In the past month, long-term Bitcoin holders have unprecedentedly sold approximately 400,000 BTC, worth over $40 billion, becoming the core driving force behind this round of market deep correction.

Under the dual pressure of tightening macro liquidity and the concentrated selling by large whales at the micro level, the crypto market is undergoing a severe test. This article will delve into the truth behind this wave of selling, interpret the macro and micro motivations behind it, and draw on historical cyclical patterns to attempt to explore the bottom signals of this market decline.

1. The Revelation of Whales: The Truth Behind the Sale of 400,000 BTC

While the market was still speculating on the reasons for the decline, on-chain data had already pointed the way: this time it was not a panic sell-off by retail investors, but a collective action by long-term holders.

1.1. The Scale of Selling Revealed by Data

According to data released by CryptoQuant analyst Maartunn,

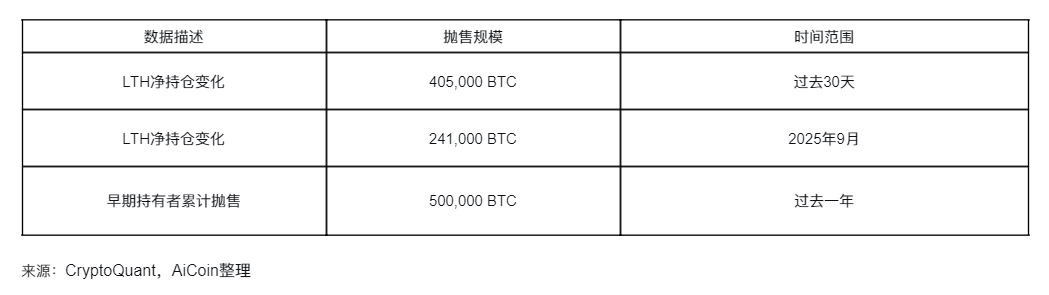

● In the past 30 days, the net holding of Bitcoin by long-term holders (LTH) has decreased by 405,000 BTC. Based on the average price during this period, the total value of this batch of sold Bitcoin is over $40 billion.

● This is not an isolated event. As early as the beginning of September 2025, this group had already begun to reduce their holdings, with a net reduction of up to 241,000 BTC in a single week.

● Research institution 10x Research further pointed out that over the past year, early holders have cumulatively sold about 500,000 BTC.

1.2. Who Are the "Long-Term Holders"?

In the field of on-chain analysis, "long-term holders" are clearly defined as addresses that have held Bitcoin for more than 155 days. They are the most steadfast group in the market and are often seen as the "ballast" of the market. When this group begins to act collectively on a large scale, it often signals a significant turning point in market trends.

1.3. The New and Old Capital Transition

Blockchain analyst @EmberCN pointed out on the X platform: “This is more like a transition of new and old capital, rather than a panic exit.” Early low-cost holders, after experiencing significant price increases, chose to take profits and lock in gains. Their selling chips are being absorbed by new institutional funds entering the market (mainly through Bitcoin spot ETFs).

1.4. Specific Whale Cases Come to Light

In addition to the collective action of long-term holders, the movements of individual "ancient whales" have had a huge impact on market sentiment.

● A typical case is that a whale who has held Bitcoin for over 14 years sold 80,000 BTC in one go with the assistance of Galaxy Digital at the end of July 2025. This transaction was completed partly through exchanges and partly through over-the-counter trading.

According to insiders, this sale was part of the client's "inheritance strategy" aimed at avoiding high estate taxes in the U.S. The disclosure of this news raised market concerns about the complete exit of long-standing holders.

2. Reasons for the Decline: A Dual Pressure of Macro and Micro

This round of market decline is the result of the combined effects of the macro environment and the internal structure of the market, forming a typical "Davis double kill."

2.1. Macro Background: The Tide of Liquidity is Receding

● The shift in the Federal Reserve's monetary policy is a core factor. In response to persistent high inflation, the Fed has shifted from "pausing interest rate hikes" at the beginning of 2025 to "discussing interest rate hikes," and has continued quantitative tightening. This has directly drained liquidity from the global capital markets, with risk assets being the first to bear the brunt.

● "Only when the tide goes out do you discover who has been swimming naked." Warren Buffett's famous quote aptly describes the current market environment. The dollar index has strengthened due to robust U.S. economic data, leading to a capital return from risk assets like cryptocurrencies back to the U.S.

● Geopolitical risks cannot be ignored either. The escalation of U.S.-China trade tensions and other uncertainties have heightened market risk aversion, with investors preferring to hold cash and other safe assets.

2.2. Micro Reasons: Whale Selling and Leverage Liquidation

Within the market, the demonstration effect of whales and the chain reaction of high leverage positions have formed a vicious cycle.

● In addition to the aforementioned collective action of long-term holders, high-leverage trading has played an "accelerator" role during the decline. According to data from on-chain monitoring platforms like Lookonchain, several whale addresses known for their "high win rates" have recently incurred massive floating losses in trades.

● For example, the whale at address "0xc2a3…" was liquidated due to a 40x leveraged long position, resulting in a loss of $6.3 million. This chain liquidation has intensified selling pressure in the market, creating a "decline-liquidation-further decline" death spiral.

3. Historical Patterns: Is the Cycle Being Rewritten?

The cryptocurrency market has always been associated with a "four-year cycle," but this round of cycles appears particularly complex due to structural changes.

Source: AiCoin Compilation

3.1. Insights from Historical Cycles

Looking back at history, each cycle has its unique driving factors and ending reasons.

● The 2013-2016 cycle was triggered by the Cyprus crisis, which later collapsed due to the bankruptcy of Mt. Gox exchange;

● The 2016-2019 cycle was driven to its peak by the ICO frenzy, followed by a bear market due to regulatory crackdowns;

● The 2019-2022 cycle reached historical highs against the backdrop of global central banks' "massive liquidity," followed by a crash due to the Fed's aggressive interest rate hikes and the LUNA/FTX debacle.

3.2. The Fundamental Differences in This Cycle

The core difference in this cycle is that institutions have become one of the dominant forces through ETFs. The entry of traditional financial giants like BlackRock and Fidelity has changed the previous model driven by retail investors and halving narratives.

● Jacob Smyth, managing partner of crypto fund APE Capital, stated: “We are witnessing a fundamental shift in market structure. The traditional 'four-year cycle' script may have been rewritten, with Bitcoin transitioning from a fringe asset to a mainstream allocation asset.”

4. Searching for the Bottom: Four Major Signals of Market Bottoming

While it is impossible to predict the absolute bottom, we can assess whether the market has entered a bottoming area through the following dimensions.

4.1. Macro Liquidity Shows a "Policy Bottom"

● Closely monitor the Federal Reserve's monetary policy trends. Key signals include: the Fed officially halting balance sheet reduction (QT) and the U.S. government resuming fiscal spending after ending the shutdown. These will be the most direct catalysts for market rebounds. Currently, the Fed's balance sheet reduction has significantly slowed, and the size of the balance sheet has dropped to the edge of the target range. Any dovish turn could become an opportunity for market rebound.

4.2. On-Chain Fundamentals: Stablecoin Supply as a Leading Indicator

● History shows that when the supply of major stablecoins (like USDT, USDC) stabilizes and begins to grow again, it indicates that the market has ample "ammunition" ready to enter. Data from on-chain analysis company CryptoQuant shows that despite the market decline, the supply of stablecoins continues to trend upward. This is a glimmer of hope for the market's resilience.

4.3. Market Sentiment Reaches "Extreme Fear"

● When the "Fear and Greed Index" remains in the "extreme fear" range, and discussions about the "end of the bull market" become mainstream in media and communities, it often indicates that market sentiment has become overly pessimistic, and a bottom is brewing.

4.4. Selling Pressure from Long-Term Holders Slows Down

● When on-chain data shows that the selling speed of LTH significantly slows down or even stops, and they begin to accumulate again, it will be a strong positive signal. Currently, selling is still ongoing but at a slower pace, requiring continued observation.

5. Market Views and Future Outlook

● Quantum Capital's Chief Strategist Li Ming believes: “This is not the end of the cycle, but a transition of the cycle. The transfer of chips from LTH to ETFs is a process of solidifying the market foundation. Once macro pressures ease, a new round of increases driven by compliant funds will be healthier.”

● On-chain research institution ByteTree analyst Sarah Chen stated: “Data shows that despite the price decline, the supply of stablecoins is still slowly increasing, indicating that off-market funds have not completely exited but are waiting for the right opportunity. The real risk lies in unexpected tightening at the macro level.”

● Anonymous whale observer WhaleWatcher warned: “The whale that sold 80,000 BTC is just the beginning. I have detected slight tentative movements from several 'ancient addresses' recently. If they act collectively, the market bottom may be deeper than expected.”

● Current overall market sentiment is shifting from wait-and-see to panic, with investors generally worried about macro uncertainties and the potential for more whale selling, and the FOMO (fear of missing out) sentiment has completely dissipated.

● For investors, at this stage, it is more important to closely monitor the evolution of the above key signals and manage risks than to predict prices. History tells us that every large-scale transfer of chips often lays a solid foundation for the next bull market—only this time, the buyers are no longer retail investors, but BlackRock and Fidelity.

The sale of 400,000 Bitcoins is a growing pain in the market's maturation process, clearly revealing the restructuring of the market's internal structure under macro headwinds. The bottom is a region, not a point, and its formation requires a resonance of macro liquidity, on-chain fundamentals, and market sentiment.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。