Original Title: Who will accrue the most value in the x402 race?

Original Author: Yash, Founder of SendAI

Original Compilation: AididiaoJP, Foresight News

x402 is迎来 its high point, with a16z calling it a $30 trillion market.

As someone who has been paying attention to x402 since its early release, I began to ponder: if this market is indeed so vast, who will emerge as the biggest winner?

This article will not explain what x402 is, but rather analyze its value accumulation and adoption from a practical perspective.

The core value of x402 is to make every API call a payment transaction. Simply put, any button click can turn into a micropayment.

x402 is not a technological innovation; it can be fully realized through blockchain transactions. All the limitations of blockchain transactions, such as gas fees and wallets, also apply to x402.

However, as a payment standard, it is incredibly powerful because it is compatible with the HTTPS protocol, allowing the entire internet to support payment functionality.

Like all payment systems, x402 has four main stakeholders:

· API Sellers (Supply Side)

· API Buyers (Demand Side)

· Intermediaries

· Underlying Chains and Tokens

1. Sellers (Supply Side)

Mainly divided into two categories:

· First-party / Second-party sellers (e.g., @switchboardxyz selling their own pricing data)

· Third-party sellers (e.g., selling @heliuslabs' RPC services through an agency API)

For the first category of sellers, once demand is sufficiently large, they have ample reason to support x402, as it can help them expand into new markets.

For example, The New York Times could enable x402 on its website, requiring crawler bots to pay for access, thus opening up new revenue streams.

Or platforms like Airbnb, after supporting x402, could allow @perplexity_ai's AI agents to pay directly with USDC and automatically earn commissions in the same transaction.

The second category of sellers often becomes an "API marketplace," integrating various APIs to provide users with convenient payment methods. Their profit model is arbitrage, such as charging a fixed fee of $20 per month and then $0.0001 per call.

In the short term, intermediaries are motivated to create API marketplaces to solve cold start problems (e.g., @corbits_dev).

For sellers, the immediate opportunity is to upgrade existing APIs or websites to support x402, gaining additional revenue and traffic from network effects.

2. Buyers (Demand Side)

API consumers, especially "AI agents." Any user or agent with a wallet can pay API fees through x402.

This is the most challenging link to initiate in the entire chain. It can be said that the current real demand is almost zero (mostly junk transactions).

There are two ways to stimulate demand:

· Sellers exclusively provide data through x402 (e.g., news websites only allow payment for crawling via x402)

· Provide enough APIs that support x402, making it easy for agents and applications to use

I believe a key driver could be @Cloudflare (a member of the x402 Foundation, particularly focused on pay-per-crawl). As the world's largest edge network/CDN service provider, Cloudflare has deep control over the distribution of network traffic (including APIs, content, and services).

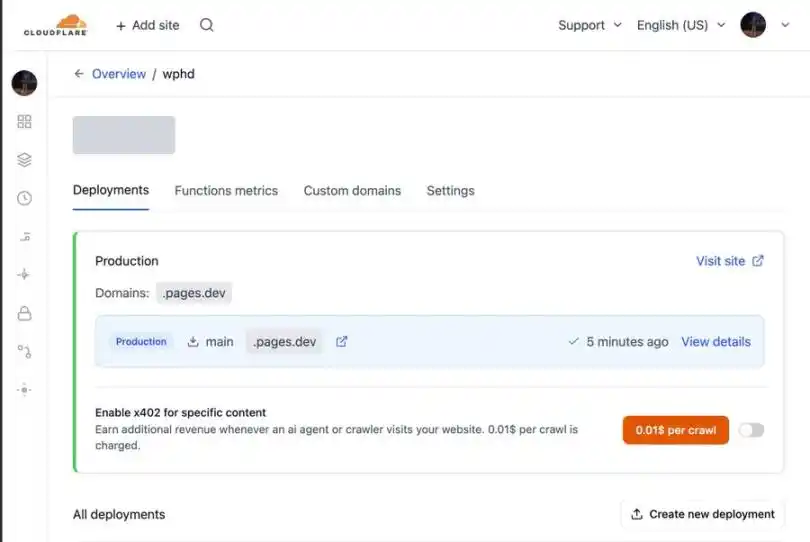

They only need to add a switch to enable x402 for specific content, allowing developers to earn additional income. (I suspect initially it will be exclusive to Coinbase/Base, supporting NET dollar payments).

I even conceptualized the interface design for Cloudflare to implement this feature.

Agent businesses (like ChatGPT, Shopify, etc.) will become the biggest demand driver for x402.

Important Note: Many people mistakenly believe that x402 can pay without a wallet, but x402 is not magic; it still fundamentally requires a wallet and blockchain transactions (including gas fees), only these have been abstracted or can be processed off-chain in bulk through API credits.

3. Intermediaries

Like Visa and Mastercard, they route payments between API buyers and sellers. They typically charge fees of 0-25 basis points (most are currently free), but this is destined to be a price war, as the barriers to building intermediaries are very low.

While Visa/Mastercard have deep moats, x402 intermediaries have almost no moat, as the real network effects accumulate on the underlying blockchain. Large companies like Cloudflare or Google can easily launch their own intermediaries on chains like Solana or Base in a day, as they control the user interface.

And giants like Coinbase may even open-source and provide intermediary services for free to promote the ecosystem, further compressing profit margins.

Current major x402 intermediaries include: @CoinbaseDev, @x402rs, and @PayAINetwork.

4. Public Chains and Tokens

As a key project of @coinbase, @base (and USDC) is naturally the main chain. However, other public chains like @SolanaFndn (which hosted the x402 hackathon) are also promoting it vigorously.

All stablecoins and public chains will strive for dominance in x402, as this can directly enhance the TVL on the chain (by increasing the amount of stablecoins locked and the number of transactions).

It will be interesting to see how stablecoin chains like @tempo and @arc integrate x402 into their enterprise development toolkits.

In my view, public chains, tokens, and wallets will capture the most value in the x402 ecosystem.

There is a reason Coinbase and @brian_armstrong are promoting x402 so vigorously; Coinbase controls the entire tech stack:

· Intermediaries (CDP)

· Public Chain (Base)

· Stablecoin (USDC)

· Wallet (Base app and Coinbase embedded wallet)

They can provide end-to-end solutions directly to enterprise clients (like Cloudflare, Vercel) while keeping the core protocol open-source.

Base is currently far ahead, but everything is just beginning.

Large companies like Stripe are likely to launch their own x402-like protocols or run x402 payments on their own chains (like @tempo). Additionally, large-scale micropayments on chains like @solana or @base are currently not economical.

For example, on Solana, due to base fees + priority fees, any payment below $0.1 is not cost-effective, as payment transactions need to compete for resources with speculative transactions (like Memecoin exchanges). I appreciate Tempo's design, which provides dedicated channels for payment transactions.

It is foreseeable that as x402 becomes more popular, there will definitely be dedicated sidechains/application chains/Rollup solutions to handle x402 payments.

Value Capture of Interfaces and Wallets

It goes without saying that the party controlling the traffic entry and user interface will capture the most value, whether it is a platform/marketplace, AI chat applications, AI browsers, etc.

In the internet space, browsers capture the most user attention, making them naturally suited to integrate x402 and control the wallet layer.

Imagine Chrome with a built-in native wallet, where every click could trigger an x402 payment. Any API could complete payments directly when needed, simply by passing a secure whitelist review.

Browser parties could easily charge a 0.05% transaction fee, and users would be willing to pay for convenience.

However, x402's biggest competitor is Stripe!

For example, the largest consumer AI application, ChatGPT, announced that it would implement business functions through @Stripe. Stripe has its own Agent Commerce Protocol (ACP), processing payments over existing card networks through shared payment tokens.

x402 and Dynamic Resource Pricing

x402 excels at handling fixed pricing (e.g., "0.001 dollars per API call"), but this does not fully leverage the true potential of blockchain: creating markets for everything.

I believe x402's uniqueness lies in realizing "resource markets." These resources can be:

· Data or results (e.g., prices, news)

· Computing power or reasoning capabilities for specific operations (e.g., booking flights)

· Complex workflows (e.g., custom chairs)

· Priority services (e.g., time slots or bandwidth reservations)

Historically, market mechanisms have solved information coordination problems, with prices naturally reflecting supply and demand.

Now imagine a future where you tell an AI agent, "Customize a chair for me with these specifications for $500."

This agent would autonomously coordinate multiple resources: sourcing wood, hiring carpenters, arranging delivery, fully automated, completely solving the resource coordination problem.

Thanks to large language models and AI agents, we now have machines capable of reasoning and negotiating across the entire supply chain. This will drive hyper-financialization, with market dynamics forming real-time pricing for every resource and action, while AI agents seamlessly transact and pay behind the scenes.

Although x402 itself does not support dynamic pricing, blockchains like Solana can create mechanisms for permissionless markets.

Imagine every Airbnb host having a dynamic market where prices are no longer fixed by the host but entirely determined by market demand; this is the world we are moving towards.

Prospects for x402

I look forward to the infinite possibilities that x402 brings.

However, it is indeed overhyped; if you want to invest in x402 tokens, 99% are likely to be air coins.

Despite a pessimistic short-term outlook, I am extremely optimistic in the long term: x402 will undoubtedly become the foundational technology of the agent-based internet and deeply integrate into the crypto network.

x402 reminds me of Solana Blinks, which allowed every click to become a Solana transaction request, but Blinks did not take off at that time.

But this time is different; we have giants like @coinbase leading the way, and if successful, we will forever change the way payments are made on the internet!

Summary

The party controlling the traffic entry and user interface (as well as assets/public chains) will gain the most value in the x402 ecosystem. This is why Coinbase is pushing so hard; it controls the entire end-to-end tech stack.

The SendAI team (especially @_0xaryan) has been closely following the development of x402 since May 2025 and is actively contributing to the x402-mcp project in collaboration with @vercel (adding @solana support for specific use cases).

In the future, we will integrate the complete x402 tech stack into broader infrastructure and applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。