly turned it into "special money for ordinary people to buy things" was the installment payment system of the early 20th century; subsequently, credit cards combined "buying" and "borrowing" into a single plastic card, and then mobile internet broke down credit limits into microloans available in seconds. Each technological upgrade has lowered the loan threshold, fragmented the scenarios, and accelerated risk control, also pushing interest rates to find new balance points between competition and regulation.

The new finance based on blockchain can greatly enhance financial efficiency, realizing an on-chain financial world that spans time, space, and asset categories.

Stablecoins and on-chain lending protocols bring a new foundation: programmable money, transparent markets, and real-time capital flow. The combination of these three may finally break the old cycle and reimagine how credit is initiated, financed, and repaid in a digital, borderless economy.

The last major transformation in credit card lending occurred in the 1990s when Capital One introduced a risk-based pricing mechanism, reshaping the consumer credit landscape. Since then, despite the emergence of numerous digital banks and fintech companies, the basic structure of the credit card industry has remained largely unchanged.

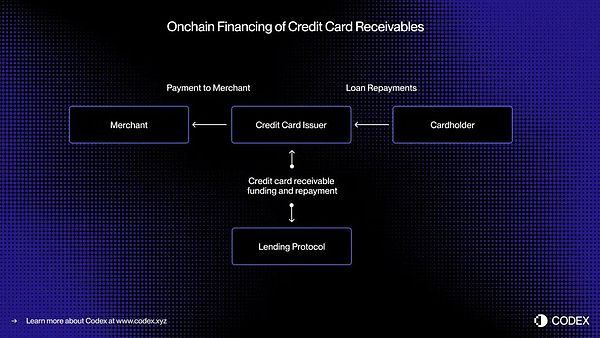

Here is a real-time case of financing credit card receivables through tokenization:

In today's card payment system, there is a time lag between transaction authorization (i.e., transaction approval) and settlement (i.e., the issuing bank transferring funds to the merchant through the card organization). By moving the financing process on-chain, these receivables can be tokenized and achieve real-time financing.

Imagine a consumer making a $5,000 purchase. The transaction is instantly authorized. Before settling with Visa or Mastercard, the issuing bank tokenizes the receivable on-chain and obtains $5,000 USDC in financing from a decentralized credit pool. Once the settlement is completed, the issuing bank transfers these funds to the merchant.

Subsequently, when the borrower repays, the repayment funds automatically flow back to the lender on-chain through a smart contract—also completed in real-time.

This method achieves real-time liquidity, transparent financing, and automatic repayment, reducing counterparty risk and eliminating the manual processes that still heavily rely on in today's consumer credit.

This is also the basic logic behind Visa's recent announcement of its Visa Direct service, which uses stablecoins for receivable financing.

3. From Asset Securitization to On-Chain Lending Pools

For decades, the consumer credit market has relied on deposits and securitization to achieve large-scale lending. Banks and issuers bundle thousands of receivables into asset-backed securities (ABS) and sell them to institutional investors. This structure provides deep liquidity but also brings complexity and opacity.

"Buy Now Pay Later" (BNPL) platforms like Affirm and Afterpay have demonstrated the evolution of credit assessment methods. They no longer grant a universal credit limit but conduct individual assessments for each transaction—differentiating between a $10,000 sofa and a $200 pair of sneakers.

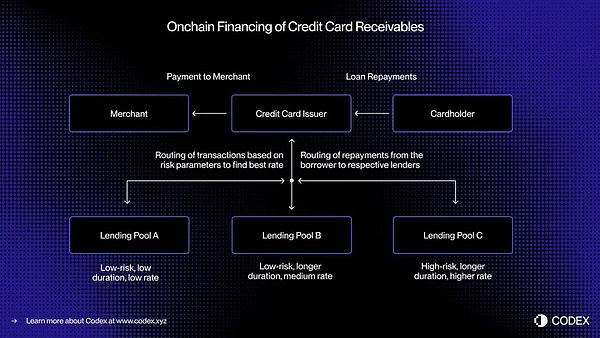

This transaction-level credit assessment generates discrete, standardized receivables, each with clear borrower, term, and risk characteristics, making them very suitable for real-time financing through on-chain lending pools.

On-chain lending can further expand this concept, allowing for specialized lending pools designed around specific borrower profiles or consumption categories. For example, one pool may focus on providing small transaction financing for prime borrowers, while another may focus on offering travel installment services for subprime consumers.

Over time, these pools may evolve into highly segmented credit markets with dynamic pricing and transparent performance metrics, accessible in real-time to all participants.

This programmability paves the way for more efficient capital allocation, better borrowing rates, and an open, transparent, and instantly auditable global unsecured consumer credit market.

4. The Emerging On-Chain Lending Stack

Reimagining unsecured lending for the on-chain era is not simply about "transplanting" credit products onto the blockchain; it requires rebuilding the entire credit infrastructure from scratch. The traditional lending ecosystem, in addition to issuers and payment processors, relies on a series of complex intermediaries:

New credit scoring methods are needed. Traditional FICO and VantageScore may be brought onto the blockchain, but decentralized identity and reputation systems may play a larger role.

Lenders also need credibility assessments—similar to on-chain rating mechanisms from Standard & Poor's, Moody's, or Fitch to evaluate credit quality and loan performance.

A less glamorous but crucial part of lending—collections—must also evolve. Debt denominated in stablecoins still requires enforcement mechanisms and recovery processes, necessitating the integration of on-chain automation with off-chain legal frameworks.

Overall, blockchain and stablecoins cannot change the business essence and risk factors of personal consumer credit; credit rating mechanisms, risk control models, and legal frameworks are all indispensable. However, envisioning the future, we can use this new on-chain lending stack to achieve global distribution of personal consumer credit, access global liquidity, realize more efficient capital allocation, better borrowing rates, and more.

5. Final Thoughts

Stablecoin credit cards have built a bridge between fiat currency and on-chain consumption; lending protocols and tokenized money market funds have redefined savings and returns; bringing unsecured credit on-chain completes the loop—allowing consumers to borrow seamlessly and investors to transparently fund credit, all driven by an open blockchain financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。