In the economic data black hole, every hesitation from the Federal Reserve stirs up a storm in the cryptocurrency market. The U.S. government shutdown has lasted for 32 days, marking the second-longest record in history, and this political deadlock is evolving into a comprehensive economic data crisis.

Over the past month, American society has been deeply affected by the "shutdown," with the payment of salaries for over a million U.S. military personnel becoming a challenge, and approximately 42 million people, or 1/8 of the U.S. population, facing difficulties in obtaining food assistance in November.

As the U.S. government shutdown continues, the interest rate market has begun to reprice the Federal Reserve's rate cut expectations, leading to a strong reaction in the cryptocurrency market: Bitcoin suddenly plummeted on the evening of November 2, briefly falling below the $110,000 mark, resulting in over 100,000 liquidations across the network.

1. The Stalemate and Data Vacuum

The U.S. government shutdown has entered its 32nd day, just a few days away from matching the longest government shutdown in U.S. history at 35 days. This political deadlock is evolving into a comprehensive economic data crisis. According to the latest statistics, over 800,000 federal employees are forced to work without pay or are on leave, and one-eighth of the U.S. population (about 42 million people) faces interruptions in food stamp distributions.

● More seriously, key data agencies such as the Bureau of Labor Statistics and the Bureau of Economic Analysis have completely ceased operations, resulting in the inability to publish key economic indicators like the November non-farm payroll report on time.

● In this data vacuum, the market can only rely on alternative indicators to gauge economic conditions. The latest private employment data released by ADP shows that private sector employment increased by 89,000 in September, far below the market expectation of 150,000, intensifying concerns about an economic slowdown.

Federal Reserve Chairman Jerome Powell recently stated, "Formulating monetary policy in a data vacuum is like driving in thick fog — we must be particularly cautious." This statement clearly indicates the central bank's dilemma in the current environment.

2. Changing Rate Cut Expectations and Market Volatility

● As the government shutdown continues, the interest rate market has begun to reprice the Federal Reserve's rate cut expectations. According to the latest data from the CME FedWatch Tool, traders' expectations for a rate cut in December have dropped from 85% a month ago to 67.8%.

This significant change reflects the market's skepticism about the Federal Reserve taking action in an environment lacking reliable data. Mark Fabri, head of interest rate strategy at JPMorgan, stated, "Without reliable official data, the Federal Reserve is more likely to adopt a wait-and-see approach, especially considering the current political uncertainty."

● The cryptocurrency market reacted strongly to this. Bitcoin suddenly crashed on the evening of November 2, briefly falling below the $110,000 mark, hitting a nearly three-week low.

● Ethereum also did not escape, dropping over 7%, falling below the $3,900 support level.

● More concerning is the scale of leveraged liquidations. The total liquidation amount across the network reached $126 million in 24 hours, with 77.55% being long positions. This liquidation pattern indicates that the market's optimistic expectations for short-term trends are being brutally cleared. "When liquidity dries up and leverage accumulates, any slight disturbance can trigger a chain reaction," noted an analyst from cryptocurrency market maker GSR Markets, "the current market structure is exceptionally fragile."

3. Analysis of Cryptocurrency Market Liquidity

● A deeper observation of the liquidity situation in the cryptocurrency market reveals a more complex picture. Bitcoin's market depth has fallen to its lowest level since January of this year, meaning that large transactions are more likely to trigger significant price fluctuations.

● In terms of capital flow, the net outflow of cryptocurrency investment products reached $184 million in the past week, marking the second consecutive week of net outflow. Meanwhile, the average daily trading volume of Bitcoin ETFs has decreased by 35%, indicating a significant cooling of institutional participation.

● On-chain data is also not optimistic. Glassnode data shows that the balance of Bitcoin on exchanges has increased by 120,000 in the past week, indicating a heightened willingness among investors to sell. The total supply of stablecoins continues to shrink, further compressing the market's purchasing power.

4. Expert Opinions and Market Sentiment

In the face of this complex situation, market experts have shown clear divisions in their opinions.

● "Bear Market Theory" Representative: Joshua Lim, former head of derivatives at Genesis Trading, believes, "The government shutdown is just a surface issue; the deeper problem is the global liquidity cycle turning. Cryptocurrencies, as high-risk assets, will be the first to bear the pressure of capital outflows."

● "Opportunity Theory" Supporter: Joey Krug, Chief Investment Officer of Pantera Capital, holds a different view: "Every time the market panics and overlooks the fundamentals, it is a good opportunity for long-term positioning. The scarcity of Bitcoin and the practical applications of blockchain will not change due to the government shutdown."

● "Neutral Observation" Camp: Zach Pandl, head of research at Grayscale, stated, "In the current environment, predicting short-term trends is nearly impossible. A prudent approach is to maintain cautious positions and wait for the political deadlock to resolve and data to normalize."

Market sentiment indicators clearly reflect this divergence. The cryptocurrency fear and greed index has currently dropped to 35, falling into the "fear" range, significantly worsening from 68 a month ago. The volatility skew in the options market also shows that investors are actively purchasing downside protection, with concerns about potential downside risks noticeably increasing.

5. Potential Risks and Future Trends

Looking ahead, investors need to closely monitor several key risk points and market trends.

● The primary risk remains the duration of the government shutdown. If, as Vice President Vance stated, the shutdown could last until late November, the damage to the economy and the market will further expand. By then, not only will consumer confidence be damaged, but corporate investment decisions will also be forced to delay, potentially triggering a broader economic slowdown.

● The second risk point lies in the Federal Reserve's policy communication. On the evening of November 3, New York Fed President Williams will deliver an important speech, and the market will look for insights into the Federal Reserve's decision-making in a data vacuum environment. Any hawkish statements could further suppress rate cut expectations and exert additional pressure on risk assets.

● The third risk comes from the structural issues within the cryptocurrency market. The current leverage ratio remains high, and if prices continue to fall, it could trigger larger-scale chain liquidations.

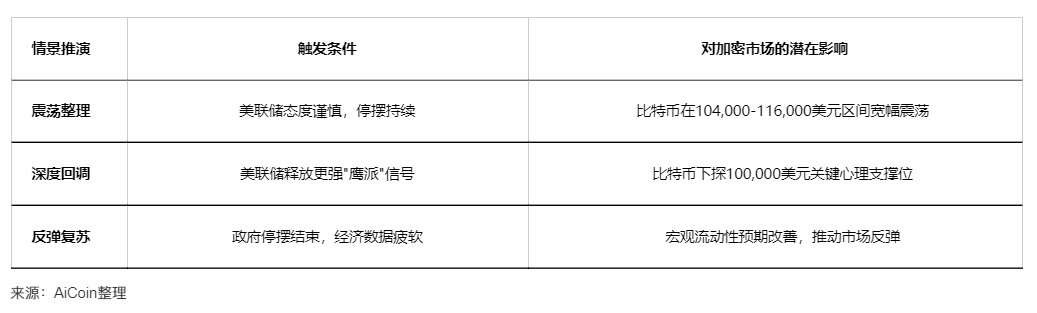

Based on the current situation, we provide the following scenario analysis for the market's future direction:

Core Tracking Indicators:

● Progress of the U.S. Government Shutdown: The Senate will attempt to pass a temporary funding bill again on the evening of November 3.

● Federal Reserve Officials' Speeches: Several officials, including Williams and Hamak, will speak this week.

● Changes in On-Chain Data: Focus on changes in exchange balances and trends in stablecoin supply.

As the U.S. government shutdown approaches the longest record in history, the cryptocurrency market is facing a severe liquidity test. In this time of uncertainty, staying calm, strictly controlling leverage, and closely monitoring macro trends may be the best strategies for investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。